Eleanor Dwyer12.19.16

The premium beauty and personal care sector is expected to see outstanding 7% current-term value growth in 2016, far outstripping mass beauty and personal care’s 2% projected growth.

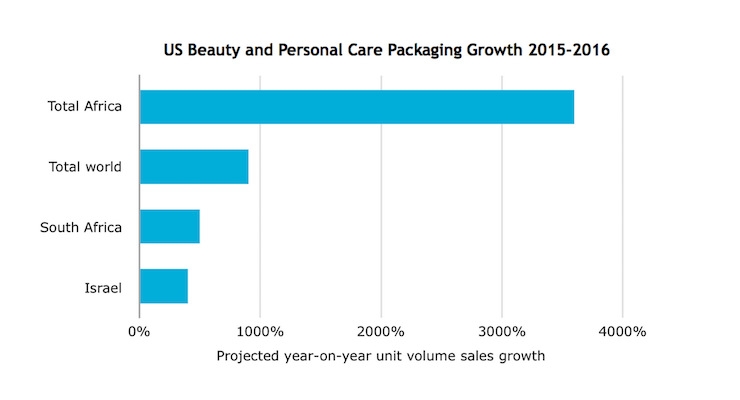

See the chart in the slideshow above: U.S. Beauty and Personal Care Packaging Growth, 2015 - 2016

Premium gained market share from mass across categories from traditionally fashion-focused color cosmetics and fragrances to historically functionally-focused sun care, skin care and hair care.

While many Americans are still curtailing spending due to low confidence in the economy, ongoing economic recovery and low fuel prices have prompted cautiously aspirational consumers to turn to premium beauty products as a relatively affordable luxury.

This overall premiumization has boosted demand for upscale packaging, including glass packaging and specialty cosmetics containers. Sales of travel size products are particular beneficiaries of this aspirational consumption, as they provide an opportunity to buy premium products at lower absolute cost, even though the price per volume is usually higher.

Small Pack Sizes Allow for Variety and Experimentation

Beauty blogs and YouTube makeup tutorials have helped popularize a wide array of avante garde beauty trends, from silver hair and blue lipstick to bee venom-based skin care. Increasingly fashion-forward beauty consumers value the ability to experiment with these trends without overextending their budgets on new products.

With the growth of beauty subscription boxes and sampling services like The Perfumed Court, a website that decants expensive fragrances into smaller bottles for resale, these beauty buyers are accustomed to convenient access to trendy premium products at lower prices. Premium brands offer a wider array of scents, colours, and textures than mass brands, appealing to consumers who want unique beauty products.

The divergent performance of premium fragrance sets and kits, which are projected to grow 6% in 2016, and their mass counterparts, which are expected to see a 1% decline, is further evidence of the growing preference for variety.

Fragrance-only sets are outperforming multi-product combinations in the premium segment, with rollerball and travel spray sets performing particularly well. Individual rollerball and travel spray fragrances are also selling well, and in 2016 volume sales of fragrances in 10 ml glass bottles, corresponding to travel sprays, are set to grow 33%. Meanwhile, volume sales of fragrances in specialty cosmetics containers, corresponding to rollerballs, are expected to see 36% volume growth.

While fragrances are the most dramatic example, flexible aluminium/plastic packaging sales are expected to benefit from the popularity of single-use face masks and other skin care treatments, and small glass jars and bottles are similarly likely to see more use as miniature trial versions of existing beauty products are released.

Manufacturers Respond to Demand for Small Formats

Many popular premium cosmetics and skin care brands are embracing the demand for small formats, offering miniature versions of their most popular products; these travel sizes are often prominently displayed alongside the full versions in beauty specialist retailers.

In July 2016, global cosmetics giant MAC launched an entire collection of miniaturized products, called Little Mac. Each piece costs only $10, enticing new consumers for whom MAC’s usual premium price point is out of reach. As MAC and other manufacturers embrace small pack sizes, specialty cosmetics containers are projected to experience healthy 4% growth through 2016.

On the other hand, some super premium beauty brands are wary of positioning travel sizes as affordable means to try their products, not wanting to diminish their premium reputation.

Louis Vuitton employed an interesting strategy in the launch of its new perfume line; the line includes a travel size option, but it is only available in sets of four 0.25 oz travel sprays at $240 for a total of 4 oz., the same price they charge for the next smallest 3.4 oz bottle. This discourages consumers from purchasing a travel size in lieu of the full size fragrance, but still offers affluent, jet-setting customers the option to round out their purchase with portable travel spays. (Louis Vuitton's Miniature Set is shown in the slideshow above.)

From aspirational desire for variety, to prudent efficiency concerns, to indulgence in luxurious convenience, consumers have many motivations to downsize, and packaging manufacturers have an opportunity to fulfill this demand.

ABOUT THE AUTHOR

See the chart in the slideshow above: U.S. Beauty and Personal Care Packaging Growth, 2015 - 2016

Premium gained market share from mass across categories from traditionally fashion-focused color cosmetics and fragrances to historically functionally-focused sun care, skin care and hair care.

While many Americans are still curtailing spending due to low confidence in the economy, ongoing economic recovery and low fuel prices have prompted cautiously aspirational consumers to turn to premium beauty products as a relatively affordable luxury.

This overall premiumization has boosted demand for upscale packaging, including glass packaging and specialty cosmetics containers. Sales of travel size products are particular beneficiaries of this aspirational consumption, as they provide an opportunity to buy premium products at lower absolute cost, even though the price per volume is usually higher.

Small Pack Sizes Allow for Variety and Experimentation

Beauty blogs and YouTube makeup tutorials have helped popularize a wide array of avante garde beauty trends, from silver hair and blue lipstick to bee venom-based skin care. Increasingly fashion-forward beauty consumers value the ability to experiment with these trends without overextending their budgets on new products.

With the growth of beauty subscription boxes and sampling services like The Perfumed Court, a website that decants expensive fragrances into smaller bottles for resale, these beauty buyers are accustomed to convenient access to trendy premium products at lower prices. Premium brands offer a wider array of scents, colours, and textures than mass brands, appealing to consumers who want unique beauty products.

The divergent performance of premium fragrance sets and kits, which are projected to grow 6% in 2016, and their mass counterparts, which are expected to see a 1% decline, is further evidence of the growing preference for variety.

Fragrance-only sets are outperforming multi-product combinations in the premium segment, with rollerball and travel spray sets performing particularly well. Individual rollerball and travel spray fragrances are also selling well, and in 2016 volume sales of fragrances in 10 ml glass bottles, corresponding to travel sprays, are set to grow 33%. Meanwhile, volume sales of fragrances in specialty cosmetics containers, corresponding to rollerballs, are expected to see 36% volume growth.

While fragrances are the most dramatic example, flexible aluminium/plastic packaging sales are expected to benefit from the popularity of single-use face masks and other skin care treatments, and small glass jars and bottles are similarly likely to see more use as miniature trial versions of existing beauty products are released.

Manufacturers Respond to Demand for Small Formats

Many popular premium cosmetics and skin care brands are embracing the demand for small formats, offering miniature versions of their most popular products; these travel sizes are often prominently displayed alongside the full versions in beauty specialist retailers.

In July 2016, global cosmetics giant MAC launched an entire collection of miniaturized products, called Little Mac. Each piece costs only $10, enticing new consumers for whom MAC’s usual premium price point is out of reach. As MAC and other manufacturers embrace small pack sizes, specialty cosmetics containers are projected to experience healthy 4% growth through 2016.

On the other hand, some super premium beauty brands are wary of positioning travel sizes as affordable means to try their products, not wanting to diminish their premium reputation.

Louis Vuitton employed an interesting strategy in the launch of its new perfume line; the line includes a travel size option, but it is only available in sets of four 0.25 oz travel sprays at $240 for a total of 4 oz., the same price they charge for the next smallest 3.4 oz bottle. This discourages consumers from purchasing a travel size in lieu of the full size fragrance, but still offers affluent, jet-setting customers the option to round out their purchase with portable travel spays. (Louis Vuitton's Miniature Set is shown in the slideshow above.)

From aspirational desire for variety, to prudent efficiency concerns, to indulgence in luxurious convenience, consumers have many motivations to downsize, and packaging manufacturers have an opportunity to fulfill this demand.