Jamie Matusow, Editor-in-Chief08.31.20

Covid-19 has dramatically altered the world—and the Beauty industry—in many ways, and will likely continue to do so for some time. Over the past six months, with country lockdowns, retail closures and stalled manufacturing, the economy has shifted, leaving both cosmetic brands and packaging providers—among scores of others—reviewing their supply chains and strategies.

Some experts say that fully serving a global marketplace requires brands to engage regional suppliers in key markets to hedge their bets and aim to prevent supply chain disruptions. Other brands favor suppliers that operate on a Made in USA/Canada-only credo as a way to control production and satisfy a growing list of customers.

According to analysts at Technavio, the global cosmetic packaging market, which stood at $25.23 billion in 2015, is likely to reach $32.31 billion by 2020, growing at a CAGR of 5.07%. But the partial halt of manufacturing in the first two quarters—and perhaps, the near future—has not yet been fully calculated.

An Expected Recovery

In general terms, a recent survey conducted by The Institute for Supply Management, found that U.S. manufacturing rose slightly higher in May, and was on a path back toward health.

In a June 2020 report focused on ‘Cosmetic & Beauty Products Manufacturing in the U.S.’, industry researcher IBISWorld identified 3,878 U.S. cosmetic and beauty products manufacturing businesses with an annual growth of 2.4% (2015-2020). Revenue was determined to be $43.1 billion over the five years to 2020, including a decline of 7.4% in 2020, primarily due to Covid.

One noticeable disruption to the beauty industry this year has been the response to supply shortages for hand sanitizer and related items. IBISWorld points out that numerous companies in the U.S. cosmetics manufacturing industry retrofitted their facilities to produce these necessities which, while providing opportunities, may have also slowed production of the usual range of products.

The IBISWorld report notes: “As the industry returns to producing products after retrofitting facilities to aid against the coronavirus pandemic, it is expected to recover. Furthermore, rising consumer confidence and disposable income are expected to contribute to some increase in spending on discretionary industry products.”

Made in USA/Canada cosmetic packaging manufacturers interviewed for this article say they have continued to see a rising interest in brands seeking domestic solutions over the last decade—adding that the pandemic has now accentuated the trend due to a wide array of advantages, including flexibility, speed-to-market, quality control, safety, communication, supporting jobs and carbon footprint. In addition to attention on local supply, an emphasis on the environment remains strong. Many of the packaging manufacturers we spoke with stress brands’ growing demands for sustainable solutions, from materials to processes.

A Growing Trend in Light of Covid-19

Sophie Poirier, brand manager, Plastube, a tube manufacturer based in Canada, and close to the U.S. border, tells Beauty Packaging, they have seen a rising interest in beauty brand partners, both pre-and post-Covid.

She says, “Local sourcing is definitely a trend—driven by the increasing ambition to support the local economy and suppliers, as well as the increasing challenges/lead times related to importing products from overseas.”

In addition to sourcing, Poirier says many of the Indie brands they work with are also seeking advice. “They are looking for counseling and technical expertise to ensure they are selecting the right type of tube and the right decoration technology.”

Plastube’s vice president of sales & marketing, Stephane Beauchemin, adds, “We like to describe ourselves as the preferred partner for the brand owners, fillers and manufacturers of products packaged in tubes for small and medium volume.” As a medium-size tube manufacturer, Beauchemin says they have the ability to work with a wide range of customers and demonstrate the agility that is required to serve their business. “The fact that we also offer a wide variety of tube formats and materials as well as a wide range of decoration technologies enables us to show flexibility and adapt to our customers’ needs.”

Arkay Packaging was founded over 98 years ago in New York City by CEO Mitchell Kaneff’s grandfather, a Ukrainian immigrant who took great pride in starting a business in his adopted homeland. Noting this heritage,

Kaneff explains: “We feel honored that our roots are in the United States and for that reason, our predominant culture is one that consistently reinforces a belief in America.” Kaneff continues, “Arkay demonstrates this belief by consistently seeking to increase—and create—jobs, and always monitoring the kind of quality that a ‘Made in the USA’ label has come to represent.” Additionally, with a manufacturing plant in Virginia, as well as Arkay’s own trucking business (Arkay Logistics), Kaneff says the company is uniquely able to guarantee its customers rapid turnovers and speed to market.

Regarding Covid-19, Kaneff believes that the current pandemic has accelerated an interest in domestic suppliers. “Customers are understandably wary of counting on countries that have endured large outbreaks of the virus and who may also—abruptly and with little warning—restrict traffic to and from the USA.”

Sean Kavanaugh, senior account manager, JSN, Irvine, CA, which offers their own in-house manufactured caps to pair with their tubes, says, “The coronavirus crisis was another reminder to some customers to look to America again. The virus has put many packaging customers on edge. They are reassured knowing we are an ‘American owned and American made’ company ready to service their needs.” Additional capabilities at JSN include a wide array of deco options as well as sustainable packaging using sugar cane tubes and PCR caps and tubes.

Madeline Blondman & Co has been a Made in USA company since its inception and “before companies bought from China,” says Randi Barron, president. “We have always felt we wanted to support manufacturing in the U.S.—both from our factory as well as from our material suppliers. We feel we have better control over info and quality.”

Barron explains: “I have very good relationships with our suppliers. We do not shop around for suppliers—we prefer to stay with the products we know so we know their consistency, which is important to maintain because of compatibility with products. Keeping our suppliers local also allows us to procure material faster—and pass that onto our customers with faster turnaround times.”

Madeline Blondman has seen a rising interest in control over supply chain, says Barron, not due to the pandemic, but because “some smaller Indie brands are more likely to seek local suppliers.”

With facilities in both the U.S. and Canada, Montebello Packaging, which touts specialties in aluminum products, tubes and aerosol cans as well as laminate tubes for beauty products, has experienced rising demand from brands (“including several high-end U.S. cosmetic brands that have had a quick growth”) looking for a secure supply, customer service and fast turnaround. “Our logistics are within days,” says Kathy Mercer, Montebello’s director of sales. She says brands are very interested in aluminum sustainability requirements.

Mercer says Montebello drew additional attention during the Covid crisis from brands looking for a secure supply in Canada, and who had had an increase for hand sanitizer business. Additional demand caused by the pandemic was for personal care products, which rose with home do-it-yourself applications.

For more than 45 years, Berry Global, headquartered in Evansville, IN, has provided beauty and personal care packaging needs with hundreds of styles and sizes of bottles, tubes, jars, over caps and closures in an array of materials, sizes, colors, decorating options and textures—both stock and custom.

Josh Edmonson, business development manager Berry M&H, says they continue to see a rising interest in beauty brands partnering with U.S. suppliers. He explains, “With the beauty marketplace trending toward premiumization, brands recognize that their packaging must be a reflection of their quality products. Innovation doesn’t just stop at the product itself; it has to be delivered on the shelf by the packaging as well.”

He says brands are increasingly looking for more specialization in their packaging, whether it be through color and material finishes, high-end decoration or sustainability options. “These can all be difficult to find and control when trying to manage a manufacturer outside the U.S.,” says Edmonson. He adds: “Brands are choosing suppliers based on relationships and business performance, as well as quality, technical innovations and price. Suppliers who are true partners with the brands will win the business.”

In particular, says Edmonson, customers are asking for assurance of supply; quality; personal attention from concept to commercial execution; premium decorating; and quick turnaround for quotes.

Harmony Paper Company, Harmony, PA, is a specialty material supplier providing environmentally friendly alternatives for luxury packaging. Anthony Grinnell, CEO, says their primary focus is their plastic-free alternative to mylar, called EcoFX, which involves a 100% plastic-free manufacturing process and final product.

Grinnell says the company has seen an increase for U.S. production with certain types of products and it’s not just limited to packaging. “We’ve also seen this in the sign and display business with domestic brands and retailers, particularly for the upcoming holiday season,” he says. “While the coronavirus has certainly played a role in this, the push for eco-friendly products has also been a major factor. Although the U.S. is behind Europe in terms of sustainability, the U.S. is well ahead of Asia. There remains a substantial lack of knowledge, mis-information, and testing protocols within the Asian market for reliably producing environmentally friendly products. Chinese manufacturers who are not directly working with a U.S.-based operation or division are at quite a disadvantage in this respect,” says Grinnell.

Innovative Plastics Corporation, a thermoformer of both light-gauge and heavy-gauge plastics, has three facilities across the U.S. (NY, TN, AZ). They also offer contract packaging/fulfillment services using various types of packaging techniques (RF sealing, thermal heat sealing, decorating service, gluing service, shrink wrapping, etc.), have in-house design engineers and build all tooling in-house.

Ray Feghhi, sales director, Innovative Plastics, says, there are a number of advantages to being a U.S.-based supplier, one being that “the cosmetic industry appears to always want shorter lead times.” He says their ability to thermoform and contract pack in one facility helps meet this goal for many of their clients. “Sourcing all of these processes in the U.S. helps to achieve these reduced lead times,” says Feghhi.

Colts Plastics is celebrating 100 years of USA manufacturing with Jay Bentley recently taking the reins as the third-generation owner of the company. In-house capabilities include injection and compression molding, silk-screening, hot stamping, heat transfer and metallizing—as well as in-house mold building and engineering support to take care of both stock and custom packaging requirements. Mark Egan, VP sales & marketing, says: “We have an extensive line of stock jars and closures available along with spatulas and other accessories used in the industry. Our in-house mold building capability allows us to provide custom tooling quickly, and at a competitive price.”

Eagan says Colts has seen a rise in business of late. “Over the past year, we have seen a significant increase in brands looking for packaging that is manufactured domestically. In addition to domestic manufacturing, the brands are looking for the utilization of material that can be recycled and the use of PCR content.”

A Return from Overseas

Additionally, Eagan tells Beauty Packaging: “During the China shutdown, we saw an increase in requests for items that were currently being sourced from Asia. These requests are continuing and brands are also looking for dual sourcing from different regions to prevent future supply chain disruptions.”

Kaneff knows that inconsistent quality, communication and language challenges, as well as timeline delays, can plague overseas manufacturing for clients. He has seen many customers returning to Arkay—for instance, after manufacturing goods in China—to “fix” a carton ineptly produced elsewhere. “Customers trust and appreciate Arkay’s guarantee of quality, as well as our quick turnaround time,” says Kaneff. “This ability to respond rapidly is crucial, and with an American plant, we can do this.” He adds, “Through procurements, purchasing and marketing, everything is communicated to the factory quicker, and Arkay’s turnaround time reflects this speed.”

According to Kavanaugh, family-owned and operated JSN has touted their “American owned, American made” mantra since its start in 1984, and says, “We are pleased with the amount of inquiries from companies wanting to ‘come home’ and buy American again. Often now a first question from prospects is ‘Where is it made?’ The next request is for packaging that is more environmentally friendly.”

Recently, JSN had a customer that bought nearly all of their packaging from China. Kavanaugh says the brand began to experience diminishing returns trying to work within China parameters and decided to launch their next project using domestic suppliers. “They chose JSN as they needed someone with the flexibility to respond to their short turnaround requirements to meet a national launch.” He says they were able to meet their required dates, leading to additional new products being awarded to JSN.

Colts recently completed a 125ml custom package with a two-pass silkscreen that was originally scheduled to be completed in Asia. Eagan says, “When the shutdown occurred in China, we quickly tooled up for this package and provided the customer with the finished components to meet their deadline.”

Marc Silverberg, president, M C Packaging Corp., Farmingdale, NY, “a green-friendly” manufacturer of printed folding cartons and packers/carriers, says, “We began to feel the effects of Covid-19 back in February, when many of our multinational CPG clients began to feel the repercussions from overseas suppliers.” Category interest varies. Silverberg says, “Industries such as hospital supply and pharma have shown an interest in bringing manufacturing back to the U.S. However, the health and beauty category is growing globally, and the trend has been to produce closer to their markets.”

MC Packaging manufactures and designs cartons out of a 200,000-sq.-ft. facility that operates on 100% wind energy. Capabilities include a full-service in-house design and innovation department, 7-color UV printing, die cutting and gluing, specialty applications and specialized environmental coatings.

With the Covid crisis, Harmony Paper’s Grinnell says they’ve seen schedules being pushed back and time frames drastically tightening up. “In many cases” he says, “there is just no time for these brands and retailers to use overseas production, particularly with the challenges of working remotely and the resulting delays in finalizing projects.” In other cases, he says, “the uncertainty of a second massive Covid outbreak and the potential disruptions in supply chains, have created a conservative mentality among brands and retailers. Nevertheless, we are still seeing a very strong demand for overseas material supply, if the timing permits.”

Supply Chain Advantages

MC Packaging’s Silverberg tells Beauty Packaging that despite its obvious downsides, the pandemic has also brought opportunities to light—including an increasing demand for sustainable packaging.

Silverberg says with the pandemic affecting every continent, shutting down global supply chains and exposing vulnerabilities, “the pressure on supply chains to react and keep up is now presenting opportunities to reevaluate where and how products are produced.” He explains, “CPG companies have pushed their supply chains for even faster turnarounds and flexibility to adjust to sudden shifts in demand. Many of our clients have supplemented their manufacturing capabilities through contract manufacturers, which allowed them to also expand and innovate their products.” One necessity that has arisen he says, is the need to design environmental packaging, and its end of life processing will take front and center, as online shopping continues.

Plastube’s Beauchemin says chief is “the ability to reduce your inventory and buy material in smaller batches by purchasing from a local supplier that can adjust/adapt rapidly to your needs.”

In addition, says Plastube’s Poirier, “Brands are looking for competitive lead times and prices, a high level of quality, flexibility in MOQ and lead times, and they are looking for eco-friendly solutions to improve their carbon footprint.”

There are tremendous advantages in cost, access, shipping, timeline, tax benefits, general supply chain benefits, etc., according to Kaneff of Arkay Packaging. He says: “The sheer quality of Arkay’s work reflects a vigilant on-site workforce made up of employees who can oversee every step of the process because it’s all done stateside.” Kaneff concludes, “Essentially, Arkay believes in the quality of American craftsmanship.”

Dependable response is high on the list for JSN’s Kavanaugh. He says, “JSN is nimble, our advantage is flexibility. We have helped so many customers out of last-minute binds, saving their product launches.” He says they think of themselves as not just a supplier, but a problem solver. “The way we schedule our machines and our open communication gives us flexibility to get a new customer launched, or to work with existing customers with unexpected needs,” he says.

“Crisis-management expertise was critical during the worst of the pandemic as clients’ demands and product mix changed rapidly,” says M C Packaging’s Silverberg, adding: “M C’s success rate in managing a crisis is well-known. Agility and flexibility to adjust and react to sudden shifts in demand is key.”

Lombardi Design and Manufacturing, Freeport NY, offers a range of capabilities that results in everything from stock propel/repel sticks to custom spray-through closures. “Our work is engineering-intensive, highly innovative, and upscale oriented, says Jack Albanese, director of new business development, adding, “Our specialty is injection molding, particularly using advanced resins such as Surlyn and Eastman co-polyesters, as well as post-consumer PET, PP and HDPE.

Albanese says they have seen “a keen interest from customers to simplify their supply chain by keeping it more U.S.-based.” The main advantage, says Lombardi, is control: “Control in terms of timing, shipping costs, and expected quality levels.”

There are two primary supply chain advantages according to Grinnell, of Harmony Paper. “First and foremost, with all of the retail, service, and food industry shutdowns and restrictions, there has been a learning curve for product demand and the packaging to support it. When brands don’t know what products are going to exceed sales forecasts, or dive off of a cliff, it’s very difficult to keep inventory levels in check. Fast turnaround times become critical and waiting 8 to 10 weeks for packaging to come from Asia simply isn’t an option. The other advantage is ‘safety.’ Even if time permits waiting for overseas production and inventory needs are known, producing overseas has been viewed as ‘risky’ at this point. Steam-lines have reduced the number of ships transporting from Asia to the U.S. Air freight rates skyrocketed during the first Covid shutdown making this a completely unaffordable option. Customs clearing shipments could shut down with a second Covid outbreak, further delaying fulfillment. The list of ‘what if’s’ goes on and on and domestic supply of packaging alleviates many of those risks,” says Grinnell.

Eagan, of Colts Plastics says some of the advantages of sourcing domestically are reduced lead-times for finished goods, ability to launch new projects faster, and greater flexibility. “We have always been open to holding safety stock for our customers to ensure that they will not have a supply chain disruption,” says Eagan.

Innovative Plastics’ Feghhi comments, “Quicker turnaround to market by sourcing items locally is a huge benefit. There is less trucking/transporting when locally sourcing, thus also eliminating the carbon footprint of each product. Sourcing many processes through one supplier allows for easier project management and tracking.”

Safety and Security

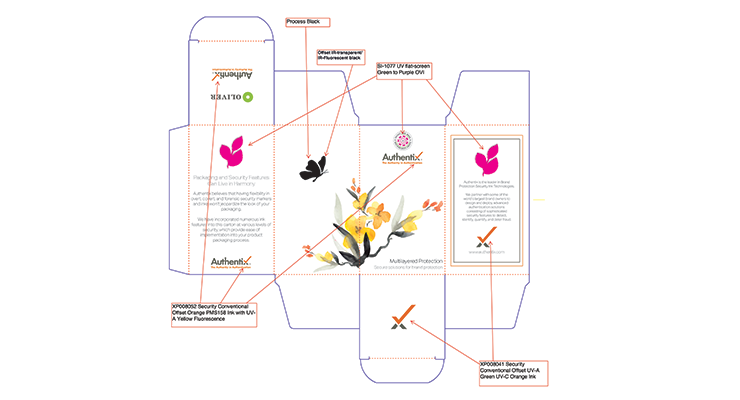

Authentix is a U.S.-based manufacturer of proprietary authentication technologies (Overt, Covert & Forensic) often used to mitigate threats to brands, including: Counterfeiting, Tampering/Adulteration, and Diversion. A security partner to global brands, their specialty is the development, delivery and implementation of brand protection security platforms based on applying these technologies on/in packaging and on/in the product itself.

Brands select specific technologies from Authentix, who then works with their packaging converters and product manufacturing to optimize and ensure the seamless integration of security elements into the package or product. “Basically,” explains Franco Diaz, CPP, brand protection director, “while we are ‘behind the scenes,’ we remain actively involved with the brand and converter.”

Diaz says the company has seen a rise in business for numerous reasons. “Beauty brands are seeking to partner with U.S. suppliers who offer solutions for and access to secure supply chains and chain-of-custody.

Brands are seeking unobtrusive security features that protect them from product diversion and other threats to their brand and customers.” He says interest has also accelerated because “the onset of coronavirus demonstrated the susceptibility of foreign-sourced products (i.e. PPE, test kits, etc.) to counterfeiting and diversion.” Beauty brands took notice, says Diaz, since those same activities could cause irreparable harm to their customers’ safety and brand reputation.

Edmonson, from Berry M&H, says it has always been a struggle for brands to balance any theoretical cost savings from sourcing overseas with safety concerns that may arise from doing so. “Even before coronavirus, consumers were increasingly willing to pay more to ensure they were receiving products that wouldn’t be harmful to themselves or their family,” he says.

“Today, that desire to ensure you are supplying your family with a safe product in safe packaging is all that more important to consumers and they are rewarding the brands that are willing to take the necessary steps to provide a safe product for their household,” says Edmonson. “Consumers are better connected and better educated on what they are buying than any generation before them. If you aren’t taking the necessary steps to protect them, they will find a brand that is willing to do so.”

How has Covid affected Berry’s requests for domestically sourced packaging? Edmonson says, “Consumers have been increasingly interested in and concerned about the safety of the products they are using over the past decade. The coronavirus situation is just a new level of concern for everyone from the brands to the consumers.”

As a domestic manufacturer, Edmonson says Berry has always taken the safety of their products seriously and they will continue to do so long after the coronavirus situation has passed.

He also says Berry has learned some valuable lessons from the pandemic. “While we have long been known for our superior GMP practices, coronavirus has helped us identify new procedures to create an even safer and cleaner manufacturing process. While the entire coronavirus situation has created difficult times for all Americans, both personally and professionally, adversity helps drive innovation and growth.” He says they know more about airborne infectious disease than they did previously, so it helps them to create a better process to protect their brands and their customers.”

Looking to the Future

What does the future look like for US/Canadian manufacturing in the beauty industry?

According to the IBISWorld report on Cosmetic & Beauty Products Manufacturing in the U.S.: “Speed and versatility are growing in importance as small beauty companies with specific target consumers seek out industry operators that are able to quickly manufacture innovative products to stay ahead of industry trends. For this reason, research and development of new products, including investment in marketing and product packaging, has increased automation and the verticalization of manufacturing has given some operators competitive advantages over others. As more small business owners enter the cosmetics and beauty products industry, manufacturers that can accommodate business owners’ requests will likely have a competitive advantage over other manufacturers. Additionally, the ability to move a product quickly from the idea stage to development is important for meeting rapidly changing consumer demand.”

The report also states that packaging manufacturers are starting to integrate digital features like NFC into everyday cosmetic packaging, and that “the demand for a cleaner aesthetic that captures the essence of the product in the most uncluttered way is on the rise.” Consumers are also demanding that packaging be reusable and sustainable.

Additionally, IBISWorld points to the increased popularity of social media platforms—which emphasizes the importance of the color, texture and packaging of products—and says “operators are expected to continue investing in research and development to formulate new and innovative products with a special emphasis on products that photograph well.”

Most promising, over the next five years, IBISWorld says consumer spending and consumer confidence are expected to grow, and as a result, domestic demand for luxury products may increase. “The steady demand for imports and the rise in consumer spending will likely provide an opportunity for increased revenue for domestic producers. The value of exports is expected to increase an annualized 0.7% to $9.5 billion over the five years to 2025 as foreign demand for U.S. goods remains strong.”

On the Supplier Side

“The coronavirus has led to much uncertainty as to what consumers want and need from their beauty brands,” says JSN’s Kavanaugh. “Currently, however, we are seeing a strong pattern of inquiries from new customers, plus existing customers proceeding with projects initially put on hold when the virus shut everything down. Will this continue as the virus prolongs? No one really knows, but based upon what we see, JSN remains positive.”

Harmony Paper’s Grinnell, tells Beauty Packaging, “The future looks good for U.S. manufacturing. With the Chinese tariffs in place and seemingly not being removed any time soon, along with the migration of manufacturing back to the U.S. due to Covid, I truly believe a meaningful amount of manufacturing will come back to the U.S. How long it stays in the U.S. will depend on the drive of retailers and brands to reduce costs and whether these lower cost countries can get up to speed on environmentally friendly production.”

Edmonson, from Berry, agrees that the future is bright for the U.S. packaging manufacturer space. He says, “When you think of all the innovations coming into the market regarding sustainability, specialty colorants, and high-end decoration, we can produce better brand-defining packaging that will drive sales.”

New innovations in light weighting and scrap recapture has made the industry more sustainable than at any point in its history, says Edmonson. “With efficiencies at an all-time high, lean manufacturing and automation innovation, we can effectively take away the one advantage that overseas manufacturing had: price.”

Edmonson adds, “Delivering an affordable pack quickly with unmatched quality and aesthetics is a hallmark of today’s domestic manufacturers.”

At Authentix, Diaz stresses the importance of keeping brands and products secure, going forward. “Brands are learning that counterfeiting and other illicit activities are a permanent and growing threat to the beauty industry. To ignore this threat is to invite risk that could destroy a brand.”

Looking ahead, Barron, of Madeline Blondman & Co, says she is hopeful for increased manufacturing in the U.S. but thinks the beauty industry itself is at a crossroads, as sales of retail beauty products will change, with a shift to online shopping as well as the limits of in-person shopping. “The ability to test and try is challenged right now,” says Barron. “It’s sort of ‘look-don’t touch.’ The distinct advantage of in-person shopping was the touch, try, and feel. The inability to do that will also drive people to the online shopping option.”

Regardless of the challenges faced, Silverberg, of MC Packaging, remains optimistic, saying, “The beauty industry has always been resilient and innovative, and will continue to grow and thrive.”

Read More

Online Exclusive: Looking to the Future of Domestic Cosmetic & Packaging Manufacturing -- Predictions from researchers and beauty industry suppliers.