Lambros Kromidas, MS, PhD, VP, Regulatory Team Leader, Shiseido and, Craig R. Weiss, Co-CEO, President, Consumer Product Testing Company11.02.20

There was a lot of noise regarding hemp and CBD use in cosmetics in 2019 and preceding the months of COVID-19. Every industry related magazine and event was replete with this subject matter. Colleagues talked about it at every gathering.

The issue could not be avoided then and it cannot be avoided now, so it is prudent to learn about it.

What follows is based on readings, seminars and webinars, talks with colleagues and some key people. This article is an attempt to share what was learned for the benefit of the novice.

We must caution the reader though that this is what we learned from many different sources and it behooves you to verify before taking any action or making any decisions. We also apologize if everything we write does not come with a linked reference. What we will discuss, however, does come from sources we trust.

As popular as this subject matter was last year, the topic waned during the primary intense Covid-19 months, but its popularity is beginning to come back. We hope many find this article timely and informative.

Although, as of this writing, there is a question if the CBD bubble is about to burst due to a surge in litigations and subsequent increased insurance costs because of lawsuits.1

The Confusion: Is It Cannabis, CBD, Hemp, or Marijuana?

Let us start by addressing confusion and incorrect use of the terms “cannabis,” “CBD,” “hemp,” and “marijuana.” They should not, but often are used interchangeably. As such, here are some essential definitions.The plant Cannabis sativa L. contains more than 80 biologically active chemical compounds.2 The two most common ones that are mentioned in every conversation are THC (delta-9-tetrahydrocannabinol) and CBD (cannabidiol).2 Cannabis sp. includes hemp and marijuana. We will explain the difference between hemp and marijuana further along in this article.

Active compounds found in Cannabis sp. are known as cannabinoids. It is estimated there are more than 100 different cannabinoids.2 These are what give the cannabis plant its medical and recreational properties. And as mentioned, the most famous examples are THC and CBD.

The difference between hemp and marijuana is the THC and CBD content. Hemp has 0.3% or less THC and trace amounts of CBD.2 Whereas marijuana has more than 0.3% THC and varying amounts of CBD that may be relatively high or low.2

As we will explain, hemp is now somewhat legal, but marijuana is not. Marijuana is still a controlled substance. Therefore, all hemp is cannabis, but not all cannabis is hemp. Cannabis also includes marijuana. Since marijuana is a controlled substance, all cannabis-derived ingredients in cosmetic products should be derived from hemp.

CBD Vs. THC

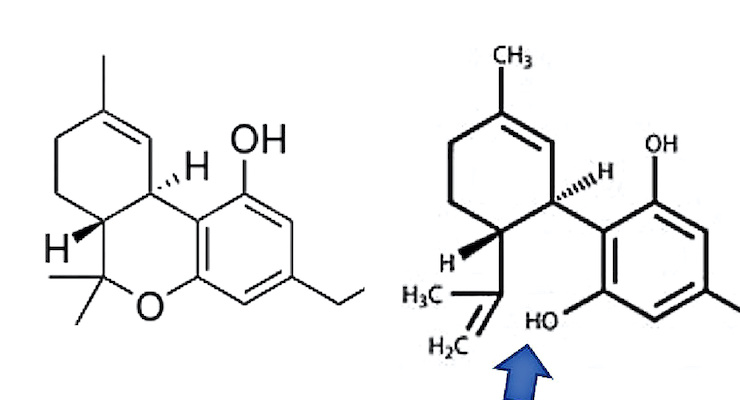

Let’s get a little more acquainted with THC and CBD. THC or (−)-trans-Δ*9-tetrahydrocannabinol, is the principal and most well-known psychoactive constituent of cannabis. See Figure 1 for the chemical structure of THC.The other most well-known and mentioned cannabinoid—the talk of the cosmetic industry—is CBD, or cannabidiol. See Figure 2 for the chemical structure of CBD.

Note that the difference between CBD and THC is a chemical bond. If you oxidize CBD (shown by the arrow in Figure 2), you get THC.

In other words, to convert CBD to THC the hydroxyl group needs to form a bond—it may do so under acidic conditions. One may wonder if CBD converts to THC if you ingest it. Doubtful, but for a discussion on the matter, see reference 3.3 Anyway, these two chemicals are isomers.4 That is, they have the same chemical formula C21H30O2 but different chemical structure.4

Yet, that single difference gives them different chemical and pharmacological properties. THC produces a “high” or intoxicating effect; CBD does not. It makes one a controlled substance and the other, not so much.

CBD is believed to be more responsible for the medicinal properties of cannabis. That is what makes it very popular and the only reason why it is used in products. So, we ask, what is the U.S. Food and Drug Administration (FDA) to make of this when CBD is added to cosmetics and nutritional products?

Hemp & CBD's Sudden Rise in Popularity

What made hemp and CBD so popular all of a sudden?It was the Agriculture Improvement Act of 2018 (aka, the 2018 Farm Bill). By the way, many just call it “The Farm Bill” but there have been many Farm Bills over the years. Therefore, for accuracy, it is best to include the year of the Farm Bill you are referencing.

The 2018 Farm Bill amended the 1937 Controlled Substances Act (CSA) to separate hemp from marijuana.5 It defined hemp as “the plant Cannabis sativa L. and any part of such plant, whether growing or not, with a THC concentration of not more than 0.3% on a dry weight basis.”5 As such, although marijuana is still illegal under the CSA as a Schedule I drug, hemp is no longer federally illegal under the CSA.

The 2018 Farm Bill also legalized the production and transportation of hemp and hemp products.6 It gave FDA authority to regulate products containing cannabis and derived compounds regardless of whether or not they are classified as “hemp.”4

Bottom line, if something comes from any part of the Cannabis sativa L. plant and contains no more than 0.3% THC, it’s hemp. This distinction is critically important because it effectively exempts hemp (and by extension, CBD derived from hemp) from the definition of marijuana under the Federal CSA, thus removing it from the list of prohibited Schedule I drugs. That is what made hemp and CBD so popular since the 2018 Farm Bill became law.

Currently there are about 35 Cannabis sp. derived cosmetic ingredients that we suppose are subject to the 2018 Farm Bill. By “cosmetic ingredients,” we mean INCIs (International Nomenclature of Cosmetic Ingredients) according to the CTFA (Cosmetics, Toiletries, and Fragrance Association) online dictionary. CTFA is now known as the Personal Care Products Council. Just because they are listed on the CTFA Dictionary of Cosmetic Ingredients, it does not necessarily make them safe or legal to use. It just means they are used, or if they are to be used, that assigned name should go on the label.

CBD Alternatives

Interestingly, since the 2018 Farm Bill passed, new cosmetic materials are being touted that they are not hemp derived nor CBD, but supposedly give the same benefits. These ingredients are not under the jurisdiction of the 2018 Farm Bill.One such ingredient has the INCI of Limonenyldihydroxybenzyl Ethoxycarbonyl Azetidine, by Kannalife.7 Also referred to as Atopidine, a CBD-like molecule with desirable CBD-based cosmetic properties such as anti-inflammatory and antioxidant. However, its chemical structure does not have very much in common with CBD. In addition, it is not referred to as a cannabinoid in the INCI entry.

Another cannabinoid-related material is from Beraca called Beracare CBA8 composed of two INCIs—Copaifera Officinalis (Balsam Copaiba) Resin and Passiflora Edulis Seed Oil.

It is touted as a cannabinoid active system of Amazonian oils. It is “positioned as a safe alternative to CBD since CBD is not approved in many countries for cosmetic use.”8 This position statement does hint that there may be regulatory and safety reasons to using hemp/CBD, and that is why alternative ingredients are getting hyped. More on that point below.

Continuing with the thread of non-hemp derived material, Vytrus Biotech came up with Kannabia Sense9 made of eight INCIs. One of the eight is Cannabis Sativa Callus Lysate.

According to Vytrus Biotech, this material is made from cannabis plant stem cells but it is free of CBD and THC.9 The reader at this point may ask, then why use it? This material is said to act as a postbiotic to initiate the synthesis of cutaneous oxytocin to modulate neurochemical networks and enhance the feeling of well-being through the Microbiota-Skin-Brain Axis (MSBA).9 Simply put, microbes on your skin feed on it to create the feel-good oxytocin.

Another material worth mentioning is Canapure (INCI not given) by Symrise that mimics natural CBD.10 Apparently, X-ray structure analysis showed that the absolute configuration matches that of CBD.10 Canapure is synthesized to 99.8% purity from D-limonene obtained from the renewable raw material of orange peels—a byproduct of orange juice manufacturing.10 Due to its synthetic production, the ingredient is free of pesticides, weed killers, and other environmental impurities that one needs to be aware for hemp derived material.10

Another material that comes from orange peels is the last non-hemp derived material we will discuss. It appears that Japan-based Hiro International discovered the presence of actual CBD in orange peels.11 The orange peel CBD is structurally the same as hemp-derived CBD but with no THC—not even a trace.11 It is our opinion that more raw material suppliers will turn to CBD from oranges and will therefore become more popular in time.

We are sure there will be other materials to follow that are not hemp derived or are not CBD but give similar benefits.

Why expend so much effort if hemp and CBD are the greatest new ingredients? One reason could be that they want to circumvent regulations and legalities—which we detail here.

Regulatory Issues

As already noted, the 2018 Farm Bill made lawful cannabinoids derived from industrial hemp so long as THC is below the 0.3% threshold. This means that use of CBD in cosmetics may be legal if the source complies with all the state and federal growing laws.There are federal and state laws on farming Cannabis sativa L. and one must ensure the source of material is obtained from plants farmed per state and federal regulations. It would behoove companies to obtain a statement to that effect from the raw material supplier. Outside of the federal regulation, each state may adopt its own regulations.

On Jan. 3, 2020, the Office of Environmental Health Hazard Assessment (OEHHA) of California added “cannabis (marijuana) smoke” and THC to the Prop 65 list of reproductive toxicants.2

The listing of THC is without a maximum allowable dose level (MADL)/safe harbor level and that could significantly impact any product, including cosmetics, that contain CBD. As discussed, CBD is generally derived from THC-deficient hemp, rather than THC-rich marijuana, but THC is often still present—albeit at very low levels—in hemp-derived CBD.

Since Prop 65 is centered on exposure to a chemical, the mere presence may be enough to trigger a warning. If a safe harbor is not established that aligns with the 2018 Farm Bill of 0.3% THC by weight, there would be different state and federal standards adding to regulatory hurdles that must be addressed.

For that reason, it is critically important to ensure an appropriate safe harbor for THC that sufficiently protects hemp-derived CBD. Of course, this would not be an issue if one of the alternate cosmetic materials free of THC, as discussed above, is used. Let us hope impacted industry organizations collaborate with OEHHA to mitigate the matter.

Other Considerations

There are other state-by-state matters to consider. States recognize there is money to be had from this booming trend and may be considering state regulations to collect fees—such as state tax. For example, as of January 2020, sales of hemp-derived CBD products are subject to a 3% excise tax in Louisiana.12In Utah, products containing cannabis-derived ingredients are required to register with the Utah Department of Agriculture and comply with the Utah registration requirements.13

There is much ado regarding state matters, and there is a plethora of bills, too. As such, it’s important to consider what the implications are in every state.

Marketing Cosmetics with Cannabis

Regarding the U.S. FDA, which has direct impact on the cosmetics industry, the verdict is unknown as of this writing.As previously noted, the 2018 Farm Bill gave FDA authority to regulate products containing cannabis and derived material. The FDA currently deems cannabis-derived ingredients unlawful for use in food and dietary supplements, but is allowing sales of those products as long as they are not marketed with drug or “structure/function” claims.

Since 2018, the FDA has approved only one CBD product called Epidiolex from GW Pharmaceuticals PLC, a prescription drug product to treat two rare, severe forms of epilepsy.14 There are no other FDA-approved drug products that contain CBD, and CBD is neither a monograph drug nor approved for use in any pharmaceutical product, of any delivery format, other than Epidiolex.

It all raises the question: if CBD is a drug active known to mitigate epilepsy, would it not make every product with CBD an unapproved drug?

Furthermore, cannabis-derived ingredients and especially CBD, are used for their medicinal properties in cosmetics regardless if they claim such things.

Since that is their intent, and FDA says that intent matters if a product is or is not a drug regardless of its claims, then aren’t all such cosmetics unapproved drugs?

It should be noted that no existing CBD beauty products that we are aware of make clinical claims relative to their inclusion of CBD.

Since CBD is so well-publicized, prominent CBD labeling may be enough for brands to attract consumers without making any claims—especially not taking chances with anti-inflammation statements or other drug-like claims.

Before moving on to a discussion of regulatory global status, consider insurance implications. After listening to several presentations by different law firms and related readings in the past year or so, it appears that in the current uncertain legal and regulatory environment, the marketing of cosmetics and toiletries with Cannabis sp. L. related material may carry risks— risks that some insurance carriers may not be willing to take.

Therefore, any company considering marketing such products is well served to contact its insurance carrier. The reason why insurance carriers may be cautious is not only that they are apprehensive of FDA, but also because they do not think such materials are adequately studied and are therefore worried about safety.

The best advice given to minimize the risk for beauty companies is to:

- Not make any therapeutic or drug claims;

- Ensure it is hemp as defined above or use CBD with no more than 0.3% THC;

- Get documentation to that effect; and

- Source from reputable suppliers. (Of course, there are additional measures one may take based on one’s insurance carrier.)

Regulating CBD In Global Markets

Now we turn briefly to the regulatory status that we became aware of for some other global region markets.In September 2018, Cannabis sp. (hemp) derivatives were added to Canada’s Hot List. As per the Hot List, cosmetics must not contain an isolated or concentrated phytocannabinoid or a synthetic duplicate.15-16

Furthermore, cosmetics must not contain more than 10 ppm (i.e., 10 ug/g) THC.15-16 In Canada, a cosmetic can contain Cannabis sativa seed oil with THC as long as the finished formula limit does not exceed 10 ppm.16

As previously noted, hemp contains trace amounts of CBD but in Canada you cannot claim that a product has CBD nor can you intentionally add CBD.16

Only naturally occurring CBD in Cannabis sativa seed oil is allowed in cosmetics without making any claims toward the CBD.16 CBD is on Canada’s Prescription Drug List (PDL) and the only legal pathway to market a product containing CBD is through the prescription route.16

For this reason, Cosmetics Alliance created a Self-Care Cannabis Task Force which is a working group that will be doing research and data collection on CBD for its safety and efficacy.16

The aim of this task force is to provide a unified effort among the industry(s) to secure a legal route to market for cosmetics with CBD.16 The Self-Care Cannabis Task Force held its inaugural meeting in February 2020. As of right now, cannabinoids are governed under the Cannabis Act.16 The end goal of the Cosmetics Alliance is to have CBD governed under the Food and Drug Regulation (FDR) and eventually the Self-Care Framework, where it will be allowed in cosmetics and Natural Health Products with appropriate claims.16

Regarding regulatory status in Brazil, cannabis is found in the List of Narcotic, Psychotropic, Precursor and other substances under special control (Ordinance 344/98) and in the list of prohibited substances in cosmetics in item 306 (narcotics, natural and synthetic).

ANVISA (Brazilian Health Surveillance Agency) recently published an exclusive public consultation for the medication sector. That is, it approved cannabis substances exclusively for medical use.17

It is our understanding from personal communications that ABIHPEC (Associação Brasileira da Indústria de Higiene Pessoal, Perfumaria e Cosméticos) was supposed to start discussions in March 2020 with the other associate organizations to determine the potential of requesting ANVISA to allow its use in cosmetics. We have not heard anything as of this writing and assume due to COVID-19 this is not a priority.

Having discussed the Americas, we briefly turn to Europe, Middle East, ASEAN, and China.

Cannabis derivatives are listed in the EU Cosmetic Regulation Annex II/306 as prohibited in cosmetics products.18-19

This entry refers to narcotics, natural and synthetic, based on 1961 Convention on Narcotic Drug.18-19 Some cannabis derivatives might be out of the scope of the Convention but it will be up to the E.U. RP (Responsible Person) to provide the evidence to justify why a certain cannabis ingredient is outside the scope of the 1961 Convention.

For France, some specific hemp products may be authorized for cosmetics under strict conditions regarding THC—namely, there should be no THC in the finished product. Also, any reference or depiction of cannabis, such as a cannabis leaf for example, on the product is forbidden.20

In the U.K., some cannabis ingredients may be used in cosmetic products under specific criteria.18 The ingredient must not contain any THC and must not be sourced from the flowering or fruiting part of the plant. Bottom line, in the E.U., for all intended purposes, marketing CBD/Cannabis sp. products is not allowed and one better check with their RP before marketing any such products.

In early 2019, there was some hope that the E.U. Commission would consider CBD as a novel food, but as of August 2020, it was reassessing its stance despite strong opposition from French and German hemp industry groups. Because Cannabis sp. are listed in Schedule I of the United Nations Single Convention on Narcotic Drugs, 1961, the E.U. Commission was leaning toward classifying CBD as a narcotic rather than novel food.28-29 However, this may not be the situation in the U.K. as it exits the E.U.30

The Middle East basically follows the E.U. cosmetic regulations; Cannabis sp. and derived ingredients are, for the most part, considered narcotic drugs and their cosmetic use is forbidden. One also must consider and respect Islamic principles and any ingredient coming from cannabis could have a negative connotation—likewise for the ASEAN region.

In Israel, some derivatives may be authorized under strict conditions. It is our understanding that the INCI Cannabis Sativa Seed Oil may be used in cosmetics if the raw material manufacturer assures that the THC content does not exceed 10 ppm.

In China, all ingredients used in cosmetics must be found in the list of allowed cosmetic ingredients. The latest list is dated 2015. Based on that list, only three INCIs are allowed—Cannabis Sativa Fruit, Cannabis Sativa Seed Oil, and Cannabis Sativa Leaf Extract.

Finally, CBD is approved as a therapeutic/medicine in Australia/New Zealand and prohibited in China, Hong Kong, and Japan. At this point, we reiterate the previously-mentioned caution to the reader: these are learnings from many different sources and it behooves you to verify before taking any action or making any decisions based on this information.

In addition to the governmental regulations, one may also need to contend with retail regulations, as this new high trend is capturing the attention of retailers. For example, Sephora has CBD standards that require it to be domestically produced from U.S. grown hemp and it must be tested at least three times for quality and purity.21 A Certificate of Analysis (COA) that verifies the CBD content matches any label claims must be available upon request, and the product that contains it must meet Sephora’s Clean at Sephora standards.21

CBD Is In Vogue in the U.S.

Regardless of the governmental and retail regulation hurdles and restrictions in cosmetics, due to the 2018 Farm Bill, hemp/CBD is in vogue in the U.S.It is a U.S. phenomenon and hemp is included in everything from cosmetics to drugs to coffee to backpacks to bracelets and shoes.

According to Allied Market Research, North America generated nearly two-fifths of the global CBD skin care market in 2019.22 AMR maintains that the CBD skin care market will grow from an estimated $736.6 million in 2019 to $3.48 billion by 2026.

E-commerce will have the fastest growth with department stores contributing about one-third of the global CBD skin care market growth.22 But of course these estimates were before COVID-19.

Claim-Free

It is important to note that as of this writing, no existing U.S. CBD beauty products make clinical claims relative to their inclusion of CBD. Due to its popularity, at the moment, prominent CBD labeling is enough for brands to attract consumers without taking chances with anti-inflammation statements or other drug-like claims.23Most CBD brands are small- to medium-sized operations or indie brands. CBD brand Prima has announced a retail partnership with Sephora, via the Clean at Sephora program.21

The Estée Lauder Companies Inc. appears to be testing the waters for cannabis-derived skin care with the launch of a mask formulated with hemp seed oil, marketed through its Origins brand also exclusively for Sephora.24

We hope this introduction and discussion of the regulatory aspects of this high trend gave you a taste of where the cosmetics market is at the moment and make you pause to ponder your position on using cannabis-derived ingredients. If you choose to use them, allow us to inform you on what you should look for when evaluating a hemp-based raw material.

What To Use In a Formula—And Testing for Potency

First and foremost, the material must be legal. Is it from hemp and does it have less than 0.3% THC?After that, it is advisable that the material is tested upon arrival to ensure it meets requirements.

Testing can be conducted in-house if your company has the required instrumentation or contracted to a third-party lab. Testing for CBD and THC is relatively costly to conduct in comparison to other cosmetic ingredients and should be treated more like a pharmaceutical ingredient.

It is not advisable to just rely on the manufacturer’s certificate of analysis (COA) since exceeding the 0.3% THC threshold will make your product a Schedule I drug.

Potency testing is essential, first to provide for the legality of the product—which must include the aforementioned THC testing—and also to determine CBD level and possibly a complete cannabinoid profile.

It is important to establish a complete cannabinoid profile to ensure that the material you are getting over the product’s manufacturing lifetime is the same standard of quality to which you agreed. This is especially important if you are labeling “Full Spectrum” or with actual CBD quantity.

When reviewing THC concentration, it is essential to know that the analytical method used has a limit of detection below 0.3%.

The testing of THC and other cannabinoids are conducted by high pressure liquid chromatography (HPLC) equipped with either an ultraviolet (UV), or a mass spectrometry detector (MS).

Either detection method works; the MS detector allows for a significantly lower limit of detection. Testing every lot can be expensive and a logistical nightmare, so instituting a vendor certification program with periodic testing against the manufacturer’s COA may be the way to go.

One may also consider giving this material its own dedicated space in the manufacturing facility—space that is less accessible and under environmentally-controlled conditions, as the material may have stability and contamination issues.

To ensure consistency, one should consider testing before using in the manufacturing process. Following are other parameters to consider to hopefully avoid any potential pitfalls.

Other Parameters

Terpene variety and concentration should be a consideration when evaluating a hemp-based cosmetic ingredient. Terpenes are aromatic oils that color cannabis varieties and have distinctive flavors; as such, they can fundamentally change the character of a finished product.Once again, establishing consistency is paramount. Additionally, terpenes have been linked to many bioactive properties that have benefits for a cosmetic formulation, from antibacterial, anti-fungal, to anti-inflammatory properties.25

Testing for Impurities & Contamination

Since hemp is a plant, the character of the hemp ingredient is directly correlated to the environment in which it is grown. There are several environmental parameters that should be evaluated.The first of which is heavy metals, typically tested as elemental impurities. We recommend ICP-MS analysis as it has a very low limit of detection. Remember there are limits of these impurities allowed in cosmetics in most jurisdictions.

Pesticide residual analysis is something to also consider, as pesticides can be carried through during processing. Most pesticide analysis utilize EPA methods, which have extremely low limits of detection.26 The EPA methods are conducted using double MS detectors and are relatively expensive to set up and run.

Since most, if not all, of the hemp-based ingredients will be processed, typically chemically extracted, it is important to be aware of residual solvent in your material. There are many compendia methods for this and should be part of your evaluation. Depending on the chemicals used for extraction, the residual solvents can cause issues like skin irritation and may be on prohibited or limited use lists in some jurisdictions.

Finally, since Cannabis sp. is cultivated in humid, warm environments conducive to microorganism growth, microbiological contamination is a concern. There are many methods that may be used to determine contamination.

Essentially, you need to know the ingredient is not contaminated and there are no objectionable organisms. Warm humid environments before plant harvest or during storage are also conducive to molds and fungi that can infect production.

As such, you may want to assure yourself no mycotoxins are present. Mycotoxins such as aflatoxins (B 1, B 2, G 1, G 2) and ochratoxin A are secondary metabolites produced by molds and fungi that can cause disease and death.27

Once you have your hemp-based ingredient characterized and your product formulated, your next step would be to subject the product to your company’s safety testing program. At the bare minimum, your safety-testing program should include clinical testing, like human repeated insult patch testing (HRIPT), or safety in-use studies.

A reputable testing facility should ask for a report on the THC level of your ingredient and should also ask about the limit of detection of the analytical method used. You may also be asked to certify that the ingredient is derived from hemp.

We hope that this article puts the matter of using Cannabis sp. derived ingredients in perspective and provides a foundation on which to build. At the very least, we hope we provided some things to consider when marketing cosmetics with hemp/CBD.

ABOUT THE AUTHORS

Lambros Kromidas is vice president and regulatory team leader, Shiseido.

Craig Weiss is co-CEO and president, Consumer Product Testing Company, Inc. Email Weiss.

References & Sources

-

Prance-Miles, Louise. July 2020. Global Cosmetics News. Has the CBD Bubble Burst? Cannabis Firms See Surge in Insurance Costs Amidst Slew of Lawsuits.

-

Personal Care Products Council. January, 2020. Personal Communication. Hemp and CBD in Cosmetic Products.

-

Komnenov, Dragana. April 2019. Rx Leaf: Can the pH Level in Stomach Acid Can Convert CBD to THC?

-

Bloom, Josh. April 2019, American Council on Science and Health. CBD and THC - The Only Difference is One Chemical Bond

-

Havens, Jonathan A. May, 2019. Cosmetics and Cannabis: A Match Made in Heaven or a Recipe for Disaster? PCPC Legal and Regulatory Conference presentation from Saul Ewing Arnstein & Lehr LLP.

-

Mahecha, Laura. December 2018. Kline Group. What does passage of the Farm Bill mean for health and personal care CBD marketers?

-

Behrens, Michele. January 2020. Cosmetics & Toiletries. CBD-mimic Secures New INCI Name.

-

Author name not provided. February 2020. GCI. Beracare CBA Bears Alternative to CBD.

-

Behrens, Michele. June 2020. Cosmetics & Toiletries. Kannabia Sense: An Oxytocin Activator Without the CBD.

-

Behrens, Michele. June 2020. Cosmetics & Toiletries. [Updated] Canapure By Symrise Mimics Natural CBD.

-

Ward, Susan. February 2020. Hemp-free CBD: Japanese firm discovers presence of CBD in orange peels.

-

Author name not provided. June 2019. Sales Tax Institute. CBD Products Subject To Tax in Louisiana, Effective January 1, 2020.

-

Blinkoff, Sharon and Craig Weiss. Spring 2020. Cannabis in Cosmetics. Is the hallucinogen of the 1960s, the new biotech answer in beauty? CBD Inside & Out, Vol.1(1): 22-27.

-

FDA. June 2018. FDA Approves First Drug Comprised of an Active Ingredient Derived from Marijuana to Treat Rare, Severe Forms of Epilepsy.

-

Canada’s Cosmetic Ingredient Hot List. July 2020.

-

Ganesh, Linitha. March 2020. Canada Cosmetic Alliance. Personal communication.

-

Author name not provided. March 2019. ANVISA approves new regulation concerning medicinal products derived from Cannabis for human use.

-

Meredith, Emma. February 2019. Cosmetics & Toiletries. EU Regulatory Update: CTPA’s Take on Claims and Cannabis.

-

European Commission. January 2019. Annex II: List of Substances Prohibited in Cosmetic Products

-

Public Health Code. Legifrance

-

Author name not provided. February 2020. GCI. Sephora Unveils New CBD Standards with Prima Partnership.

-

Global CBD Skin Care Market to Reach $3.48 Billion by 2026.

-

Nelson, Ryan. September 2019. HBW Insight. CBD Pollinating New Beauty Categories With Cannabis Cachet: Sunscreens, Deodorants And More.

-

Nelson, Ryan. September 2019. HBW Insight. Lauder/Origins’ Hello, Calm Mask: Gateway To Bigger Cannabis Skin-Care Play?

-

Author name not provided. March 6, 2020. Medical News Today. What to know about terpenes.

-

US EPA. Setting Tolerances for Pesticide Residues in Foods

-

Peraica M, Radic B, Lucic A, and Pavlovic M. Toxic Effects of Mycotoxins in Humans. Bulletin of the World Health Organization, vol.77, no.9, 1999.

-

Gallen, Tom. July 2020. HBW Insight. EU CBD Market Under Threat With Narcotic Classification Favored.

-

Gallen, Tom. August 2020. HBW Insight. Hemp Industry Appeals To National Governments Over CBD Narcotic Classification.

-

Ridley, David. August 2020. HBW Insight. UK CBD Pathway Clear As EU Decides.