Jamie Matusow, Editor-in-Chief09.01.18

A “Made in the USA” label has traditionally held a reputation for quality, as well as a promise of employment for domestic workers. The official definition according to the Federal Trade Commission requires that a product advertised as “Made in the USA” be entirely manufactured in the United States. While a number of companies adhere strictly to this practice, others are combining various worldwide services to best meet brands’ needs. Over the past several years, a growing trend has been for global suppliers to open “centers of excellence” in the U.S. to serve the strong North American market.

The timing for manufacturing products in the U.S. seems optimal at present.

According to Brad Thompson, head of operations, Americas, and president Geka USA, “The general U.S. market indicates continuing growth: Manufacturing job growth since 2011 has been stable and more recently increasing.” When it comes specifically to plastics, the outlook is especially promising. Thompson says because the fundamental components of a mascara or lip gloss package are made from plastic, it is important to understand the U.S. plastics industry. “The U.S. injection molding and plastics industry in general has outpaced U.S. manufacturing in job growth and efficiency improvements (according to the Society of the Plastics Industry),” says Thompson. “Furthermore, projections going forward indicate continued growth in the U.S. plastics sector.”

Overall, an efficient supply chain remains the No. 1 reason suppliers are choosing U.S. manufacturing. In addition, the waning cost advantages of overseas production, various time and language differences, and convenience have all been contributors to a more local commitment. But there’s more.

A Focus on Supply Chain

Greg Maze, senior brand and sales manager, Neenah Packaging, Alpharetta, GA, says, “We are seeing brands move to domestic manufacturing as a way to better manage their supply chain. Quality control can also be more challenging for brands that source internationally. Although project specification may happen domestically, for reasons such as timing, product availability, or lack of oversight, that specification can be compromised in overseas production.”

Further, Maze says the brands that Neenah partners with appreciate the ease of setting up international supply chain solutions, with domestic support. “It’s the best of both worlds—the ability to source needed products internationally though one of our authorized distributors, yet guarantee environmental certifications because it was domestically produced.” (Read more about Neenah and environmental certifications later in this article.)

HCP Packaging gets frequent requests for domestic manufacturing from customers interested in speed-to-market, and in smaller MOQs for ranges with a wide selection of color-matching.

Local Control for Flexibility

Richard Engel Jr., president & COO, Decotech Inc., also sees a trend toward companies making the “best of both worlds,” with some brands modifying their supply chains with a move toward a mix of regional services in an effort to speed up production and time-to market.

“Many large brands are changing their supply chains to a local, regional structure to combat long lead times,” says Engel.

“However, we decorate several items that begin in Europe, cross the Atlantic to our facility, and return to Europe for fill and sale. It all depends on whether you have something unique that the client will take the time and effort to plan and execute with a global supply chain.”

Engel says within the last few years, their clients have come to place more of a premium on shorter lead times than they ever did before. “Speed to market is the name of the game and planning has been pushed aside in favor of reacting rapidly to what the market is telling you at the moment,” he says. “We have to be very flexible and react to rapid replenishment orders if an item sells well. Our clients could never chase business so quickly if they had to rely heavily on foreign supply.”

Items that Decotech makes in the U.S. for the USA market “obviously have the advantage of shorter lead times, faster development schedules, and better customer service because you can work with people in person, in their own time zone,” says Engel.

Flexibility and the ability to control inventory are features at ScreenTech/Spraye Tech, where John Schofield, owner, says, “As a decorator what we have seen is a trend by customers to want to control the decoration locally. The container, in our case mostly glass, in most situations is manufactured off shore. Because the value added through decoration can exceed the value of the glass container, the customer likes the ability to be on hand for color development and approvals. This process lends itself even more when there are multiple SKUs involved using the same container. It provides great flexibility to market and the ability to control inventory per SKU.”

A total valuation of cost to market is mandatory in determining where it will be best to manufacture.

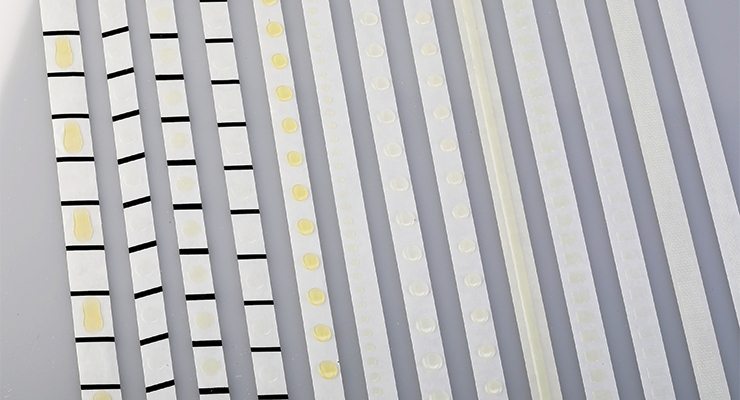

Erica Roberts, vice president/general manager of Glue Dots International, Germantown, WI, says, “With a focus on supply chain costs, coupled with a trend of rising rates for overseas manufacturing and shipping, many companies are evaluating their total cost to market and see keeping manufacturing in the U.S. as an advantage.” She adds that speed to market, inventory control and a quality branded product are all becoming more important to brands looking to catch the consumers’ U.S. dollar.

U.S. manufacturers today, and in the future, can leverage a higher skilled workforce, according to Roberts, allowing them to ramp up production when necessary to meet local market demands, and/or quickly shift production to in-demand items. Ultimately, she says, “The advantage for suppliers and brands is the ability to meet the demand for better quality products and services while shortening supply chain costs and lead times.”

Politics Play a Role

Politics also play a role in the rise of domestic manufacturing, according to Alex Piagnarelli, North American sales director, Lindal North America Inc. (In May, Lindal, with headquarters in Germany and manufacturing locations throughout the world, opened a 100,000-sq. ft. facility in Columbus, IN. It includes manufacturing, R&D, offices, and warehousing of aerosol packaging solutions, to meet growing domestic demand. It’s part of a more than $20-million investment committed for the U.S. market last year, which includes production, offices, laboratories and warehousing, all on the same campus.)

Piagnarelli says, “The current political environment is driving a ‘Buy American’ movement, and recent import tariffs imposed by the U.S. government will impact offshore purchases, making domestic manufactured goods more attractive.”

In addition, says Piagnarelli, the increasing cost of ocean transport (largely driven by increasing fuel costs) makes the comparative cost of U.S.-made products more appealing. “Additionally,” he points out, “in terms of supply chain management, we see an increasing number of delays at ports of entry due to high traffic patterns and severe and unpredictable weather conditions. This is compounded by a U.S. trucker shortage which results in goods sitting at the port of entry waiting for trucks to arrive.

Finally, with increasing pressure to reduce inventory levels at our customer facilities, customers are pushing suppliers for just-in-time supply and shorter lead times. Domestic manufacturing and sourcing inevitably become more attractive.”

Global Trends

With a thriving USA cosmetics market, a number of global companies have opened domestic facilities to serve local customers quickly and efficiently.

“For the past three years, there has been a growing global trend toward a more closely-knit system from suppliers to fillers to customers to consumers to ensure faster time-to-market, made here, made responsibly and with transparency,” explains Stéphane Barlet, sales director, dispensing North-America, Albéa.

Recently, Albéa developed a Made in the USA pack for Clean Reserve, a “green” fragrance and beauty brand, which selected the SLPP pump from Albéa for its “warm and fuzzy” Avant-Garden perfume collection. Manufactured in Albéa Thomaston, CT, the supplier’s “fragrance pump center of excellence for the Americas zone,” the SLPP pump is a robust beauty sprayer. The invisible dip tube that Clean Reserve opted for is a subtle element of the elegant design of the packaging. Including gasket-free fastening technology for maximum compatibility with fragrance. SLPP makes it possible to spray from three different angles while enhancing the sophisticated fragrance formula.

Debra Pepe, director of operations and package development for Clean Reserve, says, “Albéa’s SLPP pump and its invisible dip tube were chosen as part of the fragrance packaging, in line with the clean and natural, yet luxurious, look of the bottle. Focusing on sustainability, Clean Reserve enjoyed collaborating with Albéa finding in our team a reliable partner providing great service and technical expertise without compromising on quality.”

HCP Packaging also continues to expand its global capabilities in North America, including at its facility in New Hampshire.

Cheryl Bisset, vice president of sales, HCP Packaging USA, Inc., says, “HCP recognizes that this is more than a transient trend; this is the business atmosphere we are now operating in.” Bisset explains that HCP has taken “an adaptable approach” to their global manufacturing strategy to respond to the changing environment, achieving strong double-digit growth in North American manufacturing in the past few years, and is on track to achieve strong double-digit growth in North America again for 2018.

Over the past two years, Bisset says HCP has seen “a significant push for regionalization” as customers are looking to reduce lead times and launch products as quickly as possible. A demand for faster speed-to-market has prompted HCP to add capabilities in their North America plants to more closely mirror the available capabilities in their China facilities. In Mexico, they have added five new molding machines ranging in tonnage from 180 to 280 and doubled their lacquer capacity. HCP has also installed seven new molding machines in their Hinsdale, NH, plant; ranging in tonnage from 100 to 280 ton and also installed numerous automated assembly lines. In addition, Bisset says the company has expanded their twisted-wire mascara brush-making capacity by 20% and is in the process of expanding blow molding capacity by 10%. HCP has expanded capabilities in North America to include Surlyn molding as well as bi-injection this past year.

With specialties in mascara and gloss, HCP has also broadened their commodity capabilities in North America and has added lipstick, saleable compacts, perfume caps and nail caps. “Know-how and engineering support allow brands to realize product ideas in region and with velocity,” says Bisset.

HCP USA recently manufactured the innovative, TPE over-molded cap for NARS’ first 16-hour radiant foundation. The complex three-piece custom cap is manufactured in an innovative, fully automated work cell designed to provide the accuracy and repeatability required to achieve the high aesthetic demands of this over-molded cap,” says Bisset. According to HCP, “The pack is the ultimate in functional minimalism, perfectly in line with the brand’s contemporary and sleek image, featuring a sharp-square profile and a matte black finish.”

In 2008, Geka strengthened its position in the USA with a manufacturing plant in Elgin, IL. Since then, says Thompson, “It has grown significantly and the local business continues to expand.” Geka offers a unique modular and flexible Block Building System (BBS) with an endless combination of possibilities for bottles, caps and applicators/brushes for the lips and eyes without the need of investment from the customer. In Elgin, Thompson says, they are expanding their BBS program to include a cylindrical design completed this year, and a travel size (the mini) pack that will be in operation September 2018. In the Chicago area, they locally built their first bottle tool, and can now offer “exceptional” delivery times for tools in U.S. currency.

“Furthermore,” says Thompson, “we are investing in new state-of-the-art hot foil printing systems. We are also working at full speed on the introduction of SAP third quarter of 2018. This will enable all Geka locations to work with a standardized ERP system in the future. Further milestones include upgrading our existing ISO system with R&D quality processes using stage gate methodology by Q4 2018, and the ability to fill mascara and supply fully finished mascara product by second quarter of 2019.”

Thompson says there are big advantages to working with a U.S. packaging company such as Geka Mfg. Corp. “We offer innovation in materials and decoration, sampling, and project management with far greater responsiveness, than trying to overcome time zones and distance to suppliers in Europe and Asia. Once products go into production, the high cost of shipping and tariffs, plus the long lead times are eliminated. If customer changes are required during an initial production for launch, Geka USA can immediately respond with engineering solutions and support. The proximity to customers is a must-have and with our manufacturing plant in Elgin, IL and our sales offices in New York City and Los Angeles, we have local representation close to customers.”

Geka recently developed Lash Intensity by Mary Kay: The mascara was first produced in Germany, but the biggest issue was reducing the lead time. Transferring the Mary Kay production from Europe to Elgin was the obvious answer, says Thompson. He explains, “We now save six weeks of transit and also gain in flexibility by working seven days a week rather than five days a week as in Europe.” What’s more, “The product is perfectly identical to the German production, with local resins,” adds Thompson.

France-based glass manufacturer Verescence reacted to the trend toward domestic manufacturing early on. Sheherazade Chamlou, vice president of sales and marketing, Verescence, says, “Given the strength and size of the U.S. beauty market and the fact that local production is critical to speed, flexibility and quality, Verescence opened its glass manufacturing plant in Covington, GA, in 1996 followed by its decoration plant in Sparta, GA, in 2002 in order to get closer to its major customers.”

By opening manufacturing sites in the U.S, Chamlou says, “Verescence made a major commitment to an historic beauty market dynamized by global beauty brands.” Over the years, she says, “Verescence has invested continuously in additional equipment and know-how backed up by years of experience in high-end glass and decoration manufacturing to keep pace with the market as well as streamlining systems and processes to increase speed of product launches.

“Regional production is a global trend impacting the United States, Europe, Asia and other markets,” Chamlou explains. Faced with a volatile market that is difficult to anticipate, she says beauty brands are increasingly sensitive to the agility of suppliers and their ability to respond in a very short time frame. The relatively low barrier of entry into the beauty industry has led to an increasingly crowded marketplace. As global competition continues to heat up, global beauty brands have implemented new operational initiatives aimed at increasing productivity, driving down costs and improving quality and customer experience. By opening “centers of excellence” brands consolidate their best practices and new technologies in a single location, explains Chamlou. She says, “The speed-to-market factor shows no sign of slowing and as product life cycles continue to shorten, brands will be more and more inclined to buy locally and closer to their ‘centers of excellence.’ In this respect, Verescence continues to invest in new technologies such as virtual simulation and 3D printing to help shorten the design process, accelerate prototyping and produce customized tool parts.”

Digitalization at the Core

Why the shift in global manufacturing trends over the last few years? Albéa’s Barlet says consumers crave transparency, new products crave legitimacy—and brands crave intimacy reflecting the twin trends of acceleration and digitalization—and THIS has changed over the last few years.”

Chamlou also mentions acceleration and digitalization. “The beauty industry has changed more in the last 3-5 years than in the previous three decades,” she says. “The digital transformation, the impact of fast fashion, influencer marketing, together with ever-shifting consumer interests have all reshaped the way the beauty industry does business.” To engage Millennials and Gen Z consumers, Chamlou says brands have to develop products very fast to be immediately reactive to social media trends, and to create Instagram-worthy packaging which results in an extraordinary brand experience both on-line and in stores. She says, “A critical element in speed is proximity of manufacturing. Time to market is about getting to market quickly and more frequently. A domestic supply chain can be advantageous to both suppliers and brands. Local manufacturing helps brands hold less inventory, be more reactive to the market, reduce the total cost of ownership as well as save on taxes, long-distance transportation and in some cases air freight. For suppliers, bringing all their capabilities together to produce closer to their clients helps create strong collaboration and strategic relationships through quicker and better customer service with no language barrier and no time change, increased flexibility and reactivity, by developing and producing locally with a domestic supply chain.”

Paul McLaughlin, vice president creative, Revlon, has worked with Verescence on many projects in both their U.S. and overseas plants. Recently McLaughlin worked with Verescence on the Soiree Juicy Couture bottle—from design through final production—which he says “was challenging and rewarding.” For the Soiree Juicy Couture project, the group focused on using the U.S. plant in Sparta, GA, to achieve “what would normally have to be produced in Europe due to the complicated design and production.”

Verescence has been focused on strengthening the company’s U.S. plant, allowing challenging projects, aggressive schedules, and complicated coordination to be executed in the States.

The Soiree Juicy Couture bottle design required nine steps of decoration for the complex spatter effect design, explains McLaughlin. “After glass production, the process included one color four passes of silk screening and one color four passes of tempo printing, as well as gluing of a metal plaque.

“The Juicy Couture bottle being developed in the U.S. was key to this project,” says McLaughlin. “Not only was the bottle development and production timeframe reduced, it was more convenient to oversee all development phases of this project in the United States.”

Best of all, McLaughlin says, “The final results were successfully achieved in this complicated project. The package speaks for itself and to the consumer.”

Environmental Certifications

Made in the USA products can also provide advantages for domestic brands looking to reduce their environmental footprint.

Located in Maspeth, Queens, NY, Burton Packaging has been providing packers and liners for the beauty industry since 1948.

Owner Phyllis Kossoff, says, “Not only is U.S. manufacturing important for America, but also for the world; the U.S. Environmental Protection Agency requires manufacturers to adhere to strict environmental standards.”

Neenah Packaging’s Maze says: “If you consider packaging production with respect to a brand’s environmental footprint, there are many advantages to producing domestically. For instance, if a product is produced in the U.S., but its set-up box is produced internationally, those boxes need to ship to the U.S. for fulfillment. Set-up boxes can’t be broken down so companies are essentially shipping boxes of air. The environmental footprint in cases like these is more significant than people might realize.”

Additionally, Maze says environmental certification is much easier to achieve and verify if the packaging is produced domestically.

“Brands that are FSC certified typically plan to showcase their environmental certifications on their packaging. It can be very difficult to find international manufacturing or production facilities that carry FSC certification. All FSC certifications must adhere to chain of custody guidelines, meaning everyone in the supply chain that touches the project has to have that same FSC certification. So, if a brand uses an international converter or provider that doesn’t have that certification, the brand cannot put the FSC logo on their box.”

Finally, the term “recycled” varies from domestic to international, says Maze. In the U.S., under EPA guidelines, a paper has to have a minimum of 30% post-consumer waste to carry the recycle logo. International suppliers often designate a paper as “recycled” without having to specify whether it contains post-consumer or pre-consumer waste. This is where brands can run into the challenge of monitoring and verifying sustainable initiatives and certifications,” he explains.

Neenah also provides an environmental audit report. A customer’s paper orders are audited and a report is created, detailing the exact number of trees and gallons of water saved, etc. It’s essentially an overview of how a brand has decreased its carbon footprint by partnering with Neenah.

For example, Neenah is currently working with a global brand that requires a 30% post-consumer waste content for its packaging. The brand manager was originally looking into sourcing the paper overseas, thinking it would simplify production. However, when Neenah pointed out that they ran the risk of losing their sustainability certification because chain of custody regulations cannot be guaranteed with international production, they understood the benefit of working with a domestic-based supply chain. Maze says this is just one of many such examples.

The Future of U.S. Manufacturing

Looking at the current and future status of U.S. manufacturing companies, Ellen Manning, vice president marketing and sales, at Eagle Systems, Ocean, NJ, which sells machines for foil application, says, “There have been a lot of consolidations, but I see many companies adding to their growth, buying equipment and expanding their markets.” She says that cold foil has taken “a massive hold” on the marketplace and is no longer used to replace hot foil or laminated foil board. “Cold Foil has its own market now that cannot be touched by any other processes,” says Manning, adding “brand owners are now specifying cold foil as the process they want.”

Cold foil has also opened new markets for foil manufacturers, adhesive and blanket manufacturers as well, says Manning, and the manufacturing is growing at rapid paces in quite a few sectors that affect the end consumers. “As a USA manufacturer and not having fair trade until now has made a major difference in a short time,” explains Manning. “For example, if we sell a machine to China, Made in USA, the end user pays 25% duty on our products. If there is a competitive piece of equipment made in China, then the duty is 50%. This makes it impossible to sell to these markets. But now more manufacturing will come back because they will need to compete on an even playing field. Never in history has this changed until now.”

The total cost-to-market factor is critical to both suppliers and brands when making U.S.-based manufacturing decisions.

Consumers, too, with their increased focus on scrutinizing labels in relation to decision-making have been showing certain preferences for Made in the USA goods. In Beauty, a number of websites/portals with only Made in USA beauty products are active, including USAlovelist, blushinghollywood, overstock, Ulta and Sephora.

The timing for manufacturing products in the U.S. seems optimal at present.

According to Brad Thompson, head of operations, Americas, and president Geka USA, “The general U.S. market indicates continuing growth: Manufacturing job growth since 2011 has been stable and more recently increasing.” When it comes specifically to plastics, the outlook is especially promising. Thompson says because the fundamental components of a mascara or lip gloss package are made from plastic, it is important to understand the U.S. plastics industry. “The U.S. injection molding and plastics industry in general has outpaced U.S. manufacturing in job growth and efficiency improvements (according to the Society of the Plastics Industry),” says Thompson. “Furthermore, projections going forward indicate continued growth in the U.S. plastics sector.”

Overall, an efficient supply chain remains the No. 1 reason suppliers are choosing U.S. manufacturing. In addition, the waning cost advantages of overseas production, various time and language differences, and convenience have all been contributors to a more local commitment. But there’s more.

A Focus on Supply Chain

Greg Maze, senior brand and sales manager, Neenah Packaging, Alpharetta, GA, says, “We are seeing brands move to domestic manufacturing as a way to better manage their supply chain. Quality control can also be more challenging for brands that source internationally. Although project specification may happen domestically, for reasons such as timing, product availability, or lack of oversight, that specification can be compromised in overseas production.”

Further, Maze says the brands that Neenah partners with appreciate the ease of setting up international supply chain solutions, with domestic support. “It’s the best of both worlds—the ability to source needed products internationally though one of our authorized distributors, yet guarantee environmental certifications because it was domestically produced.” (Read more about Neenah and environmental certifications later in this article.)

HCP Packaging gets frequent requests for domestic manufacturing from customers interested in speed-to-market, and in smaller MOQs for ranges with a wide selection of color-matching.

Local Control for Flexibility

Richard Engel Jr., president & COO, Decotech Inc., also sees a trend toward companies making the “best of both worlds,” with some brands modifying their supply chains with a move toward a mix of regional services in an effort to speed up production and time-to market.

“Many large brands are changing their supply chains to a local, regional structure to combat long lead times,” says Engel.

“However, we decorate several items that begin in Europe, cross the Atlantic to our facility, and return to Europe for fill and sale. It all depends on whether you have something unique that the client will take the time and effort to plan and execute with a global supply chain.”

Engel says within the last few years, their clients have come to place more of a premium on shorter lead times than they ever did before. “Speed to market is the name of the game and planning has been pushed aside in favor of reacting rapidly to what the market is telling you at the moment,” he says. “We have to be very flexible and react to rapid replenishment orders if an item sells well. Our clients could never chase business so quickly if they had to rely heavily on foreign supply.”

Items that Decotech makes in the U.S. for the USA market “obviously have the advantage of shorter lead times, faster development schedules, and better customer service because you can work with people in person, in their own time zone,” says Engel.

Flexibility and the ability to control inventory are features at ScreenTech/Spraye Tech, where John Schofield, owner, says, “As a decorator what we have seen is a trend by customers to want to control the decoration locally. The container, in our case mostly glass, in most situations is manufactured off shore. Because the value added through decoration can exceed the value of the glass container, the customer likes the ability to be on hand for color development and approvals. This process lends itself even more when there are multiple SKUs involved using the same container. It provides great flexibility to market and the ability to control inventory per SKU.”

A total valuation of cost to market is mandatory in determining where it will be best to manufacture.

Erica Roberts, vice president/general manager of Glue Dots International, Germantown, WI, says, “With a focus on supply chain costs, coupled with a trend of rising rates for overseas manufacturing and shipping, many companies are evaluating their total cost to market and see keeping manufacturing in the U.S. as an advantage.” She adds that speed to market, inventory control and a quality branded product are all becoming more important to brands looking to catch the consumers’ U.S. dollar.

U.S. manufacturers today, and in the future, can leverage a higher skilled workforce, according to Roberts, allowing them to ramp up production when necessary to meet local market demands, and/or quickly shift production to in-demand items. Ultimately, she says, “The advantage for suppliers and brands is the ability to meet the demand for better quality products and services while shortening supply chain costs and lead times.”

Politics Play a Role

Politics also play a role in the rise of domestic manufacturing, according to Alex Piagnarelli, North American sales director, Lindal North America Inc. (In May, Lindal, with headquarters in Germany and manufacturing locations throughout the world, opened a 100,000-sq. ft. facility in Columbus, IN. It includes manufacturing, R&D, offices, and warehousing of aerosol packaging solutions, to meet growing domestic demand. It’s part of a more than $20-million investment committed for the U.S. market last year, which includes production, offices, laboratories and warehousing, all on the same campus.)

Piagnarelli says, “The current political environment is driving a ‘Buy American’ movement, and recent import tariffs imposed by the U.S. government will impact offshore purchases, making domestic manufactured goods more attractive.”

In addition, says Piagnarelli, the increasing cost of ocean transport (largely driven by increasing fuel costs) makes the comparative cost of U.S.-made products more appealing. “Additionally,” he points out, “in terms of supply chain management, we see an increasing number of delays at ports of entry due to high traffic patterns and severe and unpredictable weather conditions. This is compounded by a U.S. trucker shortage which results in goods sitting at the port of entry waiting for trucks to arrive.

Finally, with increasing pressure to reduce inventory levels at our customer facilities, customers are pushing suppliers for just-in-time supply and shorter lead times. Domestic manufacturing and sourcing inevitably become more attractive.”

Global Trends

With a thriving USA cosmetics market, a number of global companies have opened domestic facilities to serve local customers quickly and efficiently.

“For the past three years, there has been a growing global trend toward a more closely-knit system from suppliers to fillers to customers to consumers to ensure faster time-to-market, made here, made responsibly and with transparency,” explains Stéphane Barlet, sales director, dispensing North-America, Albéa.

Recently, Albéa developed a Made in the USA pack for Clean Reserve, a “green” fragrance and beauty brand, which selected the SLPP pump from Albéa for its “warm and fuzzy” Avant-Garden perfume collection. Manufactured in Albéa Thomaston, CT, the supplier’s “fragrance pump center of excellence for the Americas zone,” the SLPP pump is a robust beauty sprayer. The invisible dip tube that Clean Reserve opted for is a subtle element of the elegant design of the packaging. Including gasket-free fastening technology for maximum compatibility with fragrance. SLPP makes it possible to spray from three different angles while enhancing the sophisticated fragrance formula.

Debra Pepe, director of operations and package development for Clean Reserve, says, “Albéa’s SLPP pump and its invisible dip tube were chosen as part of the fragrance packaging, in line with the clean and natural, yet luxurious, look of the bottle. Focusing on sustainability, Clean Reserve enjoyed collaborating with Albéa finding in our team a reliable partner providing great service and technical expertise without compromising on quality.”

HCP Packaging also continues to expand its global capabilities in North America, including at its facility in New Hampshire.

Cheryl Bisset, vice president of sales, HCP Packaging USA, Inc., says, “HCP recognizes that this is more than a transient trend; this is the business atmosphere we are now operating in.” Bisset explains that HCP has taken “an adaptable approach” to their global manufacturing strategy to respond to the changing environment, achieving strong double-digit growth in North American manufacturing in the past few years, and is on track to achieve strong double-digit growth in North America again for 2018.

Over the past two years, Bisset says HCP has seen “a significant push for regionalization” as customers are looking to reduce lead times and launch products as quickly as possible. A demand for faster speed-to-market has prompted HCP to add capabilities in their North America plants to more closely mirror the available capabilities in their China facilities. In Mexico, they have added five new molding machines ranging in tonnage from 180 to 280 and doubled their lacquer capacity. HCP has also installed seven new molding machines in their Hinsdale, NH, plant; ranging in tonnage from 100 to 280 ton and also installed numerous automated assembly lines. In addition, Bisset says the company has expanded their twisted-wire mascara brush-making capacity by 20% and is in the process of expanding blow molding capacity by 10%. HCP has expanded capabilities in North America to include Surlyn molding as well as bi-injection this past year.

With specialties in mascara and gloss, HCP has also broadened their commodity capabilities in North America and has added lipstick, saleable compacts, perfume caps and nail caps. “Know-how and engineering support allow brands to realize product ideas in region and with velocity,” says Bisset.

HCP USA recently manufactured the innovative, TPE over-molded cap for NARS’ first 16-hour radiant foundation. The complex three-piece custom cap is manufactured in an innovative, fully automated work cell designed to provide the accuracy and repeatability required to achieve the high aesthetic demands of this over-molded cap,” says Bisset. According to HCP, “The pack is the ultimate in functional minimalism, perfectly in line with the brand’s contemporary and sleek image, featuring a sharp-square profile and a matte black finish.”

In 2008, Geka strengthened its position in the USA with a manufacturing plant in Elgin, IL. Since then, says Thompson, “It has grown significantly and the local business continues to expand.” Geka offers a unique modular and flexible Block Building System (BBS) with an endless combination of possibilities for bottles, caps and applicators/brushes for the lips and eyes without the need of investment from the customer. In Elgin, Thompson says, they are expanding their BBS program to include a cylindrical design completed this year, and a travel size (the mini) pack that will be in operation September 2018. In the Chicago area, they locally built their first bottle tool, and can now offer “exceptional” delivery times for tools in U.S. currency.

“Furthermore,” says Thompson, “we are investing in new state-of-the-art hot foil printing systems. We are also working at full speed on the introduction of SAP third quarter of 2018. This will enable all Geka locations to work with a standardized ERP system in the future. Further milestones include upgrading our existing ISO system with R&D quality processes using stage gate methodology by Q4 2018, and the ability to fill mascara and supply fully finished mascara product by second quarter of 2019.”

Thompson says there are big advantages to working with a U.S. packaging company such as Geka Mfg. Corp. “We offer innovation in materials and decoration, sampling, and project management with far greater responsiveness, than trying to overcome time zones and distance to suppliers in Europe and Asia. Once products go into production, the high cost of shipping and tariffs, plus the long lead times are eliminated. If customer changes are required during an initial production for launch, Geka USA can immediately respond with engineering solutions and support. The proximity to customers is a must-have and with our manufacturing plant in Elgin, IL and our sales offices in New York City and Los Angeles, we have local representation close to customers.”

Geka recently developed Lash Intensity by Mary Kay: The mascara was first produced in Germany, but the biggest issue was reducing the lead time. Transferring the Mary Kay production from Europe to Elgin was the obvious answer, says Thompson. He explains, “We now save six weeks of transit and also gain in flexibility by working seven days a week rather than five days a week as in Europe.” What’s more, “The product is perfectly identical to the German production, with local resins,” adds Thompson.

France-based glass manufacturer Verescence reacted to the trend toward domestic manufacturing early on. Sheherazade Chamlou, vice president of sales and marketing, Verescence, says, “Given the strength and size of the U.S. beauty market and the fact that local production is critical to speed, flexibility and quality, Verescence opened its glass manufacturing plant in Covington, GA, in 1996 followed by its decoration plant in Sparta, GA, in 2002 in order to get closer to its major customers.”

By opening manufacturing sites in the U.S, Chamlou says, “Verescence made a major commitment to an historic beauty market dynamized by global beauty brands.” Over the years, she says, “Verescence has invested continuously in additional equipment and know-how backed up by years of experience in high-end glass and decoration manufacturing to keep pace with the market as well as streamlining systems and processes to increase speed of product launches.

“Regional production is a global trend impacting the United States, Europe, Asia and other markets,” Chamlou explains. Faced with a volatile market that is difficult to anticipate, she says beauty brands are increasingly sensitive to the agility of suppliers and their ability to respond in a very short time frame. The relatively low barrier of entry into the beauty industry has led to an increasingly crowded marketplace. As global competition continues to heat up, global beauty brands have implemented new operational initiatives aimed at increasing productivity, driving down costs and improving quality and customer experience. By opening “centers of excellence” brands consolidate their best practices and new technologies in a single location, explains Chamlou. She says, “The speed-to-market factor shows no sign of slowing and as product life cycles continue to shorten, brands will be more and more inclined to buy locally and closer to their ‘centers of excellence.’ In this respect, Verescence continues to invest in new technologies such as virtual simulation and 3D printing to help shorten the design process, accelerate prototyping and produce customized tool parts.”

Digitalization at the Core

Why the shift in global manufacturing trends over the last few years? Albéa’s Barlet says consumers crave transparency, new products crave legitimacy—and brands crave intimacy reflecting the twin trends of acceleration and digitalization—and THIS has changed over the last few years.”

Chamlou also mentions acceleration and digitalization. “The beauty industry has changed more in the last 3-5 years than in the previous three decades,” she says. “The digital transformation, the impact of fast fashion, influencer marketing, together with ever-shifting consumer interests have all reshaped the way the beauty industry does business.” To engage Millennials and Gen Z consumers, Chamlou says brands have to develop products very fast to be immediately reactive to social media trends, and to create Instagram-worthy packaging which results in an extraordinary brand experience both on-line and in stores. She says, “A critical element in speed is proximity of manufacturing. Time to market is about getting to market quickly and more frequently. A domestic supply chain can be advantageous to both suppliers and brands. Local manufacturing helps brands hold less inventory, be more reactive to the market, reduce the total cost of ownership as well as save on taxes, long-distance transportation and in some cases air freight. For suppliers, bringing all their capabilities together to produce closer to their clients helps create strong collaboration and strategic relationships through quicker and better customer service with no language barrier and no time change, increased flexibility and reactivity, by developing and producing locally with a domestic supply chain.”

Paul McLaughlin, vice president creative, Revlon, has worked with Verescence on many projects in both their U.S. and overseas plants. Recently McLaughlin worked with Verescence on the Soiree Juicy Couture bottle—from design through final production—which he says “was challenging and rewarding.” For the Soiree Juicy Couture project, the group focused on using the U.S. plant in Sparta, GA, to achieve “what would normally have to be produced in Europe due to the complicated design and production.”

Verescence has been focused on strengthening the company’s U.S. plant, allowing challenging projects, aggressive schedules, and complicated coordination to be executed in the States.

The Soiree Juicy Couture bottle design required nine steps of decoration for the complex spatter effect design, explains McLaughlin. “After glass production, the process included one color four passes of silk screening and one color four passes of tempo printing, as well as gluing of a metal plaque.

“The Juicy Couture bottle being developed in the U.S. was key to this project,” says McLaughlin. “Not only was the bottle development and production timeframe reduced, it was more convenient to oversee all development phases of this project in the United States.”

Best of all, McLaughlin says, “The final results were successfully achieved in this complicated project. The package speaks for itself and to the consumer.”

Environmental Certifications

Made in the USA products can also provide advantages for domestic brands looking to reduce their environmental footprint.

Located in Maspeth, Queens, NY, Burton Packaging has been providing packers and liners for the beauty industry since 1948.

Owner Phyllis Kossoff, says, “Not only is U.S. manufacturing important for America, but also for the world; the U.S. Environmental Protection Agency requires manufacturers to adhere to strict environmental standards.”

Neenah Packaging’s Maze says: “If you consider packaging production with respect to a brand’s environmental footprint, there are many advantages to producing domestically. For instance, if a product is produced in the U.S., but its set-up box is produced internationally, those boxes need to ship to the U.S. for fulfillment. Set-up boxes can’t be broken down so companies are essentially shipping boxes of air. The environmental footprint in cases like these is more significant than people might realize.”

Additionally, Maze says environmental certification is much easier to achieve and verify if the packaging is produced domestically.

“Brands that are FSC certified typically plan to showcase their environmental certifications on their packaging. It can be very difficult to find international manufacturing or production facilities that carry FSC certification. All FSC certifications must adhere to chain of custody guidelines, meaning everyone in the supply chain that touches the project has to have that same FSC certification. So, if a brand uses an international converter or provider that doesn’t have that certification, the brand cannot put the FSC logo on their box.”

Finally, the term “recycled” varies from domestic to international, says Maze. In the U.S., under EPA guidelines, a paper has to have a minimum of 30% post-consumer waste to carry the recycle logo. International suppliers often designate a paper as “recycled” without having to specify whether it contains post-consumer or pre-consumer waste. This is where brands can run into the challenge of monitoring and verifying sustainable initiatives and certifications,” he explains.

Neenah also provides an environmental audit report. A customer’s paper orders are audited and a report is created, detailing the exact number of trees and gallons of water saved, etc. It’s essentially an overview of how a brand has decreased its carbon footprint by partnering with Neenah.

For example, Neenah is currently working with a global brand that requires a 30% post-consumer waste content for its packaging. The brand manager was originally looking into sourcing the paper overseas, thinking it would simplify production. However, when Neenah pointed out that they ran the risk of losing their sustainability certification because chain of custody regulations cannot be guaranteed with international production, they understood the benefit of working with a domestic-based supply chain. Maze says this is just one of many such examples.

The Future of U.S. Manufacturing

Looking at the current and future status of U.S. manufacturing companies, Ellen Manning, vice president marketing and sales, at Eagle Systems, Ocean, NJ, which sells machines for foil application, says, “There have been a lot of consolidations, but I see many companies adding to their growth, buying equipment and expanding their markets.” She says that cold foil has taken “a massive hold” on the marketplace and is no longer used to replace hot foil or laminated foil board. “Cold Foil has its own market now that cannot be touched by any other processes,” says Manning, adding “brand owners are now specifying cold foil as the process they want.”

Cold foil has also opened new markets for foil manufacturers, adhesive and blanket manufacturers as well, says Manning, and the manufacturing is growing at rapid paces in quite a few sectors that affect the end consumers. “As a USA manufacturer and not having fair trade until now has made a major difference in a short time,” explains Manning. “For example, if we sell a machine to China, Made in USA, the end user pays 25% duty on our products. If there is a competitive piece of equipment made in China, then the duty is 50%. This makes it impossible to sell to these markets. But now more manufacturing will come back because they will need to compete on an even playing field. Never in history has this changed until now.”

The total cost-to-market factor is critical to both suppliers and brands when making U.S.-based manufacturing decisions.

Consumers, too, with their increased focus on scrutinizing labels in relation to decision-making have been showing certain preferences for Made in the USA goods. In Beauty, a number of websites/portals with only Made in USA beauty products are active, including USAlovelist, blushinghollywood, overstock, Ulta and Sephora.