Joanna Cosgrove, Contributing Editor09.01.22

Ongoing supply chain issues are causing businesses in the USA and overall, in North America, to reevaluate long-held, low-cost import strategies to satisfy consumer demand.

Consulting firm McKinsey & Company has surveyed supply-chain executives and tells Beauty Packaging that even though the global industry has been in a pandemic flux for over two years, USA/NA companies continue to mull the long-term versus short-term viability of shifting from China to their home turf given the associated cost and restructuring headaches.

“While most companies planned to prioritize nearshoring as a priority for their supply chains, ultimately a much smaller percentage did so in practice,” comments McKinsey’s Liz Hempel, operations practice partner. “When we asked supply chain executives back in 2020, 40% said they planned to reshore some of the supplier base, and when surveyed a year later, only 15% of them had actually done it. Companies were much more likely than expected, it turns out, to increase inventories rather than to implement nearshoring or regionalization strategies.”

Although the process of nearshoring by developing a supply base or restructuring internal production is long-term and complex, and requires a significant investment that’s not generally recouped for an average of about two years, Hempel says it’s a viable longer-term solution. “When taking into account other economic and non-economic factors, such as the ability to decrease inventories and associated carrying costs, lead time reduction, and the ability to rapidly respond to demand, companies have found that locating production closer to customers can come with a strategic advantage.”

To help manage costs associated with U.S.-based production, Hempel says companies usually zero in on labor rates and freight costs first—both of which have risen sharply. “For example, shipping costs from Asia to the U.S. have tripled in the last three months alone, and labor costs across the EU have risen up to 8% in some industries,” she says.

McKinsey’s recent supply chain executive survey revealed more than 50% of consumer and retail companies planned to adjust inventory strategies in 2022 to minimize the impacts of disruptions–and that’s on top of a 7% increase in inventory coverage that was already in the works from 2018-2021. “This is reflective of a rising level of awareness that supply chains can no longer be an afterthought, and instead need to be a strategic C-level priority,” she says.

Companies are prioritizing supply chain resilience to improve their positional response to disruptions while mitigating risk. “There are many levers companies can pull to build resilience to improve productivity and supply chain management, including the implementation of advanced analytics for real-time demand planning, data sharing with suppliers, dual sourcing, and bringing manufacturing processes and workforces closer to customer,” says Hempel. “More often than not, it’s a combination of levers that are needed to navigate today’s unpredictable market.”

To take the pulse of the cosmetic packaging industry, Beauty Packaging asked key executives from USA/NA packaging suppliers to respond to the following two questions:

2. We started manufacturing the packaging of the latest Clinique Foundation in Asia. A combination of the TikTok effect and obvious supply chain limitations (transportation, material shortage) has led us to duplicate the production in NA while providing a global regionalized approach, closer to filling locations. This required a new tooling investment that takes time to build and develop. But the benefits are obvious: a shorter supply chain and a lower carbon footprint.

1. Getting back to pre-pandemic execution levels has been a challenge; however, we believe it is essential to continue to reinvest and build our team and capacity to instill confidence in our customers, control costs and mitigate future risk of supply disruptions.

2. As a strategic partner to Estée Lauder, Anomatic supported the North American launch of La Mer Lip Balm from start to finish including package development, tooling, and production of the jar, metal cap with laser engraving and anodizing plus assembly of the cap and liner in-house. Anomatic [also recently partnered] with REN Clean Skincare for their launch of Clearcalm and Evercalm in a 100% recyclable package, with the collaboration and support of Verescence. The jar lid is revolutionary, being the first all-aluminum lid, which is 100% recyclable.

There is also a growing awareness of the legitimacy and currency of a ‘Made in America’ branding due to an increase in customers’ desire to lessen their carbon footprint and fast-track their use of sustainable materials. The desire consumers now have for a ‘home-grown’ product has shown to be advantageous over a product created abroad, and this has served to increase demand. The fact that Arkay, now in its 100th year in business, recently achieved Platinum Level EcoVadis–a recognition just 1% of the world’s suppliers attain–serves to highlight Arkay’s stewardship and its allegiance to diversity, altruism and corporate responsibility to environmental safety and leadership.

A real advantage for our customers is the ability to come to the factory to see their product in pre-production. Having the ability to stand next to a production line and see your actual product being produced gives you the opportunity to make sure that the design is perfect before it comes off the line.

1. Supply chain disruptions have placed in evidence our dependency on imports, especially from Asia. In our segment, some 800 million plastic tubes have been imported every year. Freight cost and import duty hikes are pushing North America preference even further. There is no U.S. capacity to absorb the imports and thus, the smaller brands/companies will (they are already) be left at the end of the line and their lead times will further grow and this will turn into an important opportunity for medium size and small packaging suppliers that can provide a higher level of service to these customers.

2. We have decided to vertically integrate several of our processes, especially those related to closures, and develop North American partners to enhance reliability of supply and reduce lead times. We have worked with customers to adjust their packaging needs to those components available. For instance, changing caps, replacing tamper seals for tamper-evident shrink bands, replacing hot stamping and silk-screening decorations for metallic inks and digital printing.

1. Working with domestic packaging companies, we have found a willingness on the part of the packaging house to provide quick turns, shorter runs and an in-general flexibility to accommodate customers. If brands, suppliers and consumers are open to spending a bit more money, they will get much more in return.

2. FM Brush New York re-opened after only a few months, during the Covid shutdown, as an essential business. We were able to ramp up to full production almost immediately. When customers were ready to begin purchasing, as lockdown restrictions loosened, they needed a quick turn to fill the pipeline, but they also wanted reasonable minimums, we were ready to go with inventory on the shelves, a motivated production team equipped to manufacture the same artist quality brushes we had produced since 1929. One customer needed brushes for a promotion for their employees, but didn’t want to wait months for the product to arrive. We were able to ship brushes to them in under two weeks.

2. JP recently helped ‘right the ship’ for an emerging brand whose product utilized a Thermo Formed Cosmetic Blister that was designed, engineered and tooled offshore. After months invested in production with a different supplier, and with a product launch date approaching, this customer was informed that only their formed blisters were viable, not the filling or sealing. Our NY-based engineering team jumped in to help, receiving materials and designing, engineering and producing a filling, sealing and cutting system for the brand—and in less than two weeks, the customer had finished goods for launch.

2. JPatton is a GA-based U.S. company in the business of producing security and decorative Labels, HangTags and Seals that are often holographic, and multi-layered with other classes of security technologies. Challenges we face in their production are usually based on the availability of materials; however, as a U.S. manufacturer we rely heavily on our U.S. partners so that has helped us avoid the recent supply-chain delays. JPatton products are more often than not, customized, and are designed to prevent counterfeiting and also to secure our customers’ supply chains.

2. Lombardi produces Orifice Reducers assembled with purity seals in the USA and abroad. During the supply chain crisis, shortages of imported aluminum restricted the availability of these seals. Lombardi’s agility was to redirect seals it uses overseas to its U.S. production line. This proactive move allowed us to maintain production requirements without interruption for our U.S. customers throughout the pandemic.

2. We are so proud to introduce our new Neenah Environment Mailer. We’ve created a durable, paper-based, fully recyclable premium mailer for soft goods. Our biggest challenge was making the substrate both printable, for customization, and water-resistant for functionality. As e-commerce continues to grow and consumer awareness of sustainability increases, it was imperative that our mailer be completely recyclable, while maintaining a premium look. The result is a fresh, new sustainable solution, manufactured in the USA, perfect for any premium brand looking to elevate their storefront-to-doorstep user experience.

2. Another development is an increase in our flexible packaging and shrink sleeve business. A number of our customers made the switch from rigid packaging out of necessity because they could not obtain the packaging components they typically used. With shrink sleeves, the uptick is two-fold. Procuring tinted containers has been problematic over the last two years. Exorbitant prices and lead times prompted clients to find an alternative, so we’ve been producing colored sleeves that look identical to tinted containers for a lower price and faster turnaround. Additionally, much of the direct deco format was produced overseas. Advancements in inks, coatings, materials, and equipment have allowed label converters to simulate direct-to-container packaging with shrink sleeves so brands are opting out of producing their packaging in Asia.

2. We have added in-line perfecting (back printing), in-line cold foil and variable digital foil and/or polymer utilizing Scodix technology. We are the only company in the world with both Scodix E-106 and Scodix Ultra 6000 under the same roof. We have also added full rigid box production capabilities with both Emmeci and Kolbus equipment. The additions on the folding carton side have allowed us to offer a unique and wide array of innovative decoration techniques that include in-line cold foil, conventional hot foil stamp, variable digital foil/polymer, silkscreen printing/coating, film laminations, etc. The rigid box capability has allowed customers to move production away from Asia and back to the U.S. for more predictable lead times at competitive prices.

At Verescence, we are committed to promoting our unique glass know-how and strongly encourage our customers’ marketing teams to come to our factories to film the production of their bottle for their content strategy on social networks.

2. Verescence set up in the United States at the end of the 1990s to be closer to the filling sites of its American customers and better serve them.

Verescence North America manufactured Oui Juicy Couture PLAY, which consists of four stackable 15ml fragrance bottles that allow you to create your new signature scent. Challenges included how to develop a deep push-up and have a perfect fit with the top and bottom plate in order to stack one bottle on top of the other. BP

Consulting firm McKinsey & Company has surveyed supply-chain executives and tells Beauty Packaging that even though the global industry has been in a pandemic flux for over two years, USA/NA companies continue to mull the long-term versus short-term viability of shifting from China to their home turf given the associated cost and restructuring headaches.

“While most companies planned to prioritize nearshoring as a priority for their supply chains, ultimately a much smaller percentage did so in practice,” comments McKinsey’s Liz Hempel, operations practice partner. “When we asked supply chain executives back in 2020, 40% said they planned to reshore some of the supplier base, and when surveyed a year later, only 15% of them had actually done it. Companies were much more likely than expected, it turns out, to increase inventories rather than to implement nearshoring or regionalization strategies.”

Although the process of nearshoring by developing a supply base or restructuring internal production is long-term and complex, and requires a significant investment that’s not generally recouped for an average of about two years, Hempel says it’s a viable longer-term solution. “When taking into account other economic and non-economic factors, such as the ability to decrease inventories and associated carrying costs, lead time reduction, and the ability to rapidly respond to demand, companies have found that locating production closer to customers can come with a strategic advantage.”

To help manage costs associated with U.S.-based production, Hempel says companies usually zero in on labor rates and freight costs first—both of which have risen sharply. “For example, shipping costs from Asia to the U.S. have tripled in the last three months alone, and labor costs across the EU have risen up to 8% in some industries,” she says.

McKinsey’s recent supply chain executive survey revealed more than 50% of consumer and retail companies planned to adjust inventory strategies in 2022 to minimize the impacts of disruptions–and that’s on top of a 7% increase in inventory coverage that was already in the works from 2018-2021. “This is reflective of a rising level of awareness that supply chains can no longer be an afterthought, and instead need to be a strategic C-level priority,” she says.

Companies are prioritizing supply chain resilience to improve their positional response to disruptions while mitigating risk. “There are many levers companies can pull to build resilience to improve productivity and supply chain management, including the implementation of advanced analytics for real-time demand planning, data sharing with suppliers, dual sourcing, and bringing manufacturing processes and workforces closer to customer,” says Hempel. “More often than not, it’s a combination of levers that are needed to navigate today’s unpredictable market.”

To take the pulse of the cosmetic packaging industry, Beauty Packaging asked key executives from USA/NA packaging suppliers to respond to the following two questions:

- What has been the most significant development in “Made in USA/NA” packaging production within the last two years? How will this affect brands, suppliers and consumers?

- Describe a recent product your company has produced domestically. What were the challenges? Did it solve/alleviate any supply chain issues?

ALBÉA

1. Customers are getting away from “just in time” and are looking for assurance of supply and reliability. Brands are seeking shorter supply chains, improved agility and a reduced carbon footprint. They have to build inventory to anticipate demand volatility. Manufacturing components closer to the consumers allows brands to get the right product to the market in a shorter amount of time, so that shelves are full. This means less out-of-stock and a lower environmental impact but higher costs.2. We started manufacturing the packaging of the latest Clinique Foundation in Asia. A combination of the TikTok effect and obvious supply chain limitations (transportation, material shortage) has led us to duplicate the production in NA while providing a global regionalized approach, closer to filling locations. This required a new tooling investment that takes time to build and develop. But the benefits are obvious: a shorter supply chain and a lower carbon footprint.

ANOMATIC

Damien Dossin, President & CEO1. Getting back to pre-pandemic execution levels has been a challenge; however, we believe it is essential to continue to reinvest and build our team and capacity to instill confidence in our customers, control costs and mitigate future risk of supply disruptions.

2. As a strategic partner to Estée Lauder, Anomatic supported the North American launch of La Mer Lip Balm from start to finish including package development, tooling, and production of the jar, metal cap with laser engraving and anodizing plus assembly of the cap and liner in-house. Anomatic [also recently partnered] with REN Clean Skincare for their launch of Clearcalm and Evercalm in a 100% recyclable package, with the collaboration and support of Verescence. The jar lid is revolutionary, being the first all-aluminum lid, which is 100% recyclable.

ARKAY

Arkay takes pride in manufacturing in its Roanoke, VA, facility, as well as its design work in its Hauppauge, NY, studio. The pluses now outweigh any minuses for USA-made production due to cost savings, access, shipping, timeline/speed to market, and supply chain benefits.There is also a growing awareness of the legitimacy and currency of a ‘Made in America’ branding due to an increase in customers’ desire to lessen their carbon footprint and fast-track their use of sustainable materials. The desire consumers now have for a ‘home-grown’ product has shown to be advantageous over a product created abroad, and this has served to increase demand. The fact that Arkay, now in its 100th year in business, recently achieved Platinum Level EcoVadis–a recognition just 1% of the world’s suppliers attain–serves to highlight Arkay’s stewardship and its allegiance to diversity, altruism and corporate responsibility to environmental safety and leadership.

BERRY GLOBAL INC.

Many of our U.S. facilities offer vertical integration and/or complete-package manufacturing at a single location. Our total package solutions can improve lead time and quality while potentially reducing freight cost. Our Evansville, IN, laminate tube plant is a great example of this, where we produce award-winning tubes from ‘pellet to pallet.’ This vertical integration allows us to control and manage the supply chain resulting in fast lead times, product consistency, and superior quality with one of the lowest carbon footprints of any tube in the market. Americans take their sustainability seriously and Berry’s 2025 initiatives help brands reach their goals through our responsible manufacturing practices.A real advantage for our customers is the ability to come to the factory to see their product in pre-production. Having the ability to stand next to a production line and see your actual product being produced gives you the opportunity to make sure that the design is perfect before it comes off the line.

COII Packaging

I have always said that there was no reason to manufacture cosmetic packaging out of the country. We have quality materials, creative innovations, and a tremendous talent pool, right here without being logistically cumbersome. Producing here in the USA makes the cost of goods manageable and just in time, ultimately benefiting all consumers at the retail level. At COII we try to operate with a ‘lean and mean’ model on the labor front. There is a lot of thought and creativity in how we lay out jobs for printing and finishing, especially in this time period where paperboard is in short supply.CTL PACK

Andy Olsen, VP Sales & Marketing1. Supply chain disruptions have placed in evidence our dependency on imports, especially from Asia. In our segment, some 800 million plastic tubes have been imported every year. Freight cost and import duty hikes are pushing North America preference even further. There is no U.S. capacity to absorb the imports and thus, the smaller brands/companies will (they are already) be left at the end of the line and their lead times will further grow and this will turn into an important opportunity for medium size and small packaging suppliers that can provide a higher level of service to these customers.

2. We have decided to vertically integrate several of our processes, especially those related to closures, and develop North American partners to enhance reliability of supply and reduce lead times. We have worked with customers to adjust their packaging needs to those components available. For instance, changing caps, replacing tamper seals for tamper-evident shrink bands, replacing hot stamping and silk-screening decorations for metallic inks and digital printing.

FM BRUSH COMPANY

Jacqueline Mink, Executive Director of Retail & Cosmetic Sales1. Working with domestic packaging companies, we have found a willingness on the part of the packaging house to provide quick turns, shorter runs and an in-general flexibility to accommodate customers. If brands, suppliers and consumers are open to spending a bit more money, they will get much more in return.

2. FM Brush New York re-opened after only a few months, during the Covid shutdown, as an essential business. We were able to ramp up to full production almost immediately. When customers were ready to begin purchasing, as lockdown restrictions loosened, they needed a quick turn to fill the pipeline, but they also wanted reasonable minimums, we were ready to go with inventory on the shelves, a motivated production team equipped to manufacture the same artist quality brushes we had produced since 1929. One customer needed brushes for a promotion for their employees, but didn’t want to wait months for the product to arrive. We were able to ship brushes to them in under two weeks.

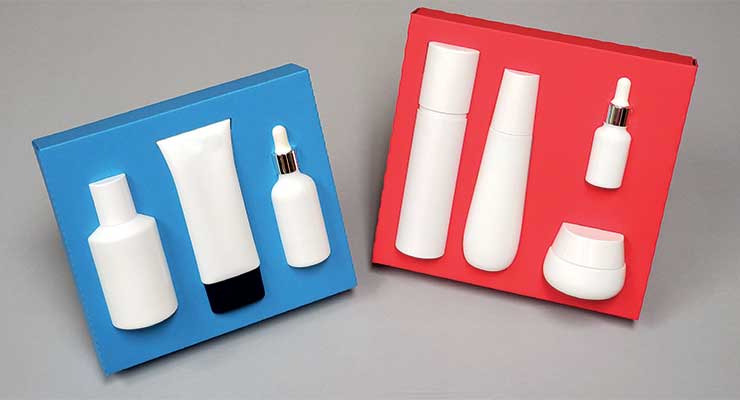

GENERAL FIBRE

The General Fibre Patented Envirotray is a very significant development to the packaging industry. The result of developing/implementing the Envirotray has not only removed more than 200 tons of plastic from the waste stream but also created growth in the U.S. manufacturing job market. Last year alone, General Fibre has seen most top beauty brands use the GFP Envirotray as a replacement to plastic vacuum formed trays in gift sets. The Envirotray is manufactured in the U.S. at our facility, FSC certified, recyclable and biodegradable.JP PACKAGING

1. Having a domestic supply chain and producing in New York, we are meeting and exceeding tight timelines for brands and offer the security of cost-effective and reliable shipping. Couple this with ‘home-grown customer service,’ where there is only a three-hour time difference depending on what coast you are on, and ease of communication and it can reduce lead times and stress on product launches.2. JP recently helped ‘right the ship’ for an emerging brand whose product utilized a Thermo Formed Cosmetic Blister that was designed, engineered and tooled offshore. After months invested in production with a different supplier, and with a product launch date approaching, this customer was informed that only their formed blisters were viable, not the filling or sealing. Our NY-based engineering team jumped in to help, receiving materials and designing, engineering and producing a filling, sealing and cutting system for the brand—and in less than two weeks, the customer had finished goods for launch.

JPATTON

1. An increased reliance on e-commerce packaging solutions [has resulted in] packaging suppliers [having] to innovate and create new and compelling e-commerce packaging for domestic brands. Brands utilized these customized packaging solutions to promote, protect and secure their products, and consumers had peace-of-mind that the product they ordered was legitimate, received in good condition, and sometimes with the option to be authenticated via smartphone technologies that often provided access to brands’ consumer engagement platforms.2. JPatton is a GA-based U.S. company in the business of producing security and decorative Labels, HangTags and Seals that are often holographic, and multi-layered with other classes of security technologies. Challenges we face in their production are usually based on the availability of materials; however, as a U.S. manufacturer we rely heavily on our U.S. partners so that has helped us avoid the recent supply-chain delays. JPatton products are more often than not, customized, and are designed to prevent counterfeiting and also to secure our customers’ supply chains.

LOMBARDI DESIGN & MFG

1. One result of the supply chain crisis was a re-prioritization of getting parts produced over getting parts for the cheapest price. Whether the reason was called regionalization or ‘sleeping well at night,’ the result was the same: USA/NA manufacturers had a distinct advantage in their ability to shorten lead times and deliver on time during this period. Domestic manufacturing costs were now weighed against the price of not having product to sell. Many brands opted in favor of the former, paying for domestic manufacturing in order to keep inventories available for in-store and online sales.2. Lombardi produces Orifice Reducers assembled with purity seals in the USA and abroad. During the supply chain crisis, shortages of imported aluminum restricted the availability of these seals. Lombardi’s agility was to redirect seals it uses overseas to its U.S. production line. This proactive move allowed us to maintain production requirements without interruption for our U.S. customers throughout the pandemic.

NEENAH

1. The pandemic-related disruptions in our supply chains resulted in multiple paper machine re-builds and added capacity in NA. This meant more premium packaging boards being sourced locally versus overseas and provided a major opportunity for mills to fine tune their production of these grades, some making enhancements such as adding in higher amounts of post-consumer fiber, introducing texture, and even creating beater-dyed colors to meet brand standards.2. We are so proud to introduce our new Neenah Environment Mailer. We’ve created a durable, paper-based, fully recyclable premium mailer for soft goods. Our biggest challenge was making the substrate both printable, for customization, and water-resistant for functionality. As e-commerce continues to grow and consumer awareness of sustainability increases, it was imperative that our mailer be completely recyclable, while maintaining a premium look. The result is a fresh, new sustainable solution, manufactured in the USA, perfect for any premium brand looking to elevate their storefront-to-doorstep user experience.

OVERNIGHT LABELS

1. We [have been] very fortunate because we primarily only ever purchased material that was domestically sourced, even if we paid a little more for it. We are now seeing a shift by our customers and competitors towards domestic sourcing and production. For most, pricing is no longer the number one driver as availability and lead times are more important than ever before.2. Another development is an increase in our flexible packaging and shrink sleeve business. A number of our customers made the switch from rigid packaging out of necessity because they could not obtain the packaging components they typically used. With shrink sleeves, the uptick is two-fold. Procuring tinted containers has been problematic over the last two years. Exorbitant prices and lead times prompted clients to find an alternative, so we’ve been producing colored sleeves that look identical to tinted containers for a lower price and faster turnaround. Additionally, much of the direct deco format was produced overseas. Advancements in inks, coatings, materials, and equipment have allowed label converters to simulate direct-to-container packaging with shrink sleeves so brands are opting out of producing their packaging in Asia.

SCREENTECH

The most significant development in ‘Made in America’ for us as a U.S. decorator is more and more customers due to supply chain issues are using their existing glass bottles or stock glass bottles and using our decorating capabilities to differentiate their packages. It has allowed our customers to be able to continue to get new products to the market in a timely fashion.TPC PRINTING & PACKAGING

1. The primary result of [Covid interruptions] has been an unusual increase in production and product-to-market lead times. Brand teams have been forced to work around significant lead times, and product launches have become more complex due to supply chain issues.2. We have added in-line perfecting (back printing), in-line cold foil and variable digital foil and/or polymer utilizing Scodix technology. We are the only company in the world with both Scodix E-106 and Scodix Ultra 6000 under the same roof. We have also added full rigid box production capabilities with both Emmeci and Kolbus equipment. The additions on the folding carton side have allowed us to offer a unique and wide array of innovative decoration techniques that include in-line cold foil, conventional hot foil stamp, variable digital foil/polymer, silkscreen printing/coating, film laminations, etc. The rigid box capability has allowed customers to move production away from Asia and back to the U.S. for more predictable lead times at competitive prices.

VERESCENCE

1. Thanks to our two production sites in Georgia, we demonstrate strong industrial agility, which allows us to respond both to the demands of the biggest beauty groups for large volumes, but also to Indie brands thanks to a range of stock bottles.At Verescence, we are committed to promoting our unique glass know-how and strongly encourage our customers’ marketing teams to come to our factories to film the production of their bottle for their content strategy on social networks.

2. Verescence set up in the United States at the end of the 1990s to be closer to the filling sites of its American customers and better serve them.

Verescence North America manufactured Oui Juicy Couture PLAY, which consists of four stackable 15ml fragrance bottles that allow you to create your new signature scent. Challenges included how to develop a deep push-up and have a perfect fit with the top and bottom plate in order to stack one bottle on top of the other. BP