Marie Redding, Senior Editor02.03.21

In a role reversal, eye makeup has become more popular than lipstick, since our lips are hidden under face masks—but market forecasters say the color cosmetics market as a whole is expected to begin to make a comeback this year. And as consumer demand increases, so does the need for packaging.

“Eyes and lashes have been a key focal point due to face masks. As a result, mascaras with volumizing effects are more in demand,” says Eleanor Bunting, marketing manager, ICS. “Video calls and meetings have also heightened this lash trend,” she adds. “Many people want to look ‘awake’ and energized for video conferences.”

“We see a rise in requests from beauty brands for mascara packaging—it’s a growing category,” says Cheryl Morgan, creative marketing manager, HCP Group. “One trend for mascara is ultra-slim packaging and fiber applicators, which offer excellent dexterity and controlled application. They can reach even the tiniest lashes—and are suitable for creating fun looks such as colored or ombre lashes,” she explains. “Our global Lash Studios provide interactive environments for beauty brands to work collaboratively with our mascara experts to ensure a pack provides the perfect application performance for new product launches,” she adds.

HCP says that in 2019 the company produced 249 million lipsticks; 142 million mascara packs; and 126 million lip gloss packs.

In the lip category, the pandemic has changed the types of products that are most in demand, suppliers say. “The trend in lip color now is toward long-lasting formulas that will resist while covered with a mask. This means more volatile formulas, and a greater need for airtight packaging,” explains Monika Pfeifer, business development director, Asquan.

There is also a shift from lipstick to more moisturizing lip balms, serums, and oils. “The global lip market will be hardly affected by Covid-19,” says Morgan Sochon, communication manager, Axilone–Ileos Group. “We have seen a big drop in color makeup—but we also see a recent rebound in Asia, along with a growing demand for more moisturizing formulas and lip balms,” she explains. She says beauty brands often choose Axilone’s high-performance mechanisms for these types of lip formulas.

ICS’s Bunting says, “New types of lip products, such as lip balms, lip scrubs, and lip masks, are growing in popularity right now, because consumers are incorporating more wellness-focused products into their daily routines.”

There is an increasing desire for all things healthy—for our bodies and the planet. “As far as lip packaging, sustainability is at the core of all our packaging innovations,” says Jackie Paterno, vice president, CTK Cosmetics. Paterno says she often hears requests from beauty brands for sustainable options in the lip category that also provide a luxury feel.

Walter Dwyer, president, Cosmopak, also says that new types of lip products are being requested. “We think the lip treatment category will benefit from Covid. We’re seeing more interest in lip balms, oils, and glosses—and less requests for traditional lipsticks.” Cosmopak’s range includes lip balm stick packs, tins and jars.

Stefanie Gunz, head of marketing, Geka, also says “wellness” is on the rise. “Consumers are staying at home more—and taking a closer look at ingredients. They are taking a deep dive into healthy treatments and want to know more about the products they purchase—and attitudes toward sustainability are changing, dramatically.”

HCP’s Morgan agrees, and says, “The pandemic has pushed the topic of sustainability and the bigger picture of considered consumption to the forefront of both brands’ and consumers’ minds; consumers are looking to both take care of themselves and of the planet. Demands that have been accelerated by the pandemic include refillable packaging, PCR and bio-based replacements for plastic. Refill and streamlined, mono-material packaging that is more easily recycled is a top trend across all categories.”

Several of suppliers’ latest packaging innovations for lip color and mascara are featured here—including applicators and brushes—which are key for liquid lipstick, lip gloss and mascara.

New Self-Care Options for Eyes & Lips

As the trend toward skin care-inspired lip products continues, suppliers are offering a variety of packaging options to accommodate these products. “We have adapted to the post-Covid era by launching a new collection focused on ‘Beauty & Care’ called Take Care,” says Geka’s Gunz.‘Take Care’ showcases packaging solutions for 2-in-1 treatment products. “The collection includes a lip pampering oil, a lash and brow serum, a silicone mask brush, a gua sha board and a beauty bag,” says Geka. The transparent lip oil is enriched with jojoba oil for extra hydration. “The ready-to-go packaging is a squared design, molded in clean white with a pearly effect—and decorated in rose gold hot foil,” says Gunz.

The lip oil features Geka’s new pearl-shaped applicator, “softPearl,” which provides a 360-degree application. “This applicator allows an easy dip and a gentle application of the lip oil,” says Gunz. “The design is eye-catching and our customers can choose antibacterial flocking,” she adds.

ICS’s Bunting is also hearing new types of requests from beauty brands, due to the “wellness” trend. “The increased focus on self-care is influencing color cosmetics to adopt a skin care approach,” she says. “Beauty brands are adopting a self-care approach and adding active moisturizing ingredients to lipsticks and lip glosses—and as a result, we are seeing more lip formulations in packaging that is traditionally used for skin care products, such as tubes, jars, and rollerball packs,” she adds.

Asquan is another supplier that offers solutions for ‘lip care.’ “Our latest ASQ design in the lip care category is our 15ml essential tottle. The smooth, large, and soft TPE reducer makes it perfect for applying a lip oil or lip mask,” says Pfeifer.

HCP’s Morgan also mentions the self-care trend, and how it is influencing lip color. “The lip category is embracing self-care products that deliver on the ‘feel-good’ factor. We offer a variety of packaging for lip balms, oils, and overnight treatments. We also have lip tints infused with nourishing ingredients,” she says.

HCP’s Fusion Glass Lip Gloss is a thick-walled PET bottle designed for a lip serum or oil formulated to soothe dry, irritated lips. It is paired with HCP’s soft, heart-shaped flexible applicator, which holds a generous amount of product. HCP also offers Everyday Balm Trendstick for lip balm. “External parts can be molded in transparent, translucent or opaque materials to achieve various aesthetics,” says Morgan.

Lip Gloss, Serums, Oils—and Applicators

Several suppliers say there’s a shift toward lip gloss, since lipstick requires taking more time to apply with greater accuracy. “Glossy lip formulations are a key lip trend, despite mask-wearing. The current stay-at-home lifestyle has inspired more casual, laid-back apparel, and this affects consumers’ lip product choices,” says ICS’s Bunting. “Our chubby doe foot applicators are an ideal choice, and apply a generous amount of bulk in just one swipe. Stick packaging for lip balms also provides the same effortless swipe-on application option,” she says.HCP recently partnered with Regi Laboratories to launch Lip Therapy, which it calls an “eco-lip gloss.” “It is a luxuriously soothing beauty solution with a reduced environmental impact,” says Morgan. The versatile lip gloss stock pack is manufactured in PCR material. Regi Laboratories provides its Silky & Shine Lip Therapy formula. The bottle is molded in 100% R-PET and the cap is 100% R-ABS. The soft rounded tip of the applicator is HCP’s soft, rounded “Ballet “ flocked tip, which features a two-sided flat surface for optimum agility during application.

HCP also offers Double Flock and Power Flock—high-performance lip gloss applicators that provide superior product-loading. “Our Double-Flock is dual-length flocking that holds lots of formula to provide extreme coverage. Our extra dense Power-Flock fibers provide an ultra-sensory experience due to the large surface area of the flexible applicator, which ensures a smooth application,” Morgan explains.

Cosmopak offers its new Triangle Vial and Diamond Cut Vial, which are ideal for lip gloss. The Triangle vial is paired with a flocked applicator. Cosmopak’s Diamond Cut Vial features a solid color diamond cap and clear diamond cut base. It is paired with a doe foot applicator.

Cosmopak’s versatile TPEE applicator is compatible with most formulas. “It is a direct-molded flock, which makes it chemical-free, since there is no gluing the flocking,” explains Dwyer. “It can be used with a variety of formulas, including lip gloss, liquid lipstick and lip oils. We offer several shapes, as well as custom applicator designs,” he says.

Asquan offers a variety of rigid core precision applicators, which are ideal for high-pigmented liquid lipstick, and softer styles for oils and gloss. “For lip oil, the trend is toward softer, more flexible flocked tips. Flexible, broad shapes provide both a “real” and perceived increased level of comfort while applying a lip gloss or “lip care” product,” Pfeifer explains.

Sustainable & Refillable Packaging for Lip Color

Lip color packaging comes in many forms, including many types of sustainable solutions. For lipstick, traditional bullets are typically in a case with a twist-up mechanism. Several parts, in different materials, makes recycling a challenge. For this reason, some suppliers are offering mono-material lipstick packaging.“Our newest innovation is our PET mono-material lipsticks,” says ICS’s Bunting. “The cap, base and inner mechanisms are all 100% recyclable PET, so when the formulation is all used up, simply pop the whole pack into the recycling bin,” she says.

Refillable lipstick is also increasingly popular. Axilone-Ileos just launched a patented, premium refillable aluminum lipstick case. “It is fully customizable—and available in a snap or magnetic fit,” says Sochon. It incorporates the supplier’s “key-&-lock” refill cartridge system. “This prevents high-end lipstick cases from being refilled with low-end products,” she explains.

CTK Cosmetics offers new refillable options for lip gloss. “We are working with beauty brands to develop refillable lip packaging that features a luxurious outer bottle and cap in plastic or metal, with special finishes—with an inner refill vial made from PET,” says Paterno. “Our Refillable Lip Gloss offers sustainability without compromising luxury. It’s a simple, yet sleek vial design. The refill system assembles with a simple twist and click,” she adds.

ICS also offers a refillable lipstick package, in PCR. “It is aesthetically pleasing and functionally effortless to use,” says Bunting. The user pulls the lipstick godet out of the base, then inserts the refill into the base until it securely clicks in place. “At ICS we have a variety of refillable packaging available, ranging from jars to pencils, to compacts and sticks,” Bunting adds.

ICS also offers a push-up stick package, ideal for a lip balm, or even lipstick. It is made from 100% paperboard, without an inner plastic mechanism. “Simply use your finger to gradually push up the paper base until your desired amount of product is showing. Once your formulation is all used up, you can recycle or compost the whole pack,” Bunting says.

HCP offers many types of sustainable packaging for lip color in a variety of plastics—and will soon announce it may be using plastic from Ocean Waste Plastics, which collects plastic waste from the sea.

HCP's current sustainable options include a PCR stick package, ideal for lip balm. Its new 100% aluminum lipstick case is optimized for recycling. “It is lightweight, made from a single material, and economical to manufacture. It also has a strong mechanical resistance and can be used with specially designed fashion parts to create a completely new, eye-catching launch,” Morgan says. “As consumers seek out packaging that can be more easily recycled, streamlined and mono-material designs offer a significant benefit,” she adds.

Asquan also offers several innovative sustainable designs. “Sustainability is a huge focus for us. We have been working with our factories, and now we are able to incorporate PCR in most of our standard packaging,” says Pfeifer. “For lip gloss, we have both thin-walled, blow-molded PCR flacons and thick-walled injected PCR,” she says. Asquan also offers mascara bottles with 100% PCR. In addition, they offer refillable lipstick cases, and a mono-material balm stick. “We are focusing on developing mono-material components, which can be recycled in one piece,” she adds.

For Mascara, the Brush is Key

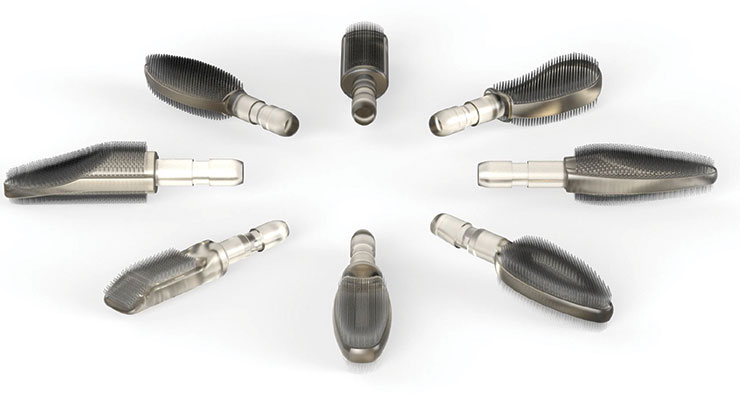

In the mascara category, the brush is key—and how well it works with the formula, bottle, and wiper. HCP’s solutions for mascara include twisted wire brushes and micro-injection molded plastic brushes. The company is known for its “Twist & Cut” fiber brush technology. The team at HCP’s innovations include its Spider Brush fiber treatment, a patented mascara technology that takes volumized lash results to the next level. “A variety of Spider Brush styles are available with single or multiple reservoirs,” says Morgan.Another option is its innovative Feather Comb applicator. “It is precision-molded in black EcoWood, a raw bio-based material that is completely plastic-free, carbon neutral and exclusive to HCP. The comb-style brush achieves excellent separation and lengthening results, while the feather-shaped profile has a tapered tip to groom brows or reach inner and outer corner lashes,” says Morgan.

HCP is also testing its bio-based fiber brushes, and early trials indicate that the performance is comparable to nylon twisted wire brushes. “As sustainability permeates every aspect of the industry, we are meeting more requests for bio-based fiber brushes. We can support bio-based fiber from multiple supply sources including fiber mascara brushes made from castor oil (100% bio-based), EcoWood or PLA,” says Morgan.

ICS offers beauty brands a vast selection of mascara packs, including all types of brushes. “We work with our clients to navigate through the technical maze of pairing or designing the right stem, wiper and brush combination for the formula to help create the ideal mascara,” says Bunting. “There is an increased demand for mascara that volumizes and lengthens.

Mixed fiber brushes accomplish this. The smooth, soft fibers are generously charged with bulk to gently release onto lashes for voluminous coverage, while the stiff fibers comb and separate the lashes—providing a long, dramatic lash look,” she explains.

Geka is another team of “mascara experts” offering new molded brushes and fiber filaments, and just expanded its portfolio of molded brushes for mascara last October. Its new two-component brush, “pureDefinition,” is a bi-injected brush designed to deliver defined volume and lash lengthening.

The brush is produced using Geka’s “Sandwich” technology. “Gaps between the brush’s alternate rows of conical bristles and slim wedge-shaped discs create bulk reservoir zones, so that more of the formula can be transported to the lashes,” Gunz explains. “Lashes won’t stick together because they are separated and lengthened by the bristles and discs,” she says.

The bristles at the tip even reach the tiniest lashes in the corner of the eyes and create an extra push-up effect,” she adds.

This year, Geka will launch two new fiber filaments, and they are made from sustainable materials. Currently, Geka offers its “EOSgreen” fiber filaments, which are made from 100% renewable raw materials from the castor oil plant. “The bio-based fiber filament meets all requirements for volume, lengthening, curling and separation,” says Gunz. “In addition, we offer vegan fiber filaments, too,” she says.

SGB Packaging Group recently announced its partnership with Ponzini, to offer brands all types of brushes, including fiber and injected styles. The supplier also offers brushes made from eco-materials. Its catalogue includes ergonomic shaped applicators and assymetrical brushes designed to reach every lash, for curling and volumizing effects. The supplier also offers multi-functional comb brushes.

Asquan also offers numerous options for mascara in PET, PETG, and PP, to house different types of formulas. “We just published our mascara packaging catalog with a full range, from minis to large bottles, combined with our combined molded and fiber brushes for volume, curve, lengthening and definition effects,” she says.

Final Tips: Collaborate With Your Packaging Supplier

Consulting with your packaging supplier early on will always ensure a successful launch, but this mantra may be even more important when developing lip color and mascara products.“A great mascara is challenging to execute, and a ‘clean’ mascara formula is even trickier,” says Syeira Simon, Cosmopak’s product development and formula innovation manager.

“Many of the natural raw materials do not perform as well as synthetic and it can take quite a bit of R&D time. We offer ready-to go turnkey options,” she adds.

HCP will also soon offer ready-to-go mascara solutions, pairing its “tried and tested” formulas with applicators for fast development. “Our team works closely with brands to achieve both speed-to-market and impressive results with unique and customizable designs, plus cutting-edge technologies. We develop and match our molded and fiber mascara applicators for on-trend formulas,” says Morgan.

Lip color packaging will also greatly affect the user’s experience. “Many lipstick formulations require specific godet fitments, so it is important that the packaging and formulation developers collaborate,” says ICS’s Bunting. “Our packaging and formulation teams have technical expertise in lipstick packaging. Depending on whether the lipstick formulation is firmer or more creamy will result in specific godet requirements and our experts will work closely together to ensure your packaging is fit for the formulation,” she explains.

In the end, collaboration is key.

Contact us to find out more about the suppliers in this article, and use our online Buyer’s Guide to find your next supplier partner.

What Do Market Analysts Say?

Market Trends for Lip Color & Mascara

This is mascara’s time to shine, since face masks are covering our lips and all eyes are on our eyes.

“The popularity of eye makeup can be attributed to increased experimentation at home and wearing makeup while virtually socializing or during conference calls,” states Emma Fishwick, account manager, NPD UK Beauty. “As consumers are required to wear face coverings, the lip segment declined,” she notes.Overall, color cosmetics sales have been on the decline since 2019 globally when consumer demand began shifting to skin care—and then the pandemic made matters even worse. “Home seclusion trends in 2020 accelerated the declines in color cosmetics already being seen in 2019,” Euromonitor states.

NPD Group says that 71% of consumers in the U.S. were wearing less makeup in 2020, but behaviors will soon change. NPD’s latest Makeup Report states: “While many makeup consumers are currently using less color cosmetics, 83% of those who use it less often due to the pandemic say that they will return to their regular routines once things get back to normal.”

The comeback is already underway. Analysts at Euromonitor say the color cosmetics market in the U.S. will begin to bounce back this year, and begin to show positive growth by 2024.

The global market for lipstick, which was estimated at $13.1 billion in 2020, is projected to reach $18.2 billion by 2027—growing at a CAGR of 4.8% according to a July 2020 report by Global Industry Analysts at Research and Markets. “After an early analysis of the business implications of the pandemic and its induced economic crisis, growth in the Matte segment is readjusted to a revised 5.2% CAGR for the next 7-year period,” the report states. The lip gloss segment is projected to record a 4.5% CAGR and reach $6.3 billion by 2021.

As for eye makeup, Grand View Research (GVR) valued the market size at an estimated $14.5 billion in 2018, and expects a CAGR of 5.7% through 2025. The eye makeup market includes mascara as well as eye shadow, eye liner, brow products and more.

NPD’s UK report shows that new demands for mascara may stick, post-pandemic. Pre-lockdown, eye makeup sales accounted for 22% of total makeup sales in the UK, which increased to 24% during lockdown. Once lockdown was eased, eye makeup increased its share to 25% of total prestige makeup sales. Mascara and eye shadow sales drove the increase.