Nancy Jeffries, Contributor02.23.21

Fact-filled, and ultimately positive, the recent State of the Beauty Industry Report, presented virtually by Cosmetic Executive Women (CEW), on February 11th, placed strong emphasis on recovery following a roller coaster year.

Jill Scalamandre, Chairwoman, CEW, and President, bareMinerals and Buxom, welcomed attendees, introduced the speakers, and thanked the sponsors for their participation.

The speaker roster included:

- Courtney Emery, Director of Cultural Strategy, sparks & honey

- Sarah Jindal, Associate Director, Global Beauty & Personal Care, Mintel

- Yarden Horwitz, CoFounder, Spate

- Flynn Matthews, Head of Insights & Measurements, Global CPG, Google

- Tara James Taylor, Senior Vice President Beauty Personal Care Vertical, Nielsen IQ

- Larissa Jensen, Vice President, Industry Advisor, The NPD Group

Miranda Gordon, Vice President Marketing, Fine Fragrance, Mane, lead sponsor of the day’s event, spoke of fragrance as a fine wine, and noted the importance of listening to its nuances.

She correlated the notes of fragrance to the multitude of stories contained within data, urging attendees to listen not just to the loudest, but to listen to the data that whispers about emerging stories that are worth hearing. “Our data is singing to us, may we listen carefully,” said Gordon.

Sparks & Honey Talks Tech—And Identifies 5 Clusters

Courtney Emery, Director of Cultural Strategy, sparks & honey, which combines technology and cultural consultancy to understand trends that impact our future, described how their platform translates culture into structured data.Q is an AI-driven platform that collects, organizes, and measures culturally relevant signals from thousands of sources. It then tags each signal individually to understand its place in the taxonomy to quantify changes and trends.

Emery highlighted significant signals that were generated in 2020, including the #Me Too Movement, Black Lives Matter, climate change, joblessness, and more, noting how each signal is analyzed and tagged.

To understand beauty, explained Emery, the Q system identified trends that emerged, particularly pharma and beauty in 2020, based on their number of tags.

Clearly, the impact of Covid-19 and other significant signals in 2020 brought enormous changes, most significantly the growing interest in health and wellness, representation and empowerment, and growing digital engagement.

The Q system identified 30 trends that defined beauty in 2020.

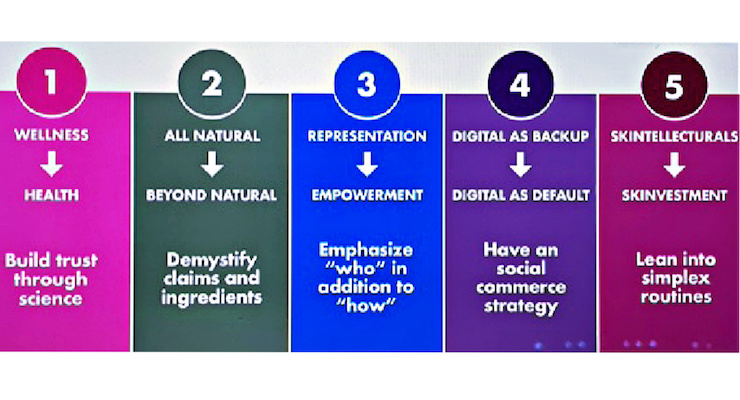

Five clusters were identified, and these included wellness and health; all natural and beyond natural; representation and empowerment; digital as backup and digital as default; and skintellectuals and skinvestment.

The Wellness Cluster

In the Wellness cluster, Covid increased demand for hygienic and immune-boosting beauty; and doctors and nurses emerged as trusted experts and pandemic heroes. Mental health and sleep concerns were amplified by loneliness.The All-Natural Cluster

The All-Natural cluster, supported technology as allowing for greater traceability and understanding, and highlighted consumers continued resistance to greenwashing. Consumers are looking beyond natural claims to understand that sometimes synthetic is better, as increased understanding of ingredients centered on efficacy.The Representation and Empowerment Cluster

Representation and empowerment revealed that consumers expect diversity that is deeper than who is shown in brand ads, and they are looking at who brands are financially and culturally empowering. Women entrepreneurs and black-owned businesses came to the fore, along with empowering previously marginalized groups, and creating room on the beauty aisle.The 'Digital As Default' Cluster

Digital as backup saw the adoption of mobile commerce and social commerce, and consumers became more comfortable with online shopping. 2020 was the year of TikTok, and the data feedback loop continued to feed custom solutions and lower barriers of entry for a variety of beauty groups, including male consumers.The Skintellectual and Skinvestment Cluster

The Skintellectual and Skinvestment cluster identified how recession drives demand for high-value, multipurpose products, and the no-makeup-makeup look accelerated. Investment will continue to support high value products, and non-invasive procedures will continue to rise. Increasingly, said Emery, consumers are seeking low effort and low budget solutions.The key takeaways were to build trust through science, demystify claims and ingredients, and empower who is creating products.

Mintel Trends

Sarah Jindal, Associate Director, Global Beauty & Personal Care, Mintel, highlighted trends for 2021, notably citing the online potential for brands in the future.She said that 38% of US beauty consumers are more comfortable shopping online for beauty than in past years; and this is setting the stage for brands to create new channel strategies to engage the consumer.

Jindal said Covid-19 has accelerated a shift in how consumers discover and purchase products, which has created a need for a “true omnichannel” beauty experience that includes the professional sector. The new channel strategies will encourage different ways to engage with the consumer, address e-commerce pain points, drive business to own-brand sites, and provide easy access.

Creating the No-Touch Shopping Experience

Creating the No-Touch Shopping Experience will bring challenges to brands to provide rapid delivery, streamlined online experiences, live shopping engagement with a social aspect, and no-contact, self-service shopping. She cited as an example a recent partnership between Coty and Go Puff, a quick access digital delivery service which provides rapid delivery of cosmetics to consumers.Engaging the Senses with Experiential E-Commerce

While beauty remains a tactile business, Engaging the Senses with Experiential E-Commerce, another strategic approach, is giving rise to things like touchscreens, tactile interfaces, and sound tracks, including the importance of creating a “brand mood” with audio. “Does your brand have a soundtrack?” asked Jindal, explaining that this kind of engagement brings cross-category partnerships into play, as well as shared databases.Actions to be considered for success include personalized touchpoints leveraging professionals as part of the beauty experience, and clear brand transparency. For the future, she highlighted the importance of user-generated content to garner consumer trust, tapping into emotion and experience with sounds, and a range of touchless technologies.

The Beauty Eco-lution

The Beauty Eco-lution trend focuses on shifting purchase habits as consumers focus more on sustainability, ethics, and safety; and risk-aversion post-pandemic will drive consideration of how and where consumers purchase products.According to Mintel, 64% of US beauty consumers would like to see more innovative sustainability ideas from big beauty brands. High value will continue to be placed on transparent sustainability to drive business, and consumers will weigh social and environmental considerations equally.

“Sustainability will be the heartbeat of every company,” said Jindal. She highlighted the need to bridge the “say-do gap,” emphasizing ethics and the need to drive change with “beauty with a cause.”

Community Collaboration and Support Local

Community Collaboration and Support Local, looks at opportunities for brands to collaborate with and support local businesses, as purchase patterns are shifting to local neighborhoods, with less focus on price.Building and re-building trust through community engagement and experience is paving the way for beauty to enter a new era of trust. These initiatives are about the people and not necessarily about buying products.

Clean Beauty with Ethics and Safety

Clean Beauty with Ethics and Safety continues to grow, and will impact how the consumer buys products.Brands will need to marry ethics with safety to cater to conscious consumers. Jindal noted the importance of the product journey pre-purchase, and how it will continue to impact purchase decisions.

Citing carbon emissions and sourcing, from start to finish, as well as the ethical/eco-friendly conversation, as key aspects for consumers, Jindal said, “Brands need to think across the spectrum. It’s about driving discovery, but also getting consumers to buy more, while thinking about new ingredient stories and new product forms.”

In the future, actions will center on the urban-rural continuum to drive innovation; exploring the undiscovered benefits of existing products and ingredients; and addressing the new meaning of convenience.

The Beautiful Mind

The Beautiful Mind was identified to recognize and address a time to renovate the mind.Wellness has become an important part of beauty and the pandemic has driven the concept of holistic health, with a focus on mental wellbeing. Mintel found that 38% of women in the US, aged 25-34 are interested in beauty products that reduce stress and anxiety.

Creating and rebuilding trust will remain key to consumer purchase, so providing safe environments should be emphasized, as well as offering automation, to reduce risk for consumers and employees. Jindal cited Germany’s use of the automated “Pepper” robot at retail venues, which reminds consumers to stay safe, wear masks, and keep social distance.

Routines and Community Bring Normalcy

Routines and Community Bring Normalcy, highlighted the power of a sense of normality during uncertain times. Don’t underestimate beauty routines, recognize the importance of multi-layered experiences and a sense of community; and be inclusive and diverse.Beauty with a Brain highlighted the measurable mind-body connection; generating data and quantifiable results; and emphasizing trust, credibility, and functionality to lead the way with brands.

Beauty (Re)Valued

Beauty (Re)Valued explored a reassessment of what value means to consumers, vis-a-vis quality, convenience, and purchase impact.According to Mintel, 70% of US consumers agree that it is worth paying more for products of higher quality, hence the need to redefine value in terms of clear communication of product benefits; and offer the right tools and products to enable consumers to effectively perform routines at home. As DIY becomes permanent for many, communication will need to include guidance in pairing professional treatments with at-home maintenance to prolong benefits.

Mintel’s data emphasized the importance of experiences, leveraging consumer interest in learning new skills and trying new products, and evolving sampling and trial for a seamless discovery journey.

Trading Up & Trading Down

Finally, in Trading Up & Trading Down, Jindal addressed the redefinition of luxury with ingenuity and innovation, explaining that while stripped back beauty routines and a flexible approach to justify product purchase have been on the rise, the new luxury includes the optimization of functionality. She cited as an example, affordable price points of candles at Ikea, with high design ceramic packaging, for added consumer connectivity.For the future, Direct To Consumer (DTC) models will gain competitive edge with strong consumer-brand relationships, a continuation of DTC models which have done well during Covid.

The new luxury will connect emotionally with consumers through stories and by broadcasting sustainability, and consumers will remain loyal to brands that adapted to new patterns and routines.

Google and Spate Take the Pulse of the Consumer

Flynn Matthews, Head of Insights, Global CPG, Insights & Measurements, Google, and Yarden Horwitz, Co-Founder, Spate, discussed the seismic shift to digital, noting a +2 hour increase in daily digital use, and a +200% ecommerce sales increase over the past year.Digital consumer sales in beauty saw a significant increase during lockdown, a very destabilized market in March of 2020 at the start of Covid, and the beginning of re-stabilization in the summer.

Wellness products led the way, with Vitamin C, zinc, and elderberry supplements, hand soap, hand sanitizers, and hand masks leading in sales. Consumers then moved to DIY beauty products, including hair color, root touch-ups, and nail products; as well as face bronzers, and facial masks; and at-home product creation, including making your own lip gloss, DIY hair color remover, and DIY blackhead strips.

There was an uptick in sales of hydrocolloid patches and in general, products with efficacy.

In June, stress-relief gummies saw a big search on Google; August saw the beginning of the quest to address maskne; September showed new interest in more creative haircuts, as well as haircare and coloring trends; November searches increased for hair accessories; and December saw a marked increase for hydrocolloidal treatment patches.

Functionality remained key, with strong sales for Cerave, riding the wave of the TikTok effect; and skin care, including Cetaphil and Naturium gained market share. Cerave in particular was said to see a +882K increase in average monthly searches.

By The Numbers: Top Trending Skin Care & Hair Care Brands

Other top trending skin care brands included The Ordinary (+183K), Paula’s Choice (+52K), Cetaphil (+47K), Youth to the People (+45K). Naturium saw +19,161% Year on Year Growth;The Inkey List (+1,625%), Junik (+1,160%), Aklief (+876%); and Buttah Skin (+822%), year on year growth.

Top trending hair care brands were Dyson (+329K) increase in average monthly searches; Monat (+230K); Arctic Fox (+195K); Olaplex (+175K); and Function of Beauty (+148K).

In Year on Year (YOY) growth, Bondi Boost held the top spot, with +2,518% year on year growth.

By The Numbers: Top Trending Makeup Brands

Top trending Makeup brands were Il Makiage, with +105K increase in average monthly searches; followed by Ilia (+58K); Glamnetic (+50K); Thrive Causemetrics (+34K); and Grande Cosmetics (+32K).Glamnetic saw year on year growth of +1,083%; followed by Doe Lashes (+981%); Ioni Lashes (+823%); Liaison (+634%); and Item Beauty (+401%) year on year growth.

Makeup brands showed significant growth in lashes, and lash extensions.

Makeup brand searches showed steady growth in Black-owned brands, including Beauty Stat (+159.4%) YOY growth; Ancient Cosmetics (+159.4% YOY growth); and Mented Cosmetics (+51.4% YOY growth).

By The Numbers: Trending Ingredients

Searches for products that included specific ingredients, for example, Niacinamide, Retinol, and Vitamin C, in skin care, also grew. In May 2020, searches for Niacinamide saw +184.0% growth.Top trending ingredients in the wellness category included zinc, apple cider vinegar, collagen, elderberry, Vitamin C, and Vitamin D; and in skincare, retinol, Vitamin C, niacinamide, salicylic acid, bha, and hyaluronic acid.

Top hair care ingredients were coconut, castor oil, olive oil, aloe vera, rice water, and amla.

Active ingredients continue to impact consumer purchase, particularly as consumers seek products that are gentle.

As consumers discovered which ingredients were more drying and/or harsh, particularly during extensive use of hand sanitizers and creams, it became an important part of their search to zero in on functionality and sensitivity at the same time.

By The Numbers: Top Trending Treatments

Cetaphil Gentle Face Scrub saw +97.6% YOY growth; Salicylic Acid Daily Gentle Cleanser by Cosrx, saw +43.6% YOY growth; and Cetaphil Gentle Acne Cleanser saw +24.1% YOY growth.Top trending treatments included Botox Lip Flip, which has seen an increase as services become more available; as well as brow lamination, lip blushing, and gua sha skin treatment, based on traditional Chinese medicine.

Consumers are also using social media to be exposed to different styles and aesthetics, for example E-Girl Hair, which experienced +217.9% growth; and other aesthetics options, each offering its own look, for example dyed bangs (+118.1% YOY growth), the use of freckle pens (+89.3% YOY growth), or eyebrow slits (+62.6% YOY growth). Other top Internet Aesthetics offerings included Cottagecore; Baddie Aesthetic; Soft Girl Aesthetic; Kid Core; Y2K Aesthetic; Kawaii Aesthetic; Clowncore; Glitchcore; and Scenecore.

In summary, how you look and how you feel manifested in searches from April 2020 until the end of the year.

By The Numbers: Comfort, Care, & Skin Care

Safety and stress care moved to comfort and care, and skin care was “on fire” this past year.Likewise, the luxury and comfort experience of beauty is staying strong. Body care, hand care, body washes, and treatments continued to grow.

Body wash searches, particularly for body washes with efficacy and beautiful fragrance gained momentum. The Aesop brand, for example, got stronger as consumers searched for the best scented hand creams. Oil body cleansers, body washes for men, and body butters were also on the rise.

Hand massage, reflexology, hand creams, and herbal hand sanitizers also grew. More commoditized categories continue to evolve to a certain level of sophistication, as consumers sought stress relief, safety, and comfort.

By The Numbers: The Chill Zone

In the Chill Zone, according to Google and Spate, there was a marked rise in candles, up +60%, and air fresheners, up +40%.Aromatherapy and essential oils, showed +20% growth, demonstrating big increases in an already growing category. The combined growth in advanced treatments, the rise of “tweakments,” the Internet aesthetics categories, and the continued search for comfort, safety, stress relief and efficacy provide a lot of information with which key brand players can engage.

Next Up: A Stress-Relief Stretch Break

Corene Summers, Wellness Coach, offered virtual attendees a 10-minute meditation and stress-relief stretch, to recharge their readiness for the data that followed.She advised that in keeping with the growth of aromatherapy during these uncertain times, there are particular scented oils to help individuals stay focused and feel energized, including lemon, orange, peppermint, spearmint, rosemary, and eucalyptus.

Notable Statistics

The interlude also provided a glimpse of the revealing statistics that stood out during the past year—- hand sanitizer sales grew by 594%

- 1/3 of mass beauty sales are now online

- cruelty-free beauty product sales increased by 75%

- searches for Black-owned beauty brands grew by +185%

- prestige beauty sales declined by -19%; and total prestige beauty industry losses reached -$3.8 billion.

- According to the NPD Group, US sales in beauty, across categories, were: Makeup, -34%; Skincare, -11%; Fragrance, -8%; and Hair, +7%.

NielsenIQ Reviews an Unforgettable Year

Tara James Taylor, Senior Vice President, Beauty Personal Care Vertical, NielsenIQ, acknowledged that while stores closed, and beauty sales declined, the industry showed resilience.Grocery stores became the main shopping destination for consumers and online sales increased. Studies showed that vaccine skepticism varied across countries, with 54% of the population in the UK saying yes to the vaccine immediately; versus 41% in the US. In Japan, statistics revealed that 57% of the population preferred to wait for some time; while 30% of the population in France said no to the vaccine.

In an altogether unforgettable year, omni-shopping grew; sensitize and moisturize became key to hand care; DIY grew; and multicultural products, click and collect shopping, natural beauty sustainability, and CBD/Hemp products, also were on the rise.

Taylor said that online sales were the accelerant for beauty, and beauty and personal care sales rose +16%, with hand care and hair care strong online performers.

In addition, convenience and safety drove shopping habits, with consumers seeking clean beauty, therapeutic and clinical products for facial skincare, like Cerave and Cetaphil. Gentle products showed continued growth, with 90% of consumers seeking gentle and efficacious ingredients.

Multicultural Consumers

Multicultural consumers drove personal care during the pandemic, and consumers engaged with both ingredients and social consciousness; 36% planned to increase hand moisturization; 18% planned to add products to their skincare routines; and 17% planned to deep condition their hair.African-Americans were 2.4X more likely to buy hair treatments; Hispanics 1.4X more likely to buy lip and artificial nail products; and Asian Americans spent 1.3X more on skincare, and 1.5X more on fragrances.

Self-Care & The Men's Market

Beauty made strides with products that resonated in self-care and low-maintenance for the growing at-home lifestyle, with a top trend being “Beauty for Me.” This manifested in such products as skincare for a particular facial condition, and the need for hand moisturization, due to the effects of frequent hand washing.The premium men’s market also grew (+4.8%), with top brands including Dove Men + Care, Every Man Jack, Raw Sugar, and Dr. Squatch. Vegan certified grew (+40.7%), with such brands as Garnier Fructis, and Dr. Bronners, showing increased sales. Within the organic beauty category, Shea Moisture, Love Beauty and Planet, and ME! Bath, were strong performers; and cruelty-free products saw a +74.6% increase.

DIY Beauty & Wellness

Resilience and DIY were dominant beauty trends, and brands acted fast to tap into their resources and seize opportunities on a global scale.In bath and body, Essenza Bath Bomb sales increased to +11mm, and Mei Apothecary Gua Sha Skin Care, sales grew to +1.4mm.

Taylor noted growth came to those brands that thought outside the box, citing a rise in pet grooming sales (+27%), with such products as Burt’s Bees Tearless Shampoo for Pets.

In the wellness category, beauty supplements and personalization went mainstream, with such retail venues as Target, offering customizable hair care products, and others offering beauty opportunities at home.

Pockets of growth identified in mass, predicted to continue growing into 2021, include those smaller pools of innovation, which still drive 13% of category sales. These include products in the CBD/Hemp category, as well as vegan certified, organic, cruelty-free, and premium men’s products.

Taylor emphasized that 2021 is a new year, and it is time to drive with purpose and empathy.

“It is not just a nice color and a package anymore. Move quickly, prepare to pivot, and embrace fun. In a stressful and challenging world, beauty should be a bit of an escape,” said Taylor.

NPD Group Sees Opportunity

Larissa Jensen, Vice President, Industry Advisor Beauty, The NPD Group, declared 2020 as the year that “hit prestige beauty like a brick.” In 2020, the US prestige beauty market decline was -19% and lost -$3.8 billion.“We may feel burdened and challenged, but opportunities are there,” said Jensen.

Comparing the journey to a seed, which must come completely undone to achieve its greatest expression, everything must change. The shell cracks and the insides come out; and to someone who doesn’t understand growth, it would look like complete destruction. Jensen’s metaphor is not lost on the beauty industry.

“Brands are finding distribution outside of prestige channels,” she said, “and NPD is tracking traditional prestige, plus innovation labs and direct retail models, to understand the changes.” The pandemic took its toll, with door-to-door closures, promotion, and consumer shifts driven by Covid, resulting in total volume sold in 2020 returning to 2015 spend levels. Retail spend started to grow in different areas as consumers moved online, but makeup remained especially challenged.

Bath specialty retailers were strong due to consumer demand for their product assortment, including soaps, candles, and hand sanitizers; and other categories defied market dynamics, including growth in fragrance, potpourri, body spray, hand soap, exfoliators, and body serum. (overall +$27.0 million). Declines online were seen in makeup cross segment, including lip color, and fragrance sets with ancillaries (-$7.6 million).

New Consumer Preferences May Stick

Jensen noted that behaviors have changed because of Covid, and preferences have emerged that could stick. Brands will have to determine which channels will respond to specific strategies, and how they will maximize each.“Brick and mortar declines nearly mirrored online growth, and recognizing differentials revealed online penetration,” she said. “As individuals move to online it will be key to see why nuances are important. Brands sold in prestige channels have shifted, mid-range brands are capturing share, and the key to uncovering opportunities lies in recognizing the subtleties between the channels,” she said.

Jensen described how prestige distribution continues to morph, noting that more than half of makeup units sold online were on promotion. Direct retail declined through the crisis, and as stores closed, consumers moved online, with Direct Retail performing better than prestige during and after lockdown; presenting a key opportunity for direct retailers to fill a void for consumers.

She cited both Sephora and Ulta as having increased their footprint by approaching consumers in different ways, noting two game changing partnerships that increased retail footprints. Target and Kohl’s saw increased purchase frequencies, higher spend per buyer, and a large consumer base. The partnership between Ulta and Target, expanded their existing consumer base; while Sephora and Kohl’s partnership targeted new consumers.

The Stay-At-Home Economy

The stay-at-home economy has seen increased demand for sports equipment, small appliances, and housewares; and Americans have been saving on things like travel, and using their purchase power in the beauty segment and elsewhere.Fragrance took a huge hit in March and April, but grew +40% in June, a significant rebound. However, makeup has been unable to break out of the slump since Covid, as fewer consumers are using makeup and more are using skincare products.

While 2020 was hard on everyone, the female job market was particularly hard hit, said Jensen. Female job loss totaled one million more jobs lost then men, and this greatly impacted the beauty market.

While 54% of total US workers are staying home, in those regions, makeup performance is weaker. The recovery of the makeup segment will be tied to the work recovery of women in those areas.

In 2020, makeup continued to lose share to skincare (makeup purchase fell 21% year on year, and average spend declined 3.8%); and clinical brands surpassed natural brands.

The TikTok docs became a social media sensation, as TikTok became the app of choice for dermatologists to recommend products and educate consumers.

Comfort was key, as consumers purchased candles, slippers, sweatpants, and electric blankets, growing double digits in the comfort category. Feeling good, vis-à-vis clean brands and CBD product growth translated to +70%. In addition, spa days, supporting black-owned brands, and holiday spend, all saw growth. Brick and mortar channel also boosted results for fragrance and hair for holiday in December.

Clearly, 2020 was a year that changed everyone; with 49% still not comfortable shopping in stores; 64% still not comfortable eating in restaurants.

This significant statistic appears to have found an antidote in the selection of Pantone’s 2021 color of the year, Illuminating Yellow.

2021 Will See Growth

Much like the buried seed noted by Jensen at the beginning of the presentation, 2021 will ultimately see growth, and is already seeing growth in fragrance. “Recovery, however, will be determined by when the consumer is ready to engage in normal activity,” said Jensen.She urged brands to adhere to strategies that leverage promotion; leverage the strengthen of each channel; maximize product assortment to meet consumers’ changing needs; and own the transformation.

Beauty's Top Winners in 2020

Jensen closed with a breakdown of the year’s top winners in the beauty market.Top Launches By Country

Top launch products by country were:

- US: Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

- Canada: Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

- Mexico: Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

- UK: Marc Jacobs Perfect

- Italy: Dior Capture Totale Cell Energy Cream

- Spain: Paula’s Ibiza Loewe

- France: Miss Dior Rose N’ Roses

- Germany: Boss Alive

- Peru: Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

- Chile: MAC Maker Lipstick

- Argentina: Good Girl Supreme

- Brazil: Good Girl Supreme

- China: Lancôme Clarifique Refining Enzymatic Dual Essence

Topping the Lists in Hair Care

2020 Top Hair Launch:

- Living Proof Perfect Hair Day (PHD) Dry Shampoo

Top 5 Notable Hair Launches:

- Daily Rinse Shampoo: Ouai Fine Hair Shampoo

- Treatment: Olaplex No. 0 Intensive Bond Building Hair Treatment

- Daily Rinse Conditioner: Ouai Fine Hair Conditioner

- Styling: Drybar Liquid Glass Miracle Smoothing Sealant

- Hair Color: Drybar Blonde Ale Color-Enhancing Brightening Hair Mask

Top 5 Hair Brands:

- Olaplex

- Living Proof

- Moroccan Oil

- Bb Bumble and bumble

- Oribe

Topping the Lists in Skin Care

2020 Skincare Top Launch:

- Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

More Top Skincare Launches in 2020:

- #1 in Units: Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

- #1 Black Friday: Philosophy Purity Made Simple One-Step Facial Cleanser Paraben Free

- #1 Online: Clinique Limited Edition Moisture Surge 72-Hour Auto Replenishing Hydrator

- #1 Velocity: Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

- #1 in New York: Estée Lauder Advanced Night Repair Synchronized Multi-Recovery Complex

Top 5 Skincare Brands:

- Clinique

- Estée Lauder

- Lancôme

- Kiehl’s

- La Mer

Topping the Lists in Makeup

US Makeup, 2020 Makeup Top Launch:

- Too Faced Cosmetics – Born This Way, The Natural Nudes Eye Shadow Palette

More #1 Makeup Launches in 2020:

- #1 in Units: Benefit Cosmetics Brow Microfilling Eyebrow Pen

- #1 Black Friday: MAC Powder Kiss Liquid Lipcolour

- #1 Online: Too Faced Cosmetics - Born This Way, The Natural Nudes Palette

- #1 Velocity: Hermes Satin Rouge Lipstick

- #1 in New York: Too Faced Cosmetics - Born This Way, The Natural Nudes Palette

Top 5 Makeup Brands:

- MAC

- It Cosmetics

- Clinique

- Benefit

- Lancôme

Topping the Lists in Fragrance

Top 10 Fragrance Launches:

- Marc Jacobs Perfect

- Acqua Di Gio Profundo

- Armani My Way

- Valentino Voce Viva

- Coach Dreams

- Paco Rabanne 1 Million Parfum

- Coco Mademoiselle L’Eau Privée

- Good Girl Supreme

- Polo Deep Blue Coach Blue

Top 5 Prestige Men’s Fragrance Parent Brands:

- Sauvage

- Bleu De Chanel

- Acqua Di Gio Pour Homme

- YSL Y Homme

- Gucci Guilty Homme

Read Next

Drunk Elephant is our Beauty Company of the Year: Excellence in PackagingKey Insights on Lip Color & Mascara Packaging