11.14.23

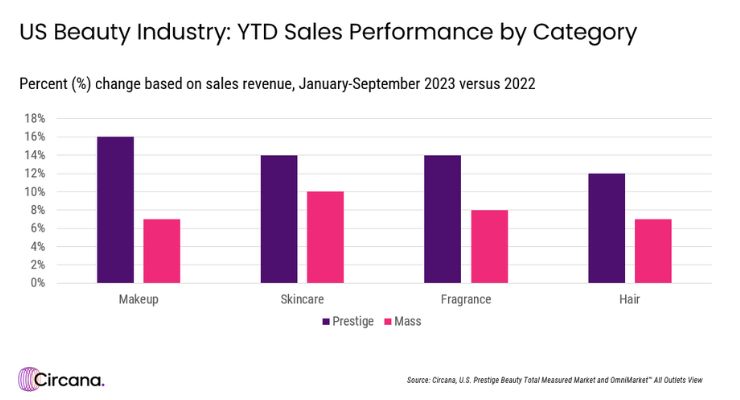

U.S. prestige beauty industry sales revenue grew by 14% this year through September, compared to the same nine-month period in 2022, according to Circana, formerly IRI and The NPD Group.

In comparison, mass market beauty sales experienced a year over year increase of 8%.

This continues a trend from last year. U.S. prestige beauty industry sales revenue grew 15% year over year, reaching $27.1 billion in 2022.

Fragrance sets, which typically offer more value for the price, increased more than double the rate of juices. Meanwhile, the demand for luxury brands within the prestige market has slowed, with units sold up 1% this year.

A stronger demand for hair products continues to be seen in the prestige side of the business as units sold was a mixed bag across the mass channels. In the prestige market, sales continued to grow at a double-digit pace across most of the hair care and styling segments.

In comparison, mass market beauty sales experienced a year over year increase of 8%.

This continues a trend from last year. U.S. prestige beauty industry sales revenue grew 15% year over year, reaching $27.1 billion in 2022.

Makeup is the Fastest-Growing Category Based on Sales Revenue

Within the prestige channels, makeup was the fastest-growing category based on sales revenue. Lip makeup grew, driven by products such as oils and balms, as well as lip gloss, which grew faster than lipstick. All segments within face makeup grew, while eye makeup sales experienced the softest growth. According to Checkout, Circana’s receipt-based tracking service, spend per buyer on makeup increased by 10% this year, while purchase frequency rose by 4%.Skincare is the Fastest-Growing Category Based on Units Sold

In the prestige market, skincare was the fastest-growing category based on units sold. It was also the only category whose average price remained flat, while average price across the other categories increased. Looking at specific skincare segments, face serum, up 21% based on dollar sales, and face cream, up 12%, were two of the biggest growth contributors. Body skincare continued to outpace the overall category.Consumers Find Value in Lower-Priced Prestige Products

“Value” continues to be a buzzword for fragrance purchases. Consumers are increasingly finding value in lower priced prestige fragrance products amid a slowdown in demand for high premium luxury brands, contributing to the softer increases in average selling prices this year.Fragrance sets, which typically offer more value for the price, increased more than double the rate of juices. Meanwhile, the demand for luxury brands within the prestige market has slowed, with units sold up 1% this year.

A stronger demand for hair products continues to be seen in the prestige side of the business as units sold was a mixed bag across the mass channels. In the prestige market, sales continued to grow at a double-digit pace across most of the hair care and styling segments.