01.03.23

According to a recent report from data and analytics company GlobalData, easing pandemic control measures, particularly mask mandates, and a growing interest in natural cosmetics will sustain the demand for makeup in Japan in the coming years. However, the emergence of new Covid-19 variants, and surging inflation will constrain consumer spending on color cosmetics in the immediate future.

As a result, the Japanese makeup market will expand by a marginal compound annual growth rate (CAGR) of 0.1% over 2021–2026 to reach JPY 531.8 billion ($5.5 billion) by 2026.

GlobalData’s report, “Japan Make-up - Market Assessment and Forecasts to 2026” reveals that the eye makeup category will register the fastest value CAGR over 2021–26, followed by the lip makeup category.

“Eye makeup sales rose as consumers continued to use face masks in indoor environments and outdoors. Online sales of cosmetics also surged as more companies started developing and augmenting their direct-to-consumer (D2C) platforms. Moreover, market leaders leveraged augmented reality (AR) apps to provide a personalized shopping experience for digitally-savvy consumers.”

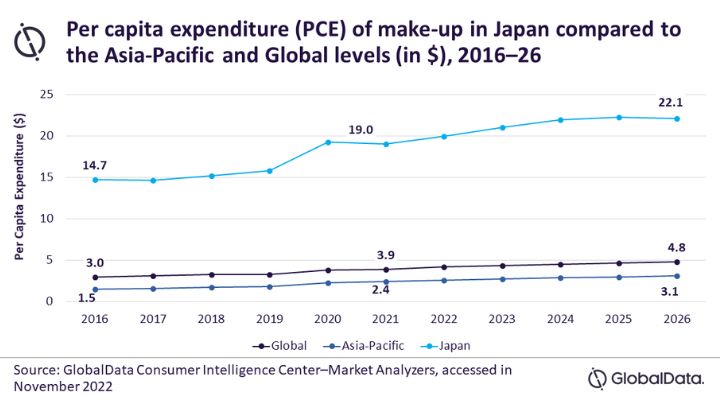

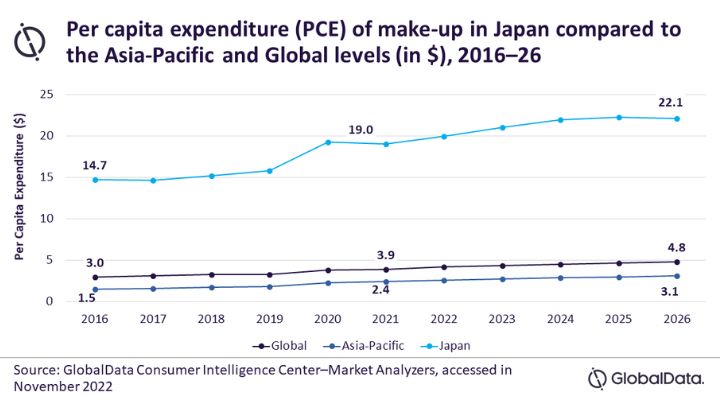

The per capita expenditure (PCE) on makeup in Japan increased from $14.7 in 2016 to $19 in 2021, surpassing the regional average of $2.4 and the global average of $3.9. Japan’s PCE on makeup will surge to $22.1 by 2026.

Kao Corporation, Shiseido Company, and L’Oréal S.A. were the top three companies in the Japanese makeup sector in 2021, and Shiseido and Kose were the leading brands. Parapharmacies/drugstores were the leading distribution channel, followed by eRetailers and hypermarkets & supermarkets.

“The renewed focus on holistic health and wellness in light of the pandemic has accentuated the trend towards free-from makeup. Going forward, the improving consumer sentiment and the launch of innovative natural and safe formulations will lend impetus to the Japanese makeup market. However, spiraling inflation and emergence of new Covid-19 variants can derail overall consumer spending on color cosmetics.”

As a result, the Japanese makeup market will expand by a marginal compound annual growth rate (CAGR) of 0.1% over 2021–2026 to reach JPY 531.8 billion ($5.5 billion) by 2026.

GlobalData’s report, “Japan Make-up - Market Assessment and Forecasts to 2026” reveals that the eye makeup category will register the fastest value CAGR over 2021–26, followed by the lip makeup category.

Sales Gradually Revive

Suneera Joseph, consumer analyst at GlobalData, comments, “The Covid-19 related lockdowns and strict restrictions stifled consumer movement, leaving a significant impact on the sales of makeup products in 2021. However, the lifting of restrictions in H2 2022 and the subsequent resumption of out-of-home activities and social gatherings gradually revived sales.“Eye makeup sales rose as consumers continued to use face masks in indoor environments and outdoors. Online sales of cosmetics also surged as more companies started developing and augmenting their direct-to-consumer (D2C) platforms. Moreover, market leaders leveraged augmented reality (AR) apps to provide a personalized shopping experience for digitally-savvy consumers.”

The per capita expenditure (PCE) on makeup in Japan increased from $14.7 in 2016 to $19 in 2021, surpassing the regional average of $2.4 and the global average of $3.9. Japan’s PCE on makeup will surge to $22.1 by 2026.

Kao Corporation, Shiseido Company, and L’Oréal S.A. were the top three companies in the Japanese makeup sector in 2021, and Shiseido and Kose were the leading brands. Parapharmacies/drugstores were the leading distribution channel, followed by eRetailers and hypermarkets & supermarkets.

Natural and Organic Beauty Products Gain Traction

“As the economic and social activities normalize, the demand for novel color cosmetics will accelerate in Japan over the forecast period. Natural and organic beauty products are gaining traction due to rising consumer concerns about the long-term harm caused by chemical formulations with petroleum-based chemical additives, allergens and pesticides,” Joseph concludes.“The renewed focus on holistic health and wellness in light of the pandemic has accentuated the trend towards free-from makeup. Going forward, the improving consumer sentiment and the launch of innovative natural and safe formulations will lend impetus to the Japanese makeup market. However, spiraling inflation and emergence of new Covid-19 variants can derail overall consumer spending on color cosmetics.”