Jamie Matusow, Editor-in-Chief08.30.19

Regionalization of supply and dialogue around tariffs are behind a current upswing in the popularity of beauty industry manufacturing in the U.S. Here, suppliers comment on the pros and possible pitfalls in a global economy.

As with manufacturing companies in general, suppliers in the beauty industry range from those that are firmly based in the U.S., to those that operate in facilities elsewhere in the world. Over the past decade, with speed-to-market becoming ever more critical in the cosmetics industry, a number of global companies have taken advantage of opportunities to open plants and produce packaging and formulation in the United States, in close proximity to their American customers. Perks can include operating in the same time zone, easy communication, flexibility, prompt technical support, lower shipping costs and quality control—as well as contributing to domestic job growth.

Meanwhile, many prominent cosmetic packaging manufacturers continue to combine a global supply chain with domestic production to best meet clients’ needs in various regions of the world.

This year, the talk of and, the reality of, imposed taxes—and the unknown future of increased tariffs (at press time)—has made U.S. manufacturing more appealing to some, while others say their global supply chains remain as strong as ever, and price increases are negligible to consumers. In any respect, it’s become a hot—and often volatile—topic in the industry. While there are many complex factors involved, a number of suppliers we spoke with for this article emphasized that, for a variety of reasons, more and more customers are asking for “Made in the USA.”

Mixed Messages

Beauty Packaging reached out to a number of manufacturers, some based in the U.S., others that operate global, regional and domestic facilities, in order to get a closer look at where USA cosmetic manufacturing stands today—and what the future may hold.

Mitchell Kaneff, chairman/CEO of Arkay Packaging, says: “There was a time when a company could proudly announce that its products were exclusively made in the USA, but the world of commerce and manufacturing has gotten more complex in recent years where you can manufacture something in a domestic facility, but still rely on a foreign country for parts. Regardless, there is a strong advantage for domestic manufacturing and Arkay Packaging is one of those companies that takes great pride in having our manufacturing facility right in Roanoke, VA, as well as both our design studio and sales office in New York.” He adds: “At the end of the day, the pros outweigh the cons in terms of USA-made product: cost, access, shipping, and timeline/speed to market are obvious, but there are also tax benefits and general supply chain benefits. Additionally, there’s a strong public relations component when a company such as Arkay Packaging can manufacture on American soil and contribute to the employment and well-being of a local community and region.”

At JSN Cosmetic Packaging, headquartered in Irvine, CA, Casey Nagel, vice president business development, tells Beauty Packaging: “Regardless of individual political persuasion, U.S. manufacturing is enjoying an expansive opportunity. The recent tax law incentives have encouraged investment in new capacity which, as a tube and closure manufacturer with high cap expenditure requirements, is certainly valued. It’s also helped stem the flow of companies moving production out of the U.S., which we believe benefits the entire gamut of packaging manufacturers. We expect this to continue unless there is a political change to one less favorable or supportive of business.” As a side note, Nagel says this happens to be concurrent with increasing off-shore costs in both labor and freight.

While brand owners have expressed concerns with the potential impact of tariffs and uncertainty related to trade negotiations with China—and while these macro-economic concerns weigh on their purchasing decisions, Doug Doroh, vice president sales & marketing, at Oliver Inc., Hauppauge, NY, says it is the ability to react quickly that is stated as a main driver to use domestic manufacturers.

Doroh says that companies are concerned with responding to shifting consumer demands, ingredient changes, and the ability to add graphics for retail promotions. “There is a fundamental loss of control when packaging is produced on the other side of the world, and with compressed manufacturing schedules, buyers are immersed in controlling the process from art creation and proofing to delivery,” he explains. “At Oliver, we’ve made significant investments to streamline our processes, upgrade equipment with higher speeds, and increased capabilities for short-run digital folding cartons to meet these demands. We want print and folding carton packaging Made in the USA to be a cost-effective, reliable, and quality choice for all of our customers.”

On-Shoring or Moving Elsewhere

Some suppliers view the movement toward U.S. manufacturing as on-shoring—what’s moved to countries like China is making its way back.

At Compax Packaging, Jing Santos, VP of sales, says the company continues to grow its U.S. production facilities year-after-year to keep up with domestic demand, doubling production capacity in their Salt Lake City facility in the last year alone. He says, “The industry recognizes the benefits of manufacturing domestically—lower lead times, higher quality, a reduced carbon footprint and, the biggest selling point over the past year—no tariffs. More and more customers are asking for Made in the USA.” What are they requesting specifically? Santos says “tubes, bottles, glass, lipgloss, mascara, custom airtight closures—everything.”

Compax’s focus on U.S. production was a cost and time benefit in producing L’Oréal’s Urban Decay Setting Spray.

Seven years ago, Compax produced Urban Decay’s Setting Spray in China. As product volume grew, L’Oréal wanted reduced lead times and reduced cost. The answer: Santos says, “We brought production stateside to our SLC facility three years ago, reducing lead time by six weeks and cost by approximately 30%.”

Michael King, president & CEO of Eagle Systems, Ocean, NJ, says: “Manufacturing is coming back to the States. In many areas, what moved to China is making its way back, mainly because the economics are moving towards an even playing field.” He explains, “What some folks are calling trade wars, I call fair trade. Balancing the duty scales on both sides is a good thing short- and long-term. For too long, the U.S. has been selling overseas and duty charges have been astronomical for selling equipment. When products were sold to the USA, there was no duty.”

Voicing a slightly different perspective, Anthony Grinnell, CEO, Harmony Paper Company, Sedalia, MO, observes: “What we are seeing is not so much a movement toward the U.S., but a movement out of China. Some of the manufacturing is coming back to the U.S., but most of it is simply moving to other overseas manufacturers that do not have tariffs. Where we are seeing the greatest migration of raw materials and finishing processes coming back to the U.S. are on those that did not have a substantial pricing advantage to begin with.”

Talking Tariffs

Grinnell says the progression has accelerated drastically over the last few months. “When President Trump imposed the list 1 and list 2 tariffs, many thought it would end there and that the proposed list 3 tariffs on $200 billion worth of imported goods was a ‘bluff.’ When the list 3 10% was enacted, many, myself included, were shocked.

However, a 10% tariff, while high enough to throw high volume commoditized goods into panic mode, was not enough to dissuade the sourcing of non-commoditized, premium goods. Many expected those tariffs to bring China to their knees and work out a deal shortly thereafter. Very few imagined it would escalate to the point of list 3 goods going to 25%. That increase has caused panic across virtually every company sourcing from China and has thrown supply chains into a tailspin.”

“Tariffs have impacted the cost calculation,” comments Scott L. Rusch, president and CEO, Anomatic Corporation, headquartered in New Albany, OH. “However, this does not automatically mean production moves to the U.S. as there are other low-cost country alternatives. Resourcing and retooling take time and vendors that are willing to invest.”

JSN’s Nagel says, “From the viewpoint of packaging manufacturing, segments that lost business to offshore production are now encouraged by former customers to ‘re-shore.’ Certainly, manufacturers dependent upon export will view a different world.”

Tariffs have incited a fairly immediate shift in U.S. business, according to Richard Engel Jr., president & COO of Decotech, located in Englewood, NJ. He tells Beauty Packaging: “Ever since the tariffs kicked in, there has been a rapid swing back to the U.S. for component and packaging sourcing. At Decotech we’re seeing increased business from existing clients along with many inquiries from new clients looking for local high-quality decoration on glass or plastic containers.”

Engel says they’ve also been told by more than one client that “the speed-to-market and rapid product development cycles they are experiencing from local suppliers like us now outweighs the pricing differentials caused by bringing business back from China.”

He says tariffs have “caused many brands to re-open their eyes to the fast and flexible supply base that exists right in their own backyard.” In addition, Engel says, “Late-stage differentiation has been increasingly adopted by more of our clients in the past 24 months. This year at Decotech, we’ve been involved in new developments from concept to finished goods in as little as six weeks. That’s next to impossible to execute with an offshore supply base.”

Eagle Systems’ King says tariffs are “creating more jobs here—and watching closely, you will see the growth in all sectors of products being produced here in the USA.”

Opening U.S. Doors

As mentioned, tariffs aren’t the only reason for manufacturing in the U.S. A number of suppliers are following the regionalization momentum, in which they choose to produce goods close to their customers—wherever they are in the world.

Regionalization of supply is a continuing trend, according to Anomatic’s Rusch. He tells Beauty Packaging, “Marketers have expressed a strong desire to manufacture products in the country or region to which they are selling. The advantages cited are short lead times to replenish, agility to accelerate production to meet surge in demand and speed-to-market for new products.”

However, regionalization is not without risk.

Rusch, says, “Naturally, my view as a manufacturer is that regionalized supply is a big advantage to the brand for the reasons mentioned earlier. The disadvantage for the manufacturer in the U.S. is the risk that trade policy reverts back, i.e, tariffs are removed. In this case, if the U.S. supplier expands production capacity through investments in plants and equipment, there is risk that over-capacity occurs.”

Tokiwa Cosmetics America, headquartered in Monroe Township, NJ, officially opened its doors at the end of April 2019. A division of Tokiwa Corp., it is the manufacturing hub of Tokiwa products for North America and Europe.

Robert Congionti, VP of operations, tells Beauty Packaging, “Tokiwa decided to build a large manufacturing site in the U.S.A. capable of manufacturing many of the same innovative products we produce in Japan, to satisfy the expected cosmetic needs of both North America and Europe.”

He says, “It is obvious that this is a timely issue that has become front and center due to the recent and severe tariff issues, but Tokiwa started to plan its move toward a U.S. manufacturing site several years ago, when sales growth in Japan, Europe and the U.S.A., began to pressure our Japanese manufacturing facilities and capabilities.” As far as tariffs, Congionti says, “I think that the longer the tariffs stay in place, there will be more of an effort for companies to quickly establish manufacturing operations in the U.S.”

Geka GmbH, strengthened its market presence in the American market opening a “cutting-edge” bottling plant in Elgin, IL, about 35 miles from Chicago. It has a clean room, temperature and humidity controls, and a laboratory for product testing—the same testing procedures as at its headquarters in Bechhofen, Germany—and works with local partners for “first-class formulations,” that have been carefully screened by Geka’s experts in Germany. Geka says it cooperates with locally based qualified laboratories to guarantee the highest quality.

According to Geka, “Customers want speed-to-market, quality, on-time delivery, lower shipping costs, and professional local project management to ensure expectations are met throughout the product launch. Geka’s investments at its site in the USA and future steps and plans for this region, show that Geka is reacting to the needs and requests of the dynamic beauty industry and its customers to improve Geka’s agility, live up to strong market dynamics, optimize processes and shorten lead times.”

An initial investment was made by Geka in September 2018: Hot-foil printing machines were installed to decorate complex, square bottles for lip gloss. The machine system has an inline image processing system which can fully check the print quality of the product. Therefore, Geka Elgin now offers full-service production in the areas of production, decoration and filling, including bottling.

On the other hand, Geka recently announced an expansion into Asia, with a production site in Shanghai bringing them closer to their Asian customers.

Schwan Cosmetics, also headquartered in Germany, chose Murfreesboro, TN for a “high-tech competence center” for the product development and manufacture of color cosmetics that Holli Montgomery, managing director Schwan Cosmetics USA, Inc., says “appeals to our clients from New York to San Francisco, providing them exclusive added value through the label ‘Made in the USA.’ With this move, they have merged their two plants—in Piscataway, NJ and Lewisburg, TN—into a single center of excellence which was inaugurated in September 2015.

In Murfreesboro, Schwan develops and manufactures a large variety of high-performing cosmetic products for lips, eyes, brows and face, especially offered on the U.S. market and focusing on their American consumers and their individual needs. The company offers sharpenable and mechanical pencils in slim and chubby form as well as liquid products like eye liners.

Advantages/Disadvantages for Brands and Suppliers

“Compared to offshore competition, USA manufacturing is performed in highly regulated environments,” says JSN’s Nagel. “It results in integrity of manufactured products with mandated use of pristine raw materials. Other advantages are of course the norm: proximity of supply, direct customer service, availability of technical support, time in shipping and time to shelves, ease of communication, on and on…”

Grinnell, of Harmony Paper, says: “Unfortunately, if the China/U.S. trade war continues, the world will see the negative impact for years to come. The short-term advantage is that some manufacturing will come back to the U.S. There are two long-term disadvantages. One is that pricing will go up on every product affected by the China tariffs. The reason companies source goods from overseas is to save money because it’s cheaper than manufacturing in the U.S. When their cost of goods goes up, so will the pricing to the retailers who sell their products and the consumers who buy them. The second is that the manufacturing coming back to the U.S. will inevitably leave again, once again driven by consumer demand for lower prices and company demands for higher profits. Whether that manufacturing goes back to China if/when tariffs are eliminated or if it goes to another country that takes China’s place, it will leave the U.S. again at some point. It’s a global economy today and it’s too easy to find suppliers and shop prices.”

According to Tokiwa’s Congionti, “The most obvious and instant benefits for a brand are the elimination of four-to-six-weeks transit time and import costs. Opportunities in development time for a new product or shade matching can be greatly reduced when your formulator or manufacturer is stateside. Multiple shade matching which could take weeks if not longer when done overseas, can be reduced to days if you can directly meet and work with the formulator. Color nuances are very difficult to communicate electronically, but very effective when done face to face.”

Another benefit for brands using a U.S. based manufacturer revolves around sustainability, as Compax’s Santos mentioned..

JSN’s Nagel says, “The current interest in Renewable and Sustainable brings into play an increasing concern over maintaining the pristine materials level we offer. It is yet another reason to be close to your manufacturer out of concern for the end product composition as well as maintaining precision of the manufacturing equipment.”

Arkay Packaging’s Kaneff says while the landscape has gotten more complex and there is concern about imposed tariffs, the core benefits of domestic manufacturing remain the same. He explains, “I think a ‘Made in America’ branding remains strong, especially in this climate of increasing awareness of a company’s carbon footprint and the use of sustainable materials. The knowledge the public might have of a ‘home-grown’ product, produced in a facility that is more transparent and can be proven eco-friendly has a great advantage over something that is entirely crated abroad. And we, as suppliers, profit from speed to market and the utilization of tax incentives, as well as supply chain benefits.”

According to Schwan’s Montgomery, “There’s a broad variety of advantages for our clients, including shorter lead times, domestic supply chains as well as a sustainable footprint, an increasingly growing issue for today’s customers.” In addition, she says, “Having a facility located in the U.S. also allows the brands that are in The Americas to visit our facility quite easily. Face-to-face interaction enables us as a company to build strong and long-time partnerships.”

Specific Customer Requests

While Santos from Compax is fielding specific requests, as mentioned earlier, Harmony Paper’s Anthony, finds that customers aren’t specifically requesting anything in terms of Made in the USA. He says, “What we are hearing rather is ‘where are your products made?’ Everyone is on edge and worried about supply chain reliability in China. There is no threat to the supply chain itself, only the prices paid.”

Recently Harmony supplied the paper for a large cosmetics brand carton. They manufactured the paper overseas and worked with a domestic packaging company on the West Coast to complete the project. He says, “This scenario worked out extremely well because we were still able to save the brand substantial costs on the materials, but they had the advantage of working with a domestic printer/converter. I am not discounting that there are some good quality packaging companies in China, but when it comes to outstanding craftsmanship, high standards in quality control, and communication, the U.S. is well ahead of China.”

At Tokiwa, Congionti says customers are requesting faster speed to market, especially with new products. “Working overseas to develop new products can definitely take much longer as opposed to working with a local qualified formulator or contract manufacturer.”

Challenges Remain

But U.S. production is not necessarily without challenges. Congionti says one of the challenges they face in the U.S. is that components are still coming in from overseas. He says, “Component manufacturers with flexible and global operations are looking at this situation closely and assessing a shift and/or expanding operations in the U.S.A., however the industry has not realized the full benefit potential with products entirely Made in the USA.”

Eagle System’s King says, “We will continue to grow if our government continues down the fair-trade path. If we switch back to selling, and duty fees against our product, then we will go downhill. I feel strongly about our economy growing. USA manufacturing had gone so far down, that with our economy now, there is not enough manufacturing in the USA and we and our customers are growing at amazing rates.

The northern California clean beauty brand Juice Beauty’s formulas are all developed, formulated and manufactured in the U.S., as is all of their secondary packaging. While the packaging of this product [shown], is not made in the USA, the brand is going into production with a USA-made component within the next couple of months.

Karen Behnke, founder, tells Beauty Packaging why the brand chooses domestic manufacturing when possible: “Juice Beauty is committed to our EcoValues and one important one is sustainability. Of course, our first goal is to have the highest level of certified organic ingredient content in our formulas to enhance the efficacy and for the health of our bodies and the planet. But our second goal is sustainability with packaging. Juice Beauty already uses as much glass as possible and prints with FSC certified paper and plant inks, but we are also making the move (starting with our sample tubes) to a bioresin process and moving our bestsellers to Made in the USA PCR (Post Consumer Recycled material) containers. We are excited about these efforts as we want to save on petroleum waste by limiting overseas shipping; the convenience of the U.S. with visiting factories and shipping is amazing; and we feel we have better control on quality and transparency. For all these reasons, Juice Beauty sources as many ingredients and packaging options as close to our California headquarters as possible.”

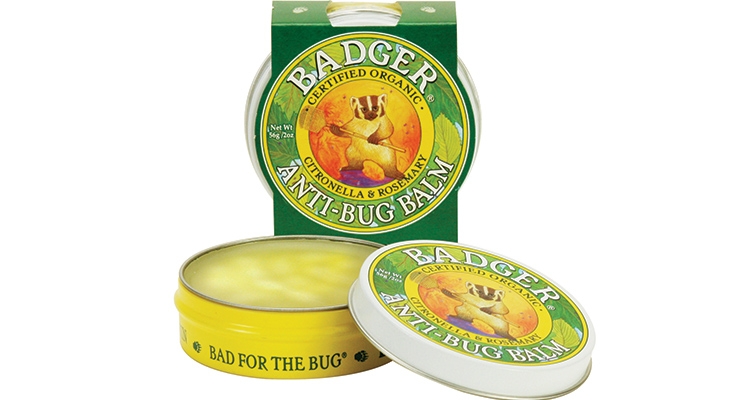

Headquartered in New Hampshire, W.S. Badger Co., Inc. is a family-owned and operated manufacturer of personal care for babies, kids, and adults. They specialize in anti-bug sunscreen and other related products, using organic, DEET-free formulas that are “Good for the Skin. Bad for the Bug” and safe for use by the whole family.

Badger is equally known for its unique company philosophy, pioneering family-friendly benefits, and B Corp community engagement, all of which has earned it numerous awards and recognition, including a spot on Forbes’ “Small Giants 2017: America’s Best Small Companies” list.

Rebecca Hamilton, co-CEO of W.S. Badger, tells Beauty Packaging: “We’ve made a conscious choice to partner with U.S. manufacturers whenever possible to keep our supply chain geographically short, reduce our overall environmental impact by conserving energy in freight and shipment of raw materials, and support U.S. labor and employment. We are proud of our communities, and we want to show that to the world.”

(Editor’s note: Hamilton was recently appointed to the nonpartisan federal advisory committee: The National Women’s Business Council. See the story here.)