John Nelson, Editor, Smithers07.13.22

As it enters the 2020s, personal care packaging is facing the prospect of legally enforced extended producer responsibility (EPR) schemes. These are founded on a “producer pays” principle, while also seeking to reward innovation away from less sustainable formats.

The current status and future evolution of this important development is tracked and analyzed in depth in The Impact of EPR Legislation on the Packaging Industry to 2032 – a new expert study from Smithers.

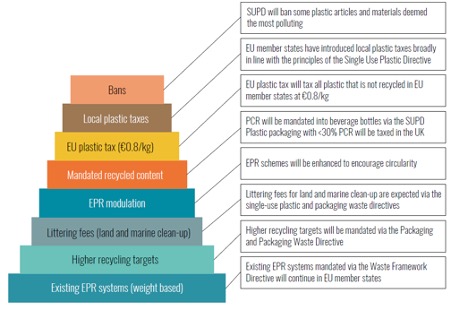

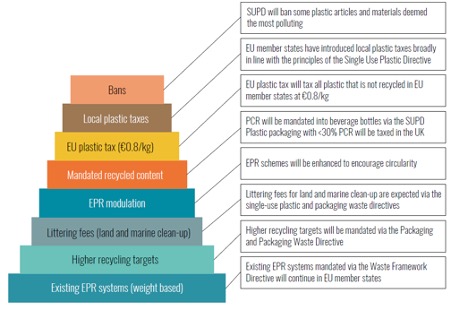

The drive is being led by the EU, with multiple jurisdictions worldwide watching and assessing the suitability of its policies for their home markets. Smithers’ analysts identify the following as directly applicable to personal care and beauty brand owners:

Product bans are the most direct option for legislators, but the only packaging material currently being targeted in Europe is expanded polystyrene (EPS). And plastic cotton bud sticks have been banned in Europe since July 2021, via the Single-Use Plastics Directive. The same legislation is placing pack labelling, consumer education and disposal obligations on sellers of personal care and cosmetic wipes.

Plastic taxes and surcharges are looking to push brands to substitute away from harder to recycle polymer materials, where there is limited scope in personal care. One option to optimize recyclability is to ensure caps and closures are of the same plastics family as the base unit, to enable them to be recycled together. The EU will oblige all beverage caps to be tethered to their container from 2024, a step that could be extended to other products in the future.

There are multiple mandates to include post-consumer recycled (PCR) content in packaging. The initial rounds of these target polyethylene terephthalate (PET) beverage bottles, but again will be extended to other container types in time. Multiple personal care lines are already using PCR, at up to 100% by weight, but the challenge will be the sourcing of adequate supplies of polyolefins (HDPE/PP).

For aesthetic and organoleptic reasons, beauty products typically require higher grade PCR resins – cleared for food contact. Currently only around 10% of PCR resins are food contact approved, and volumes of PP and HDPE are especially low (~3%)—meaning there will be competition for these superior grade materials, and price premiums.

Some beauty brands have pioneered the use of bioplastics, such as polylactic acid (PLA). These are falling out of favor however as EPRs prioritize high-volume recycling, where PLA can contaminate recovered stocks of more common polymers, and damage the material performance of any PCR resins.

The Impact of EPR Legislation on the Packaging Industry to 2032 is available from Smithers.

Summary of the main financial and fiscal initiatives in the EU that affect packaging. Source: Smithers

About the Author

John Nelson is an award-winning editor and journalist working in the market reports and consultancy business of Smithers. Here he covers market and technology developments across multiple technical and commercial segments; including paper, packaging, sustainability, printing, nonwovens, rubber and tires.

The current status and future evolution of this important development is tracked and analyzed in depth in The Impact of EPR Legislation on the Packaging Industry to 2032 – a new expert study from Smithers.

The drive is being led by the EU, with multiple jurisdictions worldwide watching and assessing the suitability of its policies for their home markets. Smithers’ analysts identify the following as directly applicable to personal care and beauty brand owners:

Product bans are the most direct option for legislators, but the only packaging material currently being targeted in Europe is expanded polystyrene (EPS). And plastic cotton bud sticks have been banned in Europe since July 2021, via the Single-Use Plastics Directive. The same legislation is placing pack labelling, consumer education and disposal obligations on sellers of personal care and cosmetic wipes.

Plastic taxes and surcharges are looking to push brands to substitute away from harder to recycle polymer materials, where there is limited scope in personal care. One option to optimize recyclability is to ensure caps and closures are of the same plastics family as the base unit, to enable them to be recycled together. The EU will oblige all beverage caps to be tethered to their container from 2024, a step that could be extended to other products in the future.

There are multiple mandates to include post-consumer recycled (PCR) content in packaging. The initial rounds of these target polyethylene terephthalate (PET) beverage bottles, but again will be extended to other container types in time. Multiple personal care lines are already using PCR, at up to 100% by weight, but the challenge will be the sourcing of adequate supplies of polyolefins (HDPE/PP).

For aesthetic and organoleptic reasons, beauty products typically require higher grade PCR resins – cleared for food contact. Currently only around 10% of PCR resins are food contact approved, and volumes of PP and HDPE are especially low (~3%)—meaning there will be competition for these superior grade materials, and price premiums.

Some beauty brands have pioneered the use of bioplastics, such as polylactic acid (PLA). These are falling out of favor however as EPRs prioritize high-volume recycling, where PLA can contaminate recovered stocks of more common polymers, and damage the material performance of any PCR resins.

The Impact of EPR Legislation on the Packaging Industry to 2032 is available from Smithers.

Summary of the main financial and fiscal initiatives in the EU that affect packaging. Source: Smithers

About the Author

John Nelson is an award-winning editor and journalist working in the market reports and consultancy business of Smithers. Here he covers market and technology developments across multiple technical and commercial segments; including paper, packaging, sustainability, printing, nonwovens, rubber and tires.