Kayla Villena, Senior Analyst – Beauty & Fashion, Euromonitor International09.01.18

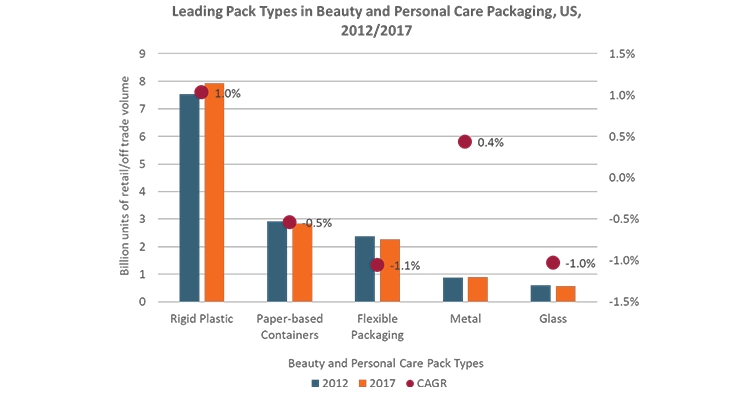

Glass is the least prevalent pack type in the U.S., accounting for 3.9% of beauty and personal care packaging in retail volume terms in the U.S., down from 4.2% in 2012, according to Euromonitor International.

Some reasons for this decline are not limited to the beauty world. Glass is more expensive to produce than other pack types. In addition, the risk for breakage during production, transport and shelving is high.

Despite a slight volume decline over the past five years, glass continues to be utilized by a subset of beauty and personal care players to communicate brand values that reach beyond its functional purpose of housing and protecting the product.

Demand for Glass Driven by Ethical Living and Sustainability Trends

Glass possesses a favorable image among consumers. The positive reputation of glass is boosted by a megatrend Euromonitor International dubs as Ethical Living—a movement toward global sustainability characterized by being mindful of other human beings, animal welfare and/or the environment when making consumer choices.

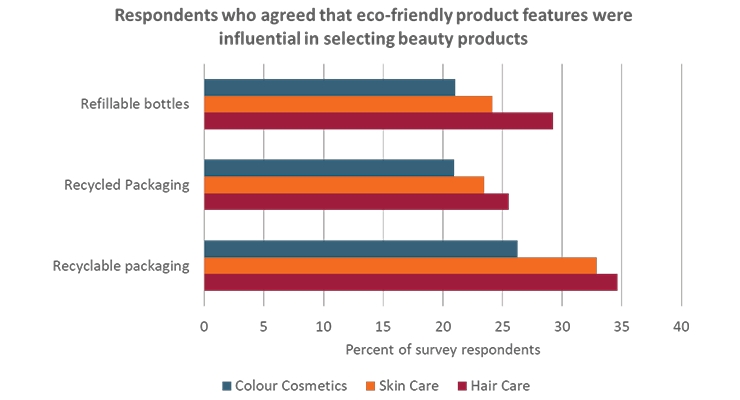

Eco-friendly features in beauty products are desired among U.S. consumers. According to Euromonitor International’s Beauty Survey, at least one-fifth of respondents agreed that recycled packaging was an influential product feature in selecting skincare, hair care and color cosmetics products in 2017. Recyclable packaging exerted an even higher influence on respondents across the three product categories.

Glass is the pack type of choice for beauty players who prioritize reusable, recyclable packaging because it is 100% recyclable and can be recycled endlessly without loss in quality or purity.

Brazilian cosmetics giant Natura Cosméticos SA began using 20% post-consumer recycled glass in packaging for some of their men’s fragrance lines in 2015. Natura went one step further to demonstrate its dedication to recycling, making refill packs in 100% post-consumer recycled PET for its fragrance lines, which were originally made with recycled glass. By sourcing recycled glass and reducing the amount of glass it needs to produce through refills, Natura pursues its mission for sustainable development that resonates with eco-conscious consumers.

Glass Is a Vessel for Premiumization

In addition to its eco-friendly image, glass is the pack type of choice among a subset of premium beauty players. Glass serves as a point of differentiation for premium players to stand out from masstige and mass players in a competitive beauty and personal care environment.

Glass is the most common pack type used in fragrances in the U.S. Accounting for 47% of U.S. fragrance packaging volume in 2017, glass packaging is an integral part of fragrance storytelling, particularly among premium fragrances. Even among fragrance brands that emphasize simple, minimalistic designs like Jo Malone and Replica, using high-quality, thick glass with minimal color and graphics is still part of their brand storytelling.

Manufacturers are gravitating toward glass bottles as primary packaging for premium skincare, particularly moisturizers in oil and serum format, with some using bottle droppers as closures to give consumers greater control for application. Following skincare trends, glass bottles communicate a scientific, medicinal, simplistic positioning, which are fashionable claims in the dynamic U.S. skincare industry. The renewed interest in glass bottles in facial moisturizers piggybacks on the resurging popularity of essential oils, which communicate a clean, holistic and wellness image to consumers.

Glass also emphasizes minimalist, no-frills packaging on paper labels, an aesthetic that premium skincare players are using to communicate expertise and technology. Trending, emerging brands offering products in this format include Canadian-based The Ordinary, which was launched in U.S. Sephora stores in 2017; Sunday Riley, which was founded by a cosmetic chemist and product formulator and carried in high-end department stores like Nordstrom and Sephora; and Drunk Elephant’s Virgin Marula Luxury Facial Oil, which formulates skincare products free of skin irritants.

Although glass is commonly used in fragrances and skincare, it is appearing as a niche format in other categories. According to Euromonitor, the U.S. is the only country to track a sizeable volume of glass packaging in styling agents and body wash/shower gel. Although the penetration of glass in hair styling agents is low, glass-packaged styling agents are limited to niche, premium, health-and-wellness positioned brands. For example, Olivine Atelier is a high-end brand that sells a hair mist in a glass bottle available at select Anthropologie locations. Among body wash/shower gel players, Sabon, which sells shower gel/body wash in glass bottles across 16 store locations and online, and fast-growing beauty specialist retailer Fresh are emphasizing their premium image to consumers, even though glass is unlikely to grow in these products.

Men’s hair care is also an emerging segment for glass bottles. Premium, masstige, niche and indie brands are using glass bottles for men’s hair care in pomades and cream format. Some examples include: indie brand High Rise, which has three SKUs of pomade packed in glass, and Baxter’s of California’s Hard Water Pomade. While other pack types dominate men’s hair care, the evolution of glass in men’s hair care and overall men’s grooming will be interesting to follow in the U.S., given the healthy growth witnessed in men’s grooming.

Because of its premium nature and high usage among premium, super premium and niche beauty brands, glass is unlikely to grow in significant volumes for the overall beauty and personal care industry. However, glass is an important differentiating factor among premium players, and will continue to be used in order to relay values of sustainability and premiumization.

About the author:

Kayla Villena is senior analyst–Beauty & Fashion, Euromonitor International

Some reasons for this decline are not limited to the beauty world. Glass is more expensive to produce than other pack types. In addition, the risk for breakage during production, transport and shelving is high.

Despite a slight volume decline over the past five years, glass continues to be utilized by a subset of beauty and personal care players to communicate brand values that reach beyond its functional purpose of housing and protecting the product.

Demand for Glass Driven by Ethical Living and Sustainability Trends

Glass possesses a favorable image among consumers. The positive reputation of glass is boosted by a megatrend Euromonitor International dubs as Ethical Living—a movement toward global sustainability characterized by being mindful of other human beings, animal welfare and/or the environment when making consumer choices.

Eco-friendly features in beauty products are desired among U.S. consumers. According to Euromonitor International’s Beauty Survey, at least one-fifth of respondents agreed that recycled packaging was an influential product feature in selecting skincare, hair care and color cosmetics products in 2017. Recyclable packaging exerted an even higher influence on respondents across the three product categories.

Glass is the pack type of choice for beauty players who prioritize reusable, recyclable packaging because it is 100% recyclable and can be recycled endlessly without loss in quality or purity.

Brazilian cosmetics giant Natura Cosméticos SA began using 20% post-consumer recycled glass in packaging for some of their men’s fragrance lines in 2015. Natura went one step further to demonstrate its dedication to recycling, making refill packs in 100% post-consumer recycled PET for its fragrance lines, which were originally made with recycled glass. By sourcing recycled glass and reducing the amount of glass it needs to produce through refills, Natura pursues its mission for sustainable development that resonates with eco-conscious consumers.

Glass Is a Vessel for Premiumization

In addition to its eco-friendly image, glass is the pack type of choice among a subset of premium beauty players. Glass serves as a point of differentiation for premium players to stand out from masstige and mass players in a competitive beauty and personal care environment.

Glass is the most common pack type used in fragrances in the U.S. Accounting for 47% of U.S. fragrance packaging volume in 2017, glass packaging is an integral part of fragrance storytelling, particularly among premium fragrances. Even among fragrance brands that emphasize simple, minimalistic designs like Jo Malone and Replica, using high-quality, thick glass with minimal color and graphics is still part of their brand storytelling.

Manufacturers are gravitating toward glass bottles as primary packaging for premium skincare, particularly moisturizers in oil and serum format, with some using bottle droppers as closures to give consumers greater control for application. Following skincare trends, glass bottles communicate a scientific, medicinal, simplistic positioning, which are fashionable claims in the dynamic U.S. skincare industry. The renewed interest in glass bottles in facial moisturizers piggybacks on the resurging popularity of essential oils, which communicate a clean, holistic and wellness image to consumers.

Glass also emphasizes minimalist, no-frills packaging on paper labels, an aesthetic that premium skincare players are using to communicate expertise and technology. Trending, emerging brands offering products in this format include Canadian-based The Ordinary, which was launched in U.S. Sephora stores in 2017; Sunday Riley, which was founded by a cosmetic chemist and product formulator and carried in high-end department stores like Nordstrom and Sephora; and Drunk Elephant’s Virgin Marula Luxury Facial Oil, which formulates skincare products free of skin irritants.

Although glass is commonly used in fragrances and skincare, it is appearing as a niche format in other categories. According to Euromonitor, the U.S. is the only country to track a sizeable volume of glass packaging in styling agents and body wash/shower gel. Although the penetration of glass in hair styling agents is low, glass-packaged styling agents are limited to niche, premium, health-and-wellness positioned brands. For example, Olivine Atelier is a high-end brand that sells a hair mist in a glass bottle available at select Anthropologie locations. Among body wash/shower gel players, Sabon, which sells shower gel/body wash in glass bottles across 16 store locations and online, and fast-growing beauty specialist retailer Fresh are emphasizing their premium image to consumers, even though glass is unlikely to grow in these products.

Men’s hair care is also an emerging segment for glass bottles. Premium, masstige, niche and indie brands are using glass bottles for men’s hair care in pomades and cream format. Some examples include: indie brand High Rise, which has three SKUs of pomade packed in glass, and Baxter’s of California’s Hard Water Pomade. While other pack types dominate men’s hair care, the evolution of glass in men’s hair care and overall men’s grooming will be interesting to follow in the U.S., given the healthy growth witnessed in men’s grooming.

Because of its premium nature and high usage among premium, super premium and niche beauty brands, glass is unlikely to grow in significant volumes for the overall beauty and personal care industry. However, glass is an important differentiating factor among premium players, and will continue to be used in order to relay values of sustainability and premiumization.

About the author:

Kayla Villena is senior analyst–Beauty & Fashion, Euromonitor International