Charles Sternberg, Assistant Editor05.10.21

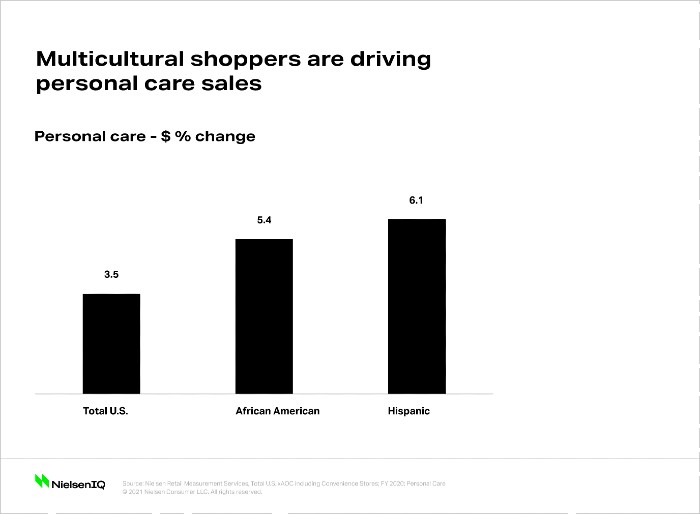

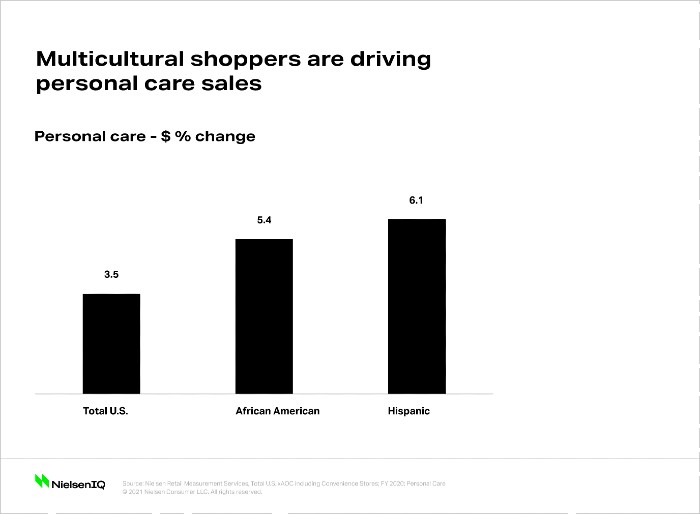

While the industry at large saw a shift away from professional treatments in 2020, some groups were more impacted than others. In fact, according to analysis from NielsenIQ, purchasing trends revealed that multicultural beauty consumers had to pivot past the general population when spending on personal care during the pandemic.

Hispanic Consumers

Hispanic consumers went relatively undeterred last year as they were the only ethnic cohort to drive color cosmetics volume in 2020, and spent 13% more than the average consumer on beauty and personal care.

Despite being subject to the same living and working restrictions, sales data showed that Hispanic shoppers continued to purchase and wear cosmetic products that were ditched by many. For instance, when compared to the general population, this group is 1.4x more likely to buy lip cosmetics than any other segment. When taking a deeper look into which shoppers are driving this growth, low-income shoppers (<$50,000) make up the largest portion of both buying households (38.8%) and dollars (39.6%) within the Hispanic segment, presenting a tremendous opportunity for beauty and personal care retailers.

Hispanics have also kept pace with the rise in natural DIY beauty and over-indexed for hair care treatments and artificial nails measured in 2020. The pandemic caused all types of consumers to place health and wellness at the top of mind, but Hispanic shoppers developed a stronger sentiment for natural and sustainable beauty than most. According to NielsenIQ’s Summer COVID Survey, 21% of Hispanics said they would seek more natural products in the near future vs. 11% of White shoppers. As the demand for cosmetic and personal care incrementally increases amid the vaccine rollout, retailers can appeal to Hispanic shoppers through high-value, natural cosmetic products with an environmentally friendly focus.

African American Women

African American women are traditionally known to rely on salon visits and professional styling products to maintain their hair and had to make some drastic adjustments during lockdown. The widespread disruption brought on was evidenced by the 41% of African American women who indicated that the COVID-19 crisis prompted changes to their hair styling and maintenance regimens.

The swift transition from salons to consumers’ homes caused African Americans to dramatically increase purchasing for hair care products, and they’re now 2.4x more likely to buy hair treatments compared to the average beauty shopper. Similar to the Hispanic segment, low-income shoppers account for a much larger share of African American beauty buying households (43.3%) and dollars (39.1%) than middle and high-income shoppers, meaning retailers need to hone in on value-based products and execute promotions when targeting multicultural consumers.

The sharp rise in Black-owned beauty brands has allowed African Americans to discover an entirely new world of products that are specifically geared towards them and their at-home needs, further fueling consumers’ newfound preference for natural beauty and DIY self care. Black-owned brands and brands who have spoken out about social justice causes have been heavily resonating with this segment, and 39% of African Americans expect to purchase more products from Black-owned brands while another 29% plan to purchase from brands that have spoken about the Black Lives Matter movement.

The Black Lives Matter movement caused multicultural consumers to demand more representation and options from beauty brands and retailers, says NielsenIQ. These shoppers will gravitate toward brands which align with their social values and products that are specifically tailored to their skin and hair care needs.

Health and wellness will remain a priority for most, meaning multicultural consumers will continue to seek out products with organic, natural and cruelty-free claims. As we prepare for a shift toward normalcy and more consumers feel comfortable venturing out of their homes and attending social gatherings, the demand for beauty and personal care will further accelerate. Categories that experienced steep declines will regain their relevance, but will need to consider newfound consumer preferences.

Hispanic and African American consumers have a track record of far out-spending other ethnic groups when it comes to beauty and personal care, and we can expect multicultural consumers to fuel cosmetics growth into 2021 as they look for products that enhance their natural beauty rather than mask it, concludes NielsenIQ.

Hispanic consumers went relatively undeterred last year as they were the only ethnic cohort to drive color cosmetics volume in 2020, and spent 13% more than the average consumer on beauty and personal care.

Despite being subject to the same living and working restrictions, sales data showed that Hispanic shoppers continued to purchase and wear cosmetic products that were ditched by many. For instance, when compared to the general population, this group is 1.4x more likely to buy lip cosmetics than any other segment. When taking a deeper look into which shoppers are driving this growth, low-income shoppers (<$50,000) make up the largest portion of both buying households (38.8%) and dollars (39.6%) within the Hispanic segment, presenting a tremendous opportunity for beauty and personal care retailers.

Hispanics have also kept pace with the rise in natural DIY beauty and over-indexed for hair care treatments and artificial nails measured in 2020. The pandemic caused all types of consumers to place health and wellness at the top of mind, but Hispanic shoppers developed a stronger sentiment for natural and sustainable beauty than most. According to NielsenIQ’s Summer COVID Survey, 21% of Hispanics said they would seek more natural products in the near future vs. 11% of White shoppers. As the demand for cosmetic and personal care incrementally increases amid the vaccine rollout, retailers can appeal to Hispanic shoppers through high-value, natural cosmetic products with an environmentally friendly focus.

African American Women

African American women are traditionally known to rely on salon visits and professional styling products to maintain their hair and had to make some drastic adjustments during lockdown. The widespread disruption brought on was evidenced by the 41% of African American women who indicated that the COVID-19 crisis prompted changes to their hair styling and maintenance regimens.

The swift transition from salons to consumers’ homes caused African Americans to dramatically increase purchasing for hair care products, and they’re now 2.4x more likely to buy hair treatments compared to the average beauty shopper. Similar to the Hispanic segment, low-income shoppers account for a much larger share of African American beauty buying households (43.3%) and dollars (39.1%) than middle and high-income shoppers, meaning retailers need to hone in on value-based products and execute promotions when targeting multicultural consumers.

The sharp rise in Black-owned beauty brands has allowed African Americans to discover an entirely new world of products that are specifically geared towards them and their at-home needs, further fueling consumers’ newfound preference for natural beauty and DIY self care. Black-owned brands and brands who have spoken out about social justice causes have been heavily resonating with this segment, and 39% of African Americans expect to purchase more products from Black-owned brands while another 29% plan to purchase from brands that have spoken about the Black Lives Matter movement.

The Black Lives Matter movement caused multicultural consumers to demand more representation and options from beauty brands and retailers, says NielsenIQ. These shoppers will gravitate toward brands which align with their social values and products that are specifically tailored to their skin and hair care needs.

Health and wellness will remain a priority for most, meaning multicultural consumers will continue to seek out products with organic, natural and cruelty-free claims. As we prepare for a shift toward normalcy and more consumers feel comfortable venturing out of their homes and attending social gatherings, the demand for beauty and personal care will further accelerate. Categories that experienced steep declines will regain their relevance, but will need to consider newfound consumer preferences.

Hispanic and African American consumers have a track record of far out-spending other ethnic groups when it comes to beauty and personal care, and we can expect multicultural consumers to fuel cosmetics growth into 2021 as they look for products that enhance their natural beauty rather than mask it, concludes NielsenIQ.