02.09.16

According to market analyst Technavio, the future of the global nail polish market is poised to grow at a CAGR of 3.47% through 2019. The report takes into account revenue generated from retail sales of nail care products, and does not include salon or spa services.

Arushi Thakur, a lead cosmetics and toiletry analyst at Technavio, says, “The nail care market has witnessed a positive growth rate over the past decade and is expected to maintain the positive trend during the forecast period. Advances in technology have allowed for consumers to not have to go to nail bars and salons for nail care services, instead they can do it at home.” Thakur says in 2012, OPI released its first nail decals, “OPI Pure Lacquer Nail Apps,” giving users an option to choose from several different designs including rattlesnake, lace, and fishnet prints.

The market is also flourishing due to its collaboration with various designers, according to Thakur. “Polish and cosmetics brands often tie up with fashion designers to develop new colors and patterns that are showcased in global fashion shows such as Milan, Italy, Paris, and New York. For instance, models sported nude nails with a vertical silver stripe of OPI's “My Signature Is DC,” at the Dion Lee Spring 2015 show. At Carolina Herrera Spring 2015, the models sported classy looks, which included romantic red nails using Essie A List.

Technavio’s consumer and retail research experts have highlighted the following three major drivers that are expected to uplift the global nail care market.

Affordable Indulgence

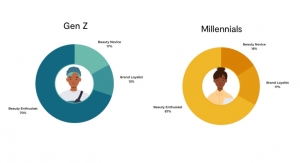

The rising demand for nail polish among the younger population is one of the primary drivers of the market. For instance, in the nail polish category, the average price of a mass category nail polish is approximately $8. Essie sells its nail polish at $8.50 and OPI sels for $9. The engagement is high among women aged 25-34 who are interested in the benefits of the product and prefer long-wearing products and natural claims.

Globally, approximately 91% of girls between the ages of 9 and 17 use some sort of nail product, making it one of the most popular cosmetic items among teen girls.

Fashion trends such as nail art are transforming nails into a stylish accessory. Other than the trending concepts such as glitter, magnetic and metallic finishes, and nail art, women are generating high interest for natural nail care concepts, as well as products that help in ease of use and convenience. The improving economy is prompting consumers to indulge in nail care products as an affordable luxury.

Product Innovation Driving Growth

In the nail care market, constant change is required, whether in terms of process or product. For instance Revlon Parfumerie Scented Nail Enamel offers scented nail polish, but the scent comes out only when the polish has dried. Some of Revlon's other innovative style offerings include Italian Leather, Bordeaux, Lavender Soap, and Autumn Spice.

Collistar brand has developed a color and care nail polish which claims to deliver salon type treatment at home. This product claims to give a foundation effect, camouflaging imperfection and strengthening the nails with keratin.

Bourjois brand launched its nude and tattoos collection in May 2014, offering adhesive designs that can trail over the nails and onto the cuticles and fingers. Deborah Lippmann’s Silk collection aims to deliver an innovative “matteen” finish of luxurious silk offering shades such as Red Silk Boxers, Harem Silk from Bombay, and Pseudo Silk Kimono.

Growing Presence of Nail Bars and Salons

One of the major factors for the growth of the industry is the growing presence of nail bars and salons across the globe. In 2013, nail salons in the US generated revenue of more than $8 billion, which increased to $8.5 billion in 2014.

Professional nail salons offer customers various services starting from specialty manicures/pedicures to nail art, new long-wearing polish brands, acrylics etc. Also, the salon technicians deliver professional nail care services and meet the needs of the customers.

The acquisition of salon brands such as Sinful Colors, OPI, and Essie by the major U.S. players — Revlon, Coty, and L’Oréal—respectively, has affected the market growth with salon brands sales. Premium salon brand nail polish sales in the U.S. were almost equivalent to 30% of the total nail polish sales of the market in 2014.

Read More

What's Trending for Nails?

Arushi Thakur, a lead cosmetics and toiletry analyst at Technavio, says, “The nail care market has witnessed a positive growth rate over the past decade and is expected to maintain the positive trend during the forecast period. Advances in technology have allowed for consumers to not have to go to nail bars and salons for nail care services, instead they can do it at home.” Thakur says in 2012, OPI released its first nail decals, “OPI Pure Lacquer Nail Apps,” giving users an option to choose from several different designs including rattlesnake, lace, and fishnet prints.

The market is also flourishing due to its collaboration with various designers, according to Thakur. “Polish and cosmetics brands often tie up with fashion designers to develop new colors and patterns that are showcased in global fashion shows such as Milan, Italy, Paris, and New York. For instance, models sported nude nails with a vertical silver stripe of OPI's “My Signature Is DC,” at the Dion Lee Spring 2015 show. At Carolina Herrera Spring 2015, the models sported classy looks, which included romantic red nails using Essie A List.

Technavio’s consumer and retail research experts have highlighted the following three major drivers that are expected to uplift the global nail care market.

Affordable Indulgence

The rising demand for nail polish among the younger population is one of the primary drivers of the market. For instance, in the nail polish category, the average price of a mass category nail polish is approximately $8. Essie sells its nail polish at $8.50 and OPI sels for $9. The engagement is high among women aged 25-34 who are interested in the benefits of the product and prefer long-wearing products and natural claims.

Globally, approximately 91% of girls between the ages of 9 and 17 use some sort of nail product, making it one of the most popular cosmetic items among teen girls.

Fashion trends such as nail art are transforming nails into a stylish accessory. Other than the trending concepts such as glitter, magnetic and metallic finishes, and nail art, women are generating high interest for natural nail care concepts, as well as products that help in ease of use and convenience. The improving economy is prompting consumers to indulge in nail care products as an affordable luxury.

Product Innovation Driving Growth

In the nail care market, constant change is required, whether in terms of process or product. For instance Revlon Parfumerie Scented Nail Enamel offers scented nail polish, but the scent comes out only when the polish has dried. Some of Revlon's other innovative style offerings include Italian Leather, Bordeaux, Lavender Soap, and Autumn Spice.

Collistar brand has developed a color and care nail polish which claims to deliver salon type treatment at home. This product claims to give a foundation effect, camouflaging imperfection and strengthening the nails with keratin.

Bourjois brand launched its nude and tattoos collection in May 2014, offering adhesive designs that can trail over the nails and onto the cuticles and fingers. Deborah Lippmann’s Silk collection aims to deliver an innovative “matteen” finish of luxurious silk offering shades such as Red Silk Boxers, Harem Silk from Bombay, and Pseudo Silk Kimono.

Growing Presence of Nail Bars and Salons

One of the major factors for the growth of the industry is the growing presence of nail bars and salons across the globe. In 2013, nail salons in the US generated revenue of more than $8 billion, which increased to $8.5 billion in 2014.

Professional nail salons offer customers various services starting from specialty manicures/pedicures to nail art, new long-wearing polish brands, acrylics etc. Also, the salon technicians deliver professional nail care services and meet the needs of the customers.

The acquisition of salon brands such as Sinful Colors, OPI, and Essie by the major U.S. players — Revlon, Coty, and L’Oréal—respectively, has affected the market growth with salon brands sales. Premium salon brand nail polish sales in the U.S. were almost equivalent to 30% of the total nail polish sales of the market in 2014.

Read More

What's Trending for Nails?