By Jamie Matusow with Joanna Cosgrove, Editor-in-Chief with Contributing Editor11.01.17

Update: Coty ranks at #13 on our latest report Top 20 Global Beauty Companies 2021.

New York, NY

www.coty.com

Beauty Sales:

$7.7 Billion

Key Personnel:

Camillo Pane, chief executive officer; Edgar Huber, president, luxury; Laurent Kleitman, president, Coty Consumer Beauty; Andrew Stanleick, senior vice president, Coty Consumer Beauty Europe; Daniel Ramos, chief scientific officer; Sylvie Moreau, president, professional beauty.

Major Products/Brands:

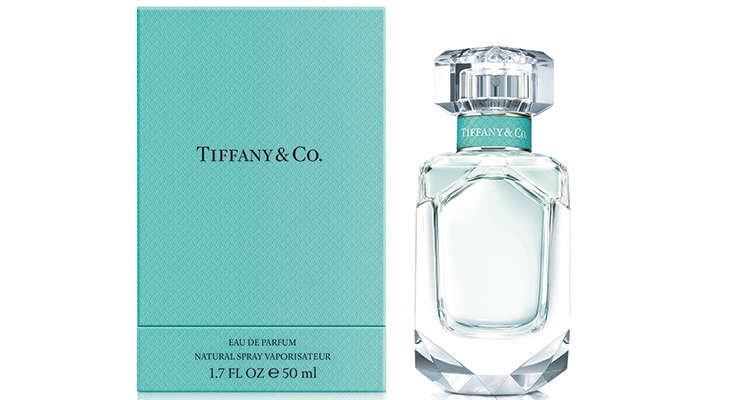

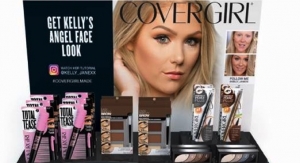

Coty Consumer Beauty: color cosmetics, retail hair coloring and styling products, body care and mass fragrances including Adidas, Bourjois, Clairol, CoverGirl, David Beckham, Katy Perry, Max Factor, Rimmel, Sally Hansen and Wella; Coty Luxury: prestige fragrances, skincare and beauty including Marc Jacobs, Calvin Klein, Chloé, Gucci, Hugo Boss, Balenciaga, Bottega Veneta, Alexander McQueen, Davidoff and Miu Miu, Lancaster and philosophy; Coty Professional Beauty: Clairol Professional, Nioxin, OPI, Sebastian Professional, System Professional and Wella Professionals.

New Products:

Fragrances: Calvin Klein Deep Euphoria, Joop! Homme Sport, Davidoff Horizon, Miu Miu, Marc Jacobs Decadence, Marc Jacobs Divine Decadence, Marc Jacobs Splash; Color cosmetics: OPI Hello Kitty, OPI Infinite Shine; Skin care: Playboy Play It Wild, Adidas UEFA Champions League Edition, Adidas toiletries, Adidas Born Original.

Comments: In late 2015, Coty committed to a complex plan to broaden its beauty presence, improve its management team and restructure its divisions that transformed the brand into a leaner, meaner beauty category competitor. That momentum hinged on solidifying Coty’s standing as a top major player in beauty with a splashy, $12 billion purchase of popular but struggling P&G brands two years ago. The company also snapped up the license to Burberry Beauty, and in February 2016 completed the acquisition of the beauty and personal care business of Hypermarcas SA, gaining a leg up in the Brazilian beauty market. While Coty’s growth strategy was structured for the long-term, the short-term results last year weren’t overwhelmingly positive.

Despite ranking No. 1 in fragrance, No. 2 in professional haircare and No. 3 in color cosmetics, the company experienced a 1% sales dip in 2016. Coty’s fragrance sales accounted for 46% of its 2016 sales, followed by cosmetics (36%) and skin/body care (16%).

By category, skin and body care sales dipped 10% to $693 million, with every brand in the company’s skincare stable reporting a decline in sales. The fragrance category also suffered an 8% loss. Coty execs lamented the loss, nodding to the declined interest in celebrity and lifestyle brands, all except for the Marc Jacobs franchise, which posted gains.

Coty’s color cosmetics group was the only segment that delivered in 2016, with sales climbing 7% to more than $1.5 billion. Coty singled out Sally Hansen as a bright spot, but acknowledged that OPI, NYC New York Color and Astor all dipped slightly.

Coty reported that its Professional and Luxury divisions performed well. Luxury category net revenues increased 40% to $2.6 billion compared to Legacy-Coty net revenues in the prior-year reflecting the contribution from the acquired P&G Beauty Business. Luxury net revenues decreased 1% for the combined company at constant currency compared to the prior year, reflecting declines in Calvin Klein and Marc Jacobs partly offset by growth in Hugo Boss, philosophy and Chloe.

In the Consumer Beauty division, net revenues increased 63% to $3.7 billion as reported compared to the previous year, which the company attributed to contributions from the acquired P&G Beauty Business, Younique and Hypermarcas brands. Consumer Beauty net revenues decreased 2% for the combined company at constant currency compared to the prior year, reflecting a 10% organic decline largely offset by positive contributions from both Younique and seven months of the Hypermarcas Brands. The organic decline reflected weakness in several of the acquired P&G Beauty Business brands CoverGirl, Clairol and Wella Retail, as well as continued weakness in the U.S. nail category which pressured the Sally Hansen brand.

Professional Beauty net revenues increased 10%, jumping from $250 million to $1.4 billion thanks in large part to the P&G Beauty Business and ghd acquisitions. Strong momentum in Wella and System Professional salon hair care was offset by declines in OPI, though these declines moderated in Q4 compared to prior quarters.

Looking Ahead

2017 continues to be transformational for Coty. Despite a 5% increase in sales in Q3 2017 after stacking their deck with a ready-made stable of popular consumer brands, Coty shocked the market with a surprise Q4 slump that saw shares fall 13%. Excluding the positive contribution from the acquisitions of ghd and Younique, the company’s combined organic net revenues declined 3%. Executives pointed to unexpected costs connected to specific P&G brands it had acquired (CoverGirl, Max Factor cosmetics and Clairol hair dyes), owning up to the realization that the brands were struggling more than they had originally realized when Coty acquired them.

While the company didn’t discuss a long- or short-term strategy to kick start a turnaround, CEO Camillo Pane held firm to his belief that the brands were still a solid acquisition and that Coty was better positioned to turn them toward success than their two previous corporate owners.

New York, NY

www.coty.com

Beauty Sales:

$7.7 Billion

Key Personnel:

Camillo Pane, chief executive officer; Edgar Huber, president, luxury; Laurent Kleitman, president, Coty Consumer Beauty; Andrew Stanleick, senior vice president, Coty Consumer Beauty Europe; Daniel Ramos, chief scientific officer; Sylvie Moreau, president, professional beauty.

Major Products/Brands:

Coty Consumer Beauty: color cosmetics, retail hair coloring and styling products, body care and mass fragrances including Adidas, Bourjois, Clairol, CoverGirl, David Beckham, Katy Perry, Max Factor, Rimmel, Sally Hansen and Wella; Coty Luxury: prestige fragrances, skincare and beauty including Marc Jacobs, Calvin Klein, Chloé, Gucci, Hugo Boss, Balenciaga, Bottega Veneta, Alexander McQueen, Davidoff and Miu Miu, Lancaster and philosophy; Coty Professional Beauty: Clairol Professional, Nioxin, OPI, Sebastian Professional, System Professional and Wella Professionals.

New Products:

Fragrances: Calvin Klein Deep Euphoria, Joop! Homme Sport, Davidoff Horizon, Miu Miu, Marc Jacobs Decadence, Marc Jacobs Divine Decadence, Marc Jacobs Splash; Color cosmetics: OPI Hello Kitty, OPI Infinite Shine; Skin care: Playboy Play It Wild, Adidas UEFA Champions League Edition, Adidas toiletries, Adidas Born Original.

Comments: In late 2015, Coty committed to a complex plan to broaden its beauty presence, improve its management team and restructure its divisions that transformed the brand into a leaner, meaner beauty category competitor. That momentum hinged on solidifying Coty’s standing as a top major player in beauty with a splashy, $12 billion purchase of popular but struggling P&G brands two years ago. The company also snapped up the license to Burberry Beauty, and in February 2016 completed the acquisition of the beauty and personal care business of Hypermarcas SA, gaining a leg up in the Brazilian beauty market. While Coty’s growth strategy was structured for the long-term, the short-term results last year weren’t overwhelmingly positive.

Despite ranking No. 1 in fragrance, No. 2 in professional haircare and No. 3 in color cosmetics, the company experienced a 1% sales dip in 2016. Coty’s fragrance sales accounted for 46% of its 2016 sales, followed by cosmetics (36%) and skin/body care (16%).

By category, skin and body care sales dipped 10% to $693 million, with every brand in the company’s skincare stable reporting a decline in sales. The fragrance category also suffered an 8% loss. Coty execs lamented the loss, nodding to the declined interest in celebrity and lifestyle brands, all except for the Marc Jacobs franchise, which posted gains.

Coty’s color cosmetics group was the only segment that delivered in 2016, with sales climbing 7% to more than $1.5 billion. Coty singled out Sally Hansen as a bright spot, but acknowledged that OPI, NYC New York Color and Astor all dipped slightly.

Coty reported that its Professional and Luxury divisions performed well. Luxury category net revenues increased 40% to $2.6 billion compared to Legacy-Coty net revenues in the prior-year reflecting the contribution from the acquired P&G Beauty Business. Luxury net revenues decreased 1% for the combined company at constant currency compared to the prior year, reflecting declines in Calvin Klein and Marc Jacobs partly offset by growth in Hugo Boss, philosophy and Chloe.

In the Consumer Beauty division, net revenues increased 63% to $3.7 billion as reported compared to the previous year, which the company attributed to contributions from the acquired P&G Beauty Business, Younique and Hypermarcas brands. Consumer Beauty net revenues decreased 2% for the combined company at constant currency compared to the prior year, reflecting a 10% organic decline largely offset by positive contributions from both Younique and seven months of the Hypermarcas Brands. The organic decline reflected weakness in several of the acquired P&G Beauty Business brands CoverGirl, Clairol and Wella Retail, as well as continued weakness in the U.S. nail category which pressured the Sally Hansen brand.

Professional Beauty net revenues increased 10%, jumping from $250 million to $1.4 billion thanks in large part to the P&G Beauty Business and ghd acquisitions. Strong momentum in Wella and System Professional salon hair care was offset by declines in OPI, though these declines moderated in Q4 compared to prior quarters.

Looking Ahead

2017 continues to be transformational for Coty. Despite a 5% increase in sales in Q3 2017 after stacking their deck with a ready-made stable of popular consumer brands, Coty shocked the market with a surprise Q4 slump that saw shares fall 13%. Excluding the positive contribution from the acquisitions of ghd and Younique, the company’s combined organic net revenues declined 3%. Executives pointed to unexpected costs connected to specific P&G brands it had acquired (CoverGirl, Max Factor cosmetics and Clairol hair dyes), owning up to the realization that the brands were struggling more than they had originally realized when Coty acquired them.

While the company didn’t discuss a long- or short-term strategy to kick start a turnaround, CEO Camillo Pane held firm to his belief that the brands were still a solid acquisition and that Coty was better positioned to turn them toward success than their two previous corporate owners.