By Steve French, Managing Partner, and Jan Nash, VP of Research, Natural Marketing Institute (NMI)04.03.20

Over the past few years the CBD market has skyrocketed. The passing of the U.S. 2018 Farm Bill to legalize hemp farming opened the door to nationally retailed CBD products which have exploded onto the block. CBD rapidly mainstreamed from a substance that was relatively unheard of to a unique product category, resulting in CBD merchandise available in outlets ranging from Whole Foods to hair salons, and from Amazon to farmer’s markets.

To better understand this phenomenon and what matters to consumers, NMI recently conducted a comprehensive research project surrounding the whole cannabis plant—including CBD, hemp and marijuana—and its impact on whole health across general population adults in North America, with a focus on pathway to purchase, product opportunities, market sizing and strategic marketing applications.

Consumer research in the U.S. included nine focus groups and a quantitative study of 4,000 general population adults in February/March 2020. With over 3,000 surveys completed, NMI is providing a sneak peek at the quantitative shopper insights data along with the completed qualitative research results.

The Consumer Market

According to NMI’s recent study, U.S. adult general population awareness of CBD is extremely high; 95% of consumers indicated they were aware of CBD. More than one in five adults have tried CBD; nearly one in five have used CBD in the past six months, equating to more than 40 million consumers. An additional 60+ million indicate they are likely to try CBD products in the near future. With over 100 million potential buyers, what’s driving such interest in CBD?

Perceived Benefits

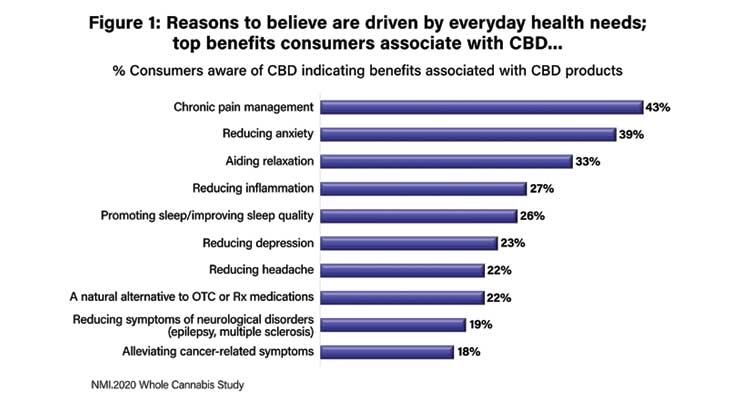

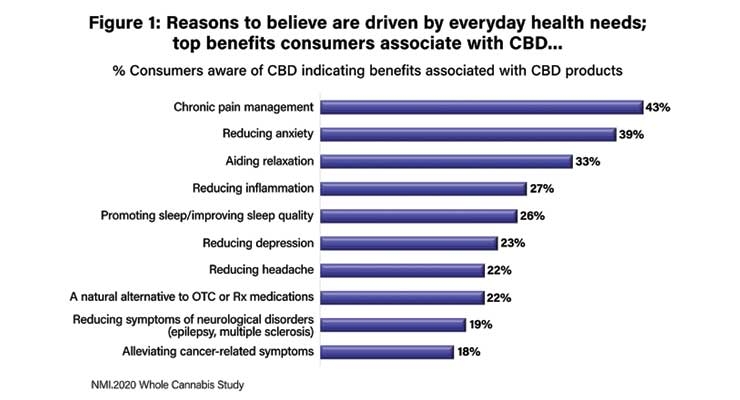

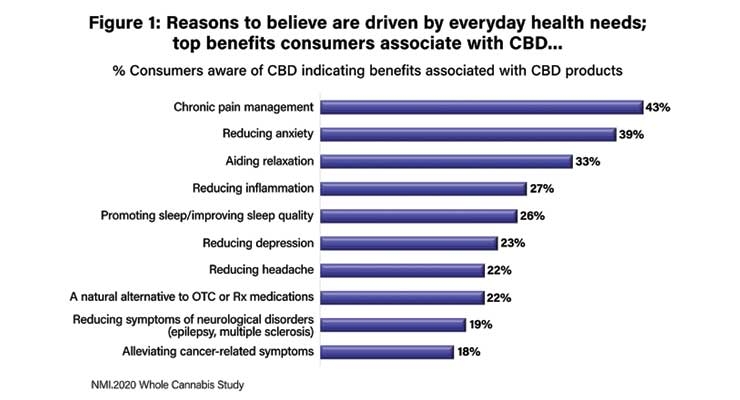

Seven out of 10 consumers believe CBD offers some type of benefit, and everyday health needs drive consumers to embrace CBD. NMI discovered the most common reasons to use CBD are for widespread health needs such as chronic pain management, reduction of anxiety, and relaxation (see Figure 1).

FIGURE 1

All generations, from Millennials and older, agree CBD is good for chronic pain management. Millennials, especially younger Millennials, and Generation X are significantly more likely than other generations to cite anxiety relief, reducing depression, and headaches. Generation X is the cohort most likely to cite reduction of inflammation as a benefit; implications being that inclusion of CBD in products for exercise recovery and inflammation treatment may provide popular relief options for this group.

Consumers under age 40 are more likely to cite promoting better sleep as a benefit of CBD, versus their over 40 counterparts, perhaps as a result of the everyday stressors of managing careers and raising families. Millennials are most likely to cite aiding relaxation as a benefit of CBD.

Most consumers see CBD as distinct from traditional medications in that it does not have side effects. Many of these same consumers are looking for alternatives to OTC and/or traditional pharmaceuticals to treat or manage their health conditions. Benefits of CBD align with the top health issues consumers are facing, and that alignment, combined with consumer desire for natural remedies, makes CBD a good option for many consumers to use in self-treatment, a market opportunity that is still relatively untapped.

Consumption Vehicles

Consumers have many options when it comes to consuming CBD. In states like California and Massachusetts, where the legalization of marijuana has also resulted in the mainstreaming of CBD, it is particularly easy to get CBD as an add-in to products at coffee shops, bakeries, etc. This has the simultaneous effect of encouraging trial and reducing any stigma associated with taking CBD.

Consumers like edible CBD products for their discreetness (i.e., others don’t know they are ingesting CBD) and portability. Non-users of CBD find these formats potentially appealing for the same reasons.

Food formats such as gummies, chocolates, honey sticks, and coffee are popular among the CBD users participating in NMI focus groups. Within the NMI national online consumer survey, favorite foods to consume with CBD were chocolates and sweets such as cookies, brownies, cupcakes and other baked goods, and non-chocolate candy, including gummies, mints and gum. Other popular formats cited were nutritional bars, ready-to-drink (RTD) beverages, water infused with CBD and fortified or functional foods such as protein bars.

The Perils of Self Treatment: Guidance Needed

CBD users are desperate for clearer guidance on CBD product dosing and purity. This is especially true within the dietary supplement category but is applicable to all consumables. According to NMI nationwide focus groups, many doctors are not supportive of CBD use, therefore consumers do their own research on dosing, product information and reviews. Currently, consumers are guessing at correct doses utilizing online research, word of mouth, and trial and error to determine which CBD products are trustworthy and effective.

Users of CBD need more guidance from medical and subject matter experts on forms and dosing requirements. Non-users need proof of safety and efficacy, ideally from the medical community, before they will try CBD.

Those who have not yet tried CBD have some concerns that, without FDA oversight, it is not entirely safe. It will be especially important to these consumers to offer scientific studies from credible third parties that say CBD is safe, beneficial to their health and not psychoactive.

Clear, easy to understand, on-pack messaging, dosage education, and third-party certification for quality and efficacy are key to guiding current users and reassuring interested parties in order to grow the market.

The Buzz

CBD is currently the hottest ingredient on the market and the buzz surrounding it is fueling store inventory decisions to provide consumers with a variety of options that include tinctures, capsules, topicals, foods, beverages and other forms. Mainstream drug retailers such as CVS, Rite Aid and Walgreens are rolling out topical CBD products in selected states; grocery stores such as Wegmans carry CBD chocolates, nutrition bars, water, teas and tinctures, while convenience stores such as Sheetz will offer CBD topicals, tinctures, vape pens and capsules. Many of these channels not already carrying CBD foods and beverages are likely to consider these as future offerings. Other retailers hoping to enter the space are watching closely. Given the accelerated market entry, CBD has the potential to become a traditional health remedy and also a functional food staple as well.

As NMI continues to analyze its rich Whole Cannabis survey data on 4,000 U.S. consumers and 1,000 Canadian consumers, NMI market forecasting will be derived from this research for companies to determine where the best opportunities really are—a journey for decades to come.

NMI is a strategic consulting, market research, and business development firm specializing in the health, wellness and sustainability marketplace. For more information on NMI’s services, additional results of the Whole Cannabis Study, or proprietary research tools, contact Steve French at [email protected] or visit www.NMIsolutions.com.

To better understand this phenomenon and what matters to consumers, NMI recently conducted a comprehensive research project surrounding the whole cannabis plant—including CBD, hemp and marijuana—and its impact on whole health across general population adults in North America, with a focus on pathway to purchase, product opportunities, market sizing and strategic marketing applications.

Consumer research in the U.S. included nine focus groups and a quantitative study of 4,000 general population adults in February/March 2020. With over 3,000 surveys completed, NMI is providing a sneak peek at the quantitative shopper insights data along with the completed qualitative research results.

The Consumer Market

According to NMI’s recent study, U.S. adult general population awareness of CBD is extremely high; 95% of consumers indicated they were aware of CBD. More than one in five adults have tried CBD; nearly one in five have used CBD in the past six months, equating to more than 40 million consumers. An additional 60+ million indicate they are likely to try CBD products in the near future. With over 100 million potential buyers, what’s driving such interest in CBD?

Perceived Benefits

Seven out of 10 consumers believe CBD offers some type of benefit, and everyday health needs drive consumers to embrace CBD. NMI discovered the most common reasons to use CBD are for widespread health needs such as chronic pain management, reduction of anxiety, and relaxation (see Figure 1).

FIGURE 1

All generations, from Millennials and older, agree CBD is good for chronic pain management. Millennials, especially younger Millennials, and Generation X are significantly more likely than other generations to cite anxiety relief, reducing depression, and headaches. Generation X is the cohort most likely to cite reduction of inflammation as a benefit; implications being that inclusion of CBD in products for exercise recovery and inflammation treatment may provide popular relief options for this group.

Consumers under age 40 are more likely to cite promoting better sleep as a benefit of CBD, versus their over 40 counterparts, perhaps as a result of the everyday stressors of managing careers and raising families. Millennials are most likely to cite aiding relaxation as a benefit of CBD.

Most consumers see CBD as distinct from traditional medications in that it does not have side effects. Many of these same consumers are looking for alternatives to OTC and/or traditional pharmaceuticals to treat or manage their health conditions. Benefits of CBD align with the top health issues consumers are facing, and that alignment, combined with consumer desire for natural remedies, makes CBD a good option for many consumers to use in self-treatment, a market opportunity that is still relatively untapped.

Consumption Vehicles

Consumers have many options when it comes to consuming CBD. In states like California and Massachusetts, where the legalization of marijuana has also resulted in the mainstreaming of CBD, it is particularly easy to get CBD as an add-in to products at coffee shops, bakeries, etc. This has the simultaneous effect of encouraging trial and reducing any stigma associated with taking CBD.

Consumers like edible CBD products for their discreetness (i.e., others don’t know they are ingesting CBD) and portability. Non-users of CBD find these formats potentially appealing for the same reasons.

Food formats such as gummies, chocolates, honey sticks, and coffee are popular among the CBD users participating in NMI focus groups. Within the NMI national online consumer survey, favorite foods to consume with CBD were chocolates and sweets such as cookies, brownies, cupcakes and other baked goods, and non-chocolate candy, including gummies, mints and gum. Other popular formats cited were nutritional bars, ready-to-drink (RTD) beverages, water infused with CBD and fortified or functional foods such as protein bars.

The Perils of Self Treatment: Guidance Needed

CBD users are desperate for clearer guidance on CBD product dosing and purity. This is especially true within the dietary supplement category but is applicable to all consumables. According to NMI nationwide focus groups, many doctors are not supportive of CBD use, therefore consumers do their own research on dosing, product information and reviews. Currently, consumers are guessing at correct doses utilizing online research, word of mouth, and trial and error to determine which CBD products are trustworthy and effective.

Users of CBD need more guidance from medical and subject matter experts on forms and dosing requirements. Non-users need proof of safety and efficacy, ideally from the medical community, before they will try CBD.

Those who have not yet tried CBD have some concerns that, without FDA oversight, it is not entirely safe. It will be especially important to these consumers to offer scientific studies from credible third parties that say CBD is safe, beneficial to their health and not psychoactive.

Clear, easy to understand, on-pack messaging, dosage education, and third-party certification for quality and efficacy are key to guiding current users and reassuring interested parties in order to grow the market.

The Buzz

CBD is currently the hottest ingredient on the market and the buzz surrounding it is fueling store inventory decisions to provide consumers with a variety of options that include tinctures, capsules, topicals, foods, beverages and other forms. Mainstream drug retailers such as CVS, Rite Aid and Walgreens are rolling out topical CBD products in selected states; grocery stores such as Wegmans carry CBD chocolates, nutrition bars, water, teas and tinctures, while convenience stores such as Sheetz will offer CBD topicals, tinctures, vape pens and capsules. Many of these channels not already carrying CBD foods and beverages are likely to consider these as future offerings. Other retailers hoping to enter the space are watching closely. Given the accelerated market entry, CBD has the potential to become a traditional health remedy and also a functional food staple as well.

As NMI continues to analyze its rich Whole Cannabis survey data on 4,000 U.S. consumers and 1,000 Canadian consumers, NMI market forecasting will be derived from this research for companies to determine where the best opportunities really are—a journey for decades to come.

NMI is a strategic consulting, market research, and business development firm specializing in the health, wellness and sustainability marketplace. For more information on NMI’s services, additional results of the Whole Cannabis Study, or proprietary research tools, contact Steve French at [email protected] or visit www.NMIsolutions.com.