Nicholas Micallef, Senior Analyst Beauty and Personal Care, at Euromonitor International06.01.16

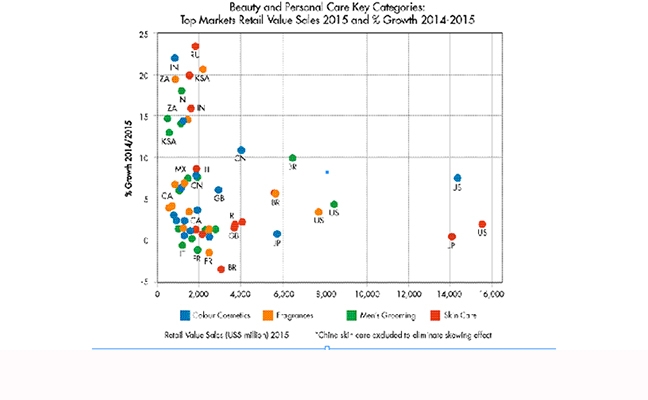

Euromonitor International’s Beauty and Personal Care 2016 edition data reveals the latest insights on the industry’s 2015 performance and key prospects through to 2020. The upsurge in the premium segment dominates the scene, as the growth of 6% outpaced the mass segment for the first time, to reach nearly $100 billion. Discretionary categories, namely color cosmetics, fragrances and skin care, were responsible for the premium segment growth. Overarching trends including authenticity, personalization, and a unique proposition, fueled growth in brands that best encompassed these trends in their products.

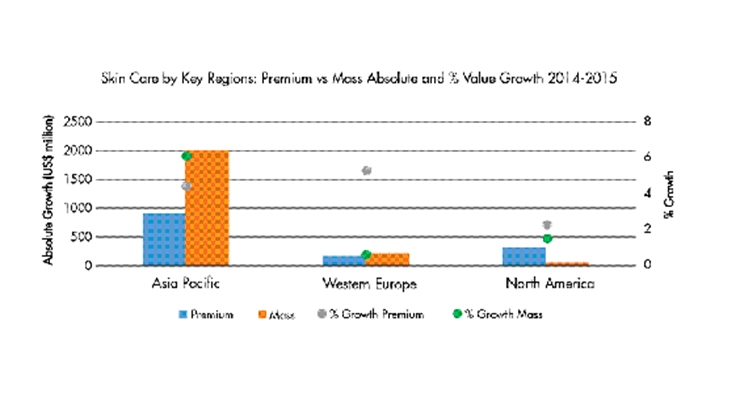

North America led premium growth. Premium color cosmetics and premium fragrances both doubled growth (12.9% and 4.5%, respectively) in 2015, when compared to 2014. Premium skin care outperformed the mass segment in North America and Western Europe, while in Asia Pacific, mass skin care grew faster (6%) than the premium counterpart (4.4%), but was slower than 2014 growth (premium 4.2%, mass 7.5%), hinting at greater dynamism in premium skin care. Mass fragrances continued to slip, shrinking by $21 million in North America, and remained flat at $3.4 billion in Western Europe.

The U.S. Boosts Color Cosmetics

Color cosmetics’ stellar performance of over 6% in 2015 meant it outperformed global beauty and personal care (4.7%), attributable to the premium segment, and robust categories, including lip products, foundation/concealer and BB/CC creams, the latter witnessing a rapid five-fold expansion over 2010-2015, to reach $1.7 billion globally. The significant performance (7.4%) by the leading U.S. market, reaffirms its status as a hotbed for innovation, and its successful economic recovery is facilitating the gradual shift to premium color cosmetics, which witnessed 13% growth, compared to just 2.3% in the mass segment.

Premium market front-runner Estée Lauder had reasons to celebrate, as it experienced gains of 7.4% in the U.S. derived from its billion dollar MAC brand, and fast-growing Smashbox and Bobbi Brown, benefitting from Millennials’ quest for personal expression through the use of what is perceived as “cool” and “photo-ready” makeup. The company also operates a unified distribution platform both online and with the expansion of its own MAC stores, which helped boost makeup appointments in-store that were originally booked online.

The fast expansion of beauty specialists such as Ulta also helped spur sales, facilitated by aggressive loyalty programs to encourage purchases, while the retailer also triggered an interest in a well-groomed brow, with the eyebrow contouring concept, and simultaneously, benefitting LVMH’s Benefit with the opening of Brow Bars at Ulta stores.

Sensing these dynamics, L’Oréal’s NYX Cosmetics opened several standalone stores to capitalize on its robust digital presence, in addition to being a truly multicultural brand with an extensive range of shades that target virtually all ethnicities. Millennials are hailed for driving growth as many embrace color cosmetics as a pasttime, while social media enables them to share tips, discuss products and post tutorials. K-beauty’s influence has been unprecedented, driving interest in products such as BB creams and steering innovation in textures, packaging and delivery formats.

China’s Weight on Skin Care Growth Slows

Global skin care grew more slowly in 2015; however, demand remains robust at 4.6%. Premium skin care growth picked up (4.7%), following a deceleration in previous years at the expense of mass skin care, which continued to slow. This trajectory was reflected in China, which despite the slower pace, grew at a healthy 6.7% sustained by the resilient premium segment.

Regional players including Amore Pacific and LG emerged as winners thanks to the unrivalled heritage of Korean brands such as Innisfree, with its unique sourcing bolstered by a free-standing retail strategy, The History of Whoo, famous for its use of unconventional ingredients such as deer antler in its anti-aging serum BiChup Ja Saeng Essence, and Laneige, popular for its innovations based around cushion technology and sleeping masks.

Thailand entered the top 10 skin care markets, boasting a CAGR of 8% over 2010-2015 to reach nearly $2 billion. Increasing disposable incomes boosted anti-agers (11% in 2015), and induced interest in acne treatments and facial cleansers as consumers sought to address oily skin conditions prevalent in Thailand’s humid climate. Moreover, skin whitening remains a salient feature consumers seek in their products.

Middle Eastern Fragrance Houses Flavoring Global Market

Global fragrances witnessed growth of 6.2% in 2015 bolstered by premium scent, particularly, in Saudi Arabia, which expanded by 20.6%, led by regional leaders Arabian Oud and Abdul Samad al Qurashi, earning them a combined share of 60%. Arabian Oud’s outlet expansion is granting greater reach to consumers. Religious factors such as restrictions on female driving and unaccompanied women, coupled with the hot climate, which limits the ability to walk for too long outside, means retailers have a narrow retail gravitation zone.

The strength of regional players is proving a challenge for global rivals to gain a significant foothold. Partly, this is because oud-based fragrances remain popular, and these players are locally reputed for their tradition in perfumery. Fragrance houses such as Tom Ford and Gucci penetrated these markets with similar offerings, however, their fortunes did not particularly meet expectations. There is an intrinsically Arab value in oud that global brands have not necessarily authentically communicated to local consumers, who often fail to see the association between the international name and oud. This calls for global players to either partner with local perfumers to develop authentic scent experiences for the Middle East, or penetrate the region via acquisition of local players such as Ajmal.

Middle East fragrances are also traditionally unisex, thus weighing positively on the premium segment’s global performance, which also benefitted from growing momentum in North America, where it grew by 23%, encouraged by fragrance houses, such as Tom Ford and Calvin Klein, embarking on a genderless trend, and recent acquisitions, such as Le Labo by Estée Lauder, operating mainly in the unisex space.

About the author:

Nicholas Micallef is Senior Analyst Beauty and Personal Care, at Euromonitor International

North America led premium growth. Premium color cosmetics and premium fragrances both doubled growth (12.9% and 4.5%, respectively) in 2015, when compared to 2014. Premium skin care outperformed the mass segment in North America and Western Europe, while in Asia Pacific, mass skin care grew faster (6%) than the premium counterpart (4.4%), but was slower than 2014 growth (premium 4.2%, mass 7.5%), hinting at greater dynamism in premium skin care. Mass fragrances continued to slip, shrinking by $21 million in North America, and remained flat at $3.4 billion in Western Europe.

The U.S. Boosts Color Cosmetics

Color cosmetics’ stellar performance of over 6% in 2015 meant it outperformed global beauty and personal care (4.7%), attributable to the premium segment, and robust categories, including lip products, foundation/concealer and BB/CC creams, the latter witnessing a rapid five-fold expansion over 2010-2015, to reach $1.7 billion globally. The significant performance (7.4%) by the leading U.S. market, reaffirms its status as a hotbed for innovation, and its successful economic recovery is facilitating the gradual shift to premium color cosmetics, which witnessed 13% growth, compared to just 2.3% in the mass segment.

Premium market front-runner Estée Lauder had reasons to celebrate, as it experienced gains of 7.4% in the U.S. derived from its billion dollar MAC brand, and fast-growing Smashbox and Bobbi Brown, benefitting from Millennials’ quest for personal expression through the use of what is perceived as “cool” and “photo-ready” makeup. The company also operates a unified distribution platform both online and with the expansion of its own MAC stores, which helped boost makeup appointments in-store that were originally booked online.

The fast expansion of beauty specialists such as Ulta also helped spur sales, facilitated by aggressive loyalty programs to encourage purchases, while the retailer also triggered an interest in a well-groomed brow, with the eyebrow contouring concept, and simultaneously, benefitting LVMH’s Benefit with the opening of Brow Bars at Ulta stores.

Sensing these dynamics, L’Oréal’s NYX Cosmetics opened several standalone stores to capitalize on its robust digital presence, in addition to being a truly multicultural brand with an extensive range of shades that target virtually all ethnicities. Millennials are hailed for driving growth as many embrace color cosmetics as a pasttime, while social media enables them to share tips, discuss products and post tutorials. K-beauty’s influence has been unprecedented, driving interest in products such as BB creams and steering innovation in textures, packaging and delivery formats.

China’s Weight on Skin Care Growth Slows

Global skin care grew more slowly in 2015; however, demand remains robust at 4.6%. Premium skin care growth picked up (4.7%), following a deceleration in previous years at the expense of mass skin care, which continued to slow. This trajectory was reflected in China, which despite the slower pace, grew at a healthy 6.7% sustained by the resilient premium segment.

Regional players including Amore Pacific and LG emerged as winners thanks to the unrivalled heritage of Korean brands such as Innisfree, with its unique sourcing bolstered by a free-standing retail strategy, The History of Whoo, famous for its use of unconventional ingredients such as deer antler in its anti-aging serum BiChup Ja Saeng Essence, and Laneige, popular for its innovations based around cushion technology and sleeping masks.

Thailand entered the top 10 skin care markets, boasting a CAGR of 8% over 2010-2015 to reach nearly $2 billion. Increasing disposable incomes boosted anti-agers (11% in 2015), and induced interest in acne treatments and facial cleansers as consumers sought to address oily skin conditions prevalent in Thailand’s humid climate. Moreover, skin whitening remains a salient feature consumers seek in their products.

Middle Eastern Fragrance Houses Flavoring Global Market

Global fragrances witnessed growth of 6.2% in 2015 bolstered by premium scent, particularly, in Saudi Arabia, which expanded by 20.6%, led by regional leaders Arabian Oud and Abdul Samad al Qurashi, earning them a combined share of 60%. Arabian Oud’s outlet expansion is granting greater reach to consumers. Religious factors such as restrictions on female driving and unaccompanied women, coupled with the hot climate, which limits the ability to walk for too long outside, means retailers have a narrow retail gravitation zone.

The strength of regional players is proving a challenge for global rivals to gain a significant foothold. Partly, this is because oud-based fragrances remain popular, and these players are locally reputed for their tradition in perfumery. Fragrance houses such as Tom Ford and Gucci penetrated these markets with similar offerings, however, their fortunes did not particularly meet expectations. There is an intrinsically Arab value in oud that global brands have not necessarily authentically communicated to local consumers, who often fail to see the association between the international name and oud. This calls for global players to either partner with local perfumers to develop authentic scent experiences for the Middle East, or penetrate the region via acquisition of local players such as Ajmal.

Middle East fragrances are also traditionally unisex, thus weighing positively on the premium segment’s global performance, which also benefitted from growing momentum in North America, where it grew by 23%, encouraged by fragrance houses, such as Tom Ford and Calvin Klein, embarking on a genderless trend, and recent acquisitions, such as Le Labo by Estée Lauder, operating mainly in the unisex space.

About the author:

Nicholas Micallef is Senior Analyst Beauty and Personal Care, at Euromonitor International