Kayla Villena, Senior Beauty Analyst at Euromonitor International12.30.19

Despite years of strong gains, the U.S. color cosmetics market is expected to slow as consumers shift to skincare, and fashion and beauty enthusiasts decrease their spend.

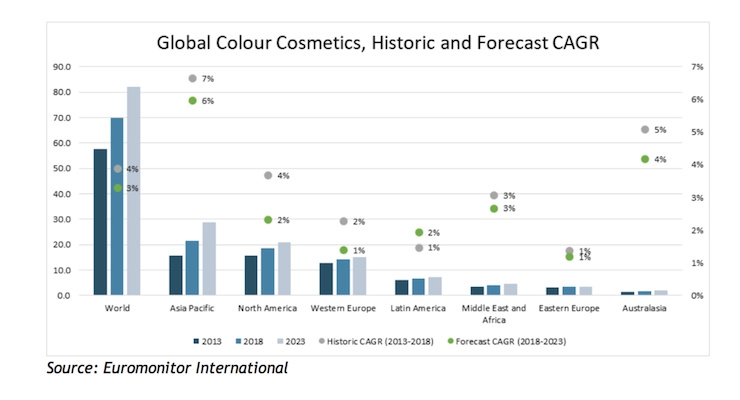

Growing 5.6% annually from 2013 to 2018, the U.S. color cosmetics market will only increase 2.4% through 2023, according to Euromonitor International. The slowdown in color cosmetics is occurring in all regions, except Latin America, in which forecasted color cosmetic gains in Mexico and Brazil is boosting the category.

So how will the industry react to this slowdown? How can brands capture a larger share of this fragmented landscape?

First, players should focus on high-growth categories, particularly foundation/concealer, lipstick, and other brow and lash makeup products, whose $9.8 billion absolute value gains will account for 50% of absolute value gains of total color cosmetics in the U.S. from 2018 to 2023, according to Euromonitor International.

Second, players should inject health-inspired beauty, green, clean and ethical features, and personalization in color cosmetics product lines, as these trends were cited as having the greatest influence on sales of beauty and personal care players in the next five years in a Euromonitor survey.

Health-inspired beauty draws much of its influence from skincare, so expanding in skincare adjacent products, such as setting sprays and tinted moisturizers, and incorporating skincare desired features in color cosmetics (e.g. all natural ingredients, not tested on animals, etc.), can help align product portfolios with consumers’ increased demand for skincare. Incorporating green, clean and ethical features also resonates with consumers, such as refillable packaging, which provides novelty and communicates sustainable values to consumers.

Third, licensing limited-edition or seasonal releases is a way to reverse a lack of newness and innovation, which was cited as contributing to a lower enthusiasm among consumers. Lastly, taking advantage of new growth opportunities, such as premium men’s fragrances, mass men’s skincare, and mass men’s bath and shower, is a way to expand consumer base.

Color cosmetics is expected to recover eventually, but it may take at least five years for the color cosmetics segment to rebound, once players incorporate megatrends like healthy living and personalization and skincare-like benefits in color cosmetic products.

In the meantime, international expansion in promising color cosmetics markets in Asia Pacific and Latin America can be a place of growth for players frustrated by slower sales in the U.S.

The cyclical demand of skincare and color cosmetics also suggests that skincare will decelerate eventually, giving way for color cosmetics to rebound, but only after being transformed to align with consumers’ expectations.

To learn more, download the presentation, How To Win in an Evolving Color Cosmetics Market.