Mylan Nguyen, Packaging Analyst, Euromonitor International12.14.17

As explored in Euromonitor International’s Global HDPE Bottles: Growth and Opportunities report, in 2016, the volume of HDPE bottles sold through retail reached almost 97 billion units globally, up by 2% on 2015.

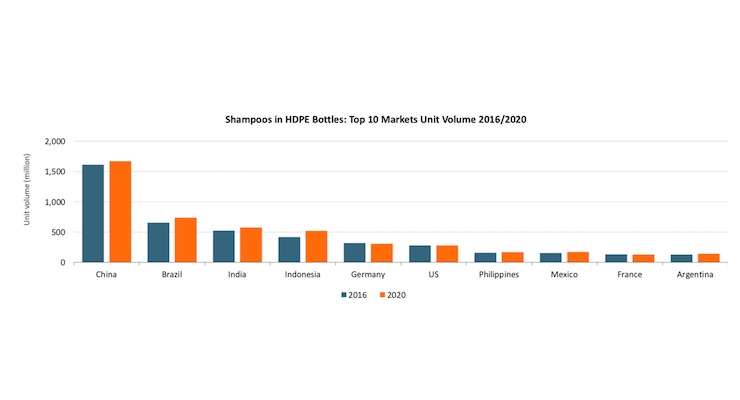

Within beauty and personal care, shampoos remain the main application for HDPE bottles.

Globally, shampoos are still dominated by single-use sachets (an affordable format mainly popular in India and Indonesia); however, rising urbanization and disposable incomes have led to the increased adoption of shampoos in larger formats, highly contributing to the growth of HDPE bottles mainly in developing markets. Over 2016-2020, China will rank first globally in terms of unit volumes, however growth will be led by Indonesia and Brazil, which are expected to be the largest growing markets, according to Euromonitor International.

In Indonesia, flexible plastic in shampoos continues to dominate; however, the shift from the traditional sachets to more practical HDPE bottles is expected to generate an extra 100 million HDPE bottles by 2020. Looking at pack sizes, shampoos in HDPE bottles remain smaller than the global average, with 170ml and 80ml the most common formats, offered by the likes of Pantene (Procter & Gamble) and Sunsilk (Unilever), the leading shampoo brands in Indonesia. Examples of launches in small pack sizes include Sunsilk’s new shampoo targeting Muslim women wearing a hijab, in a 70ml HDPE bottle.

Consumers Demand Value for Money Leading to Size Polarization

Value for money is the global trend in shampoos, from developing regions where consumers are looking for affordability through smaller sizes, typically in single-use flexible plastic of 5ml, a format used in India, Indonesia and the Philippines, to developed regions, where there is a shift toward larger pack sizes, as consumers increasingly go for more economical shampoo bottles, leading to a growing preference for 400ml HDPE bottles in Western Europe, for example.

Growing Competition from Stand-Up Pouches

While globally flexible plastic, HDPE bottles and PET bottles are the common pack types for beauty and personal care products, competition from stand-up pouches continues to grow. (See the chart above.)

Offering a cheaper alternative to price-conscious consumers as well as representing an ecologically-friendly light weight packaging, stand-up pouches in bath and shower are growing in many markets in Asia Pacific. In Japan, refills in stand-up pouches are driven by men's products in bath and shower and hair care and are part of leading brands’ offerings, such as Men's Bioré and Gatsby.

In Malaysia, a rising number of brand owners are offering refill pack packaging as a response to consumers cutting down on their spending. For example, Shokubutsu, Dettol, Lux and Lifebuoy offer stand-up pouches, at a cheaper price than their equivalent product in HDPE bottle format.

In Brazil, while present in bath and shower, stand-up pouches are becoming increasingly important in hair care. Strongly used by the influential leading direct sellers Natura Cosméticos and Avon Cosméticos, stand-up pouch refills continue to gain popularity among consumers.

In Russia, at a time of declining consumer purchasing power, brand owners are focusing on increasing their volume sales, reducing shampoo prices through packaging, using stand-up pouches instead of HDPE bottles. For example, Natura Siberica launched its ranges of shampoos and conditioners in stand-up pouches with plastic screw closures in 2015.

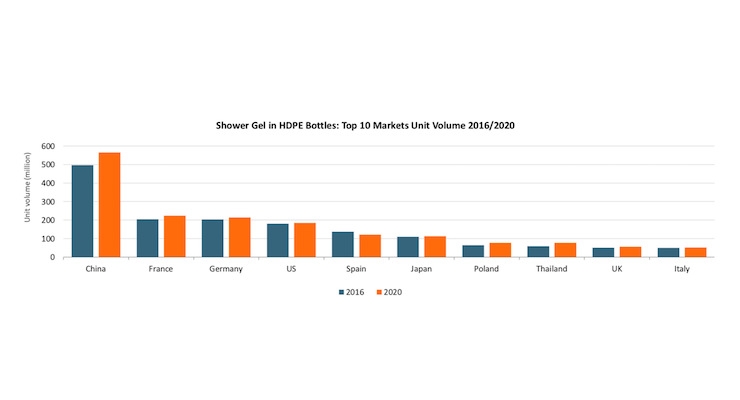

HDPE Bottles Set to Grow 200 Million in Shower Gel by 2020

In beauty, body wash/shower gel follows shampoos in terms of growth prospects. (See the second chart in the slider above.)

While accounting for 2.2 billion units of HDPE in 2016, shower gel is expected to generate an extra 200 million bottles by 2020. Looking at the top 10 markets, China is the market offering the strongest prospects thanks to its large population moving away from bar soap and adopting shower gel instead, driven by rising disposable incomes and urbanization in the country.

As a result, flexible paper and folding carton, soap’s main packaging types, see a decline in China while HDPE bottles are benefiting from shower gel sales, particularly 400ml bottles which is the most common pack size.

Despite their maturity, France and Germany also offer growth opportunities. In France, the rising success of dermatological shower gels sold in chemists/pharmacies has encouraged mass brands to develop their own, such as the new Advanced Sanex range by Colgate-Palmolive, Cadum Surdoux with talc by the L’Oréal Groupe and Johnson & Johnson’s Le Petit Marseillais range for sensitive skin. These launches contribute to make these hypoallergenic shower gels affordable and therefore should drive volume sales in the country over 2016-2020.

Shampoos – the key application for HDPE bottles in beauty – offer strong growth for the pack type as consumers shift from single-use formats to larger family-sized shampoos. Rising urbanization and disposable income are driving this growth in emerging markets, led by India and Brazil.