Jamie Matusow, Editor-in-Chief04.30.18

Consumer awareness of the impact of packaging on the environment, particularly plastics, has sparked renewed interest in measures for solutions, and many beauty brands and suppliers have taken the issue to heart.

At the start of 2018, the EU announced plans to make all plastic packaging across the continent recyclable or reusable by 2030. Frans Timmermans, the European Commission’s first vice-president, who is responsible for sustainable development, said: “If we don’t change the way we produce and use plastics, there will be more plastics than fish in our oceans by 2050.”

In the last few months, Amcor, Ecover, Evian, L’Oréal, Mars, M&S, P&G, PepsiCo, Coca-Cola, Unilever, Walmart and Werner & Mertz—which together reportedly use in excess of 6 million metric tons of plastic packaging a year—have committed to using only reusable, recyclable or compostable packaging by 2025, according to the Ellen MacArthur Foundation.

With ocean plastic in the headlines, P&G’s Head & Shoulders bottle drew attention last year; it contains 25% beach plastic that is collected from beaches, oceans, rivers and other waterways. Other brands are following suit, including ColorProof, which uses plastic bottles made of 10% ocean-bound up-cycled plastic.

Peter Hays, consumer analyst at GlobalData, a data and analytics company, comments: “Consumers are highly sensitive to the environmental implications of packaging formats.

While the implications of product formulation have long been a focus of consumers, it is becoming clear that the packaging waste produced by everyday purchases also has a detrimental effect on the environment.”

At Nate Packaging, president/owner Ray Lewis, tells Beauty Packaging: “When an eco-consumer shops and all things are equal (cost, formula performance), package sustainability is now driving the consumer to purchase the brand as they can relate to their personal drive to save the planet.”

Environmentally friendly packaging, overall, is becoming increasingly essential, according to research from GlobalData, which found that 65% of consumers globally always or mostly recycle product packaging. With the majority of global consumers already recycling, demand for environmentally friendly packaging will increase further in response to heightened publicity around plastics ending up in the ocean, according to the firm.

In Defense of Plastics

But David Luttenberger, global packaging director at Mintel, says the heightened talk around ocean plastics speaks of a broader issue—and opportunity.

Luttenberger tells Beauty Packaging, “Right now the buzz phrase is ‘ocean plastics,’ but what many brands, including beauty and personal care brands, are missing, is the bigger picture and the larger opportunity.”

The Mintel Packaging Team explains and illustrates in its 2018 “Sea Change” trend, that the ocean plastics issue is about more than just plastic, plastic waste, or the novelty of converting a bottle out of reclaimed or diverted ocean plastics. “The bigger opportunity,” explains Luttenberger, “is about using the current ocean plastics issue as the entry point, the catalyst to engage consumers in a conversation they are truly interested in having with brands. It is an opportunity to talk about what brands are doing across glass, metal, paperboard, and even ‘next-generation’ bio-based materials, and how they are being sourced, converted, and recovered and repurposed more responsibly.”

Luttenberger adds, “It’s also a tremendous opportunity to share facts about the good that plastics bring to our lives, the opportunity to push the percentage of plastics that could be recycled—and dispel the myth that all plastics are evil and only destructive. It’s an opportunity to push and support the environmental and financial advantages of plastics recycling, as well as how we divert and recover all types of packaging.”

Millennials and Gen Z at the Core

Interest in sustainable packaging in the beauty industry is drawing increased attention of late, in part due to young, informed consumers and Indie brands with environmental awareness and principles at their core.

Regina Haydon, an analyst at Mintel, notes in her article on page 46 of this issue: “Packaging is now central to environmental thinking, with more brands taking real actions in order to relate to eco-conscious consumers. Whether it is recyclable, made from recyclable materials or biodegradable, packaging has become a key focus of innovation for a growing number of beauty brands.”

“Millennials and Gen Z are big purchasers and frequent users of beauty and personal care products and these groups have an increased interest in the environment,” says Rebecca Vara, vice-president of sales-Personal Care, Berry Global. “These consumers are strongly influenced by a brand’s sustainability story and how the packaging fulfills that story. Being able to offer a product with significant PCR content can help drive sales and create the right social ‘buzz’ among the right demographic,” she explains.

Inger Heinke, business development director Cartonboard USA, BillerudKorsnäs, tells Beauty Packaging: “Interest in eco-friendly packaging is definitely on the increase around the world. Sustainability is moving from discussion to action everywhere, including with 193 countries adopting the UN’s sustainability goals.” Heinke says that in a recent BillerudKorsnäs consumer panel study on Packaging Sustainability, 66% of consumers said that they would be willing to pay more for sustainable packaging. (Peter Malmqvist, marketing director Americas, BillerudKorsnäs, will present this unique consumer panel at Luxe Pack NY 2018.)

Naturals Draw Attention to the Issue

With many of today’s consumers seeking “farm-to-face” beauty products that are plant-based, natural, organic, vegan or biodynamic—driven in part by Indie brands and of increasing awareness on the part of Millennials and Gen-Z-ers—these same brand owners and consumers are paying more attention to packaging components as well.

At Neenah Packaging, Greg Maze, senior brand & sales manager, says the interest continues to intensify for green labeling and certifications, managing sustainable supply chains as well as designing and producing sustainable packaging. “There does appear to be a direct correlation between the rise in natural organic beauty products and the heightened attention to product and packaging ingredients,” says Maze. For secondary packaging, he says, there’s an emphasis on post-consumer (PC) materials. “Many of our customers want ‘PC content’ box papers and board, with many asking for PC100 (papers made with 100% post-consumer content) by name. It may be that ‘PC’ has become a household word as the fashion world runs to set up PC recycling systems in response to growing attention of industry waste. We also see more brands proudly putting eco-logos and certifications on their packaging. Brands want their eco-conscience and eco-consciousness made visible.”

Out-of-the-Box Recycling Solutions

While many packages now carry a recycling logo, recyclability is not always a simple solution, even when facilities are available. GlobalData’s Hays says: “While packaging recyclability is laudable, the recycling process requires additional energy. A more environmentally friendly packaging format might use recyclable materials while also reducing unnecessary packaging. Better still would be offering consumers reusable packaging.”

Elise Kim, account executive, Nest-Filler USA, tells Beauty Packaging, “Refillable cartridges or refillable inner cups of double-walled jars seem to be on a rise because they are usually made of recyclable packaging such as PP (Polypropylene) & PET (Polyethylene Terephthalate).” Refillable requests, she says, are often driven by demands such as cost-effectiveness, an efficient form of customizing different SKUs, impactful appearance on social media, and the end-user’s essence of ‘giving back.’ ”

Tom Szaky, CEO, TerraCycle, a company that offers innovative solutions for recycling difficult-to-recycle materials, talks about the complexities involved in recycling some beauty products, and how these issues can be addressed, such as with a recent project they carried out with Garnier.

“Some products—like shampoo bottles—are widely recycled through most curbside recycling programs,” says Szaky. However, he adds, many other beauty products (like flexible tubes, caps, pumps and trigger heads for shampoo bottles, lipstick, eyeliner, and many others) typically can’t be recycled at the curb. This is why Garnier launched the Beauty Recycling Program: to provide a recycling solution for ALL personal care and beauty waste.

Last year, Garnier teamed up with DoSomething.org and TerraCycle through a national campaign and college competition to encourage Millennials to recycle empty beauty products.

The goal was to collect 10 million empty containers by the end of 2017—which was met. Garnier is now repeating the effort and launched Rinse.Recycle.Repeat on March 1, 2018, featuring actress Mandy Moore, Garnier’s brand ambassador. Moore will help educate young people on how to responsibly recycle in the bathroom and divert one million empty beauty product packages from landfills this year.

Once collected, TerraCycle will recycle the packaging into pelletized lumber, and the winning school will receive a recycled garden donation made from recycled personal care and beauty products collected through the program.

Additionally, for any plastics and films that cannot be recycled municipally, retailers or consumers can purchase TerraCycle’s Beauty Products and Packaging Zero Waste Boxes to ensure that all of the packaging is 100% recyclable through a cost-effective, turnkey solution that requires little setup. The price includes return shipping to TerraCycle, as well as the processing fee.

Plastic Challenges

While singular efforts grow, the widespread results of recycling pledges remain to be seen.

Mintel’s Luttenberger tells Beauty Packaging: “We have seen of late some grandiose claims from big global brands about how they will, during the next few years, reduce, or even eliminate, their use of plastics, or significantly increase their percentages of recycled plastic content. These efforts make for great headlines and create a momentary spike in positive consumer sentiment.” However, he says, “The proof will be in whether those efforts come to fruition during the period noted, in the amounts claimed, and within a budget that will not result in production cost increases being passed through to consumers.”

Luttenberger says, “When suppliers work with brands to put technology in a context that brand marketers can share with consumers, then it becomes a win for the supplier, a win for the brand-owner, and a win for the consumer.”

Current Trends

From glass and metal, to plastics, to board, to supply chain credentials, marketing and packaging teams are increasingly aware and inquisitive.

Mike Warford, director of sales, ABA Packaging Corp., tells Beauty Packaging: “We are seeing a strong interest by many of our existing and new customers in finding eco-friendly packaging options that work for them. We recently exhibited at Luxe Pack LA and the strong message from many of those that visited our stand was ‘What are my most eco-friendly packaging options?’ ” He says the inquiries regarding eco-friendly packaging options seem to be the strongest among “our mid-level and start-up clients including what might be defined as Indie brands.”

At Cadence Packaging Group, which specializes in sustainable materials and innovative packaging solutions, CEO Timothy Burke, observes, “We have seen significant growth in sustainable and responsibly sourced packaging. The demand is driven by consumers who are actively seeking out brands that align with their personal values and aspirations which positively impact the environment and social justice.” He says, “Adding to the growth, consumers have access to a much larger universe of options affording them the ability to include sustainable packaging into their purchase decisions. Many brands we work with recognize their consumers’ extended awareness and place sustainable materials as a top priority.”

Increasing interest from both very small and very large customers has been apparent at JSN Cosmetic Packaging, according to Casey Nagel, senior manager of business development. He says, “Many large companies have adopted wide-ranging sustainability objectives that are being applied to an array of existing product lines. We also see smaller companies that have begun a strong individual mandate of sustainability.” Nagel observes: “The personal care market is very sensitive to the ingredients that get applied directly to the body and in turn the packaging that those ingredients come into contact with.”

Sustainability in tubes has always generated interest from consumers and retailers, according to Bruno Lebeault, marketing director North America, Viva IML Tubes, but the audience has grown. “So far the ones who were driving the demand were either the natural and organic brands or some high-end brands with a lot of success. Now all major beauty brands and retailers are fully engaged as it has become a must.”

Michael DiFranco, VP of marketing at JohnsByrne Company, a custom packaging and print solutions provider, has also noted rising interest. “We are seeing the ever-increasing environmental conscientiousness of our customers and how it is permeating their cultures and core values. Reducing their carbon footprint has shifted from a headline, to clients making it a metric or with a corporate goal of zero carbon footprint by a certain year.”

In turn, says DiFranco, “our clients are looking for the same level of commitment from their supply chain partners. They want recycled board options, soy inks, paper from protected forests—and want data on how green we manufacture and reduce our carbon impacts.”

Sean Kharche, Amcor vice president for home and personal care, says: “Brand owners and manufacturers are responding to growing consumer awareness and concern for the environment. The expectation is that companies are good corporate citizens, which includes conducting business with a respect for the environment.”

Specific Brand Requests

What in particular are brands requesting as far as sustainable packaging and practices?

“We are seeing stronger sales in glass and metal products where ease of recycling activity is reportedly the strongest,” says ABA Packaging’s Warford. In plastics, he says, “We are seeing strong inquiries for Certified Post-Consumer Recycled material content in bottles, jars and caps. Some of our customers are considering cradle-to-grave managerial projects where they will work with their cosmetic end-customers to make sure that the materials are in fact recycled properly when the product in them is used up.”

Berry Global’s Vara says brand owners are seeking more sustainable products and are looking for higher-percentage PCR content of packaging, and packaging that can be recycled or reused, “but is still beautiful and functional.”

At Diamond Packaging, Bacchetta, tells Beauty Packaging: “Brands are very interested in our environmental practices and new material options.” In fact, he says environmentally friendly packaging has become an expectation of their customers. “They continue to request more high-end decorative effects, but produced faster, more economically and with sustainability benefits,” says Bacchetta. He explains that this is often achieved through a reduction in weight or components, a greater use of FSC-certified paperboards, or in-line converting techniques (e.g., cold foiling, specialty coatings, or specialty effects).

“Many companies are also looking at sustainable packaging design as one aspect of the larger role of Corporate Social Responsibility (CSR),” says Bacchetta, “which includes sustainability, diversity, and socially responsible business practices. They recognize that brands, including many smaller boutique brands, are winning over consumers by doing “ ‘the right thing.’ ”

Furthermore, Bacchetta says brands are requesting that their suppliers report on their CSR practices and progress through third-party platforms.

Cadence Packaging Group finds that brands are requesting post-consumer waste recycled paper, FSC certified papers, recyclable papers and handles, and reusable bags.

Additionally, they are seeking sustainable printing methods (coatings), sustainable adhesives and water-based inks. On a broader level, some are seeking social responsibility through factories, water conservation, Fair Trade, reduced greenhouse gas emissions, and a reduced carbon footprint.

The conversation about recycled content has evolved according to Heinke at BillerudKorsnäs. She says, “The discussion between the brands and their consumers has finally shifted from the more simple and visible to the more important and scientific case about CO2 emissions.” She explains, “Luxury brands are shifting away from asking for some percentage of recycled content, with an understanding that recycled fibers are being optimized in lower quality materials (corrugated, tissue, newsprint), and that luxury packaging materials need to be made from premium wood-fiber based pulp, which ultimately is needed for the whole recycling cycle to happen. Now that the consumer is more educated about sustainability, carbon footprint is (and should be) more important.”

Angel Pujolasos, CEO of Pujolasos, a company that develops wooden caps for perfumery, cosmetic and spirits, says the increase in sustainable packaging has led to an increased demand for their products. He says, “The brands are demanding a completely sustainable material, which was developed with a sustainable process, using the most eco-friendly materials and technology. The brands also want these products to follow the market trends and the innovation of design,”

The New Stendhal Luxury Trend, from Pujolasos, is a collection of wooden caps based in deep relief, to get customized and unique shapes. This collection, launched by Sant Pere de Torelló, is exclusive for the perfumery market, and uses exclusive development techniques. The collection was developed with sustainable wood and is PEFC and FSC certified.

At Olcott Plastics, Joe Brodner, president, tells Beauty Packaging: “Customers are asking us to rethink our approach. They look to us as having more experience in material choice and design and are looking for a simple answer to a complex problem. We are hearing from project managers, buyers, and brand managers that eco-friendly packaging innovation requests are coming from the highest levels of companies.”

Brands are asking for innovation, according to Brodner. He says, “They are reaching some levels of material light-weighting that will be difficult to improve on without a major rethinking of approach. If they were using a mixed material package they want to make it more recyclable by going with a single material. Brands are now also contributing to mold costs in return for the rights to an idea for a certain period of time. Previously, if there was an investment necessary to make a project viable, the brands were looking for that investment to come from us. Now to get a jump on an idea, we are seeing companies being more willing to contribute to get projects off the ground.”

The Case for Plastics

Brodner says Olcott recently improved a few sizes of jars to change the weights without compromising the product integrity. “We were able to take 15% out of our new 2-oz jar, he says.” This represents about 8 million grams of plastic not having to be recycled,” he explains. Our customers appreciate that and are able to promote things like this in their marketing materials.”

Lewis, of Nate Packaging, says the company’s development team has been pushing the limits of PCR resin materials along with tool design to incorporate brands’ design strategies.

“We have been able to incorporate PCR into color cosmetic components in recycled resins that include PP, HDPE, PET at levels from 60% to 100% PCR content,” says Lewis, adding, “Our design capabilities have allowed us to engineer the designs to work with the variation that is found in the ever-changing PCR resin feed streams.” Lewis says they have produced packaging with PCR content in thick- and thin-walled lip glosses, compacts, mascaras, eyeliner pens, thick-walled jars, bottles and flip-top caps.

Nate Packaging has been working with “many of the major cosmetic companies in this area, including Burt’s Bees, L’Oréal, LVMH, and many all-natural brands, says Lewis, as “they are all driving their story for sustainable PCR resins in their packaging to meet their brand images for their consumers.”

Burt’s Bees teamed up with Nate Packaging “as it continues to push the limits for their brand to the next level in sustainability,” according to Lewis. Recently Nate was able to mold a 100% PET PCR compact in a honeycomb shape that gives an advantage of having a high-end heavy feel due to the density of the material. “We are able to give a very high-end luxe feel in a PCR resin format,” says Lewis.

At Epopack, which provides 100% PCR PET bottles and jars, Amy Pan, tells Beauty Packaging, “Customers are looking for more professional information about packaging materials. They clearly understand almost all the material can be recycled, however, some can be easier to reuse and are better than other materials.”

She says eco-friendly packaging can’t just use recyclable material, it also has to be designed in an eco-friendly way—such as a “single material concept” which allows the recycling system to run more efficient and smoothly.”

“Story-telling packaging is a popular idea that customers are looking for,” says Pan, “which is not only using eco-friendly materials, but also requires a presentable and high-quality appearance.” Here, she says, Epopack believes PET heavy-wall bottles and jars are the best fit.

“Our new product, SC4534 double layer PET caps,” says Pan, “are designed in a single material concept as well, so it also creates a high-quality/luxury look for a customer’s products.”

Pan says that more customers are using PET heavy wall bottles as an alternative to glass containers, both “to avoid the breakage issue and to reduce the carbon footprint during transportation.”

Amcor also says there’s been a shift from glass to PET.

Amcor recently became the first global packaging company pledging to develop all of its packaging to be recyclable or reusable by 2025. Kharche says the company committed to significantly increasing its use of recycled materials and driving consistently more recycling of packaging around the world. This includes using more post-consumer resin (PCR) as a key sustainability measure and leveraging technical expertise to maximize light weighting.

According to Kharche, Amcor has proven “its game-changing LiquiForm technology with the commercialization of the first personal-care package.” He says, in addition to reducing supply chain costs, LiquiForm technology has the potential to improve packaging consistency and lower the carbon footprint associated with filling and packaging. LiquiForm technology uses the packaged product instead of compressed air to simultaneously form and fill containers. By combining the forming and filling into one step, the process eliminates costs associated with the equipment and energy of the traditional blow molding process along with the handling, transport, and warehousing of empty containers.”

Tubes That Pass the Test

Tubes have become a top packaging choice for brands due to their many features, including eco-friendly materials.

JSN produced its Green Polymer line of tubes to demonstrate a series of approaches to environmentally responsible packaging. Nagel says, “These include but are not limited to plant-based resins, light-weighted components and PCR resins for both the cap and tube. To further augment the environmental footprint of the package, the components are all produced and decorated at the same facility in California.

Viva’s Lebeault says in addition to brands asking about recyclable and recycled materials, they are also attentive to where their tubes are being shipped from and trying to get them manufactured locally as importing empty tubes from overseas is generating a lot of emissions.

Viva In Mold Labeled Tubes is introducing the Eco-Tube to market. The tube, the In Mold label, and the cap are all 100% PP fully recyclable and molded under the same roof in Toronto, “generating up to 35% less emission.” Now the tube can be molded with up to 65% PCR Polypropylene. One of the main interests in Viva’s PCR solution, says Lebeault, is that the In Mold Label can mask any color limitations of PCR and achieve maximum decoration flexibility.

Viva’s Dual Chamber tube was developed to hold two different formulas in one tube with a dual flip cap, allowing full customization of the blend. Lebeault says it reduces packaging by 50% as one tube replaces two tubes; and it reduces waste by 100% as the whole injection molded tube with IML is 100% recyclable.

Berry Global received a 2018 Gold Award for Best Sustainable Tube from the Tube Council North America. The laminated tube, for Fetch…for Pets’ licensed Burt’s Bees for dogs Paw and Nose Relieving Lotion, is Berry’s first commercialized tube using PCR, yielding a maximum percentage which varies between 57% and 62% PCR, excluding the closure, and depending on the tube diameter and length. The tube specifically contains 60% PCR, excluding the closure. This was achieved by combining 53% PCR in the tube sleeve and 75% PCR in the shoulder. This PCR amount allows the tube to meet all the same quality, performance, and processing standards as Berry’s customers’ non-PCR tubes, according to Vara.

Neopac now offers PICEA, a sustainable tube that contains over 95% bio-based carbon content material in the tube body and shoulder. “For the caps, we are still developing an all-in-one-solution to complete the PICEA portfolio for cosmetic brands to achieve their goals in using sustainable tube packaging for their natural and bio-based beauty products,” says Cornelia Schmid, head of marketing at Hoffmann Neopac. The range is recyclable in the plastic stream (category 2) and food grade according to EU regulation No. 10/2011. The tube is certified by ECOCERT. With this certification, PICEA is available either as a monolayer tube concept with direct formula contact, or as a multi-layer tube with additional EVOH barrier.

Cartons That Seal the Deal

Neenah Packaging’s Maze says brands want to be able to back up their sustainability claims with hard data, so Neenah provides custom environmental impact analyses for customers to identify and quantify the resources they have saved by using the supplier’s PCW papers. One of their customers recently achieved its first year using PC 100 and was excited to see their environmental impacts, says Maze, adding: “More and more want to produce their packaging carbon-neutral.”

Recently, the Josie Maran brand moved its secondary packaging to Neenah’s folding board. Josie Maran has been pioneering natural, high-performance skincare, body care, and beauty cosmetics since founding her company in 2007. Tom Koh, head of creative marketing, Josie Maran, explains: “Through her anti-aging key ingredient, Argan Oil, Josie Maran paved the way for how a natural ingredient can be used to change the world of beauty and business led by a vision of wellness, empowerment, and social impact.”

Sourced in Morocco, Josie’s Argan Oil is responsibly harvested from Argan trees by families in Argan forest regions. Their relationship to Argan Oil is essential and sacred, providing social economic purpose to women and communities, and sustainability and preservation of the Argan tree.

In January 2017, Josie reached new success with a new product that came with another meaningful message. Argan Reserve was a natural anti-aging product unlike any other that utilized the full potential of the Argan tree. This treatment concentrate, utilized the nutrients of the Argan leaves and the Argan press cake left from the Argan Oil cold-press process, to create an anti-aging powerhouse for healthy skin. A symbol of conscious design, Argan Reserve was an entirely new Josie Maran product solely made from elements the tree harvested.

In the spirit of the product design, the Josie Maran team created a sustainable package using Neenah’s 100 PC folding board. The substrate resonated with Josie and the team, beyond the quality of the material. According to Koh, upon evaluation of several post-consumer substrate offerings on the market, the Neenah 100 PC became a brand choice with a statement that corporate responsibility could be both luxurious and beautiful. The 100 PC Neenah board is produced in a carbon neutral facility, as well as the manufacturer who prints the board. The carbon neutral logos are printed on the bottom of the Reserve carton because, “in this market, consumers are looking for companies who take the extra step towards improving environmental impacts,” says Koh.

Diamond Packaging’s carton for Viva La Juicy Sucré also captures the spirit of the brand—and was manufactured using 100% clean, renewable wind energy and produced in a Zero Manufacturing Waste to Landfill (ZMWL) facility. The carton was converted utilizing FSC-certified Iggesund Invercote G .017 paperboard.

Coatings and Films

In addition to components, eco-friendly methods and energy usage are also considerations.

Gregory Grimonprez, technical sales director, Stölzle Glass USA, Inc., tells Beauty Packaging: “Our customers are increasingly sensitive to the methods used in production of the package and their impact on the environment. Our commitment to energy and the environment is another asset perfectly suited for their philosophy.”

Stölzle Glass Group has worked on a new alternative of spray decoration called “Quali Glass Coat” which reduces the environmental impact. According to the supplier, this technology has almost no waste of processed paint, while conventional spraying averages 50%.

Innovia Films recently extended its Propafilm cosmetic overwrap range to include a non-top coated film which has improved stiffness and sparkle—and does not whiten. The extra stiffness of the film allows for down-gauging while maintaining a similar pack feel. An uncoated film also gives additional environmental benefits. According to Stephen Langstaff, global business manager, packaging, Innovia, “The carbon footprint of an uncoated film is less than that of a coated film as its production uses less energy and water. This film can be more readily recycled.”

Looking Toward a Sustainable Future

Complex issues of product protection and the certifiability of “eco-friendly” packaging are likely to remain some of the greatest challenges facing the Beauty industry.

ABA Packaging’s Warford, says: “First and foremost, any eco-friendly packaging being considered must still pass muster for the core principles of effective containment, compatibility, and dispensing. The eco-friendly materials chosen for the primary packaging components must be able to contain the products without any leakage, they need to be compatible with the product ingredients, they cannot contaminate the end product, and they need to work in harmony with the dispensing mechanisms or devices included on the packaging. With all of this to be considered, the packaging chosen still needs to be cost effective.”

Nagel, of JSN Packaging, says analysis is variable. “Unlike other industries like construction which have highly developed methods to evaluate and certify the environmental footprint of a building, the packaging industry does not have the equivalent process to measure the individual footprint of a package,” says Nagel. “The buyer has to take into account the sourcing of all individual components and how efficiently they are each produced. The distances each component must travel is of importance. There is much less environmental footprint on an entire package sourced regionally than one where components are from opposite ends of the nation or from abroad. In addition, if the supplier has a high reputation of quality, there will be less scrap and failure in filling and fulfillment.” Nagel points out: “These considerations could easily out-weigh a percentage of recycled content when developing a strategy for achieving an environmentally responsible package.”

Berry Global’s Vara, says because there are so many options out there—light weighting, recycled content, design for recyclability, bioplastics, etc.— one of the biggest challenges will be simply deciding which option is the best fit for the brand. “The next challenge,” says Vara, “will be communicating the sustainability benefits of the package to consumers.” And, she adds, “Making sure that sustainable packaging and materials offer the consumer and the brand owner the look, feel, and performance they demand will be key to success.”

JohnsByrne’s DiFranco, predicts, “With the worldwide awareness of going green and consumers demanding sustainable packaging, companies will be faced with the challenge of bottom line impacts. While the infrastructure for recycling is well in place and the availability of recycled materials is readily available, there still is a hefty premium for these materials.

Additionally, for the cosmetic company whose brand and packaging are luxe, the transition to recycled materials has its aesthetic limitations. Often companies create new ‘all natural’ product line extensions where recycled substrates align perfectly. It is always a good idea for packaging partners to be brought into these discussions to formulate the best strategy and to achieve green goals.”

According to Mintel’s Luttenberger, many claims are so basic, such as “recyclable” or “recycle where facilities exist,” that they are meaningless when it comes to consumer action. Going forward, he says, “The challenge for the beauty industry is two-fold. First, understand what beauty consumers expect from beauty brands in terms of eco-responsible packaging. Engage consumers in conversations about what is important to them. Second, strive to deliver on-pack communications that put eco-responsibility claims in context.”

For example, says Luttenberger, while consumers don’t understand such claims as ‘xyz brand achieved a 500-ton reduction in production carbon emissions,’ they do understand ‘xyz brand has reduced its water usage in the production of this product by 5 million gallons.’ ”

“The bottom line, says Luttenberger, “is that beauty brands must challenge themselves to be more than just a pretty package and an aromatic or efficacious product. Consumers expect more. Consumers expect brands to do more to protect and preserve the environment than they can do as individuals. Brands that step up to that challenge and communicate meaningful eco claims, claims with meaningful context, and claims against which consumers can either feel a sense of eco-responsible consciousness or hyper-actionability, will be the brands that consumers return to.”

The 40-year old brand is an innovator in sustainable manufacturing.

As the first beauty company to manufacture with 100% wind power at their primary manufacturing facility, Aveda has been a trailblazer in integrating sustainability into their business practices. True to their mission to care for the world, Aveda chooses to offset their carbon impacts through the support of wind power projects. All of its products are manufactured with 100% wind power through credits and offsets.

Melissa Chelminiak, director mission, partner and stakeholder engagement, says, “Aveda has long been committed to addressing climate change as a primary threat to the biological diversity we depend on for many of the ingredients in our products, and we see it as one of the most critical issues facing the world today. As one of the cleanest sources of energy available, manufacturing with wind power helps mitigate this threat—it is sustainable and cost-effective, and does not emit greenhouse gases”

Aveda offsets the carbon emissions resulting from natural gas and electricity at all of their Minnesota locations, including their corporate headquarters, Midwest distribution center, and their corporately owned Institute in Minneapolis. Beyond Minnesota, Aveda offsets carbon emissions from electricity and natural gas at their NY Institute, all of their 129 Experience Centers, their LA Distribution Center, as well as their third-party manufacturers. Even carbon emissions from the actual usage of Aveda Control Force and Air Control hair sprays have a net zero carbon impact. Aveda partners with Native Energy and their local utility Excel Energy to purchase renewable energy credits (RECs) and carbon offsets through wind power projects around the world. Chelminiak says, “When you buy Aveda, you are supporting a chain of sustainable manufacturing.”

The first hair, face, and body care products in a shower-friendly PCR paper bottle

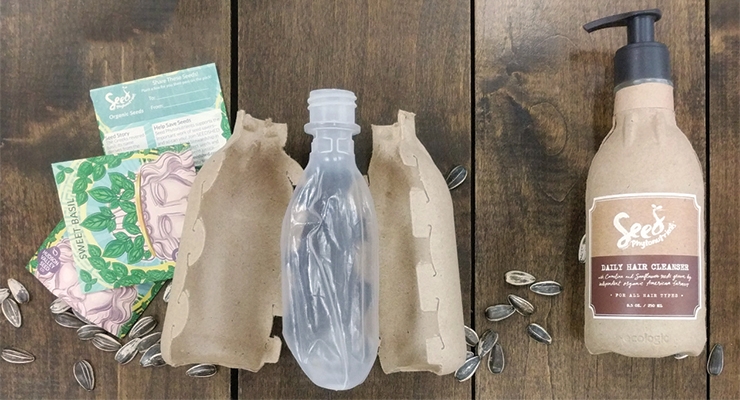

Seed Phytonutrients—a L’Oréal internally incubated sustainable startup launched in April in sync with Earth Month—crafts natural-origin hair, face, and body care products in the first-ever, shower-friendly, post-consumer recycled (PCR) paper bottle.

Seed provided Beauty Packaging with the following statement: “We feel that it’s our responsibility to lead the way and promote environmental sustainability for the beauty industry as a whole. We practice what we preach by using environmentally friendly recycled and recyclable packaging for all of our products. In partnership with Ecologic Brands, our bottles are made of 100% post-consumer recycled (PCR) corrugate and newspaper. The bottle has been treated with a mineral complex extracted from clay so you can safely take it in the shower; even after submerging this bottle in water, it maintains its shape and strength. And, because we don’t coat the shell, it can be recycled again (up to seven more times!) after use. Inside the fiber shells, we insert a thin blow-molded liner, composed of 80% post-consumer recycled HDPE, which can also be recycled. This configuration reduces the overall amount of plastic by 60% compared to a similar-sized shampoo bottle. We consider it our responsibility to care for our planet through a minimal waste mantra. We think that’s pretty cool.”

Here’s a way to recycle old mascara brushes—and do a good deed at the same time. The volunteer-run nonprofit, Appalachian Wild! has launched “Wands for Wildlife Wandraiser,” a program to gather old mascara wands and donations. Turns out the applicators are used to remove fly eggs and larva from the fur of wild animals. They work great because the bristles are close together.

At the start of 2018, the EU announced plans to make all plastic packaging across the continent recyclable or reusable by 2030. Frans Timmermans, the European Commission’s first vice-president, who is responsible for sustainable development, said: “If we don’t change the way we produce and use plastics, there will be more plastics than fish in our oceans by 2050.”

In the last few months, Amcor, Ecover, Evian, L’Oréal, Mars, M&S, P&G, PepsiCo, Coca-Cola, Unilever, Walmart and Werner & Mertz—which together reportedly use in excess of 6 million metric tons of plastic packaging a year—have committed to using only reusable, recyclable or compostable packaging by 2025, according to the Ellen MacArthur Foundation.

With ocean plastic in the headlines, P&G’s Head & Shoulders bottle drew attention last year; it contains 25% beach plastic that is collected from beaches, oceans, rivers and other waterways. Other brands are following suit, including ColorProof, which uses plastic bottles made of 10% ocean-bound up-cycled plastic.

Peter Hays, consumer analyst at GlobalData, a data and analytics company, comments: “Consumers are highly sensitive to the environmental implications of packaging formats.

While the implications of product formulation have long been a focus of consumers, it is becoming clear that the packaging waste produced by everyday purchases also has a detrimental effect on the environment.”

At Nate Packaging, president/owner Ray Lewis, tells Beauty Packaging: “When an eco-consumer shops and all things are equal (cost, formula performance), package sustainability is now driving the consumer to purchase the brand as they can relate to their personal drive to save the planet.”

Environmentally friendly packaging, overall, is becoming increasingly essential, according to research from GlobalData, which found that 65% of consumers globally always or mostly recycle product packaging. With the majority of global consumers already recycling, demand for environmentally friendly packaging will increase further in response to heightened publicity around plastics ending up in the ocean, according to the firm.

In Defense of Plastics

But David Luttenberger, global packaging director at Mintel, says the heightened talk around ocean plastics speaks of a broader issue—and opportunity.

Luttenberger tells Beauty Packaging, “Right now the buzz phrase is ‘ocean plastics,’ but what many brands, including beauty and personal care brands, are missing, is the bigger picture and the larger opportunity.”

The Mintel Packaging Team explains and illustrates in its 2018 “Sea Change” trend, that the ocean plastics issue is about more than just plastic, plastic waste, or the novelty of converting a bottle out of reclaimed or diverted ocean plastics. “The bigger opportunity,” explains Luttenberger, “is about using the current ocean plastics issue as the entry point, the catalyst to engage consumers in a conversation they are truly interested in having with brands. It is an opportunity to talk about what brands are doing across glass, metal, paperboard, and even ‘next-generation’ bio-based materials, and how they are being sourced, converted, and recovered and repurposed more responsibly.”

Luttenberger adds, “It’s also a tremendous opportunity to share facts about the good that plastics bring to our lives, the opportunity to push the percentage of plastics that could be recycled—and dispel the myth that all plastics are evil and only destructive. It’s an opportunity to push and support the environmental and financial advantages of plastics recycling, as well as how we divert and recover all types of packaging.”

Millennials and Gen Z at the Core

Interest in sustainable packaging in the beauty industry is drawing increased attention of late, in part due to young, informed consumers and Indie brands with environmental awareness and principles at their core.

Regina Haydon, an analyst at Mintel, notes in her article on page 46 of this issue: “Packaging is now central to environmental thinking, with more brands taking real actions in order to relate to eco-conscious consumers. Whether it is recyclable, made from recyclable materials or biodegradable, packaging has become a key focus of innovation for a growing number of beauty brands.”

“Millennials and Gen Z are big purchasers and frequent users of beauty and personal care products and these groups have an increased interest in the environment,” says Rebecca Vara, vice-president of sales-Personal Care, Berry Global. “These consumers are strongly influenced by a brand’s sustainability story and how the packaging fulfills that story. Being able to offer a product with significant PCR content can help drive sales and create the right social ‘buzz’ among the right demographic,” she explains.

Inger Heinke, business development director Cartonboard USA, BillerudKorsnäs, tells Beauty Packaging: “Interest in eco-friendly packaging is definitely on the increase around the world. Sustainability is moving from discussion to action everywhere, including with 193 countries adopting the UN’s sustainability goals.” Heinke says that in a recent BillerudKorsnäs consumer panel study on Packaging Sustainability, 66% of consumers said that they would be willing to pay more for sustainable packaging. (Peter Malmqvist, marketing director Americas, BillerudKorsnäs, will present this unique consumer panel at Luxe Pack NY 2018.)

Naturals Draw Attention to the Issue

With many of today’s consumers seeking “farm-to-face” beauty products that are plant-based, natural, organic, vegan or biodynamic—driven in part by Indie brands and of increasing awareness on the part of Millennials and Gen-Z-ers—these same brand owners and consumers are paying more attention to packaging components as well.

At Neenah Packaging, Greg Maze, senior brand & sales manager, says the interest continues to intensify for green labeling and certifications, managing sustainable supply chains as well as designing and producing sustainable packaging. “There does appear to be a direct correlation between the rise in natural organic beauty products and the heightened attention to product and packaging ingredients,” says Maze. For secondary packaging, he says, there’s an emphasis on post-consumer (PC) materials. “Many of our customers want ‘PC content’ box papers and board, with many asking for PC100 (papers made with 100% post-consumer content) by name. It may be that ‘PC’ has become a household word as the fashion world runs to set up PC recycling systems in response to growing attention of industry waste. We also see more brands proudly putting eco-logos and certifications on their packaging. Brands want their eco-conscience and eco-consciousness made visible.”

Out-of-the-Box Recycling Solutions

While many packages now carry a recycling logo, recyclability is not always a simple solution, even when facilities are available. GlobalData’s Hays says: “While packaging recyclability is laudable, the recycling process requires additional energy. A more environmentally friendly packaging format might use recyclable materials while also reducing unnecessary packaging. Better still would be offering consumers reusable packaging.”

Elise Kim, account executive, Nest-Filler USA, tells Beauty Packaging, “Refillable cartridges or refillable inner cups of double-walled jars seem to be on a rise because they are usually made of recyclable packaging such as PP (Polypropylene) & PET (Polyethylene Terephthalate).” Refillable requests, she says, are often driven by demands such as cost-effectiveness, an efficient form of customizing different SKUs, impactful appearance on social media, and the end-user’s essence of ‘giving back.’ ”

Tom Szaky, CEO, TerraCycle, a company that offers innovative solutions for recycling difficult-to-recycle materials, talks about the complexities involved in recycling some beauty products, and how these issues can be addressed, such as with a recent project they carried out with Garnier.

“Some products—like shampoo bottles—are widely recycled through most curbside recycling programs,” says Szaky. However, he adds, many other beauty products (like flexible tubes, caps, pumps and trigger heads for shampoo bottles, lipstick, eyeliner, and many others) typically can’t be recycled at the curb. This is why Garnier launched the Beauty Recycling Program: to provide a recycling solution for ALL personal care and beauty waste.

Last year, Garnier teamed up with DoSomething.org and TerraCycle through a national campaign and college competition to encourage Millennials to recycle empty beauty products.

The goal was to collect 10 million empty containers by the end of 2017—which was met. Garnier is now repeating the effort and launched Rinse.Recycle.Repeat on March 1, 2018, featuring actress Mandy Moore, Garnier’s brand ambassador. Moore will help educate young people on how to responsibly recycle in the bathroom and divert one million empty beauty product packages from landfills this year.

Once collected, TerraCycle will recycle the packaging into pelletized lumber, and the winning school will receive a recycled garden donation made from recycled personal care and beauty products collected through the program.

Additionally, for any plastics and films that cannot be recycled municipally, retailers or consumers can purchase TerraCycle’s Beauty Products and Packaging Zero Waste Boxes to ensure that all of the packaging is 100% recyclable through a cost-effective, turnkey solution that requires little setup. The price includes return shipping to TerraCycle, as well as the processing fee.

Plastic Challenges

While singular efforts grow, the widespread results of recycling pledges remain to be seen.

Mintel’s Luttenberger tells Beauty Packaging: “We have seen of late some grandiose claims from big global brands about how they will, during the next few years, reduce, or even eliminate, their use of plastics, or significantly increase their percentages of recycled plastic content. These efforts make for great headlines and create a momentary spike in positive consumer sentiment.” However, he says, “The proof will be in whether those efforts come to fruition during the period noted, in the amounts claimed, and within a budget that will not result in production cost increases being passed through to consumers.”

Luttenberger says, “When suppliers work with brands to put technology in a context that brand marketers can share with consumers, then it becomes a win for the supplier, a win for the brand-owner, and a win for the consumer.”

Current Trends

From glass and metal, to plastics, to board, to supply chain credentials, marketing and packaging teams are increasingly aware and inquisitive.

Mike Warford, director of sales, ABA Packaging Corp., tells Beauty Packaging: “We are seeing a strong interest by many of our existing and new customers in finding eco-friendly packaging options that work for them. We recently exhibited at Luxe Pack LA and the strong message from many of those that visited our stand was ‘What are my most eco-friendly packaging options?’ ” He says the inquiries regarding eco-friendly packaging options seem to be the strongest among “our mid-level and start-up clients including what might be defined as Indie brands.”

At Cadence Packaging Group, which specializes in sustainable materials and innovative packaging solutions, CEO Timothy Burke, observes, “We have seen significant growth in sustainable and responsibly sourced packaging. The demand is driven by consumers who are actively seeking out brands that align with their personal values and aspirations which positively impact the environment and social justice.” He says, “Adding to the growth, consumers have access to a much larger universe of options affording them the ability to include sustainable packaging into their purchase decisions. Many brands we work with recognize their consumers’ extended awareness and place sustainable materials as a top priority.”

Increasing interest from both very small and very large customers has been apparent at JSN Cosmetic Packaging, according to Casey Nagel, senior manager of business development. He says, “Many large companies have adopted wide-ranging sustainability objectives that are being applied to an array of existing product lines. We also see smaller companies that have begun a strong individual mandate of sustainability.” Nagel observes: “The personal care market is very sensitive to the ingredients that get applied directly to the body and in turn the packaging that those ingredients come into contact with.”

Sustainability in tubes has always generated interest from consumers and retailers, according to Bruno Lebeault, marketing director North America, Viva IML Tubes, but the audience has grown. “So far the ones who were driving the demand were either the natural and organic brands or some high-end brands with a lot of success. Now all major beauty brands and retailers are fully engaged as it has become a must.”

Michael DiFranco, VP of marketing at JohnsByrne Company, a custom packaging and print solutions provider, has also noted rising interest. “We are seeing the ever-increasing environmental conscientiousness of our customers and how it is permeating their cultures and core values. Reducing their carbon footprint has shifted from a headline, to clients making it a metric or with a corporate goal of zero carbon footprint by a certain year.”

In turn, says DiFranco, “our clients are looking for the same level of commitment from their supply chain partners. They want recycled board options, soy inks, paper from protected forests—and want data on how green we manufacture and reduce our carbon impacts.”

Sean Kharche, Amcor vice president for home and personal care, says: “Brand owners and manufacturers are responding to growing consumer awareness and concern for the environment. The expectation is that companies are good corporate citizens, which includes conducting business with a respect for the environment.”

Specific Brand Requests

What in particular are brands requesting as far as sustainable packaging and practices?

“We are seeing stronger sales in glass and metal products where ease of recycling activity is reportedly the strongest,” says ABA Packaging’s Warford. In plastics, he says, “We are seeing strong inquiries for Certified Post-Consumer Recycled material content in bottles, jars and caps. Some of our customers are considering cradle-to-grave managerial projects where they will work with their cosmetic end-customers to make sure that the materials are in fact recycled properly when the product in them is used up.”

Berry Global’s Vara says brand owners are seeking more sustainable products and are looking for higher-percentage PCR content of packaging, and packaging that can be recycled or reused, “but is still beautiful and functional.”

At Diamond Packaging, Bacchetta, tells Beauty Packaging: “Brands are very interested in our environmental practices and new material options.” In fact, he says environmentally friendly packaging has become an expectation of their customers. “They continue to request more high-end decorative effects, but produced faster, more economically and with sustainability benefits,” says Bacchetta. He explains that this is often achieved through a reduction in weight or components, a greater use of FSC-certified paperboards, or in-line converting techniques (e.g., cold foiling, specialty coatings, or specialty effects).

“Many companies are also looking at sustainable packaging design as one aspect of the larger role of Corporate Social Responsibility (CSR),” says Bacchetta, “which includes sustainability, diversity, and socially responsible business practices. They recognize that brands, including many smaller boutique brands, are winning over consumers by doing “ ‘the right thing.’ ”

Furthermore, Bacchetta says brands are requesting that their suppliers report on their CSR practices and progress through third-party platforms.

Cadence Packaging Group finds that brands are requesting post-consumer waste recycled paper, FSC certified papers, recyclable papers and handles, and reusable bags.

Additionally, they are seeking sustainable printing methods (coatings), sustainable adhesives and water-based inks. On a broader level, some are seeking social responsibility through factories, water conservation, Fair Trade, reduced greenhouse gas emissions, and a reduced carbon footprint.

The conversation about recycled content has evolved according to Heinke at BillerudKorsnäs. She says, “The discussion between the brands and their consumers has finally shifted from the more simple and visible to the more important and scientific case about CO2 emissions.” She explains, “Luxury brands are shifting away from asking for some percentage of recycled content, with an understanding that recycled fibers are being optimized in lower quality materials (corrugated, tissue, newsprint), and that luxury packaging materials need to be made from premium wood-fiber based pulp, which ultimately is needed for the whole recycling cycle to happen. Now that the consumer is more educated about sustainability, carbon footprint is (and should be) more important.”

Angel Pujolasos, CEO of Pujolasos, a company that develops wooden caps for perfumery, cosmetic and spirits, says the increase in sustainable packaging has led to an increased demand for their products. He says, “The brands are demanding a completely sustainable material, which was developed with a sustainable process, using the most eco-friendly materials and technology. The brands also want these products to follow the market trends and the innovation of design,”

The New Stendhal Luxury Trend, from Pujolasos, is a collection of wooden caps based in deep relief, to get customized and unique shapes. This collection, launched by Sant Pere de Torelló, is exclusive for the perfumery market, and uses exclusive development techniques. The collection was developed with sustainable wood and is PEFC and FSC certified.

At Olcott Plastics, Joe Brodner, president, tells Beauty Packaging: “Customers are asking us to rethink our approach. They look to us as having more experience in material choice and design and are looking for a simple answer to a complex problem. We are hearing from project managers, buyers, and brand managers that eco-friendly packaging innovation requests are coming from the highest levels of companies.”

Brands are asking for innovation, according to Brodner. He says, “They are reaching some levels of material light-weighting that will be difficult to improve on without a major rethinking of approach. If they were using a mixed material package they want to make it more recyclable by going with a single material. Brands are now also contributing to mold costs in return for the rights to an idea for a certain period of time. Previously, if there was an investment necessary to make a project viable, the brands were looking for that investment to come from us. Now to get a jump on an idea, we are seeing companies being more willing to contribute to get projects off the ground.”

The Case for Plastics

Brodner says Olcott recently improved a few sizes of jars to change the weights without compromising the product integrity. “We were able to take 15% out of our new 2-oz jar, he says.” This represents about 8 million grams of plastic not having to be recycled,” he explains. Our customers appreciate that and are able to promote things like this in their marketing materials.”

Lewis, of Nate Packaging, says the company’s development team has been pushing the limits of PCR resin materials along with tool design to incorporate brands’ design strategies.

“We have been able to incorporate PCR into color cosmetic components in recycled resins that include PP, HDPE, PET at levels from 60% to 100% PCR content,” says Lewis, adding, “Our design capabilities have allowed us to engineer the designs to work with the variation that is found in the ever-changing PCR resin feed streams.” Lewis says they have produced packaging with PCR content in thick- and thin-walled lip glosses, compacts, mascaras, eyeliner pens, thick-walled jars, bottles and flip-top caps.

Nate Packaging has been working with “many of the major cosmetic companies in this area, including Burt’s Bees, L’Oréal, LVMH, and many all-natural brands, says Lewis, as “they are all driving their story for sustainable PCR resins in their packaging to meet their brand images for their consumers.”

Burt’s Bees teamed up with Nate Packaging “as it continues to push the limits for their brand to the next level in sustainability,” according to Lewis. Recently Nate was able to mold a 100% PET PCR compact in a honeycomb shape that gives an advantage of having a high-end heavy feel due to the density of the material. “We are able to give a very high-end luxe feel in a PCR resin format,” says Lewis.

At Epopack, which provides 100% PCR PET bottles and jars, Amy Pan, tells Beauty Packaging, “Customers are looking for more professional information about packaging materials. They clearly understand almost all the material can be recycled, however, some can be easier to reuse and are better than other materials.”

She says eco-friendly packaging can’t just use recyclable material, it also has to be designed in an eco-friendly way—such as a “single material concept” which allows the recycling system to run more efficient and smoothly.”

“Story-telling packaging is a popular idea that customers are looking for,” says Pan, “which is not only using eco-friendly materials, but also requires a presentable and high-quality appearance.” Here, she says, Epopack believes PET heavy-wall bottles and jars are the best fit.

“Our new product, SC4534 double layer PET caps,” says Pan, “are designed in a single material concept as well, so it also creates a high-quality/luxury look for a customer’s products.”

Pan says that more customers are using PET heavy wall bottles as an alternative to glass containers, both “to avoid the breakage issue and to reduce the carbon footprint during transportation.”

Amcor also says there’s been a shift from glass to PET.

Amcor recently became the first global packaging company pledging to develop all of its packaging to be recyclable or reusable by 2025. Kharche says the company committed to significantly increasing its use of recycled materials and driving consistently more recycling of packaging around the world. This includes using more post-consumer resin (PCR) as a key sustainability measure and leveraging technical expertise to maximize light weighting.

According to Kharche, Amcor has proven “its game-changing LiquiForm technology with the commercialization of the first personal-care package.” He says, in addition to reducing supply chain costs, LiquiForm technology has the potential to improve packaging consistency and lower the carbon footprint associated with filling and packaging. LiquiForm technology uses the packaged product instead of compressed air to simultaneously form and fill containers. By combining the forming and filling into one step, the process eliminates costs associated with the equipment and energy of the traditional blow molding process along with the handling, transport, and warehousing of empty containers.”

Tubes That Pass the Test

Tubes have become a top packaging choice for brands due to their many features, including eco-friendly materials.

JSN produced its Green Polymer line of tubes to demonstrate a series of approaches to environmentally responsible packaging. Nagel says, “These include but are not limited to plant-based resins, light-weighted components and PCR resins for both the cap and tube. To further augment the environmental footprint of the package, the components are all produced and decorated at the same facility in California.

Viva’s Lebeault says in addition to brands asking about recyclable and recycled materials, they are also attentive to where their tubes are being shipped from and trying to get them manufactured locally as importing empty tubes from overseas is generating a lot of emissions.

Viva In Mold Labeled Tubes is introducing the Eco-Tube to market. The tube, the In Mold label, and the cap are all 100% PP fully recyclable and molded under the same roof in Toronto, “generating up to 35% less emission.” Now the tube can be molded with up to 65% PCR Polypropylene. One of the main interests in Viva’s PCR solution, says Lebeault, is that the In Mold Label can mask any color limitations of PCR and achieve maximum decoration flexibility.

Viva’s Dual Chamber tube was developed to hold two different formulas in one tube with a dual flip cap, allowing full customization of the blend. Lebeault says it reduces packaging by 50% as one tube replaces two tubes; and it reduces waste by 100% as the whole injection molded tube with IML is 100% recyclable.

Berry Global received a 2018 Gold Award for Best Sustainable Tube from the Tube Council North America. The laminated tube, for Fetch…for Pets’ licensed Burt’s Bees for dogs Paw and Nose Relieving Lotion, is Berry’s first commercialized tube using PCR, yielding a maximum percentage which varies between 57% and 62% PCR, excluding the closure, and depending on the tube diameter and length. The tube specifically contains 60% PCR, excluding the closure. This was achieved by combining 53% PCR in the tube sleeve and 75% PCR in the shoulder. This PCR amount allows the tube to meet all the same quality, performance, and processing standards as Berry’s customers’ non-PCR tubes, according to Vara.

Neopac now offers PICEA, a sustainable tube that contains over 95% bio-based carbon content material in the tube body and shoulder. “For the caps, we are still developing an all-in-one-solution to complete the PICEA portfolio for cosmetic brands to achieve their goals in using sustainable tube packaging for their natural and bio-based beauty products,” says Cornelia Schmid, head of marketing at Hoffmann Neopac. The range is recyclable in the plastic stream (category 2) and food grade according to EU regulation No. 10/2011. The tube is certified by ECOCERT. With this certification, PICEA is available either as a monolayer tube concept with direct formula contact, or as a multi-layer tube with additional EVOH barrier.

Cartons That Seal the Deal

Neenah Packaging’s Maze says brands want to be able to back up their sustainability claims with hard data, so Neenah provides custom environmental impact analyses for customers to identify and quantify the resources they have saved by using the supplier’s PCW papers. One of their customers recently achieved its first year using PC 100 and was excited to see their environmental impacts, says Maze, adding: “More and more want to produce their packaging carbon-neutral.”

Recently, the Josie Maran brand moved its secondary packaging to Neenah’s folding board. Josie Maran has been pioneering natural, high-performance skincare, body care, and beauty cosmetics since founding her company in 2007. Tom Koh, head of creative marketing, Josie Maran, explains: “Through her anti-aging key ingredient, Argan Oil, Josie Maran paved the way for how a natural ingredient can be used to change the world of beauty and business led by a vision of wellness, empowerment, and social impact.”

Sourced in Morocco, Josie’s Argan Oil is responsibly harvested from Argan trees by families in Argan forest regions. Their relationship to Argan Oil is essential and sacred, providing social economic purpose to women and communities, and sustainability and preservation of the Argan tree.

In January 2017, Josie reached new success with a new product that came with another meaningful message. Argan Reserve was a natural anti-aging product unlike any other that utilized the full potential of the Argan tree. This treatment concentrate, utilized the nutrients of the Argan leaves and the Argan press cake left from the Argan Oil cold-press process, to create an anti-aging powerhouse for healthy skin. A symbol of conscious design, Argan Reserve was an entirely new Josie Maran product solely made from elements the tree harvested.

In the spirit of the product design, the Josie Maran team created a sustainable package using Neenah’s 100 PC folding board. The substrate resonated with Josie and the team, beyond the quality of the material. According to Koh, upon evaluation of several post-consumer substrate offerings on the market, the Neenah 100 PC became a brand choice with a statement that corporate responsibility could be both luxurious and beautiful. The 100 PC Neenah board is produced in a carbon neutral facility, as well as the manufacturer who prints the board. The carbon neutral logos are printed on the bottom of the Reserve carton because, “in this market, consumers are looking for companies who take the extra step towards improving environmental impacts,” says Koh.

Diamond Packaging’s carton for Viva La Juicy Sucré also captures the spirit of the brand—and was manufactured using 100% clean, renewable wind energy and produced in a Zero Manufacturing Waste to Landfill (ZMWL) facility. The carton was converted utilizing FSC-certified Iggesund Invercote G .017 paperboard.

Coatings and Films

In addition to components, eco-friendly methods and energy usage are also considerations.

Gregory Grimonprez, technical sales director, Stölzle Glass USA, Inc., tells Beauty Packaging: “Our customers are increasingly sensitive to the methods used in production of the package and their impact on the environment. Our commitment to energy and the environment is another asset perfectly suited for their philosophy.”

Stölzle Glass Group has worked on a new alternative of spray decoration called “Quali Glass Coat” which reduces the environmental impact. According to the supplier, this technology has almost no waste of processed paint, while conventional spraying averages 50%.

Innovia Films recently extended its Propafilm cosmetic overwrap range to include a non-top coated film which has improved stiffness and sparkle—and does not whiten. The extra stiffness of the film allows for down-gauging while maintaining a similar pack feel. An uncoated film also gives additional environmental benefits. According to Stephen Langstaff, global business manager, packaging, Innovia, “The carbon footprint of an uncoated film is less than that of a coated film as its production uses less energy and water. This film can be more readily recycled.”

Looking Toward a Sustainable Future

Complex issues of product protection and the certifiability of “eco-friendly” packaging are likely to remain some of the greatest challenges facing the Beauty industry.

ABA Packaging’s Warford, says: “First and foremost, any eco-friendly packaging being considered must still pass muster for the core principles of effective containment, compatibility, and dispensing. The eco-friendly materials chosen for the primary packaging components must be able to contain the products without any leakage, they need to be compatible with the product ingredients, they cannot contaminate the end product, and they need to work in harmony with the dispensing mechanisms or devices included on the packaging. With all of this to be considered, the packaging chosen still needs to be cost effective.”

Nagel, of JSN Packaging, says analysis is variable. “Unlike other industries like construction which have highly developed methods to evaluate and certify the environmental footprint of a building, the packaging industry does not have the equivalent process to measure the individual footprint of a package,” says Nagel. “The buyer has to take into account the sourcing of all individual components and how efficiently they are each produced. The distances each component must travel is of importance. There is much less environmental footprint on an entire package sourced regionally than one where components are from opposite ends of the nation or from abroad. In addition, if the supplier has a high reputation of quality, there will be less scrap and failure in filling and fulfillment.” Nagel points out: “These considerations could easily out-weigh a percentage of recycled content when developing a strategy for achieving an environmentally responsible package.”

Berry Global’s Vara, says because there are so many options out there—light weighting, recycled content, design for recyclability, bioplastics, etc.— one of the biggest challenges will be simply deciding which option is the best fit for the brand. “The next challenge,” says Vara, “will be communicating the sustainability benefits of the package to consumers.” And, she adds, “Making sure that sustainable packaging and materials offer the consumer and the brand owner the look, feel, and performance they demand will be key to success.”

JohnsByrne’s DiFranco, predicts, “With the worldwide awareness of going green and consumers demanding sustainable packaging, companies will be faced with the challenge of bottom line impacts. While the infrastructure for recycling is well in place and the availability of recycled materials is readily available, there still is a hefty premium for these materials.

Additionally, for the cosmetic company whose brand and packaging are luxe, the transition to recycled materials has its aesthetic limitations. Often companies create new ‘all natural’ product line extensions where recycled substrates align perfectly. It is always a good idea for packaging partners to be brought into these discussions to formulate the best strategy and to achieve green goals.”

According to Mintel’s Luttenberger, many claims are so basic, such as “recyclable” or “recycle where facilities exist,” that they are meaningless when it comes to consumer action. Going forward, he says, “The challenge for the beauty industry is two-fold. First, understand what beauty consumers expect from beauty brands in terms of eco-responsible packaging. Engage consumers in conversations about what is important to them. Second, strive to deliver on-pack communications that put eco-responsibility claims in context.”

For example, says Luttenberger, while consumers don’t understand such claims as ‘xyz brand achieved a 500-ton reduction in production carbon emissions,’ they do understand ‘xyz brand has reduced its water usage in the production of this product by 5 million gallons.’ ”

“The bottom line, says Luttenberger, “is that beauty brands must challenge themselves to be more than just a pretty package and an aromatic or efficacious product. Consumers expect more. Consumers expect brands to do more to protect and preserve the environment than they can do as individuals. Brands that step up to that challenge and communicate meaningful eco claims, claims with meaningful context, and claims against which consumers can either feel a sense of eco-responsible consciousness or hyper-actionability, will be the brands that consumers return to.”

The 40-year old brand is an innovator in sustainable manufacturing.

As the first beauty company to manufacture with 100% wind power at their primary manufacturing facility, Aveda has been a trailblazer in integrating sustainability into their business practices. True to their mission to care for the world, Aveda chooses to offset their carbon impacts through the support of wind power projects. All of its products are manufactured with 100% wind power through credits and offsets.

Melissa Chelminiak, director mission, partner and stakeholder engagement, says, “Aveda has long been committed to addressing climate change as a primary threat to the biological diversity we depend on for many of the ingredients in our products, and we see it as one of the most critical issues facing the world today. As one of the cleanest sources of energy available, manufacturing with wind power helps mitigate this threat—it is sustainable and cost-effective, and does not emit greenhouse gases”

Aveda offsets the carbon emissions resulting from natural gas and electricity at all of their Minnesota locations, including their corporate headquarters, Midwest distribution center, and their corporately owned Institute in Minneapolis. Beyond Minnesota, Aveda offsets carbon emissions from electricity and natural gas at their NY Institute, all of their 129 Experience Centers, their LA Distribution Center, as well as their third-party manufacturers. Even carbon emissions from the actual usage of Aveda Control Force and Air Control hair sprays have a net zero carbon impact. Aveda partners with Native Energy and their local utility Excel Energy to purchase renewable energy credits (RECs) and carbon offsets through wind power projects around the world. Chelminiak says, “When you buy Aveda, you are supporting a chain of sustainable manufacturing.”

The first hair, face, and body care products in a shower-friendly PCR paper bottle

Seed Phytonutrients—a L’Oréal internally incubated sustainable startup launched in April in sync with Earth Month—crafts natural-origin hair, face, and body care products in the first-ever, shower-friendly, post-consumer recycled (PCR) paper bottle.

Seed provided Beauty Packaging with the following statement: “We feel that it’s our responsibility to lead the way and promote environmental sustainability for the beauty industry as a whole. We practice what we preach by using environmentally friendly recycled and recyclable packaging for all of our products. In partnership with Ecologic Brands, our bottles are made of 100% post-consumer recycled (PCR) corrugate and newspaper. The bottle has been treated with a mineral complex extracted from clay so you can safely take it in the shower; even after submerging this bottle in water, it maintains its shape and strength. And, because we don’t coat the shell, it can be recycled again (up to seven more times!) after use. Inside the fiber shells, we insert a thin blow-molded liner, composed of 80% post-consumer recycled HDPE, which can also be recycled. This configuration reduces the overall amount of plastic by 60% compared to a similar-sized shampoo bottle. We consider it our responsibility to care for our planet through a minimal waste mantra. We think that’s pretty cool.”

Here’s a way to recycle old mascara brushes—and do a good deed at the same time. The volunteer-run nonprofit, Appalachian Wild! has launched “Wands for Wildlife Wandraiser,” a program to gather old mascara wands and donations. Turns out the applicators are used to remove fly eggs and larva from the fur of wild animals. They work great because the bristles are close together.