Rachel Klemovitch, Associate Editor01.25.24

As the beauty industry continually evolves, new brands debut, different parent companies take over—and mergers and acquisitions form new partnerships crucial to a brand's success. Funding from an investment can quickly turn a small indie beauty brand into a globally recognized company with international distribution.

Packaging suppliers and ingredient manufacturers change as well. Companies merge and expand their capabilities—and as a result, they are more equipped to offer beauty brands more innovative packaging and formula options.

Packaging suppliers and ingredient manufacturers change as well. Companies merge and expand their capabilities—and as a result, they are more equipped to offer beauty brands more innovative packaging and formula options.

Here's a recap below—highlighting some of the mergers and acquisitions in the beauty industry in 2023 involving both brands and suppliers. Click through the links to read each story in full.

See also: All the Mergers & Acquisitions in Beauty in 2024

Beauty Brand Mergers & Acquisitions in 2023

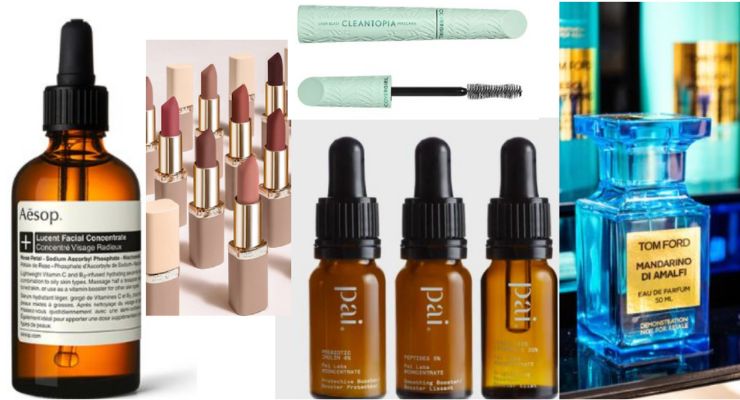

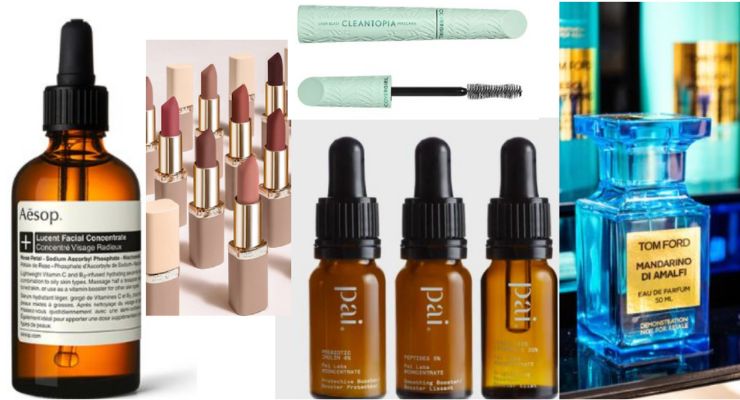

L'Oreal Buys Aesop

L'Oreal acquired Aesop from Natura & Co.—in a deal worth $2.5 billion. The company signed the deal with Natura & Co. on April 4th. The deal inspired a bidding war—and L'Oreal beat LVMH.Clarins Group Acquires a Majority Stake in Pai Skincare

Famille C Participations is the corporate venture capital arm of the Courtin-Clarins family office—and the family behind the French luxury cosmetics company Clarins Group. The company now owns a majority stake in Pai skincare. The deal became official on April 11th.ELC Completes Buyout of Tom Ford

The Estée Lauder Companies (ELC) completed the buyout of the Tom Ford brand in April, after making the deal in November 2022. ELC is now the sole owner of the Tom Ford brand and all its intellectual property.Oddity Completes Acqusition of Revela

Oddity, the parent company of Il Makiage and SpoiledChild, has acquired Revela, a biotechnology startup and forerunner in Artificial Intelligence-based molecule discovery for beauty and wellness indications, in a transaction valued at $76 million.Kering Beauté Agrees to Buy Creed

French luxury conglomerate Kering Beauté, has signed an agreement to acquire 100% of Creed from funds controlled by BlackRock Long Term Private Capital Europe and current Chairman Javier Ferrán.Foundry Acquires Blu Atlas

Foundry, a brand platform specializing in acquiring, nurturing and growing online brands, has acquired Blu Atlas—a direct-to-consumer (D2C) men's skincare, haircare and fragrance brand—marking Foundry’s third acquisition in the men’s personal care industry.Coty Sells Part of Wella to IGF Wealth Management

Coty Inc., one of the world’s largest beauty companies, has entered into a binding letter of intent to sell a 3.6% stake in Wella, a German hair care company, to investment firm IGF Wealth Management.Kao Agrees to Buy Bondi Sands Brands

Kao Corporation, and its wholly owned subsidiaries Kao Australia Pty. Limited and Kao USA Inc., have signed an agreement to acquire the Bondi Sands brands via the acquisition of Bondi Sands Australia Pty Ltd and related Bondi Sands companies.E.l.f Beauty Agrees to Acquire Naturium

As reported in August, e.l.f. Beauty has signed a definitive agreement to acquire Naturium, a fast-growing, high performance skincare brand, for $355 million in a combination of cash and stock.L Catterton Acquires Minority Stake in Maria Nila

L Catterton, a consumer-focused investment firm, has acquired a significant minority stake in Maria Nila, a Swedish sustainable professional hair care brand. Marcus Wikström, the son of Maria Nila’s founders, will continue to lead the company and remain as CEO.Ekkio Capital Buys Sanoflore from L'Oréal

Global beauty company L’Oréal has sold certified-organic beauty brand Sanoflore to French investment fund Ekkio Capital and Sergio Calandri. Financial terms of the deal were not disclosed.Hildred Capital Management Acquires Hello Bello

Hello Bello, a brand of premium, affordable baby and family care products, has reached an agreement in principle to be acquired by Hildred Capital Management, a healthcare-focused private equity firm that seeks opportunities to create value in middle-market companies.Amorepacific Acuqires Cosrx Shares

Amorepacific has acquired additional shares of Cosrx. The hypoallergenic skincare brand and will be integrated as a subsidiary of Amorepacific. In September 2021, Amorepacific acquired 38.4% of Cosrx shares and were granted a call option to purchase the remaining shares.Aurelius Buys The Body Shop from Natura & Co

Natura & Co announced that it has reached agreement to sell The Body Shop to international private equity group Aurelius for approximately $256 million. The deal is was closed by December 31st, 2023.Amyris Sells Four Beauty Brands

Amyris, a synthetic biotechnology company which filed for Chapter 11 bankruptcy in August, has auctioned off four of its consumer brands. 4U was sold to Scent Theory Products, Meno Labs was purchased by Dr. Reddy’s Laboratories, Pipette was bought by HRB Brands, and Biossance was acquired by THG Beauty.Yellow Wood Partners Buys Elida Beauty from Unilever

Unilever has agreed to sell Elida Beauty, which comprises more than 20 beauty and personal care brands, to Yellow Wood Partners. Brands under the Elida Beauty umbrella include Q-Tips, Caress, Timotei and Tigi.Unilever Acquires K18 Haircare

Unilever has agreed to acquire the premium biotech haircare brand K18. Terms of the deal were not disclosed. The transaction is expected to close in Q1 2024.