Sarah Cascone, Director of Marketing, Bluecore07.25.20

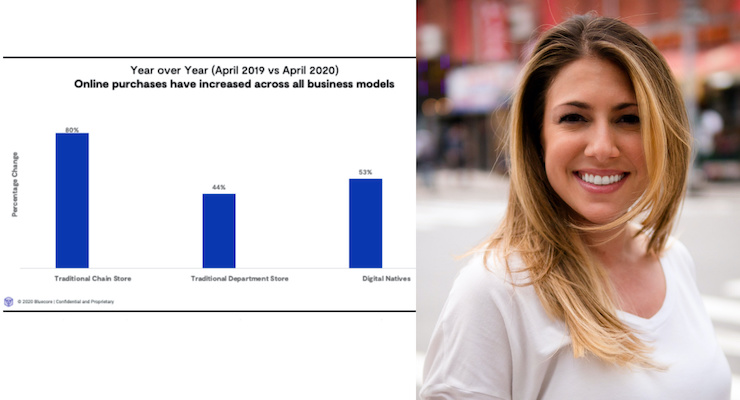

Consumers are spending more time online than ever before, and one thing is certain: Market share is up for grabs. For the first time, Beauty brands across the board -- whether digitally native, brick-and-mortar focused, or a mix of both -- have been forced to compete on the same playing field, for the same customers, as all sales shift to e-commerce.

Bluecore’s new report, COVID-19 Retail Trends in An All-DTC World, analyzes the performance of over 70 brands across sub-verticals and business models as they adjust their strategies for this accelerated shift to digital. It’s clear that when shoppers are only able to shop online, who they buy from and how they interact with brands changes, too.

In order to capitalize on this influx of online activity and changing consumer behaviors, there are three key strategies Beauty retailers must keep in mind to beat the competition and grow their business:

1. FACILITATE PURCHASES FROM 'WINDOW SHOPPERS'

Consider the online experience a window shopper has: They view a few products, maybe add one to their cart, and then get distracted by something else. COVID-19 has created even more window shoppers, with Beauty seeing a 27% increase in consumers’ viewed products and a 65% increase in add-to-carts since February. But not all hope is lost if they haven’t made their way to purchase.

Use first-party data, such as product preferences and general browsing behavior, to determine shoppers’ affinity for offers like exclusive loyalty programs or compelling discounts, and implement on-site pop-ups if their behavior suggests leaving the site. Adjusting communications to be highly personalized based on shopper behavior and the products they interact with will be what separates window shoppers from new customers.

2. TURN THAT FIRST PURCHASE INTO A SECOND PURCHASE

Consumers have been open to trying everything from new recipes to hobbies while at home, and the same goes for their approach to new brands: First-time Beauty buyers have increased 147% YOY and 129% since February. And acquiring a customer is just the beginning, there’s a prime opportunity to build a long-term relationship with this new customer given second-time buyers are 130% more valuable than first-time buyers.

Use shoppers’ purchase behavior to drive meaningful communications with them that are timely and relevant. Take replenishment campaigns for example: While the average buying cadence for sunscreen is 49 days, lip care is 64 days — and your suggested product communications should reflect these buying patterns or automate the replenishment lifecycle with technology partners able to act on the signal. With continued knowledge of shopper patterns, refine that cadence to the individual’s preferences over time to increase likelihood of a second purchase.

3. PRIORITIZE VALUE-BASED MESSAGING WHILE ALSO PROTECTING YOUR BOTTOM LINE.

Promotions may seem like an easy way to differentiate from competition but, in reality, price is only one factor in a purchase decision and creates price loyalty versus brand loyalty. Identify discount buyers and full-price shoppers in order to send appropriate offers that illustrate value while protecting your margins. Your CFO will thank you for keeping the bottom line in mind and prioritizing long-term cost optimization over short-term conversion boosts.

As the cost to acquire a new customer increases, doubling down on opportunities where customers will buy more over time is key to increasing market share while competition is at its highest. Learn from performance and refine your communications over time — after all, acquisition is only the beginning of a long-term relationship.