Beauty Packaging Staff04.30.20

NPD Group's latest insights into the Prestige Beauty Business in the U.S. indicate that consumers are shopping much more online, which is to be expected since stores are closed.

Beauty consumers are also buying more products that fit into the trendy "self-care" category.

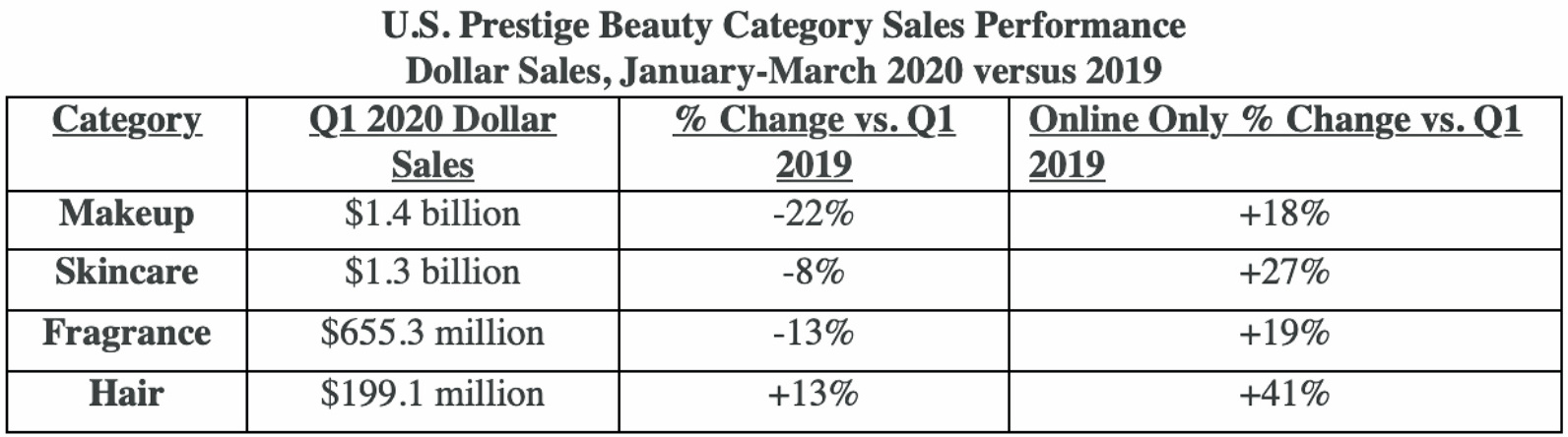

According to the report, sales of U.S. prestige beauty products were $3.6 billion in the first quarter of 2020 -- representing a 14% decline in sales over Q1 2019.

Online sales, however, grew by +24% in the first three months of this year, with double-digit increases across all categories.

NPD states, "With physical stores temporarily closed, online has come to represent nearly all of the industry sales volume."

In terms of dollar share, the online channel accounted for less than one-quarter of total prestige beauty industry sales in January and February; however, in March the online market share soared to 48%.

NPD's Quarantine-Beauty Insights

Larissa Jensen, beauty industry advisor, The NPD Group, comments, “Despite a strong start to the year across most categories, the prestige beauty industry was not immune to the steep March losses seen across retail."

Jensen continues, "Self-care and at-home beauty treatments are where the growth is for the beauty market at this moment, as consumers have no choice but to take beauty services into their own hands."

She adds, "In March, consumers began putting an even greater focus on their skin and hair care, as applying makeup and wearing fragrance have lost importance during quarantine."

Self-Care Trends, By the Numbers

As we spend more time at home, the demand for "self-care" products is on the rise.

- Dollar sales of home scents grew +4%, driven by candles (+8%), which make up nearly 70% of the market. Diffusers grew by +5%, and home ancillary gift sets +4%.

- Makeup sales were down across the board, with the exception of nail products – nail care was up +9% and sales of top/base coat nail polish grew +7%.

- Body skincare products saw sales increases, including body serum (+32%), body oil (+10%), and deodorant (+3%).

- Hand soap sales grew +73%.

In light of the Covid-19 crisis -- and in sync with the self-care trend, Lush Cosmetics' Sabine, shown above, right, introduced an online series, 'Lush Good Feels'.

The series intends to spread ways to find 'moments of happiness' at home, according to the brand's Instagram - and its bath bombs, soaps, and face masks are ideal for pampering.

Hair Products Grow By Double Digits

NPD's report also mentions hair care.

Hair care is the smallest of the beauty categories, according to NPD —and is capturing 6% of total industry Q1 sales. Hair products grew double-digits in the first quarter.

Hair color sales grew by 82%. Hair care sales including shampoo and conditioner were up +16%, with hair masks growing the fastest (+32%). The only declines came from hair styling products.

The above information - and chart below - is sourced from The NPD Group/ U.S. Prestige Beauty Total Measured Market, January-March 2020 vs. 2019.

Read More

How Covid-19 Will Impact the Hair Care Market: The pandemic will create additional demand for the Hair Care Market in the U.S. through 2024, Technavio reports.

The Beauty of Staying Home: Several bright spots emerge amid COVID crisis - Data & Insights from NPD.

Coming Off COVID-19: Beauty & Wellness Industry Trends: Unfiltered Beauty's Daniela Ciocan predicts the new beauty and shopping habits that will emerge in the ‘new normal’ -- after the coronavirus pandemic.