Jamie Matusow, Editor-in-Chief08.23.21

There have been many persuasive arguments made over the years regarding domestic manufacturing, but the long list of complexities involved—including legislation, taxes, supply chain, carbon footprint, labor costs, materials, transparency, quality and consumer loyalty—influence the process in numerous ways. Now, exacerbated by the global pandemic and the need for an easily accessible, stable supply chain—not to mention sustainability in shipping and materials—the movement has picked up speed, especially as far as speed-to-market.

While some companies are passionate about a strictly domestic operation, others have found that a synthesis of international or regional manufacturing works best for all.

A renewed focus on keeping domestic jobs has also had an impact. In April, for instance, Walmart announced a new commitment to spend an additional $350 billion on items made, grown or assembled in the United States.

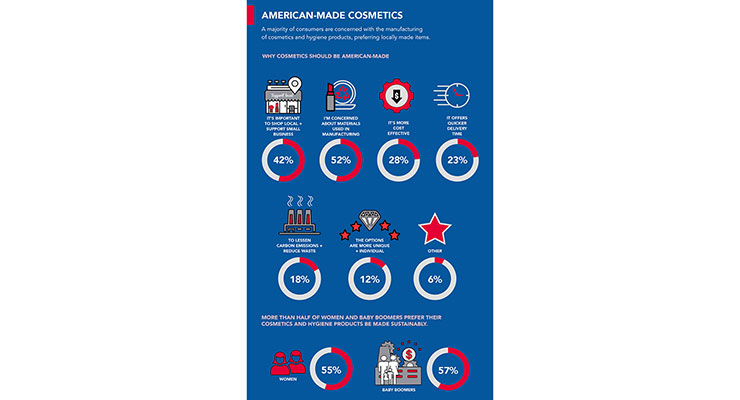

Consumers, too, are voicing their preference for domestically made cosmetic products. More than 1,000 U.S. individuals who were surveyed in CGS’s “State of the U.S. eCommerce Consumer Survey,” revealed that 63% want cosmetic and hygiene products to be made within the United States with 52% citing materials used in manufacturing as the reasoning.

According to data from the business applications provider, “as eco-friendly and clean products take the beauty industry by storm,” that data shows that over half (57%) of Baby Boomers prefer their hygiene and cosmetics are made sustainably and 61% of Gen Z-ers agree.

Manufacturers are heeding the call. Despite slowdowns, shutdowns and quarantines during the Covid-19 situation, U.S. manufacturing, in general, fared on the positive side. The Manufacturers Alliance for Productivity and Innovation Foundation predicts a 3.9% growth in production for 2019, then 2.4% in 2020 and 1.9% in 2021. The organization says manufacturing is forecast to increase faster than the general economy, due to more exports and increased capital growth. Terra Staffing Group notes: “After a disruptive 2020, employers are anticipating a return to relative normalcy and growth in the manufacturing sector.”

USA/NA Supplier Capabilities

In light of all the talk and interest in keeping production and manufacturing local, Beauty Packaging reached out to a number of USA/NA suppliers to learn more about what they offer, their observations and insights—and what they think the future holds for a domestic supply chain. A number of those we spoke with say that while interest has always been strong, they have seen an increase during the pandemic.

Plastics and Tubes

Inoac Packaging Group, Bardstown, KY, specializes in the manufacturing of injection stretch blow molded bottles and jars. In addition to blow molding, the company has extensive decorating capabilities including hot stamping, silk screening, spray painting and heat transfer labeling.

Al Lustrino, president of Inoac, tells Beauty Packaging: “Inoac is unique as we maintain a high-quality level for all our packaging. Every bottle and jar is handled utilizing automation and undergoes extensive testing and inspection before being shipped to our clients. With the major manufacturing expansion we finalized last year, Inoac is perfectly situated to supply our US/NA brands as well as our Asia-based clients.”

Inoac recently provided a Made in USA package for LimeLife by Alcone. Bob Bastedo, executive director of procurement and purchasing of LimeLife explains why he went to Inoac: “When looking for a bottle for our Dew Confidence product, the marketing and design teams wanted something with the high-end heft of glass but in plastic as the product would be used in the bath. I immediately thought of Inoac’s heavy-walled PET, and they had a Made in USA stock package that perfectly fit our needs, helped us avoid tariffs and longer lead times, and had the added bonus of allowing us to buy American.”

Alpha Packaging, headquartered in St. Louis, MO, is a North American packaging supplier whose flexible manufacturing model allows them to serve high-mix customers with a wide variety of stock molds and product families.

For example, Marny Bielefeldt, vice president of marketing, mentions their line of PET Boston Round bottles that range in size from 1-oz to 32-oz, all of which are stocked in “sizes and colors that appeal to beauty brands.” She explains that these are especially good for emerging brands that can take advantage of the wide range of sizes, and use a consistent stock or custom color across multiple shapes and sizes to convey a consistent brand image.

In addition, Bielefeldt says, “Market leaders can access our innovation team and package design center to develop unique fit, forms and finishes to set their brand apart. This broadens our reach in the personal care sector by offering a full line of standard products plus new innovative products to meet customer requirements.”

Alpha Packaging recently introduced two environmentally friendly polyethylene terephthalate (PET) jars that Bielefeldt says “substantially reduce the amount of plastic used. Both of the jars are lighter weight than our standard PET jars, and our 32-ounce beadless PET jar is 27% lighter than the jar it replaces. This is just one of many new items we’ve introduced that are designed for sustainability.”

Tubes work especially well for various cosmetic products such as skincare and sunscreen products—and conveniently making both tubes and the caps is a specialty at JSN Cosmetic Packaging, Irvine CA.

As a global plastics packaging manufacturer, Berry has the scale, capacity and expertise to provide some of the best packaging solutions brands could want, according to Vali Braselton, marketing manager, Consumer Products North America, at Berry. She explains, “We understand the importance of having conveniently located manufacturing locations within the U.S. to provide service, proximity, and collaboration for U.S. customers.”

Many of their U.S. facilities offer the advantages of vertical integration and/or complete package manufacturing at a single location (jar and matching lid, for example)—total package solutions that can improve lead time and quality. “Our Evansville, IN, laminate tube plant is a great example of this,” says Braselton, “where we produce award-winning tubes from ‘pellet to pallet.’ We start with resin and go on to form, print and cap the tubes (with Berry-made caps) in a single location. This vertical integration allows us to control and manage the supply chain resulting in fast lead times, product consistency, and superior quality with one of the lowest carbon footprints of any tube in the market.”

Paper and Cartons

Impressively, in 2022, Arkay (New York City, Hauppauge, NY, and Roanoke VA) will be commemorating its Centennial and at the same time celebrating its roots in the USA. This all-American company was actually founded by a Ukrainian immigrant—third-generation CEO Mitchell Kaneff’s grandfather, Max Kaneff—who was so proud of his adopted homeland, he began a thriving business in downtown Manhattan in 1922.

Mitchell Kaneff takes the ‘Made in USA’ message and ethic to heart, telling Beauty Packaging: “Arkay demonstrates its dominance in home-grown manufacturing by consistently seeking to fill jobs with local candidates and always monitoring the kind of quality that a ‘Made in USA’ label has come to represent.” Additionally, he notes that, with a manufacturing plant in Virginia, as well as Arkay’s own trucking business—Arkay Logistics—Arkay is uniquely able to guarantee its customers rapid turnovers and speed to market, “a particularly vital capability” in today’s cosmetic packaging marketplace.

Headquartered near Atlanta, GA, Neenah’s specialty “is making brands stand out on the shelf through our wide assortment of color and texture paper-based substrates,” says Greg Maze, director of product management, Packaging. “Because we are primarily an uncoated manufacturer, we have the advantage of offering papers for beauty or wellness that are more natural in appearance and touch. With the trend we are seeing toward minimalist design, brands can choose our papers to do a lot of heavy lifting rather than covering them with tons of ink and embellishments.”

Glass

Verescence North America, in Covington, GA, commands domestic attention as it is the only glassmaker for perfumery & cosmetics in the U.S. Michel Levisse, VP sales, new product development & marketing describes their capabilities, saying, “We manufacture premium glass bottles and jars for fragrance, skincare and makeup with a wide array of capabilities in lacquering, silk screening, hot stamping, pad printing, gluing, labelling, acid etching and assembling.”

Levisse says the Group’s strategy has been “to prioritize geographic and organizational proximity with our customers’ factories.” That’s why, he explains, they have chosen to establish themselves industrially in Georgia in the late ’90s, with the construction of a glass factory in Covington in 1996, and a decoration factory in Sparta in 2002. “This local establishment, as close as possible to our customers, has many advantages: better quality of service, faster development times, agility, competitiveness and finally, significant environmental gains,” says Levisse.

The focus is on glass decoration at Screen Tech/Spraye Tech, conveniently accessible to NYC, in Linden NJ. John Schofield, owner, VP sales & marketing, says, “The added value and visual presentation we are able to add to glass containers is very important to our customers.”

He adds that being U.S.-based allows their customers direct access to various capabilities and applications. Doing our own in-house color matching for spray and screen printing creates quicker turnaround and increased flexibility.”

Cosmetics and Skincare

Manufacturing vacuum-formed jar discs for cosmetic jars is the specialty of Great Neck, NY-based Madeline Blondman & Co., Inc. The company also manufactures both vacuum-formed and die-cut dustcovers for compacts.

Randi Barron, president, Madeline Blondman & Co., Inc., tells Beauty Packaging, “We have been very fortunate to have always been a U.S. based supplier. Throughout recent history, when many brands were asking whether we sourced in Asia, we resisted the temptation to just go for a cheaper product because we knew what our capabilities were here, and we wanted to maintain the confidence in quality that our customers came to rely on.”

Founded in 1925, Germany-based Geka is now active globally, with U.S. headquarters in Elgin, IL. Arnaud Brilland, Geka’s vice president sales, North America, says, “As a leading cosmetics packaging wholesaler in the U.S. and worldwide, we can look back on a rich heritage and our longstanding expertise in the manufacture of high-precision beauty application solutions such as mascara, lip gloss and concealer.”

Brilland says Geka offers more than 1,200 ready-to-go beauty packaging products and custom cosmetic packaging solutions. With sustainability high on the company agenda, he adds, “We also offer sustainable cosmetic packaging, such as our Reborn Collection of mascara, lip gloss, eyebrow brushes, cleaning pads and accessories which features bio-based and recycled materials.”

Recently, Brilland says Geka has developed several full-service mascara projects, all of which included local cosmetic packaging manufacturing and filling. Further support is provided by their long-term partners in Europe. “Our customers are convinced about the benefits of local production and our staff are proud to participate in manufacturing ‘Made in USA’ products,” he says.

Rising Interest in U.S./NA Suppliers

Many of the suppliers we spoke with for this article say they have seen a rising interest in beauty brands partnering with U.S./NA suppliers, and spoke about what brands are asking for in this regard. As with many things in this climate (pun intended), sustainability plays a key role.

At Alpha, Bielefeldt says that over the past 15 months, they have seen a dramatic increase in the number of brand owners who are consolidating their packaging components with domestic suppliers.

“Part of this trend may be due to the long lead times and rising costs of ocean freight, says Bielefeldt, but we also believe it’s because brands are becoming more sustainable—and that includes an effort to use fewer non-renewable resources involved with overseas shipping.”

At JSN, Kavanaugh, tells Beauty Packaging, “We have seen a tremendous demand for our products. The number one thing our customers are asking is if we are a USA manufacturer. We have always been a USA owner and manufacturer since our founding over 40 years ago. We were proudly highlighting our manufacturing location even before it became more fashionable to do so.”

Inoac’s Lustrino has seen the U.S. manufacturing trend grow over the last few years. He says, “Although we have a facility in Shanghai, most North American inquiries we receive lately are in regard to our Bardstown, KY and Monterrey, Mexico plants. With the many issues related to international transport that have occurred in the past few years including Covid, the Suez Canal blockage and the short supply of shipping containers, brands are looking for a more reliable supply chain.” In addition, he says, “Regionalizing the supply chain brings a reduction in transit time and improved sustainability. A bottle shipped from Kentucky to any point in the USA creates a much smaller carbon footprint than one shipped from overseas.”

Neenah’s Maze has also seen an uptick throughout the last couple of years, with sustainability playing a role. He says, “There is a definite macro trend toward sustainable packaging. While it started off with a push from the younger demographics, he says it has now transitioned into an overall desire for brands to become more environmentally conscious.

“It’s crucial for brands that we have sustainable options and that our substrates also provide the functionality and durability that are essential for product packaging,” explains Maze. “Neenah has always focused on producing the most beautiful packaging papers possible with premium performance attributes,” he adds.

ScreenTech/SprayeTech’s Schofield says, “We are seeing more and more companies who source their glass outside of the U.S. coming to us for their decoration because of the value they are adding to the container—in many cases, the value of the decoration exceeding the cost of the glass itself and brands wanting the hands-on ability to be involved with the process.”

Geka’s Brilland notes, “We have a lot of requests for localized manufacturing support. Beauty brands have several goals for their supply chains such as increased agility, sustainability, and cost efficiency. Working closely with a local supplier such as Geka makes all of this possible.”

Brilland says in addition to producing packaging in the USA with locally sourced raw materials, they also offer the possibility to carry out filling. “This delivers a maximum of flexibility to our customers so they can quickly respond to market opportunities,” he adds.

“Brands and manufacturers are always looking for faster lead times plus quality products and reliable supply,” says Berry’s Braselton. During the peak of Covid-19, she says, demand exceeded supply on many products, and brands were constrained by availability. “Now that we may have gotten past the worst of the pandemic in the U.S., brands and customers are bringing their focus back to innovation and sustainability,” she says.

Another area of rising interest to USA/NA beauty brands, says Braselton, is help with launching new brands. “These new brands sometimes need design and manufacturing consultation and most importantly, low minimum order quantities (MOQs) to start. At our Winchester, VA, plant we offer low MOQ packaging with hands-on manufacturing expertise and a wide variety of decoration effects. If and when a brand grows and requires higher volume, we can move the larger-scale production to other Berry locations seamlessly.”

A Rejuvenated Pandemic-Related Interest

Many beauty brands—like those in other product categories—took notice and re-evaluated their supply chains in the midst of the pandemic, when frustrations ran high due to manufacturing plant closures, quarantines and other inabilities to produce and launch products. As a result, many domestic packaging suppliers were flooded with calls “to pick up the pieces.” The same was reported in other regions of the world.

This was the case at Inoac, where Lustrino says, “Although this interest existed prior to the pandemic, we have witnessed an increase in brands’ desire to regionalize to NA manufacturing. We understand that there is ongoing activity to regionalize manufacturing in APAC and Europe to their regions as well. The overall objective is to reduce transit time, carbon footprints from intercontinental transport, and adequately size the supply base.” He adds, “All this activity has increased during the pandemic as the international supply chain experienced greater strains than domestic supply chains. Once the benefits of regionalization are experienced, going back will become increasingly difficult. At the onset of the pandemic, Inoac closed its plants as most of our clients closed their manufacturing. As our customers reopened in May of 2020, Inoac reopened our facilities and our customers were receiving bottles and jars within days.”

Arkay’s Kaneff says: “The interest in domestic suppliers definitely accelerated during the pandemic because the ability to reach most foreign countries and supply chains rooted in those countries came to a standstill. Within the U.S., however, factories could still function.” Kaneff is proud that Arkay continued operating around the clock throughout the worst of the pandemic, thereby meeting—and filling—any orders their customers urgently needed.

“The pandemic taught everyone to be wary of placing too much faith, money, and time in overseas associates and supply chains,” says Kaneff. “Certainly, access to foreign entities was dramatically limited—if not altogether halted—due to the lockdowns that ensued during this period. Brands want the highest quality and at the same time the quickest turnaround times, which Arkay seamlessly continues to provide.”

In general, Alpha’s Bielefeldt notes: “Covid-19 has accelerated the need to find competent and creative domestic partners who can support a brand’s journey through all phases of the product launch cycle.”

Neenah’s Maze has also seen a Covid-related shift in domestic packaging, in part due to the ramping up of e-commerce. He says, “If you reflect on packaging pre-pandemic, you’d probably see it more widely used at brick-and-mortar locations. With the lockdowns, companies were forced to pursue e-commerce at a more aggressive level. If you’re a high-end brand and you cannot create that same gold standard service experience in the retail store, you still want to provide it to your customers at home.”

Maze says Neenah saw a trend back to acknowledging the power of the unboxing moment. “It deterred some traditional packaging and created a whole new level of focus for many brands who adapted to the moment,” he explains. “E-commerce was gradually building anyway, but the pandemic forced brands to pivot and make advancements much faster. Brand loyalty is still important—but more often now at the consumer’s doorstep than on the store shelf.”

JSN’s Kavanaugh says, “A lot of customers were concerned about getting products from China since that was the source of Covid-19. At the beginning of the pandemic, we were supplying tubes for hand sanitizer products as unrelated cosmetic marketers jumped into that critical market. Eventually as our customers returned to what they customarily made, the pent-up demand of their regular products caused a tremendous increase in demand for our tubes.”

Kavanaugh says JSN has also received new business from customers who grew concerned with tariff charges, as well as “the tremendous increase in the freight costs coming out of China. They realized the price advantage they once experienced from China had virtually disappeared.” In addition, he says customers have become increasingly concerned with the carbon footprint as they get pushback from the consumer wanting to know what they are doing to help the environment. “When you deal with domestic manufacturers, you can lower your carbon footprint plus support domestic jobs. It is a win for everyone,” says Kavanaugh.

Berry’s Braselton says they feel that there are always advantages to domestic manufacturing, including reduced transit times, coupled with potentially lower transportation costs, ease of collaboration, and in-region hands-on technical expertise.

Berry recently produced an award-winning laminate tube for Biore Brightening Jelly Cleanser in their Evansville, IN, facility. Designed with sustainability in mind, this tube contains PCR in the sleeve, shoulder, and cap, resulting in a total PCR content of 33%. The supplier’s local technical services team worked closely with Biore to translate their vision to a premium-looking tube that uses holographic foil and process images to stand out on the market. They also produce the Divinity closure that tops the package, in the same plant, to provide a full package, assembled in the U.S.

At Verescence, Levisse says, “The year 2020 increased awareness of the challenges of sustainable development. This crisis has shown the importance of short supply chains. Brands engaged in CSR initiatives are looking for American-made glass in order to reduce the environmental impact linked to transport. At the same time, cosmetic brands accelerated their time to market to accommodate new trends and shifts in consumer behavior in a time of social distancing. Thanks to our local presence in the USA, we can be more agile and meet the demands of brands for optimized lead times.”

For example, Verescence manufactured a new hand sanitizer, ‘HANDS—Apothecary’ by DefineMe Fragrance, a niche American fragrance brand creating scents meant to empower women. They chose Verescence’s Tango glass bottle made in the USA.

Barron, of Made in USA supplier Madeline Blondman, says, “Our customers have been very focused on the supply chain, and whether it would be interrupted during Covid. Not only do we manufacture in the U.S., but we only source our raw materials from the U.S. as well. That was helpful during the pandemic because we had very little interruption.”

Meeting the Future

What will happen in the future as far as domestic packaging is anyone’s guess. Will the trend gain ground? What factors will continue to influence its expansion? We asked packaging suppliers for their thoughts.

Carl Asher, general manager, Packaging and Sustainable Solutions, Neenah, offers: “I think the future is bright. There are two, on-going trends that really support this positive outlook: consumer expectations around speed and sustainability.

“Beauty is a space in which the products are a part of people’s daily lives and so they can’t afford to wait for their items, they also want to be able to try out a variety of items fairly regularly. A domestic manufacturing footprint drives efficiency in this area,” says Asher.

“Similarly,” says Asher, “Consumers in the beauty space seek out sustainable products and brands with sustainable practices. Consumers have come to understand that transportation is a key contributor to carbon emissions, which makes brands that source from domestic manufacturers well-positioned to acquire this growing base of consumers.”

At Inoac, Lustrino comments: “In the past 25 years many companies have moved their supply chain to international manufacturers in their quest to reduce cost and increase profit. To manage an international supply chain, companies have invested significantly in tooling and infrastructure. Moving the supply chain back to the US/NA will require similar efforts and investments. To justify this change, brands need to undertake in-depth cost benefit analysis of benefit to justify the expense. These should include every aspect of the supply chain such as freight, duty, development expenses, travel for employees, and most of all, the cost impact differential when an international supplier is late versus a domestic supplier.”

At Verescence, Levisse, says, “Younger generations of consumers will push brands even more to be transparent in their communication, especially on the environmental impact of their products. In this perspective, consumers will also demand the ‘Made in USA’ label for packaging. As a glassmaker with local presence in the USA, we are determined to be the best in class in terms of sustainability with product innovations (PCR glass, lightweight glass) and process innovation (automation and digitization).”

Bill Norman, president consumer products North America, Berry Global, says, “As the beauty consumer changes, so do our product portfolio and our manufacturing capabilities. We have seen an evolution, with consumers caring more about sustainability, and we believe that sustainable packaging will be a key driver for years to come. We have already invested in a portfolio to include stock PCR products, all-plastic recyclable packages and lighter, better products. Our plants are changing to use more energy efficient processes, less water and incorporating recycled materials.”

Brad Thompson, GEKA Elgin president, notes: “The importance of local manufacturing was underscored by the pandemic and supply chain chaos that followed. As NA emerges from the pandemic, local manufacturing capability becomes increasingly important as we begin to feel the effects of global warming.

“Young people see opportunities in modern manufacturing and U.S. educators are recognizing the need for advanced technical training, says Thompson. “To further support this, manufacturers are starting apprenticeship programs to attract new talent. Brands and new ideas are developing faster than ever. U.S. manufacturing is rapidly tooling up, attracting more diversity to technology and leadership, while innovating like never before. The outlook for USA/NA manufacturing in the beauty industry is excellent—the future is in good hands.”

Solara Suncare’s founder recounts the successes and challenges of producing her brand domestically.

Solara Suncare is a new “clean mineral skin protection brand fully dedicated to making products that are healthier for our skin, our health and the planet,” says Stephanie DiPisa, founder + CEO.

When she started the luxe brand—now sold at Neiman Marcus, Nordstrom and other retailers, as well as D2C—she decided she would rely on domestic manufacturing, which turned into a somewhat challenging pursuit.

“When we first came up with the idea to start Solara in 2016, clean and Indie was not a desirable combination for some of the larger sunscreen manufacturers,” recounts DiPisa. “It took us quite some time and a bit of growth following our 2019 launch to find the world-class domestic partners that we have today, but it was well worth the wait. While cosmetic manufacturing in the USA is very accessible, to the contrary, it’s extremely difficult to source componentry fully in the USA. At the current moment, we use tubes and unit cartons manufactured in North America—however, as our line expands, the truth is that the options here in the U.S. aren’t plentiful. While there are many great packaging partners to work with based in the USA, many manufacture in Europe and Asia, meaning in some cases longer lead times and, given the current Covid supply chain challenges, much longer than usual ship times.”

At present, DiPisa says “All of our current components are made of fully recyclable materials, and our unit cartons are FSC Certified made from recycled material as well. Tubes and cartons are both manufactured in North America—both in the USA and in Canada.

Having domestic partners during the pandemic has been a huge advantage, says DiPisa. “During Covid, it was quite helpful to our supply chain to have domestic options that weren’t relying on overseas manufacturing/parts and, more importantly, shipping. I think this will remain the case for some time. However, as the product line expands, the challenge we will face—like many brands that would prefer to source domestically—is that there is certainly a shortage of Made in the USA packaging to choose from.”

See our video interview with Stephanie DiPisa.

We asked key executives of leading USA/NA packaging suppliers: ‘What advantages does your company offer brands looking for a domestic packaging provider?’

While some companies are passionate about a strictly domestic operation, others have found that a synthesis of international or regional manufacturing works best for all.

A renewed focus on keeping domestic jobs has also had an impact. In April, for instance, Walmart announced a new commitment to spend an additional $350 billion on items made, grown or assembled in the United States.

Consumers, too, are voicing their preference for domestically made cosmetic products. More than 1,000 U.S. individuals who were surveyed in CGS’s “State of the U.S. eCommerce Consumer Survey,” revealed that 63% want cosmetic and hygiene products to be made within the United States with 52% citing materials used in manufacturing as the reasoning.

According to data from the business applications provider, “as eco-friendly and clean products take the beauty industry by storm,” that data shows that over half (57%) of Baby Boomers prefer their hygiene and cosmetics are made sustainably and 61% of Gen Z-ers agree.

Manufacturers are heeding the call. Despite slowdowns, shutdowns and quarantines during the Covid-19 situation, U.S. manufacturing, in general, fared on the positive side. The Manufacturers Alliance for Productivity and Innovation Foundation predicts a 3.9% growth in production for 2019, then 2.4% in 2020 and 1.9% in 2021. The organization says manufacturing is forecast to increase faster than the general economy, due to more exports and increased capital growth. Terra Staffing Group notes: “After a disruptive 2020, employers are anticipating a return to relative normalcy and growth in the manufacturing sector.”

USA/NA Supplier Capabilities

In light of all the talk and interest in keeping production and manufacturing local, Beauty Packaging reached out to a number of USA/NA suppliers to learn more about what they offer, their observations and insights—and what they think the future holds for a domestic supply chain. A number of those we spoke with say that while interest has always been strong, they have seen an increase during the pandemic.

Plastics and Tubes

Inoac Packaging Group, Bardstown, KY, specializes in the manufacturing of injection stretch blow molded bottles and jars. In addition to blow molding, the company has extensive decorating capabilities including hot stamping, silk screening, spray painting and heat transfer labeling.

Al Lustrino, president of Inoac, tells Beauty Packaging: “Inoac is unique as we maintain a high-quality level for all our packaging. Every bottle and jar is handled utilizing automation and undergoes extensive testing and inspection before being shipped to our clients. With the major manufacturing expansion we finalized last year, Inoac is perfectly situated to supply our US/NA brands as well as our Asia-based clients.”

Inoac recently provided a Made in USA package for LimeLife by Alcone. Bob Bastedo, executive director of procurement and purchasing of LimeLife explains why he went to Inoac: “When looking for a bottle for our Dew Confidence product, the marketing and design teams wanted something with the high-end heft of glass but in plastic as the product would be used in the bath. I immediately thought of Inoac’s heavy-walled PET, and they had a Made in USA stock package that perfectly fit our needs, helped us avoid tariffs and longer lead times, and had the added bonus of allowing us to buy American.”

Alpha Packaging, headquartered in St. Louis, MO, is a North American packaging supplier whose flexible manufacturing model allows them to serve high-mix customers with a wide variety of stock molds and product families.

For example, Marny Bielefeldt, vice president of marketing, mentions their line of PET Boston Round bottles that range in size from 1-oz to 32-oz, all of which are stocked in “sizes and colors that appeal to beauty brands.” She explains that these are especially good for emerging brands that can take advantage of the wide range of sizes, and use a consistent stock or custom color across multiple shapes and sizes to convey a consistent brand image.

In addition, Bielefeldt says, “Market leaders can access our innovation team and package design center to develop unique fit, forms and finishes to set their brand apart. This broadens our reach in the personal care sector by offering a full line of standard products plus new innovative products to meet customer requirements.”

Alpha Packaging recently introduced two environmentally friendly polyethylene terephthalate (PET) jars that Bielefeldt says “substantially reduce the amount of plastic used. Both of the jars are lighter weight than our standard PET jars, and our 32-ounce beadless PET jar is 27% lighter than the jar it replaces. This is just one of many new items we’ve introduced that are designed for sustainability.”

Tubes work especially well for various cosmetic products such as skincare and sunscreen products—and conveniently making both tubes and the caps is a specialty at JSN Cosmetic Packaging, Irvine CA.

As a global plastics packaging manufacturer, Berry has the scale, capacity and expertise to provide some of the best packaging solutions brands could want, according to Vali Braselton, marketing manager, Consumer Products North America, at Berry. She explains, “We understand the importance of having conveniently located manufacturing locations within the U.S. to provide service, proximity, and collaboration for U.S. customers.”

Many of their U.S. facilities offer the advantages of vertical integration and/or complete package manufacturing at a single location (jar and matching lid, for example)—total package solutions that can improve lead time and quality. “Our Evansville, IN, laminate tube plant is a great example of this,” says Braselton, “where we produce award-winning tubes from ‘pellet to pallet.’ We start with resin and go on to form, print and cap the tubes (with Berry-made caps) in a single location. This vertical integration allows us to control and manage the supply chain resulting in fast lead times, product consistency, and superior quality with one of the lowest carbon footprints of any tube in the market.”

Paper and Cartons

Impressively, in 2022, Arkay (New York City, Hauppauge, NY, and Roanoke VA) will be commemorating its Centennial and at the same time celebrating its roots in the USA. This all-American company was actually founded by a Ukrainian immigrant—third-generation CEO Mitchell Kaneff’s grandfather, Max Kaneff—who was so proud of his adopted homeland, he began a thriving business in downtown Manhattan in 1922.

Mitchell Kaneff takes the ‘Made in USA’ message and ethic to heart, telling Beauty Packaging: “Arkay demonstrates its dominance in home-grown manufacturing by consistently seeking to fill jobs with local candidates and always monitoring the kind of quality that a ‘Made in USA’ label has come to represent.” Additionally, he notes that, with a manufacturing plant in Virginia, as well as Arkay’s own trucking business—Arkay Logistics—Arkay is uniquely able to guarantee its customers rapid turnovers and speed to market, “a particularly vital capability” in today’s cosmetic packaging marketplace.

Headquartered near Atlanta, GA, Neenah’s specialty “is making brands stand out on the shelf through our wide assortment of color and texture paper-based substrates,” says Greg Maze, director of product management, Packaging. “Because we are primarily an uncoated manufacturer, we have the advantage of offering papers for beauty or wellness that are more natural in appearance and touch. With the trend we are seeing toward minimalist design, brands can choose our papers to do a lot of heavy lifting rather than covering them with tons of ink and embellishments.”

Glass

Verescence North America, in Covington, GA, commands domestic attention as it is the only glassmaker for perfumery & cosmetics in the U.S. Michel Levisse, VP sales, new product development & marketing describes their capabilities, saying, “We manufacture premium glass bottles and jars for fragrance, skincare and makeup with a wide array of capabilities in lacquering, silk screening, hot stamping, pad printing, gluing, labelling, acid etching and assembling.”

Levisse says the Group’s strategy has been “to prioritize geographic and organizational proximity with our customers’ factories.” That’s why, he explains, they have chosen to establish themselves industrially in Georgia in the late ’90s, with the construction of a glass factory in Covington in 1996, and a decoration factory in Sparta in 2002. “This local establishment, as close as possible to our customers, has many advantages: better quality of service, faster development times, agility, competitiveness and finally, significant environmental gains,” says Levisse.

The focus is on glass decoration at Screen Tech/Spraye Tech, conveniently accessible to NYC, in Linden NJ. John Schofield, owner, VP sales & marketing, says, “The added value and visual presentation we are able to add to glass containers is very important to our customers.”

He adds that being U.S.-based allows their customers direct access to various capabilities and applications. Doing our own in-house color matching for spray and screen printing creates quicker turnaround and increased flexibility.”

Cosmetics and Skincare

Manufacturing vacuum-formed jar discs for cosmetic jars is the specialty of Great Neck, NY-based Madeline Blondman & Co., Inc. The company also manufactures both vacuum-formed and die-cut dustcovers for compacts.

Randi Barron, president, Madeline Blondman & Co., Inc., tells Beauty Packaging, “We have been very fortunate to have always been a U.S. based supplier. Throughout recent history, when many brands were asking whether we sourced in Asia, we resisted the temptation to just go for a cheaper product because we knew what our capabilities were here, and we wanted to maintain the confidence in quality that our customers came to rely on.”

Founded in 1925, Germany-based Geka is now active globally, with U.S. headquarters in Elgin, IL. Arnaud Brilland, Geka’s vice president sales, North America, says, “As a leading cosmetics packaging wholesaler in the U.S. and worldwide, we can look back on a rich heritage and our longstanding expertise in the manufacture of high-precision beauty application solutions such as mascara, lip gloss and concealer.”

Brilland says Geka offers more than 1,200 ready-to-go beauty packaging products and custom cosmetic packaging solutions. With sustainability high on the company agenda, he adds, “We also offer sustainable cosmetic packaging, such as our Reborn Collection of mascara, lip gloss, eyebrow brushes, cleaning pads and accessories which features bio-based and recycled materials.”

Recently, Brilland says Geka has developed several full-service mascara projects, all of which included local cosmetic packaging manufacturing and filling. Further support is provided by their long-term partners in Europe. “Our customers are convinced about the benefits of local production and our staff are proud to participate in manufacturing ‘Made in USA’ products,” he says.

Rising Interest in U.S./NA Suppliers

Many of the suppliers we spoke with for this article say they have seen a rising interest in beauty brands partnering with U.S./NA suppliers, and spoke about what brands are asking for in this regard. As with many things in this climate (pun intended), sustainability plays a key role.

At Alpha, Bielefeldt says that over the past 15 months, they have seen a dramatic increase in the number of brand owners who are consolidating their packaging components with domestic suppliers.

“Part of this trend may be due to the long lead times and rising costs of ocean freight, says Bielefeldt, but we also believe it’s because brands are becoming more sustainable—and that includes an effort to use fewer non-renewable resources involved with overseas shipping.”

At JSN, Kavanaugh, tells Beauty Packaging, “We have seen a tremendous demand for our products. The number one thing our customers are asking is if we are a USA manufacturer. We have always been a USA owner and manufacturer since our founding over 40 years ago. We were proudly highlighting our manufacturing location even before it became more fashionable to do so.”

Inoac’s Lustrino has seen the U.S. manufacturing trend grow over the last few years. He says, “Although we have a facility in Shanghai, most North American inquiries we receive lately are in regard to our Bardstown, KY and Monterrey, Mexico plants. With the many issues related to international transport that have occurred in the past few years including Covid, the Suez Canal blockage and the short supply of shipping containers, brands are looking for a more reliable supply chain.” In addition, he says, “Regionalizing the supply chain brings a reduction in transit time and improved sustainability. A bottle shipped from Kentucky to any point in the USA creates a much smaller carbon footprint than one shipped from overseas.”

Neenah’s Maze has also seen an uptick throughout the last couple of years, with sustainability playing a role. He says, “There is a definite macro trend toward sustainable packaging. While it started off with a push from the younger demographics, he says it has now transitioned into an overall desire for brands to become more environmentally conscious.

“It’s crucial for brands that we have sustainable options and that our substrates also provide the functionality and durability that are essential for product packaging,” explains Maze. “Neenah has always focused on producing the most beautiful packaging papers possible with premium performance attributes,” he adds.

ScreenTech/SprayeTech’s Schofield says, “We are seeing more and more companies who source their glass outside of the U.S. coming to us for their decoration because of the value they are adding to the container—in many cases, the value of the decoration exceeding the cost of the glass itself and brands wanting the hands-on ability to be involved with the process.”

Geka’s Brilland notes, “We have a lot of requests for localized manufacturing support. Beauty brands have several goals for their supply chains such as increased agility, sustainability, and cost efficiency. Working closely with a local supplier such as Geka makes all of this possible.”

Brilland says in addition to producing packaging in the USA with locally sourced raw materials, they also offer the possibility to carry out filling. “This delivers a maximum of flexibility to our customers so they can quickly respond to market opportunities,” he adds.

“Brands and manufacturers are always looking for faster lead times plus quality products and reliable supply,” says Berry’s Braselton. During the peak of Covid-19, she says, demand exceeded supply on many products, and brands were constrained by availability. “Now that we may have gotten past the worst of the pandemic in the U.S., brands and customers are bringing their focus back to innovation and sustainability,” she says.

Another area of rising interest to USA/NA beauty brands, says Braselton, is help with launching new brands. “These new brands sometimes need design and manufacturing consultation and most importantly, low minimum order quantities (MOQs) to start. At our Winchester, VA, plant we offer low MOQ packaging with hands-on manufacturing expertise and a wide variety of decoration effects. If and when a brand grows and requires higher volume, we can move the larger-scale production to other Berry locations seamlessly.”

A Rejuvenated Pandemic-Related Interest

Many beauty brands—like those in other product categories—took notice and re-evaluated their supply chains in the midst of the pandemic, when frustrations ran high due to manufacturing plant closures, quarantines and other inabilities to produce and launch products. As a result, many domestic packaging suppliers were flooded with calls “to pick up the pieces.” The same was reported in other regions of the world.

This was the case at Inoac, where Lustrino says, “Although this interest existed prior to the pandemic, we have witnessed an increase in brands’ desire to regionalize to NA manufacturing. We understand that there is ongoing activity to regionalize manufacturing in APAC and Europe to their regions as well. The overall objective is to reduce transit time, carbon footprints from intercontinental transport, and adequately size the supply base.” He adds, “All this activity has increased during the pandemic as the international supply chain experienced greater strains than domestic supply chains. Once the benefits of regionalization are experienced, going back will become increasingly difficult. At the onset of the pandemic, Inoac closed its plants as most of our clients closed their manufacturing. As our customers reopened in May of 2020, Inoac reopened our facilities and our customers were receiving bottles and jars within days.”

Arkay’s Kaneff says: “The interest in domestic suppliers definitely accelerated during the pandemic because the ability to reach most foreign countries and supply chains rooted in those countries came to a standstill. Within the U.S., however, factories could still function.” Kaneff is proud that Arkay continued operating around the clock throughout the worst of the pandemic, thereby meeting—and filling—any orders their customers urgently needed.

“The pandemic taught everyone to be wary of placing too much faith, money, and time in overseas associates and supply chains,” says Kaneff. “Certainly, access to foreign entities was dramatically limited—if not altogether halted—due to the lockdowns that ensued during this period. Brands want the highest quality and at the same time the quickest turnaround times, which Arkay seamlessly continues to provide.”

In general, Alpha’s Bielefeldt notes: “Covid-19 has accelerated the need to find competent and creative domestic partners who can support a brand’s journey through all phases of the product launch cycle.”

Neenah’s Maze has also seen a Covid-related shift in domestic packaging, in part due to the ramping up of e-commerce. He says, “If you reflect on packaging pre-pandemic, you’d probably see it more widely used at brick-and-mortar locations. With the lockdowns, companies were forced to pursue e-commerce at a more aggressive level. If you’re a high-end brand and you cannot create that same gold standard service experience in the retail store, you still want to provide it to your customers at home.”

Maze says Neenah saw a trend back to acknowledging the power of the unboxing moment. “It deterred some traditional packaging and created a whole new level of focus for many brands who adapted to the moment,” he explains. “E-commerce was gradually building anyway, but the pandemic forced brands to pivot and make advancements much faster. Brand loyalty is still important—but more often now at the consumer’s doorstep than on the store shelf.”

JSN’s Kavanaugh says, “A lot of customers were concerned about getting products from China since that was the source of Covid-19. At the beginning of the pandemic, we were supplying tubes for hand sanitizer products as unrelated cosmetic marketers jumped into that critical market. Eventually as our customers returned to what they customarily made, the pent-up demand of their regular products caused a tremendous increase in demand for our tubes.”

Kavanaugh says JSN has also received new business from customers who grew concerned with tariff charges, as well as “the tremendous increase in the freight costs coming out of China. They realized the price advantage they once experienced from China had virtually disappeared.” In addition, he says customers have become increasingly concerned with the carbon footprint as they get pushback from the consumer wanting to know what they are doing to help the environment. “When you deal with domestic manufacturers, you can lower your carbon footprint plus support domestic jobs. It is a win for everyone,” says Kavanaugh.

Berry’s Braselton says they feel that there are always advantages to domestic manufacturing, including reduced transit times, coupled with potentially lower transportation costs, ease of collaboration, and in-region hands-on technical expertise.

Berry recently produced an award-winning laminate tube for Biore Brightening Jelly Cleanser in their Evansville, IN, facility. Designed with sustainability in mind, this tube contains PCR in the sleeve, shoulder, and cap, resulting in a total PCR content of 33%. The supplier’s local technical services team worked closely with Biore to translate their vision to a premium-looking tube that uses holographic foil and process images to stand out on the market. They also produce the Divinity closure that tops the package, in the same plant, to provide a full package, assembled in the U.S.

At Verescence, Levisse says, “The year 2020 increased awareness of the challenges of sustainable development. This crisis has shown the importance of short supply chains. Brands engaged in CSR initiatives are looking for American-made glass in order to reduce the environmental impact linked to transport. At the same time, cosmetic brands accelerated their time to market to accommodate new trends and shifts in consumer behavior in a time of social distancing. Thanks to our local presence in the USA, we can be more agile and meet the demands of brands for optimized lead times.”

For example, Verescence manufactured a new hand sanitizer, ‘HANDS—Apothecary’ by DefineMe Fragrance, a niche American fragrance brand creating scents meant to empower women. They chose Verescence’s Tango glass bottle made in the USA.

Barron, of Made in USA supplier Madeline Blondman, says, “Our customers have been very focused on the supply chain, and whether it would be interrupted during Covid. Not only do we manufacture in the U.S., but we only source our raw materials from the U.S. as well. That was helpful during the pandemic because we had very little interruption.”

Meeting the Future

What will happen in the future as far as domestic packaging is anyone’s guess. Will the trend gain ground? What factors will continue to influence its expansion? We asked packaging suppliers for their thoughts.

Carl Asher, general manager, Packaging and Sustainable Solutions, Neenah, offers: “I think the future is bright. There are two, on-going trends that really support this positive outlook: consumer expectations around speed and sustainability.

“Beauty is a space in which the products are a part of people’s daily lives and so they can’t afford to wait for their items, they also want to be able to try out a variety of items fairly regularly. A domestic manufacturing footprint drives efficiency in this area,” says Asher.

“Similarly,” says Asher, “Consumers in the beauty space seek out sustainable products and brands with sustainable practices. Consumers have come to understand that transportation is a key contributor to carbon emissions, which makes brands that source from domestic manufacturers well-positioned to acquire this growing base of consumers.”

At Inoac, Lustrino comments: “In the past 25 years many companies have moved their supply chain to international manufacturers in their quest to reduce cost and increase profit. To manage an international supply chain, companies have invested significantly in tooling and infrastructure. Moving the supply chain back to the US/NA will require similar efforts and investments. To justify this change, brands need to undertake in-depth cost benefit analysis of benefit to justify the expense. These should include every aspect of the supply chain such as freight, duty, development expenses, travel for employees, and most of all, the cost impact differential when an international supplier is late versus a domestic supplier.”

At Verescence, Levisse, says, “Younger generations of consumers will push brands even more to be transparent in their communication, especially on the environmental impact of their products. In this perspective, consumers will also demand the ‘Made in USA’ label for packaging. As a glassmaker with local presence in the USA, we are determined to be the best in class in terms of sustainability with product innovations (PCR glass, lightweight glass) and process innovation (automation and digitization).”

Bill Norman, president consumer products North America, Berry Global, says, “As the beauty consumer changes, so do our product portfolio and our manufacturing capabilities. We have seen an evolution, with consumers caring more about sustainability, and we believe that sustainable packaging will be a key driver for years to come. We have already invested in a portfolio to include stock PCR products, all-plastic recyclable packages and lighter, better products. Our plants are changing to use more energy efficient processes, less water and incorporating recycled materials.”

Brad Thompson, GEKA Elgin president, notes: “The importance of local manufacturing was underscored by the pandemic and supply chain chaos that followed. As NA emerges from the pandemic, local manufacturing capability becomes increasingly important as we begin to feel the effects of global warming.

“Young people see opportunities in modern manufacturing and U.S. educators are recognizing the need for advanced technical training, says Thompson. “To further support this, manufacturers are starting apprenticeship programs to attract new talent. Brands and new ideas are developing faster than ever. U.S. manufacturing is rapidly tooling up, attracting more diversity to technology and leadership, while innovating like never before. The outlook for USA/NA manufacturing in the beauty industry is excellent—the future is in good hands.”

Solara Suncare’s founder recounts the successes and challenges of producing her brand domestically.

Solara Suncare is a new “clean mineral skin protection brand fully dedicated to making products that are healthier for our skin, our health and the planet,” says Stephanie DiPisa, founder + CEO.

When she started the luxe brand—now sold at Neiman Marcus, Nordstrom and other retailers, as well as D2C—she decided she would rely on domestic manufacturing, which turned into a somewhat challenging pursuit.

“When we first came up with the idea to start Solara in 2016, clean and Indie was not a desirable combination for some of the larger sunscreen manufacturers,” recounts DiPisa. “It took us quite some time and a bit of growth following our 2019 launch to find the world-class domestic partners that we have today, but it was well worth the wait. While cosmetic manufacturing in the USA is very accessible, to the contrary, it’s extremely difficult to source componentry fully in the USA. At the current moment, we use tubes and unit cartons manufactured in North America—however, as our line expands, the truth is that the options here in the U.S. aren’t plentiful. While there are many great packaging partners to work with based in the USA, many manufacture in Europe and Asia, meaning in some cases longer lead times and, given the current Covid supply chain challenges, much longer than usual ship times.”

At present, DiPisa says “All of our current components are made of fully recyclable materials, and our unit cartons are FSC Certified made from recycled material as well. Tubes and cartons are both manufactured in North America—both in the USA and in Canada.

Having domestic partners during the pandemic has been a huge advantage, says DiPisa. “During Covid, it was quite helpful to our supply chain to have domestic options that weren’t relying on overseas manufacturing/parts and, more importantly, shipping. I think this will remain the case for some time. However, as the product line expands, the challenge we will face—like many brands that would prefer to source domestically—is that there is certainly a shortage of Made in the USA packaging to choose from.”

See our video interview with Stephanie DiPisa.

We asked key executives of leading USA/NA packaging suppliers: ‘What advantages does your company offer brands looking for a domestic packaging provider?’