Jamie Matusow, Editor-in-Chief , with Joanna Cosgrove, Contributing Editor11.02.18

Update: Procter & Gamble ranks at #4 on our latest report Top 20 Global Beauty Companies 2021.

P&G is #4 on this year's list of Top Global Beauty Companies.

Below is a look at its brands, acquisitions, and the company’s 2018 highlights, including its SmartLabel initiative.

Corporate Sales

$66.8 billion

Beauty Sales

$12.4 billion

(FY 2017 Beauty Sales: $11.8 billion)

Key Personnel

Major Products/Brands

New Products

P&G Markets 65 brands In 10 Categories

P&G has been simultaneously adding value and tightening its belt to fortify its bottom line for long-term growth. Brand-wise, the company eliminated and/or consolidated over 100 non-core brands, slimming its category representation from 16 to 10 in 2016.

By focusing on 65 brands in 10 categories, P&G’s net income rose slightly last year to nearly $10.2 billion, with net sales driven by North America (44%), Europe (24%), Asia Pacific and Greater China (both 9%), and Latin America and India/Middle East/Africa (both 7%). Beauty and grooming represented 19% and 10% of total net sales, respectively, with Beauty net sales increasing 9%, thanks to single-digit increases in hair care, skin and personal care volumes.

After successfully trimming $10 billion from fiscal 2012 through 2016, P&G is working to save an additional $10 billion through 2021 by shrinking the reducing raw and packaging material costs, manufacturing expenses, transportation and warehousing. The company also continues to optimize the money it spends on marketing by ratcheting down on media costs related to agency fees and advertising production costs while heightening efficiencies associated with in-store materials and sampling programs.

That’s not all. P&G eliminated 2,720 jobs in 2017, this after cutting 2,120 jobs in 2016. The company also announced it was restructuring the compensation for some of its top executives, including CFO Jon Moeller, who saw his salary increase 5.3% when he was named vice chairman, but his bonus this fiscal year was reduced by 23.5%. CEO David Taylor’s base salary remained constant, but his total compensation fell about 4% overall.

Amidst the cuts, there were some strategic additions. In March, P&G acquired New Zealand-based Snowberry, which markets a carboNZero-certified range of anti-aging skincare products.

In April, P&G also acquired the consumer health business of Merck KGaA for about $4.2 billion, which P&G said would help expand its “consumer health care business by adding a fast-growing portfolio of differentiated, physician-supported brands across a broad geographic footprint” as well as providing P&G “with strong health care commercial and supply capabilities, deep technical mastery and proven consumer health care leadership that will complement P&G’s existing consumer health care capabilities and brands such as Vicks, Metamucil, Pepto-Bismol, Crest and Oral-B.”

And in May, the company implemented a new SmartLabel initiative designed to improve brand transparency. Over 3,500 P&G products across the company’s brand portfolio now feature the interactive label, which enables consumers to access detailed information such as product ingredients, usage instructions, certifications and endorsements using online and mobile platforms.

News of Note in 2018

P&G announced a 3% increase in net sales ($16.5 billion) versus last year when it released its fourth quarter results in July. The growth was driven by a 7% increase in organic sales in the company’s beauty segment and double digit increases in skin and personal care organic sales. Organic sales in the grooming segment dipped 3%.

Looking Ahead

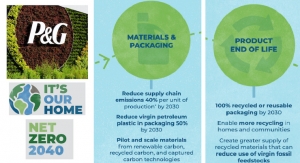

In April, P&G announced the launch of Ambition 2030, a package of broad, forward-looking goals that aimed to “enable and inspire positive impact on the environment and society while creating value for the company and consumers.” Among the targets are inspiring responsible consumption through the use of 100% recyclable/reusable packaging and launching “more sustainable innovations.”

Read Next: Coty is #5

P&G is #4 on this year's list of Top Global Beauty Companies.

Below is a look at its brands, acquisitions, and the company’s 2018 highlights, including its SmartLabel initiative.

Corporate Sales

$66.8 billion

Beauty Sales

$12.4 billion

(FY 2017 Beauty Sales: $11.8 billion)

Key Personnel

- David Taylor, chairman, president and chief executive officer

- Gary Coombe, president, global grooming

- R. Alexandra Keith, president, global hair care and beauty sector

- Juan Fernando Posada, president, Latin America selling and market operations

- Matthew Price, president, Greater China selling and marketing operations

- Marc Pritchard, chief brand officer

- Jeffrey Shomburger, global sales officer

- Markus Strobel, president, global skin & personal care

- George Tsourapas, president, global home care and P&G Professional

Major Products/Brands

- Aussie, Gillette shaving products, Head & Shoulders

- Herbal Essences, Vidal Sassoon, Rejoice hair care

- Ivory, Olay, Old Spice, Pantene, Rejoice, Safeguard

- Secret, Crest, Fixodent, SK-II, Oral-B,

- Scope and Art of Shaving

New Products

- Pantene Smooth & Sleek

- Olay Whips and Olay Minis skin care products

- Herbal Essences Bio Renew

- Old Spice Red Collection scents

- Snowberry skin care

P&G Markets 65 brands In 10 Categories

P&G has been simultaneously adding value and tightening its belt to fortify its bottom line for long-term growth. Brand-wise, the company eliminated and/or consolidated over 100 non-core brands, slimming its category representation from 16 to 10 in 2016.

By focusing on 65 brands in 10 categories, P&G’s net income rose slightly last year to nearly $10.2 billion, with net sales driven by North America (44%), Europe (24%), Asia Pacific and Greater China (both 9%), and Latin America and India/Middle East/Africa (both 7%). Beauty and grooming represented 19% and 10% of total net sales, respectively, with Beauty net sales increasing 9%, thanks to single-digit increases in hair care, skin and personal care volumes.

After successfully trimming $10 billion from fiscal 2012 through 2016, P&G is working to save an additional $10 billion through 2021 by shrinking the reducing raw and packaging material costs, manufacturing expenses, transportation and warehousing. The company also continues to optimize the money it spends on marketing by ratcheting down on media costs related to agency fees and advertising production costs while heightening efficiencies associated with in-store materials and sampling programs.

That’s not all. P&G eliminated 2,720 jobs in 2017, this after cutting 2,120 jobs in 2016. The company also announced it was restructuring the compensation for some of its top executives, including CFO Jon Moeller, who saw his salary increase 5.3% when he was named vice chairman, but his bonus this fiscal year was reduced by 23.5%. CEO David Taylor’s base salary remained constant, but his total compensation fell about 4% overall.

Amidst the cuts, there were some strategic additions. In March, P&G acquired New Zealand-based Snowberry, which markets a carboNZero-certified range of anti-aging skincare products.

In April, P&G also acquired the consumer health business of Merck KGaA for about $4.2 billion, which P&G said would help expand its “consumer health care business by adding a fast-growing portfolio of differentiated, physician-supported brands across a broad geographic footprint” as well as providing P&G “with strong health care commercial and supply capabilities, deep technical mastery and proven consumer health care leadership that will complement P&G’s existing consumer health care capabilities and brands such as Vicks, Metamucil, Pepto-Bismol, Crest and Oral-B.”

And in May, the company implemented a new SmartLabel initiative designed to improve brand transparency. Over 3,500 P&G products across the company’s brand portfolio now feature the interactive label, which enables consumers to access detailed information such as product ingredients, usage instructions, certifications and endorsements using online and mobile platforms.

News of Note in 2018

P&G announced a 3% increase in net sales ($16.5 billion) versus last year when it released its fourth quarter results in July. The growth was driven by a 7% increase in organic sales in the company’s beauty segment and double digit increases in skin and personal care organic sales. Organic sales in the grooming segment dipped 3%.

Looking Ahead

In April, P&G announced the launch of Ambition 2030, a package of broad, forward-looking goals that aimed to “enable and inspire positive impact on the environment and society while creating value for the company and consumers.” Among the targets are inspiring responsible consumption through the use of 100% recyclable/reusable packaging and launching “more sustainable innovations.”

Read Next: Coty is #5