Elle Morris, President & CEO, SnapDragon09.19.19

The American beauty care market continues to grow, and the faces of the American beauty consumer continue to change.

It’s no longer the Caucasian woman that holds the lion’s share of wallet – Latinas, African Americans and men are driving market growth exponentially.

Differing Viewpoints on Vanity

There are physical differences in hair and skin between people classified as Caucasian, African American or Black and Hispanics.

But the drivers of their beauty habits in practice are driven almost equally by physical and cultural differences.

The Beauty Habits of Caucasian Women

Caucasian women tend to wash their hair more frequently. Regardless of their hair texture (wavy, straight or curly), Caucasian hair is relatively easy to care for.

Caucasian skin can vary from dry to oily and every combination in between, but from a relatively young age, Caucasian women are taught to enroll in a skincare regimen which usually includes sunscreen.

Caucasian women tend to be concerned about premature aging at a much younger age than their Latina and African American counterparts because the appearance of wrinkles appears earlier on fairer skin.

North American cultural norms for Caucasian women hailed from Colonial, Puritanical roots for many generations.

Overt vanity has traditionally been shunned vs. the appearance of good grooming and “upkeep.”

With the advent of the Internet and selfie culture, that traditional mindset seems to have been abandoned for the younger generations (younger Millennials and Generation Z) as they embrace a more zealous approach to all aspects of beauty.

The need to receive and to give outward validation for beauty has skyrocketed with this group of younger Caucasian women and it’s not slowing down.

Latinas Are More Difficult to Classify

Latinas are more difficult to classify. While celebrities like Salma Hayek or Eva Longoria are identified as stereotypes of the dark haired, dark eyed, brown skinned beauty, the range of skin tones and hair types amongst Latinas are far more diverse; Christina Aguilera has blonde hair, fair skin and blue eyes, redhead Bella Thorne is Cuban American; Gina Torres, Tatyana Ali and Rosario Dawson are Latina actresses of African descent.

While Latinas may not all look alike, their culture is the primary unifier.

Beauty is a significant part of every Latina’s upbringing. Women are taught that Vanidad (translates to vanity in English) is a positive attribute.

Latinas consider outward beauty a part of self-confidence rather than the superficial for external validation. In turn, they appreciate and understand other Latinas and their beauty approach, openly acknowledging their counterparts’ investments in their appearance.

Hispanics represent the fastest growing segment of the US consumer packaged goods spending.

Hispanics are the second largest demographic group in the US, representing 19.5% of the population in 2019. Buying habits differ for Spanish-speaking Hispanics vs. English-speaking Hispanics.

For example, Spanish-speaking Hispanics favor beauty products touting long-lasting results, while English-speaking Hispanics prefer beauty products addressing their specific beauty goals and have anti-aging benefits.

Latinas have a higher tendency than other groups to experiment with beauty products.

Overall for Latinas, their mindset on beauty is similar across all life-stages, creating a significant opportunity for brand loyalty. However, marketers must still communicate in relevant and authentic ways across each generation.

A Beauty Snapshot of African Americans

The total buying power of African Americans is projected to rise from $1.3 trillion to $1.54 trillion in 2022.

54% of the African American population has lived their entire life in the digital age with social media usage higher than any other group of people and a mobile usage rate of 81%.

Further, 44% of African Americans are more likely to engage with brands online vs. Caucasian Americans, creating substantial opportunities for beauty marketers in the digital space and causing some brands to question investing in brick and mortar at all.

Black women in America for decades had typically been ignored by mainstream media. Without images of African American actresses and models, there were generations of these women having their beauty defined within their own social construct.

The desire to be waif-thin was almost non-existent; African American women were more self-confident than their Caucasian counterparts.

In the past few decades, the emergence of mainstream superstars such as Iman, Naomi Campbell, Tyra Banks, Beyoncé, Halle Berry, Viola Davis, Lupita Nyongo and our former First Lady, Michelle Obama, has helped to acknowledge these women as globally beautiful, not just beautiful within their own race.

That said, the parameters of African American beauty standards have broadened to encompass all shades, facial features and hair types. African American women no longer have Caucasian beauty standards thrust upon them.

Research from Nielsen shows that the spending decisions of black consumers creates a halo effect that impacts the spending habits of other demographic groups.

Consequently, the marketplace for beauty products is widening with appeal to the broader consumer market.

Men & Personal Aesthetic

Despite cultural differences of Hispanic men and African American men, they are both more accepting and interested in scent-based beauty products and fragrances, more so than Caucasian men, but all groups are sensitive to the inferred level of feminity.

Caucasian men overall historically tended to subscribe to older ideals of male grooming; their fathers and grandfathers used Vitalis and Old Spice; then came the age of the Metrosexual (the beauty-over-involved man) and more recently the trend towards hipster beards and the male top-knot illustrates a higher comfort level with male self-expression providing men with the ‘permission’ to highlight their personality through their aesthetic and style.

Traditionally Hispanic men have looked to Hispanic women as skincare pioneers with their widely different skin types and tendencies to identify natural, ingredient-based solutions to skincare issues, such as avocado and yogurt mask for dry skin.

Beauty Behaviors: Millennials, Gen X & Z

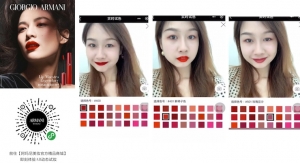

It’s no surprise that Millennials are creating a sea change in beauty. The generation that’s always on and digitally involved is largely influenced by social media and brand communities.

37% of Millennials say they are more likely to trust a brand or buy a product after seeing a trusted influencer post about it; and Millennials are three times more likely to research brands on social media than Baby Boomers are.

For Generation X, their online purchase behavior is growing – with 56% of them eschewing their preference to shop online.

Generation Z, (born between 1995 & 2010) with a spending power of $44 billion are more inclined to impulse-buy and their activation on served retail offers confirms that behavior.

Now entering the workforce, they can be price-conscious and tend to be conservative spenders but are also driven by image – and are conscious about consumption.

They seek beauty products that are just for them – 8 out of 10 Gen Z teens believe that “being yourself” best describes their definition of beauty.

Gen Z is the biggest video generation with more YouTube beauty videos watched by them than any other group; but they are also more likely than most other generations to actually BUY their beauty products in-store.

Generation Z is diverse and dynamic, and they demand a higher standard than ever before, so beauty marketers must create meaningful, experiential interactions with them to earn their trust.