Karine Dussimon, Euromonitor International 04.28.16

Despite high market maturity levels and an increasingly knowledgeable consumer, beauty and personal care packaging has room to grow further in Western Europe and should see PET bottles benefit the most. While consumers are asking for more premium offerings, environmental concerns around packaging waste in beauty are increasing, too. The sustainability debate may not seem obvious when looking at beauty and personal care products in the aisles, but it is changing the requirements of successful packaging innovation in the industry. PET’s recyclability profile and shelf appeal makes it a favorite material.

Volume sales of beauty and personal care packaging in Europe grew by 1% over 2015 to reach 22.5 billion units. This was achieved while Western Europe continues to be characterized by relatively slow growth of its consumer base compared to world levels, high market maturity and tough economic conditions. On the other hand, Western European consumers each spend significantly more on personal care products than the global average and this per capita spend is still growing faster than the global average, too.

Premiumization trend in beauty sees tubes taking the edge off HDPE

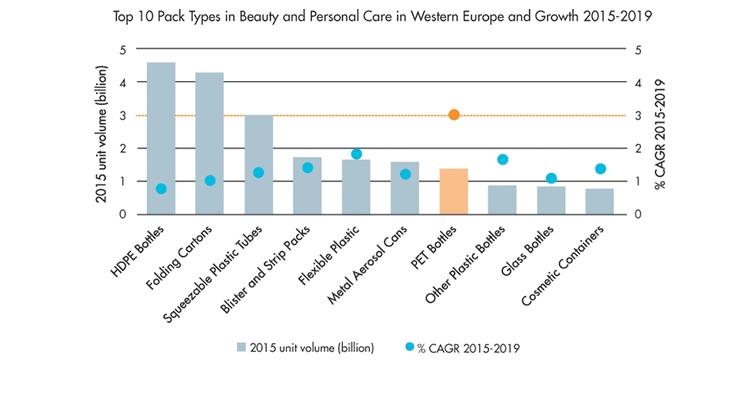

HDPE bottles unsurprisingly dominate the beauty and personal care packaging landscape in Western Europe; many everyday essentials such as shampoo and body wash are commonly found in this pack type. Squeezable plastic tubes are, however, set to show slightly brighter prospects over 2015-2019, with a CAGR of 1%, a stronger performance than predicted for HDPE. Plastic tubes are gaining presence in the region due to a premiumization trend. Tubes are, for example, better at competing with HDPE bottles in the big formats, as illustrated by the launch of Vichy aftersun by Cosmétique Active International in 300ml and Cadum body care in 400ml in France in 2015. Aside from their core position in fragrances, glass bottles are still largely confined to the much lower volume, super-premium and luxury platforms.

PET ahead as it combines premium and green perception

But the pack type that is promising the best outlook remains the PET bottle, with a 3% CAGR or an extra 174 million units expected to be sold in Western Europe over 2015-2019. PET is bound to expand its presence in bath and shower, hair care and also skin and sun care. In The Netherlands, body care brand Etos was introduced in 2015 in a range of 250ml PET bottles. As well as providing good visual differentiation, it offers brand owners a positive environmental image. The pack type is still largely perceived to be recyclable and therefore sustainably viable; an interesting advantage when we know the financial viability of its recycling operations is threatened with challenges such as recycling colored PET. Green perception matters in Western Europe. It matters as Unilever’s compressed deodorants continue to replace the larger; as standard formats equally based on a sustainable claim; as plastics is the only core pack material for which recycling targets were raised over 2016 in Holland; and as retailers in France are increasingly exploring the route of product selling with no packaging at all.

Western Europe is forecast to see further growth in beauty and personal care packaging, rising by a CAGR of 1% to 2019, an outlook which remains more dynamic than in North America or Eastern Europe. Looking forward, beauty packaging will need to help brands offer a greater consumer experience while responding to growing pressures on their sustainability profile. Succeeding in the long term will likely involve collaborative work along the supply chain, as well as with packaging waste bodies, and effectively communicating on packaging innovation toward greener credentials.

Karine Dussimon

About the author:

Karine Dussimon is sr. packaging analyst at Euromonitor International. [email protected]

Volume sales of beauty and personal care packaging in Europe grew by 1% over 2015 to reach 22.5 billion units. This was achieved while Western Europe continues to be characterized by relatively slow growth of its consumer base compared to world levels, high market maturity and tough economic conditions. On the other hand, Western European consumers each spend significantly more on personal care products than the global average and this per capita spend is still growing faster than the global average, too.

Premiumization trend in beauty sees tubes taking the edge off HDPE

HDPE bottles unsurprisingly dominate the beauty and personal care packaging landscape in Western Europe; many everyday essentials such as shampoo and body wash are commonly found in this pack type. Squeezable plastic tubes are, however, set to show slightly brighter prospects over 2015-2019, with a CAGR of 1%, a stronger performance than predicted for HDPE. Plastic tubes are gaining presence in the region due to a premiumization trend. Tubes are, for example, better at competing with HDPE bottles in the big formats, as illustrated by the launch of Vichy aftersun by Cosmétique Active International in 300ml and Cadum body care in 400ml in France in 2015. Aside from their core position in fragrances, glass bottles are still largely confined to the much lower volume, super-premium and luxury platforms.

PET ahead as it combines premium and green perception

But the pack type that is promising the best outlook remains the PET bottle, with a 3% CAGR or an extra 174 million units expected to be sold in Western Europe over 2015-2019. PET is bound to expand its presence in bath and shower, hair care and also skin and sun care. In The Netherlands, body care brand Etos was introduced in 2015 in a range of 250ml PET bottles. As well as providing good visual differentiation, it offers brand owners a positive environmental image. The pack type is still largely perceived to be recyclable and therefore sustainably viable; an interesting advantage when we know the financial viability of its recycling operations is threatened with challenges such as recycling colored PET. Green perception matters in Western Europe. It matters as Unilever’s compressed deodorants continue to replace the larger; as standard formats equally based on a sustainable claim; as plastics is the only core pack material for which recycling targets were raised over 2016 in Holland; and as retailers in France are increasingly exploring the route of product selling with no packaging at all.

Western Europe is forecast to see further growth in beauty and personal care packaging, rising by a CAGR of 1% to 2019, an outlook which remains more dynamic than in North America or Eastern Europe. Looking forward, beauty packaging will need to help brands offer a greater consumer experience while responding to growing pressures on their sustainability profile. Succeeding in the long term will likely involve collaborative work along the supply chain, as well as with packaging waste bodies, and effectively communicating on packaging innovation toward greener credentials.

Karine Dussimon

Karine Dussimon is sr. packaging analyst at Euromonitor International. [email protected]