|

Costs, currencies, colors, shapes, technologies and materials, not to mention styling, are all influencing packaging in the cosmetics, fragrance and personal care industry.

Impact of Raw Materials Costs

Whether you are a cosmetics brand manufacturer, a packaging component supplier or a producer of the raw materials that go into all of the above, cost increases are a major concern in today’s beauty business.

“The cost increase in raw materials has obviously affected us all over the world, increasing prices and impacting margins” said Jean-Paul Imbert, president, Make-up Americas for Alcan Packaging Beauty, New York.

Some relief may be coming, according to Craig Sawicki, executive vice president of TricorBraun, based in Clarendon Hills, IL. “Plastic and glass cost increases appear to be slowing, but the cost of metals continues to rise. The result for TricorBraun is that clients are asking for designs that replace metal packages with plastic,” Sawicki said.

Based in Toronto, Crystal International/Crystal Claire Cosmetics consists of two businesses: it sells components sourced in China to brand marketers and it fills components in China and in Toronto. For a company such as Crystal, which sources in Asia, raw material costs with global specified brand names including ABS, SAN, and Clarified PP are a strain and have cut into its manufacturing and selling margins, according to Bob Patterson, Crystal’s director of business development. “For any innovation involving resins, we stick to sourcing from known global companies with proven technology and consistent quality. We’ll ship in the resins for the factories if needed.”

The company has made the decision to be cautious regarding generic resins available in Asia. “We can not deal with wide spec resins being offered as a substitute that were dumped in the Asian market or being offered as equivalent by local distributors.”

Construction costs in Asia (steel & concrete) are also a factor, along with energy costs. Patterson said, “China’s currency is stable, but Taiwan’s has been floating. At some point rising oil prices may cause hyper-inflation, but never under estimate the Chinese economic drive for growth. Social and political obstacles that affect us in the West are not part of the Chinese ambition to succeed.”

Currency Rates & Globalization

The currency exchange continues to make European products more expensive and the uncertain costs of energy are putting a dent in the profitability of all products both domestic and imported, according to Jim Slowey, vice president of sales and marketing for Arrowpak, with U.S. offices in Richmond Hill, NY, and Carson, CA.

But for companies that manufacture all around the world, the impact is lessened. Currency rates aren’t hurting plastic bottle and jar supplier Inoac’s business, noted Paul Horgan, corporate vice president, Inoac Packaging Group, Bardstown, KY. “Our European plant sells to Europe and our U.S. plant sells here and to Europe, Horgan said. Inoac’s Chinese operation is mostly for the local Chinese market with a small amount going to Japan and back to the U.S. The strategy of moving tools around the world is continuing to grow as the beauty business becomes more and more a global industry. “We make the same package with the same tools in the U.S., Europe and China,” he said.

Clariant Masterbatches has established its ColorWorks Design & Technology Centers, a network of global facilities to support its customers that produce around the world, according to Caroline Sedgwick, ColorWorks manager for Clariant.

“You need an organization that can provide the global color services that are required when design and manufacturing may be taking place on different continents,” said Len Kulka, creative director, ColorWorks. “Some of our customers are even manufacturing different components of the same package in different countries. Consistency of color and consistency of brand identity can only be preserved when you work with a team that has global resources.”

“Petrochemicals prices and the weakness of the dollar are putting a lot of pressure on foreign producers to maintain prices,” said David Deans, president of Roberts Container, Chatsworth, CA. “Far East suppliers are in general holding prices for established clients, but passing on increased costs for new customers. Between resin and currency increases, new customers are seeing as much as a 15-20% increase over prices a year ago. As a result many Asian producers are bypassing the distribution “food chain” and trying to do more direct deals to be competitive,” he explained.

Compatibility and Materials

While plastics are dominant, making up approximately 90% of color cosmetics and personal care packaging, there are certain compatibility issues, which are answered only by glass, according to Sawicki. Even metal can be a problem because it can dent or scratch, so glass will always have a role to play in beauty packaging (see story p. 38).

David Hou director of marketing for Cospack America, Edison, NJ, agreed that compatibility is a top concern when packaging beauty products in plastics. “Clients are looking for high chemical resistance. They will make the inner jar PP and then use acrylic as the outside for a beautiful, clear look.”

Plastic isn’t only chosen for price. According to Fabrice Dieudonat, technical director of the innovation center Alcan Packaging Beauty, in Paris, France, certain plastic resins offer other advantages as well. “DuPont’s Surlyn or Eastman Chemical’s Glass Polymer allow for substitution of glass by plastic. The transparency and compatibility levels are equivalent to those of glass, but some angles and shapes that are not feasible with glass are achievable with these new materials,” noted Dieudonat. “Also, tolerances are improved: while glass gives dimensions of +/- 1 mm, Surlyn and The Glass Polymer allow tolerances of +/- 0.1 mm.”

Technologies Offer Innovations

Technologically speaking, there are several things going on, according to Clariant’s Kulka. “First, the computer-numerical control (CNC) technology used to make tooling has advanced to the point that it is now economically feasible to create different new and unique packaging rather than modifying standard shapes. CNC allows the tooling to be produced much more quickly and at a much lower cost than even a decade ago.

“Second, manufacturing equipment like multi-layer blow molding machines, are now accessible to even small packaging producers,” Kulka said, adding, “which makes it possible to make more exotic components even for medium-sized production runs.” The possibilities include creating a translucent layer applied over light shades, resulting in soft, feminine pastels with depth and an added iridescence.

These effects are also possible because screw technology used in the compounding machines has improved, Kulka explained. Incorporating coated mica flakes is one way to create an iridescent effect, but until recently these reflective particles would be damaged as they were dispersed in the polymer masterbatch. The coating could be stripped off the mica or the mica flakes themselves could fracture. “But we’ve found new screw designs that now allow us to get adequate dispersion without damaging the particles,” he noted.

Developments in bi-layer molding technology has also made new things possible, according to Clariant’s Sedgwick. Now, it is possible to “separate the chemistry required to contain the product, from that which creates the look of the package. You can engineer the plastic on the interior layer to resist attack by the product inside. Then you can develop the outer layer purely to create the appearance you want without worrying about incompatibility between the product and the package.”

M&H Plastics USA has developed a process of “in-mold frosting” on clear PVC/PETE bottles, according to Alex Piagnarelli, vice president of sales & marketing for the company, based in Winchester, VA. He explained that this in-mold process offers significant cost savings to traditional lacqured frosting, which is done by various third parties as a secondary procedure. “In addition the durability of in-mold frosting is far superior to lacqured sprays, and offers a very high end etched glass look to conventional plastic packaging,” he said.

Valois’ ITP (Integrated Top Packaging) technology allows pump, collar and cap to arrive at the customer site completely assembled and ready for fast fixation, according to Edward J. Quinn, national director of sales-Perfumery & Cosmetics for the company, based in Congers, NY. Quinn said, “The benefit is two-fold—the client deals with one source for all componentry from the neck up and the client gains productivity efficiencies by reducing a step during the filling process.”

|

| Cospack America offers a wide range of beauty packaging in clear and frosted styles, many with heavy or double-walled constructions. |

Growth Categories

Despite cost and currency challenges, the fragrance, cosmetic and personal care industry goes on.

An effective way to increase business is to provide full turn key services, according to Charles Chang, president of Topline. “By supplying a finished product to our clients, we reduce their costs and increase our per unit sales. It improves the cash flow and can result in faster delivery by shortening the supply chain for our customers,” Chang said.

Virtually all the sources interviewed, agreed that skin care is the beauty segment that is experiencing the most growth. That means business for plastic bottle and jar suppliers, along with the requisite caps and dispensers, is healthy. “And more color cosmetic customers are asking for skin care type packages, such as pump bottles for foundation,” added Cospack’s Hou. “The small, indy lines are more willing to experiment with new concepts.”

For carton manufacturer Wilco, the men’s category also offers promise, according to Benoit Bourguignon, director, sales and marketing, based in Quebec, Canada. “Creating an appealing package for the other gender is a challenge if you want to stay away from the traditional silver and ‘car like’ metallic colors. Metal canisters are an obvious choice, but for the cost conscious it is prohibitive. Gravure and embossing would deliver a similar effect at a fraction of the price.”

Contrasting Fashion Trends

There are two major styling trends operating in beauty packaging: hi-tech looks that are developed for hi-tech formulations, contrasted with environmentally-friendly containers (see story on p. 34) that are in demand both for products that stress natural/organic formulations or for brands that have made recycling and recyclability part of their identity.

Shapes follow function,” TricorBraun’s Sawicki said. “A specific need for a round or oval container, for a special type of grip, will dictate a design element. Features are being done for a reason rather than simply for style—function comes first.”

|

| Bottles from M&H have interesting shapes and a large front panel. |

Market Demands Fast, Effective Pack Impressions

With four to eight-tenths of a second to catch consumers’ attention in a retail environment, Sawicki said, “You have to do provocative and pragmatic package design. Once, you’ve gotten their attention, there must be something more to convince and pull them (consumers) into buying the product.”

Clariant has also seen more brand interest in making a unique statement. “To create impact or differentiation, we now see a greater willingness to produce new and unique tooling,” said Kulka. “A good example of that is seen in the new Olay Quench product line. Their pump bottle has the neck off-center,” he noted, adding, “Instead of a squared-off seal end on their tubes, they are using angled seals or, in one case, a scalloped end where the shape of the container works together with the decoration to yield a very striking look. One of the Quench containers is a tottle with a rounded end.”

“We have seen a continuing trend toward unique shapes that make a strong impression on the store shelf,” agreed, M&H’s Piagnarelli. “Marketers are also looking for bottles with wide front panels so that they have a larger ‘billboard’ for the printed or labeled message. Clear packaging and tinted clear packaging continue to be in strong demand in the market,” Piagnarelli noted.

|

Kenra Platinum Epitomizes Hi-Tech Look in Hair Care Packaging

|

|

| Kenra Platinum |

In the hi-tech category are packages that are sleek and often combine clear, heavy-walled plastic or glass with metal, such as Kenra Platinum. Kenra LLC, an Indianapolis-based hair care manufacturer has been making and marketing products since 1929. Henry J. Meyers, a barber/ stylist, purchased the company in 1959 and it has remained under family management since with an ongoing commitment to creating hair care products for the professional market.

Wanting to build on Kenra, the brand’s foundation line, the company went to TricorBraun to help develop packaging the would set Kenra Platinum apart as the “City Sister,” of Kenra, according to Keryn Stoeling, creative director for the company. “We wanted a look that would be more like a high end cosmetic that would be at home on department store counters, even though it’s available at salons,” said Stoeling. “Our challenge to TricorBraun was to get the look we wanted, hold the volumes of products needed and do it at a reasonable cost.” Four of the five containers in the Platinum line were supplied by TricorBraun. The bullet-shaped tottle that holds the Freezing Gel was supplied by Empire-EMCO, Buffalo, NY. All the packages have a high gloss, metallic look. The pieces from TricorBraun feature heavy double-walled constructions where thick clear plastic sets off the metallic inner jars and bottles for a high-tech, sophisticated look. The Empire tottle was a challenge, according to Stoeling. “They took the risk of chrome plating the packaging. The blow molder, chrome plater and decorator are all located with 25 miles in Canada and worked very closely to create the container.”

Kenra Platinum launched in December 2003 and is now available in 5000 salons. “It’s proving to have great staying power and we’re adding an aerosol spray product in the fall that will be packaged in an aluminum can with a high, gloss chrome finish,” stated Stoeling. |

|

Large Sizes Imply Value

Some brands are turning to larger size containers to compete with private label products that are now common in mass discount retailers as well as grocery and drug stores. Sawicki said, “It’s to appeal to the consumer who is cost conscious and is most concerned with cost per oz. It has nothing to do with brand loyalty.”

At Cospack America, clients are asking for larger sizes, especially for hair care products. “We’ve recently added 250ml and 300ml sizes to our line of PETE bottles, and now our largest airless container is available in a 150ml size,” said Hou.

“We have also witnessed a growing demand for larger volume packaging which we have been able to meet with our super-sized ‘Spa’ tube that we have added to our super-tube line,” reported James Farley, vice president of sales and marketing for Tubed Products, Easthampton, MA.

For carton suppliers, size is also a concern, according to Wilco’s Bourguignon. “Maximizing shelf impact and observing the ever demanding labeling laws on product chemistry are creating a demand for larger cartons or shadow boxes,” Bourguignon said. “The delicate balance between that and not creating a deceiving package for the end-user is also to keep in mind.”

“We see two diverging sizing trends,” said M&H’s Piagnarelli. “There is a trend to downsize packaging to address the increasingly mobile society, as such, travel size bottles have become very popular. However, the club stores and dollar stores are driving marketers to larger packaging to address the value shopper.”

The Decoration’s the Thing

As marketers try to keep packaging costs down, they are becoming more creative with decorative finishes, according to Hou. Some are decorating the inner tube of the double-walled airless package Cospack supplies, as well as adding some embellishments on the outer wall for unique effects, he said.

“Over the last several months we have seen a continued growing interest in more upscale decoration as evidenced by increased requests for multi-pass silk-screened and foil hot stamped tube designs,” said Tubed Products’ Farley. Tubed is also creating great effects with some of the new inks, as well as new foils and plastic colorants, according to Farley. He stated, “With the increasingly rapid movement within the cosmetic industry, we are constantly working on new, innovative packaging designs appropriate for health and beauty products.”

Marketers are adding value to their bottles through decoration,” agreed Inoac’s Horgan. “We are using new sprays and additions like a collar to embellish components. Inoac can do it all in house, because we are borrowing technologies from our parent company, a Japanese automotive parts supplier.”

Marketers are asking for lots of pearl and opalescent looks, according to Horgan, “And bright pinks are very hot right now.”

|

| Alcan Packaging Beauty adds ribbons and and glittery bags to its mini-lip vials for added decoration. |

Caroline Defrance, operational marketing manager for Alcan Packaging Beauty, based in New York, explained that there is a trend to embellish packaging with little added-details—ribbons, jewels, tassels— and to mix materials and textures in the make-up and fragrance categories.

While most of its packaging shapes are traditional components, according to Crystal’s Patterson, “We are working with more designs that have more value added features utilizing aluminum or UV metalizing. The company is also getting more requests for plaids or animal skin looks for labels.

Coextruded HDPE resins that produce a “soft touch” feel are increasing in popularity, according to Piagnarelli, especially in the spa, shower and suncare applications where a better grip on the bottle is a consumer convenience.

Color Craves Portable, Multi-Tasking Components

There is an increased demand for portable, smaller, ergonomic and functional packaging, such as mini pots, vials and tubes in the make-up and skincare segments, according to Alcan’s Defrance. Demand for products that are multi-functional, such as duos and multi-level compacts in make-up also continues to grow. She added that packaging is also continuing to be more hi-tech as in the emergence of two-in-one products and the development of air-tight packaging. At the same time, consumers demand products that are portable and functional to meet their “on-the-go” lifestyles.

|

| World Wide Packaging offers slim, portable, multi-functional compacts and kits. |

“The trend has been toward innovative, all-in-one kits—slim and portable,” agreed Kimyon Holmes, director of sales for World Wide Packaging’s West Coast office, Woodland Hills, CA. “The shape and color has varied from customer to customer. Most just want something innovative that identifies their own brand.”

Roberts Container is also answering demand for all-in-one compacts, according to Deans. “Roberts is introducing a new Night on the Town component to house lip gloss, blush, eye shadow, a credit card and even some cash. All a lady needs for that ‘special’ night out. New paper compacts using creative designs are also in style,” he said, adding, “Advantages are low cost tooling. Quick time to market and great prices.”

“Roberts also has a new lipstick mechanism that dispenses all the product. The environmentalists and frugal customers love getting that last 20% of the product left in conventional lipstick tubes,” noted Deans. Shipments start this July.

Credit card compacts are back in fashion in a thicker format that is still sleek, according to Topline’s Chang. “It’s an improvement that provides portability and fashion as well as a practical amount of product,” Chang said.

|

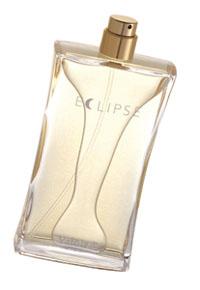

Valois' Eclipse pump is said to

have the lowest profile available

on the market. |

Innovations in Fragrance Spray Dispensers

While fragrance bottles are as individual as the scents they contain, there are trends in spray technologies. Low profile pumps are this season’s “must have” innovation in the fragrance industry. Valois developed the Eclipse, a pump with the lowest profile available on the market, according to Edward J. Quinn, Valois’ national director of sales-Perfumery & Cosmetics. Quinn said, “The Eclipse allows designers the maximum flexibility in the design of new packages. Popular colors that we are producing are pinks, lime green, turquoises, fuscias. Basically, very fresh colors.”

The popularity of celebrity fragrances will continue, according to Quinn. He added, “Super luxe and limited editions are increasing as well as the growth of ‘masstige’ products.”

Fragrance brands are asking for spray dispenser systems in which the sprayer must be “invisible,” according to Francois Danielo, technical marketing manager for Saint-Gobain Calmar, City of Industry, CA. S-G Calmar’s solution is the Melodie, an ultra low profile sprayer, which shows no mechanism in the bottle.

For complete fragrance containers, more and more customization is the trend. Eric Desmaris, global marketing manager for Rexam Dispensing Systems, Purchase, NY, said fragrance packs are adding custom collars, custom caps, custom color matches, and custom packages with spray-through features such as DKNY’s Be Delicious or True Star by Tommy Hilfiger.

Desmaris pointed out that more small-sized packaging such as Curious Britney Spears are equipped with very compact pumps. “Overall, the emphasis is on low profile designs that still ensure a practical, comfortable use by the consumer.”

Dispensing Sophistication

With the continued growth of complex formulas containing often active ingredients, how a product is delivered is becoming increasing important.

Post-mix technology is creating a lot of new interest, according to Roberts’ Deans. “Product potency and freshness can be enhanced by mixing just prior to application. Roberts is introducing a patented Dual Container Bottle for the hair color market that keeps the colorant and activator separate until activation,” he said.

In the lotion arena, there is a strong demand for airless dispensers. Desmaris added, “Sensitive and very viscous formulas require airless dispensers with pistons or pouches that prevent the contents from coming in contact with the atmosphere, but still allowing a good, efficient evacuation rate.” The Airfree system from Plastohm featuring Rexam’s airless pumps is a recent solution, as is Rexam Dispensing Systems’ new tube dispenser which uses its airless SP343 pump. The pump is snapped onto a 35mm diameter tube.

Demand has stepped up for skin treatment packaging with micro-treatment dispensers (small size package of 30ml), according to S-G Calmar’s Danielo. With the growth in the skin care category and the increase in active ingredients, S-G Calmar has developed Pure Path Technology, which features a metal free fluid path, avoiding the risk of incompatibility between the metal components and the product’s active ingredients.

“We are realizing an increasing demand for easy and innovative dispensing systems providing total seal and superior dispensing control,” noted Dieter Bakic, president of DieterBakicEnterprises, headquartered in Munich, Germany.

Beauty Turns to Tubes

The use of tubes in the beauty business, which offers consumers ease and portability, continues to grow. World Wide Packaging’s “one piece” PE oval and round tubes have been well received, according to Holmes, who explained that the cap is extruded with the tube so there is less chance of leakage and torque issues.

“Also the opening of the cap can be aligned with the decoration on the front and a new finish is available—a 360° hotstamp over a PE tube. This allows creative reverse-out print decorations with a clear window to the product or an upscale tube look altogether, which had not been available,” she said.

Tubed Products’ Farley noted that shaped tubes have been making huge inroads in what had been a basically round tube industry. “This has been confirmed in increased orders for our oval shaped tubes, and now our new rectangular tube.”

Secondary Packaging

With ever increasing automation and the focus on cost reduction, the construction of a folding carton is more important than ever, according to Wilco’s Bourguignon. “The largest marketers are looking to get away from separate components like plastic trays. We have to create a carton with an internal panel that will bear the same functionality as the separate component.”

The eternal quest to differentiate on shelf while keeping costs down is resulting in ink manufacturers offering more and more innovative products for litho offset presses like metallic inks or pearlescent varnishes with larger flakes. “At Wilco, we invested in Gravure (sheet-fed, 40 inches),” said Bourguignon. “Though the gravure technology has been there for a long time, the press size allows us to use gravure only for metallic or spot color and print 4-color process on a second pass on our litho press. We can also emboss and hot stamp in perfect register.”

Future Business

For most, the future looks good with a few disclaimers. Because TricorBraun’s business is developing packaging for future products, its activity is generally six months ahead of what is in stores. “For the past six months, TricorBraun has had the largest backlog of projects ever,” Sawicki said. “We continue to add people to keep up with the demand.”

Alcan’s Imbert is cautiously optimistic about the future. “We forecast more difficulties regarding raw material costs for the rest of 2005 and 2006, but, for our operations, the beauty market is steady and enjoys a reasonable growth, especially in some areas such as skin care,” he said.

|

Crystal International sources color

cosmetic packaging in China and fills in China and Canada. |

The future looks different viewed from the Asian source side. Crystal’s Patterson said, “It’s too hard for us to predict because sourcing saleable items from Asia is still ahead of the curve. Our growth has averaged 25-30% compounded annually the past three years because value added packaging is favorable from Asia.” Crystal expects growth opportunities to remain active through 2006 into 2007. But the only sure thing is change. “At some point the major global marketers will start to meet their sales forecasts in Asia for local use from the good qualified factory sources in Asia,” Patterson said. “This means the good Asian factories will still grow, but our sales or shipment to the West will diminish.”

Once China is no longer the least expensive region to source from, Patterson expects more change. “Which direction the supply chain will head has not been established, but there will be a shift. India and Indonesia would love to pick up the slack,” he added.

In terms of fashion and style, Clariant’s Kulka expects more sophistication coming to the mass market, and more pressure to create distinctive looks for cosmetic products.

Development cycles will be even shorter. Kulka said, “It used to be that a company would launch a product in one region and evaluate it for a year or more before deciding to roll it out globally. Now, you see products launched simultaneously around the world and within a few months, marketers know whether they have a success on their hands or if they need to make changes. And if they need to change, they’ll need to do it quickly.”

The growing consumer target group of “best agers” (45+) and older people in the Western world will require more user-friendly packaging and ergonomic elements will become a major feature of the packaging design, predicted DBE’s Bakic. “Also, cosmetic packaging specifically tailored for the young generation will increasingly become a target for the industry.”

“While Color Cosmetics has not seen period of growth, it is thought that it should be around the corner,” said Arrowpak’s Slowey. “The skin-care market will continue to show major gains for the rest of this year and beyond.”

As a packaging supplier that sources from the Far East, Roberts Cosmetic Containers is optimistic. “Business continues to look good for the balance of 2005 and forecasts for 2006 are strong, said Deans. “Roberts expects double digit results in a market with single digit growth due to new product acceptance and taking market share.

|