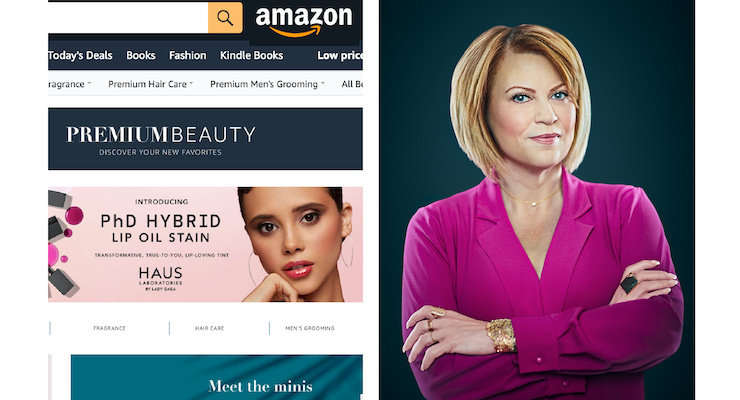

Elle Morris, Senior Global Strategy Consultant for Marks, part of SGS & Co.06.07.21

The Beauty Sector, cosmetics, skincare, personal care and fragrance, has been highly impacted by the effects of the Covid-19 pandemic.

In the U.S. alone, in-person/in-store beauty shopping is 81% of the market, so for ‘Beauty Junkies’ like me, it was tough being forced to stay at home, and not being able to spend time browsing and sampling at our favorite brick and mortar beauty retailers like Sephora, Ulta, Blue Mercury, and clean beauty upstart, Credo – as well as our corner drugstores.

There were no more personal consultations with experts. Panic ensued; what would we do now that we couldn’t browse the aisles of our favorite retail destinations and experiment with product to decide what was best for us?

Amazon Answers the Call

Just like it did for nearly all of our other pandemic-life needs, Amazon stepped up and answered the call.Consumers started relying more on product reviews and cosmetic application from Tiktok Amateur Experts such as Mikayla Nogueria, and Rose Gallagher. Their videos inspired thousands of women to try products they would likely not otherwise have considered – from mass-brand goodies to high-end brands, and in some cases, some obscure beauty brands that we never would have known of without their recommendations.

Amazon became an easy one-stop-shop for all beauty and skincare needs, along with everything else you need like household goods, clothing, etc.

Suddenly, we were all shopping for our beauty products on Amazon – even though many of us would’ve never considered shopping Amazon for beauty products before the pandemic.

With well over one year into the Covid pandemic, Amazon has become a serious player in the beauty category. They’ve increased their spending on advertising by over 50% and a good portion of that was spent on beauty.

But will that continue once the new “normal” happens?

Beauty is Growing in the On-line Space

The global beauty industry is big -- $ 511 billion in 2021 and expected to exceed $716 billion by 2025. According to Retail Insight, online share in beauty retail will increase to 23% by 2025.Couple this with the fact that department stores experienced more than a 10% sales decrease in the category for 2020, beauty brands have been moving quickly to an online sales strategy to increase their reach and to improve growth.

Amazon has been one of the leaders of the pack in selling beauty online. According to a survey by Molzi, a British Marketing Agency, seven million consumers bought beauty products from Amazon during the pandemic.

There’s more choice than ever on Amazon for Beauty Junkies. Many prestige and Indie brands who previously resisted Amazon as a sales channel, have now embraced it.

With Amazon’s gates to prevent counterfeit beauty goods (through its Premium Beauty and Indie Beauty Shop) and creating direct connections between brands and consumers (through Amazon Live, its livestream, for example) have made the channel irresistible to both brands and consumers.

An Amazon Live event for haircare brand Flawless generated 100,000 views – creating massive engagement and brand awareness.

Beauty Consumers Enjoy the Convenience

Beauty consumers have also come to enjoy the convenience of having their favorite products delivered to their front door, often overnight through their Amazon Prime membership. This is a trend that will likely continue as we emerge post-Covid-19.With Amazon, Beauty Junkies have become accustomed to a high level of convenience, service and the myriad of options on demand wherever and whenever they want.

Nothing replaces in-person beauty try-ons and sampling, but who knows when that will feel normal again.

Brands and retailers are making headway with virtual beauty tools (augmented reality). L’Oréal, last year expanded its partnership with Amazon into Canada, to offer virtual color testing via smartphone.

Something that was so crucial during the height of the pandemic, is now being considered a critical mainstay tool to help consumers experiment and engage – creating a new kind of beauty experience.

Amazon recognizes the multiple benefits to increasing their beauty business – the beauty industry consistently shows growth, even when other consumer goods sales are stalled; the global beauty industry is expected to grow at a compound annual rate of 5.81% through 2026.

And the margins in beauty are higher than other categories. The cherry on top is that beauty products are typically at higher price points, but are small and generally lightweight to ship which makes for an extremely profitable category for Amazon to sell.

Add to all of this, consumers will likely remain in the mindset of staying out of crowded places and keeping up hygienic practices for the foreseeable future. Amazon will reap the benefits and meet consumer needs, and they will continue to invest heavily in beauty offerings.

Given the explosion of Amazon beauty growth with seemingly no end in sight, there may very well be an exclusive Amazon Beauty arm in our future.