Belisa Silva, Contributing Writer03.03.17

As the U.S. population continues to become more and more nuanced in terms of the consumer demographic, beauty brands are responding by becoming more inclusive, focused on reaching broad audiences via social media rather than by targeting a particular ethnic delineation.

“Things are not looking so black or white, which has been the evolution,” says senior vice president of The NPD Group, Karen Grant, of the new multicultural landscape in beauty. “We’re seeing the ‘other’ category grow.”

According to the United States Census Bureau, by 2020, “more than half of the nation’s children are expected to be part of a minority race or ethnic group.” These numbers will continue to swell so that by 2060, just 36 percent of Americans under age 18 will be single-race non-Hispanic white, compared with 52 percent today.”

Clearly the younger beauty consumer is leading the way in terms of a new diversity, and beauty brands must respond in order to be successful.

“The younger consumer identifies more as ‘me,’ more than black or white,” says Grant. “It’s ‘I am who I am, and I just like your product.’ We are seeing that people aren’t wanting to be defined by age or race, which is liberating things as well. With younger consumers, however, the expectation is higher. This generation is well known to be image driven, especially in terms of how they look. Selfies and Snapchat have elevated the game so engagement is much higher.”

Grant says that for the most part, brands that resonate with minorities also tend to appeal to younger consumers. She named MAC, Urban Decay, Becca and Tarte as some that continue to gain the favor of younger consumers, as well as a more ethnically diverse constituency, due to their ample foundation ranges that cover a variety of skin tones, and bold colors.

“The product range is becoming more inclusive, and the colors are rich and luxe,” says Grant. “There’s a new type of inclusiveness that makes its appeal broader. It’s elevating the product offering instead of limiting it so product offerings are becoming wonderful. You think of an Urban Decay eye palette because it can go on so many skin tones. It’s an example of color product with range.”

The swell of social media coinciding with a new era of inclusiveness was explored by Tribe Dynamics in a special report first published by CEW that shows the indelible relationship between bloggers and multicultural shoppers.

According to the report, “Due to the strong relationships between influencers and their followers, influencers have increasingly become both critical of limited shade ranges and complimentary of wide shade ranges of a variety of brands’ products.” It goes on to say that “by criticizing or complimenting a brand’s usability across skin tones, these influencers are creating a new standard of inclusiveness that benefits all of their followers.”

In December 2016, beauty blogger Jackie Aina shared a video titled “The Worst Beauty Brands EVER For POC [People of Color]!,” which showcased her picks of the “worst” brands for people with dark skin tones, based on the brands’ shade offerings. “The influencer didn’t hold back in describing how the four brands—Almay, IT Cosmetics, Physicians Formula, and Laneige—did not offer sufficient face products for women of deep skin tones,” according to the report.

Conversely, brands that do well to address multiple skin tones are being praised the same way. Shayla Mitchell of Makeupshayla (who boasts 366.5K YouTube followers and 2.2M Instagram followers) posted a video titled “Drugstore Makeup Slay-Torial,” in which she praised Maybelline as a consistent drugstore option for her dark skin—and a brand that she was “excited about.”

As a result of the excitement—and vast audiences—surrounding beauty bloggers, limited-edition partnerships, starring influencers are helping brands stay relevant and drive sales. Even consumer ads have moved from showcasing classic beauty ambassadors to those that feature bloggers and social marketers.

In June, Tarte released a limited-edition makeup palette in collaboration with Mitchell. After sharing that one of the shades in the kit was “bomb” for darker skin on her channels, the palette quickly sold out and was restocking, generating $7.2 million EMV (earned media value) for Tarte in 2016. For her part, Mitchell herself drove $8.5 million EMV for Tarte over the year, according to Tribe.

As the number of Americans who identify themselves as two or more races also continues to swell, addressing the masses is more complex than ever. To keep up, brands are tucking more shades in their repertoires, and beauty conglomerates are adding brands with built-in diverse audiences to their portfolios.

According to multicultural brand expert, Elle Morris, classically “African American brands” like Black Opal and Milani are getting more nuanced for Latin, Asian, Indian skin types, and shades are equally moving the other way within typically Anglo lines. To wit, Makeup Forever’s Ultra HD Makeup has a whopping 40 shades in its arsenal, while Sephora Collection’s 10 Hour Wear Perfection Foundation is available in 37 tones. Meanwhile, L’Oréal Paris True Match Super-Blendable Makeup offers 32 shades, and MAC’s Studio Fix Powder Plus Foundation comes in an impressive 46 shades.

“Everyone is meeting in the middle,” says Morris. “Brands are doing it gradually. If you step not run, future generations won’t have any differentiation. Honestly, I don’t think millennials care about separating brands by ethnicity.”

Becca, which was purchased by Estée Lauder for an estimated $200 million in late 2016, is super focused on complexion products, and has an ample array of darker shades.

“Becca Cosmetics is a wonderful addition to our portfolio of prestige beauty brands,” said Fabrizio Freda, president and chief executive officer of The Estée Lauder Companies Inc, in a release at the time of the deal. “Its unique focus on complexion products that flatter a wide range of skin tones, combined with its sophisticated yet accessible consumer and digital engagement across channels has inspired a devoted fan base.”

According to Grant, color cosmetics, especially the lip and eye categories, are growing at the quickest rate in terms of overall beauty, as both are favored by African American and Hispanic customers alike. Brands that have robust color options and strong, inclusive social media communities are coming out on top.

Grant notes, “What we are seeing is that there’s an increase across most ethnic groups in the use of makeup. Hispanic, White and “other” give brands the broadest reach,” she says. “Most brands are recognizing the product is what [defines] the line.”

The evolution of what “nude” means is another noteworthy trend. Brands like Hourglass, Maybelline and Marc Jacobs Beauty are offering specifically nuanced shades of tan and brown in eye and lip products so women of every skin tone can have a nude option.

“The same shade that may be a nice complimentary nude on a pale woman may not disappear on a woman with more color,” says Grant. “[Multicultural] women have different undertones in their faces and lips. So the question is how do you achieve that when you come from different ethnicities?”

Founder Storytelling

In today’s socially active climate, brand founder stories are increasingly important, as they help form relationships with consumers. According to Grant, the multicultural brand of today is one that melds social following with a uniquely diverse founder story.

Iman Cosmetics, created by model and entrepreneur Iman, was originally designed to provide African American women with foundations that would work for their skin. The line, which was introduced in 1994, has evolved to include inclusive products like BB and CC creams, and shades that reach medium to tan complexions. To be even more precise in her skin tone matching, Iman has introduced the Iman Cosmetics App, which uses computer vision technology to help women find the appropriate complexion product from her line.

“I created the brand because I wanted to put a new face and a new language on what beauty is and what beauty means to a new generation of beauty,” said Iman, adding that Iman Cosmetics was the first to offer bronzers for women of color. “I was really trying to create a brand and a beauty company that was more about the skin tone of a person rather than their ethnicity.”

A newer multicultural brand launched by another vibrant multicultural personality is Lipmatic, created by the daughter of rapper Nas. Comprised of prismatic lip colors, the cheeky color-oriented line is meant to be inclusive in terms of ethnicity.

“I definitely consider my brand multicultural, says Lipmatic founder, Destiny Jones. “A big part of the brand is in embracing hip-hop and New York culture. As we all know New York is a melting pot of different cultures and nationalities and that is what I would like for my brand to represent. We try to appeal to every girl and regardless of your skin tone each color will complement you beautifully.”

Jones’ collection is also about embracing rather than disguising a woman’s features, a trend that can also be seen in today’s natural hair movement sweeping African American communities.

“I feel like for years women of color have been put down about some of our features including our full lips and this is a time where that part of our culture is more accepted and even manipulated,” says Jones, adding that social media is a key component to the brand. “I try to use a combination of beauty shots as well as street shots to show both sides of the brand and of course to show a variety of skin tones.”

Other lip-focused brands created by multicultural founders include Ka’Oir Cosmetics, a collection of brilliantly hued lip colors by model and entrepreneur, Keyisha Ka’Oir; Sashe, which offers vibrant cosmetics for sensitive skin; Magnolia Makeup, a Louisiana-based brand comprised of highly pigmented shades; and Gold Label Cosmetics, a range of bright bold lipsticks and matte lip pens.

“Beauty overall is a category in which ethnic women tend to be more engaged, whereas Caucasians is typically strongest in skin care,” says Grant. “Hispanics over-index in every [beauty] category, and the only one they do not outperform is around lip color, which is stronger among African Americans.”

One particularly successful color brand by a Hispanic founder is Melt Cosmetics, which has enjoyed a large amount of success due to social media. Melt founder Lora Arellano, who was Rihanna’s personal makeup artist, has a million followers for her personal Instagram page, and 2.3 million for her cosmetics brand.

Another notable makeup line by a Latina founder is Reina Rebelde, which was inspired by the founder’s Mexican American upbringing.

“I actually founded the brand on a very specific point of view; my experience as a Mexican-American woman and my relationship to beauty and its rituals,” says brand founder, Regina Merson. “We are the largest consumer on the market and no one was addressing us head on.”

Reina Rebelde’s artful packaging and bold color proposition is a unique part of its cultural identity.

“The color and performance of products were inspired by what it means to be a Latina woman in this country,” says Merson. “It’s about the duality of my life, having multiple cultural norms and an intense nostalgia and pride in my heritage.”

Hair Market

The multicultural hair market is definitely having a moment. Mintel reports that the ethnic haircare market is expected to reach $876 million by 2019. One of the biggest causes of the swell is the trend for black women to wear their hair naturally, which has strengthened shampoo and hair styling product sales.

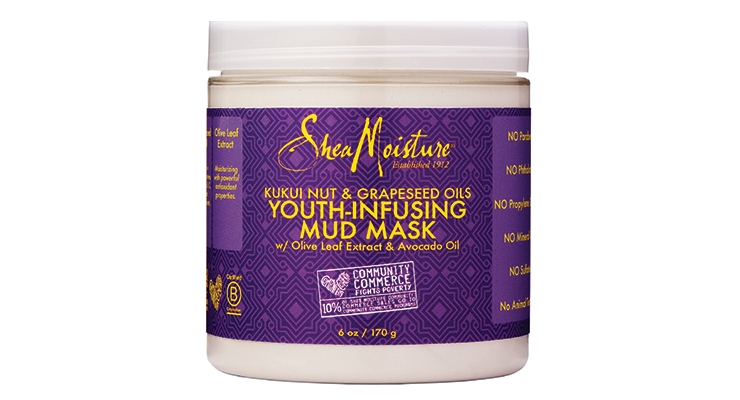

In terms of the ethnic hair market, there have been a few early success stories. Brands like Mixed Chicks, Curls, Oyin, Miss Jessie’s, and Shea Moisture, a line of natural hair products made with organic shea butter, founded by Sundial CEO Richelieu Dennis are growing in popularity—and distribution. In September 2015, Bain Capital acquired a minority stake in Sundial, which generated an estimated $200 million in 2015 for an unreported amount, valuing it at an estimated $700 million, according to Beauty of Fashion.

One of Sundial’s newest brands is Madam C.J. Walker, a haircare line named after the first self-made female millionaire. The line is now being sold through Sephora.

“We chose to partner with Sephora on the launch of Madam C.J. Walker Beauty Culture because this launch represents another step forward in our rich history,” says Davis. “In addition, it means that textured hair women, including many women of color, will have more options for products that serve them and meet their needs when they walk into their stores or are searching and shopping online.”

Retailers have been responding by allowing more space for brands that target diverse consumers. Target, for one, has devoted more space, both in-store and online to multicultural hair brands, making niche brands for women of color available to the masses. Top sellers at Target include Camille Rose Naturals, Carol’s Daughter, Shea Moisture and Tgin.

“We’ve seen higher end multicultural products like Miss Jessie’s and Diva Curl in both mass and prestige distribution,” says Elle Morris, about the influx of multicultural hair brands.

“In mass, these brands are still categorized as ethnic hair care, for the most part, but I see that as something that will change over time. We are becoming a more blended society and as we look at beauty moving forward, there won’t be a traditional face of beauty.”

For its part, Uncle Funky’s Daughter, another customer favorite at Target, has found a new audience via the retailer in today’s diverse market.

“Uncle Funky’s Daughter has been around for almost a decade, but we were the hidden secret in the curly hair community until recently,” says Renee Morris, CEO of Uncle Funky’s Daughter. “Social media platforms like Instagram and YouTube have increased our awareness to ‘curlfriends’ everywhere. We’ve grown from 200 followers two years ago on Instagram to over 30K today. We have a greater ability to educate and inspire ‘naturalistas’ and those debating whether or not to go natural.”

Following the trend of natural hair, celebrated celebrity hair stylist Kim Kimble (who counts among her clients Oprah Winfrey and Beyonce), has also introduced a natural hair-inspired product line to the market via HSN.

“Because the natural movement started getting bigger, I created a whole curl line because of it,” says Kimble. “For me it’s something that’s here to stay. It’s not a fad or a political statement, a lot of women were just crying out because they were tired of relaxing it.”

Kimble adds that social influencers are again part of the shift.

“Being in the entertainment industry, it’s more about glamour, and highly stylized looks,” says Kimble. “I’ve started seeing a lot of bloggers who are changing the game. They now are talking about how beautiful natural hair is and are teaching women to wear their hair all different types of ways. I’m very excited about it.”

“Things are not looking so black or white, which has been the evolution,” says senior vice president of The NPD Group, Karen Grant, of the new multicultural landscape in beauty. “We’re seeing the ‘other’ category grow.”

According to the United States Census Bureau, by 2020, “more than half of the nation’s children are expected to be part of a minority race or ethnic group.” These numbers will continue to swell so that by 2060, just 36 percent of Americans under age 18 will be single-race non-Hispanic white, compared with 52 percent today.”

Clearly the younger beauty consumer is leading the way in terms of a new diversity, and beauty brands must respond in order to be successful.

“The younger consumer identifies more as ‘me,’ more than black or white,” says Grant. “It’s ‘I am who I am, and I just like your product.’ We are seeing that people aren’t wanting to be defined by age or race, which is liberating things as well. With younger consumers, however, the expectation is higher. This generation is well known to be image driven, especially in terms of how they look. Selfies and Snapchat have elevated the game so engagement is much higher.”

Grant says that for the most part, brands that resonate with minorities also tend to appeal to younger consumers. She named MAC, Urban Decay, Becca and Tarte as some that continue to gain the favor of younger consumers, as well as a more ethnically diverse constituency, due to their ample foundation ranges that cover a variety of skin tones, and bold colors.

“The product range is becoming more inclusive, and the colors are rich and luxe,” says Grant. “There’s a new type of inclusiveness that makes its appeal broader. It’s elevating the product offering instead of limiting it so product offerings are becoming wonderful. You think of an Urban Decay eye palette because it can go on so many skin tones. It’s an example of color product with range.”

The swell of social media coinciding with a new era of inclusiveness was explored by Tribe Dynamics in a special report first published by CEW that shows the indelible relationship between bloggers and multicultural shoppers.

According to the report, “Due to the strong relationships between influencers and their followers, influencers have increasingly become both critical of limited shade ranges and complimentary of wide shade ranges of a variety of brands’ products.” It goes on to say that “by criticizing or complimenting a brand’s usability across skin tones, these influencers are creating a new standard of inclusiveness that benefits all of their followers.”

In December 2016, beauty blogger Jackie Aina shared a video titled “The Worst Beauty Brands EVER For POC [People of Color]!,” which showcased her picks of the “worst” brands for people with dark skin tones, based on the brands’ shade offerings. “The influencer didn’t hold back in describing how the four brands—Almay, IT Cosmetics, Physicians Formula, and Laneige—did not offer sufficient face products for women of deep skin tones,” according to the report.

Conversely, brands that do well to address multiple skin tones are being praised the same way. Shayla Mitchell of Makeupshayla (who boasts 366.5K YouTube followers and 2.2M Instagram followers) posted a video titled “Drugstore Makeup Slay-Torial,” in which she praised Maybelline as a consistent drugstore option for her dark skin—and a brand that she was “excited about.”

As a result of the excitement—and vast audiences—surrounding beauty bloggers, limited-edition partnerships, starring influencers are helping brands stay relevant and drive sales. Even consumer ads have moved from showcasing classic beauty ambassadors to those that feature bloggers and social marketers.

In June, Tarte released a limited-edition makeup palette in collaboration with Mitchell. After sharing that one of the shades in the kit was “bomb” for darker skin on her channels, the palette quickly sold out and was restocking, generating $7.2 million EMV (earned media value) for Tarte in 2016. For her part, Mitchell herself drove $8.5 million EMV for Tarte over the year, according to Tribe.

As the number of Americans who identify themselves as two or more races also continues to swell, addressing the masses is more complex than ever. To keep up, brands are tucking more shades in their repertoires, and beauty conglomerates are adding brands with built-in diverse audiences to their portfolios.

According to multicultural brand expert, Elle Morris, classically “African American brands” like Black Opal and Milani are getting more nuanced for Latin, Asian, Indian skin types, and shades are equally moving the other way within typically Anglo lines. To wit, Makeup Forever’s Ultra HD Makeup has a whopping 40 shades in its arsenal, while Sephora Collection’s 10 Hour Wear Perfection Foundation is available in 37 tones. Meanwhile, L’Oréal Paris True Match Super-Blendable Makeup offers 32 shades, and MAC’s Studio Fix Powder Plus Foundation comes in an impressive 46 shades.

“Everyone is meeting in the middle,” says Morris. “Brands are doing it gradually. If you step not run, future generations won’t have any differentiation. Honestly, I don’t think millennials care about separating brands by ethnicity.”

Becca, which was purchased by Estée Lauder for an estimated $200 million in late 2016, is super focused on complexion products, and has an ample array of darker shades.

“Becca Cosmetics is a wonderful addition to our portfolio of prestige beauty brands,” said Fabrizio Freda, president and chief executive officer of The Estée Lauder Companies Inc, in a release at the time of the deal. “Its unique focus on complexion products that flatter a wide range of skin tones, combined with its sophisticated yet accessible consumer and digital engagement across channels has inspired a devoted fan base.”

According to Grant, color cosmetics, especially the lip and eye categories, are growing at the quickest rate in terms of overall beauty, as both are favored by African American and Hispanic customers alike. Brands that have robust color options and strong, inclusive social media communities are coming out on top.

Grant notes, “What we are seeing is that there’s an increase across most ethnic groups in the use of makeup. Hispanic, White and “other” give brands the broadest reach,” she says. “Most brands are recognizing the product is what [defines] the line.”

The evolution of what “nude” means is another noteworthy trend. Brands like Hourglass, Maybelline and Marc Jacobs Beauty are offering specifically nuanced shades of tan and brown in eye and lip products so women of every skin tone can have a nude option.

“The same shade that may be a nice complimentary nude on a pale woman may not disappear on a woman with more color,” says Grant. “[Multicultural] women have different undertones in their faces and lips. So the question is how do you achieve that when you come from different ethnicities?”

Founder Storytelling

In today’s socially active climate, brand founder stories are increasingly important, as they help form relationships with consumers. According to Grant, the multicultural brand of today is one that melds social following with a uniquely diverse founder story.

Iman Cosmetics, created by model and entrepreneur Iman, was originally designed to provide African American women with foundations that would work for their skin. The line, which was introduced in 1994, has evolved to include inclusive products like BB and CC creams, and shades that reach medium to tan complexions. To be even more precise in her skin tone matching, Iman has introduced the Iman Cosmetics App, which uses computer vision technology to help women find the appropriate complexion product from her line.

“I created the brand because I wanted to put a new face and a new language on what beauty is and what beauty means to a new generation of beauty,” said Iman, adding that Iman Cosmetics was the first to offer bronzers for women of color. “I was really trying to create a brand and a beauty company that was more about the skin tone of a person rather than their ethnicity.”

A newer multicultural brand launched by another vibrant multicultural personality is Lipmatic, created by the daughter of rapper Nas. Comprised of prismatic lip colors, the cheeky color-oriented line is meant to be inclusive in terms of ethnicity.

“I definitely consider my brand multicultural, says Lipmatic founder, Destiny Jones. “A big part of the brand is in embracing hip-hop and New York culture. As we all know New York is a melting pot of different cultures and nationalities and that is what I would like for my brand to represent. We try to appeal to every girl and regardless of your skin tone each color will complement you beautifully.”

Jones’ collection is also about embracing rather than disguising a woman’s features, a trend that can also be seen in today’s natural hair movement sweeping African American communities.

“I feel like for years women of color have been put down about some of our features including our full lips and this is a time where that part of our culture is more accepted and even manipulated,” says Jones, adding that social media is a key component to the brand. “I try to use a combination of beauty shots as well as street shots to show both sides of the brand and of course to show a variety of skin tones.”

Other lip-focused brands created by multicultural founders include Ka’Oir Cosmetics, a collection of brilliantly hued lip colors by model and entrepreneur, Keyisha Ka’Oir; Sashe, which offers vibrant cosmetics for sensitive skin; Magnolia Makeup, a Louisiana-based brand comprised of highly pigmented shades; and Gold Label Cosmetics, a range of bright bold lipsticks and matte lip pens.

“Beauty overall is a category in which ethnic women tend to be more engaged, whereas Caucasians is typically strongest in skin care,” says Grant. “Hispanics over-index in every [beauty] category, and the only one they do not outperform is around lip color, which is stronger among African Americans.”

One particularly successful color brand by a Hispanic founder is Melt Cosmetics, which has enjoyed a large amount of success due to social media. Melt founder Lora Arellano, who was Rihanna’s personal makeup artist, has a million followers for her personal Instagram page, and 2.3 million for her cosmetics brand.

Another notable makeup line by a Latina founder is Reina Rebelde, which was inspired by the founder’s Mexican American upbringing.

“I actually founded the brand on a very specific point of view; my experience as a Mexican-American woman and my relationship to beauty and its rituals,” says brand founder, Regina Merson. “We are the largest consumer on the market and no one was addressing us head on.”

Reina Rebelde’s artful packaging and bold color proposition is a unique part of its cultural identity.

“The color and performance of products were inspired by what it means to be a Latina woman in this country,” says Merson. “It’s about the duality of my life, having multiple cultural norms and an intense nostalgia and pride in my heritage.”

Hair Market

The multicultural hair market is definitely having a moment. Mintel reports that the ethnic haircare market is expected to reach $876 million by 2019. One of the biggest causes of the swell is the trend for black women to wear their hair naturally, which has strengthened shampoo and hair styling product sales.

In terms of the ethnic hair market, there have been a few early success stories. Brands like Mixed Chicks, Curls, Oyin, Miss Jessie’s, and Shea Moisture, a line of natural hair products made with organic shea butter, founded by Sundial CEO Richelieu Dennis are growing in popularity—and distribution. In September 2015, Bain Capital acquired a minority stake in Sundial, which generated an estimated $200 million in 2015 for an unreported amount, valuing it at an estimated $700 million, according to Beauty of Fashion.

One of Sundial’s newest brands is Madam C.J. Walker, a haircare line named after the first self-made female millionaire. The line is now being sold through Sephora.

“We chose to partner with Sephora on the launch of Madam C.J. Walker Beauty Culture because this launch represents another step forward in our rich history,” says Davis. “In addition, it means that textured hair women, including many women of color, will have more options for products that serve them and meet their needs when they walk into their stores or are searching and shopping online.”

Retailers have been responding by allowing more space for brands that target diverse consumers. Target, for one, has devoted more space, both in-store and online to multicultural hair brands, making niche brands for women of color available to the masses. Top sellers at Target include Camille Rose Naturals, Carol’s Daughter, Shea Moisture and Tgin.

“We’ve seen higher end multicultural products like Miss Jessie’s and Diva Curl in both mass and prestige distribution,” says Elle Morris, about the influx of multicultural hair brands.

“In mass, these brands are still categorized as ethnic hair care, for the most part, but I see that as something that will change over time. We are becoming a more blended society and as we look at beauty moving forward, there won’t be a traditional face of beauty.”

For its part, Uncle Funky’s Daughter, another customer favorite at Target, has found a new audience via the retailer in today’s diverse market.

“Uncle Funky’s Daughter has been around for almost a decade, but we were the hidden secret in the curly hair community until recently,” says Renee Morris, CEO of Uncle Funky’s Daughter. “Social media platforms like Instagram and YouTube have increased our awareness to ‘curlfriends’ everywhere. We’ve grown from 200 followers two years ago on Instagram to over 30K today. We have a greater ability to educate and inspire ‘naturalistas’ and those debating whether or not to go natural.”

Following the trend of natural hair, celebrated celebrity hair stylist Kim Kimble (who counts among her clients Oprah Winfrey and Beyonce), has also introduced a natural hair-inspired product line to the market via HSN.

“Because the natural movement started getting bigger, I created a whole curl line because of it,” says Kimble. “For me it’s something that’s here to stay. It’s not a fad or a political statement, a lot of women were just crying out because they were tired of relaxing it.”

Kimble adds that social influencers are again part of the shift.

“Being in the entertainment industry, it’s more about glamour, and highly stylized looks,” says Kimble. “I’ve started seeing a lot of bloggers who are changing the game. They now are talking about how beautiful natural hair is and are teaching women to wear their hair all different types of ways. I’m very excited about it.”