08.04.23

While retailers such as Kohl’s and Target are losing ground in areas such as apparel and home goods, beauty remains strong. In fact, Ulta Beauty announced that its 2022 revenue rose 18.3% to $10.2 billion, and net income ticked up to $1.2 billion from the year prior — a record for the 33-year-old company.

Furthermore, year-over-year, consumers are spending more on beauty. 29% of consumers say they spend over $200 per month on beauty products. That number was 15% in 2022.

Why is beauty a burgeoning bright spot for retailers? PowerReviews surveyed over 26,000 beauty shoppers to shed light on the trends driving the popularity of beauty. See their insights below:

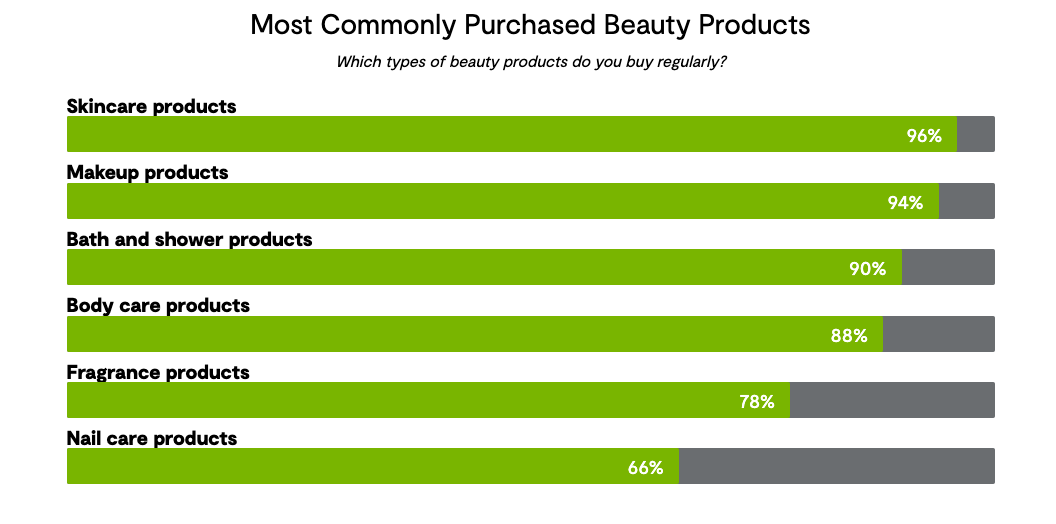

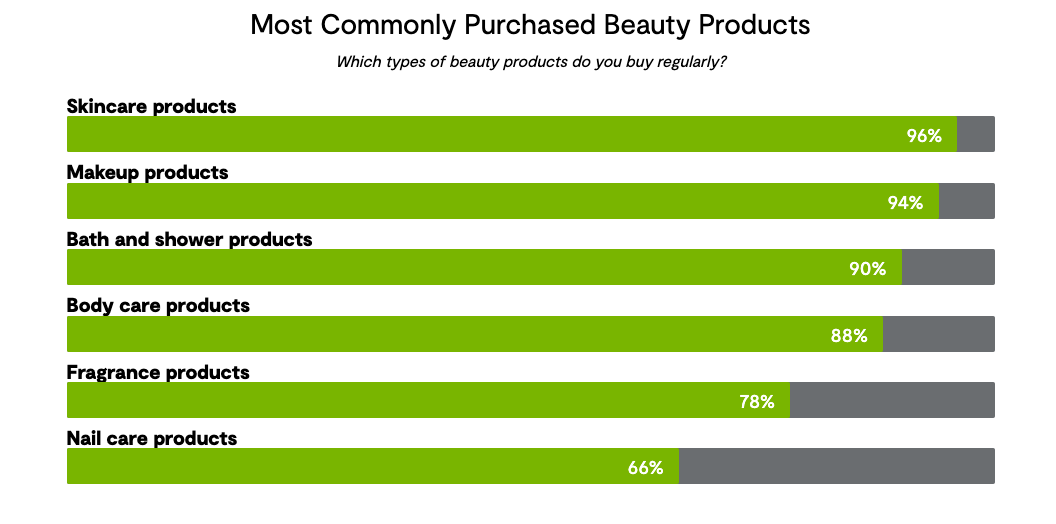

Image courtesy of PowerReviews.

The largest portion (40%) of in-store shoppers say 26 to 50% of their in-store beauty purchases from the last year were beauty products they’ve never tried before. Nearly 3 in 10 (29%) say new-to-them products made up more than half of their in-store beauty purchases in the most recent 12-month period.

37% of beauty shoppers use Google search results as a way to learn about new beauty products they’ve never purchased before. And 29% trust these results when it comes to making a purchase decision.

Nearly a third (32%) of consumers are spending more than $100 in-store on beauty products each month. In 2022, 17% said this was the case.

Ratings and reviews are the factor consumers trust the most. 89% indicate they trust ratings and reviews when it comes to deciding whether or not to buy beauty products.

34% are motivated by media on Instagram, 33% from Tiktok, 25% on YouTube, 24% by influencer endorsements, 22% from Facebook, and only 9% are influenced by celebrity endorsements, and 7% by television commercials.

Read the full consumer survey.

Furthermore, year-over-year, consumers are spending more on beauty. 29% of consumers say they spend over $200 per month on beauty products. That number was 15% in 2022.

Why is beauty a burgeoning bright spot for retailers? PowerReviews surveyed over 26,000 beauty shoppers to shed light on the trends driving the popularity of beauty. See their insights below:

Image courtesy of PowerReviews.

Buyers Are Open to New Possibilities

The largest portion of consumers (35%) shopping for beauty products online say 26 to 50% of their online beauty purchases over the past 12 months were for products they’d never tried before. Over 3 in 10 (31%) say new products account for 51% or more of their online beauty purchases from the past year.The largest portion (40%) of in-store shoppers say 26 to 50% of their in-store beauty purchases from the last year were beauty products they’ve never tried before. Nearly 3 in 10 (29%) say new-to-them products made up more than half of their in-store beauty purchases in the most recent 12-month period.

37% of beauty shoppers use Google search results as a way to learn about new beauty products they’ve never purchased before. And 29% trust these results when it comes to making a purchase decision.

Beauty Shoppers Are Guided by Their Values

38% of shoppers say it’s important that a beauty brand is Black-owned. 80% of consumers say it’s at least somewhat important to them that the product in question is “clean” -- being sustainably made with natural ingredients. While nearly half (48%) say it’s important that a beauty product they’re considering is vegan.Online Beauty Buying Is Growing

Consumers are spending a larger portion of their beauty budgets online. This year, over a third (37%) of consumers say they spend more than $101 online on beauty products per month as opposed to 24% in 2022.Nearly a third (32%) of consumers are spending more than $100 in-store on beauty products each month. In 2022, 17% said this was the case.

What Influences Consumers to Purchase Beauty Products

88% of consumers consider ratings and reviews when making a beauty purchase decision; 67% consider photos and videos from other shoppers. 70% of beauty shoppers use this content to learn about products they’ve never purchased before.Ratings and reviews are the factor consumers trust the most. 89% indicate they trust ratings and reviews when it comes to deciding whether or not to buy beauty products.

34% are motivated by media on Instagram, 33% from Tiktok, 25% on YouTube, 24% by influencer endorsements, 22% from Facebook, and only 9% are influenced by celebrity endorsements, and 7% by television commercials.

Read the full consumer survey.