Jamie Matusow, Editor-in-Chief08.23.23

When speaking with suppliers, brands, consulting firms and trend forecasters for this article, I couldn’t help but think of the Paul McCartney/John Lennon 1966 hit on the Revolver album: “Here, There & Everywhere.” And while my use of these title words bears no relation to The Beatles’ expression of a romantic love, they do resonate with today’s manufacturing conundrum as to where to best locate plants and facilities to nimbly meet customer needs.

Sparked by the years-long pandemic, the rattled world economy, global uncertainties, volatile time-to-market circumstances, inflation and other factors, some beauty brands and packaging suppliers have re-evaluated portions of their supply chain.

In some cases, global manufacturers have set up more regional manufacturing points to be closer to their markets, especially in the U.S., while increasingly, a number of North American (NA) manufacturers have continued to benefit from their US/Mexico/Canada proximity—and have drawn new customers who are looking for assets including easily accessible suppliers, face-to-face contact and quick delivery.

Production, filling, delivery, sustainability, carbon footprint, speed to market, available personnel, brand and consumer concerns and costs can each play a part in the decision-making—and the move to localize services.

Transportation and shipping costs, and maintaining inventory, have become top-of-mind concerns for many manufacturers over the past couple of years, due especially to crises caused by the pandemic.

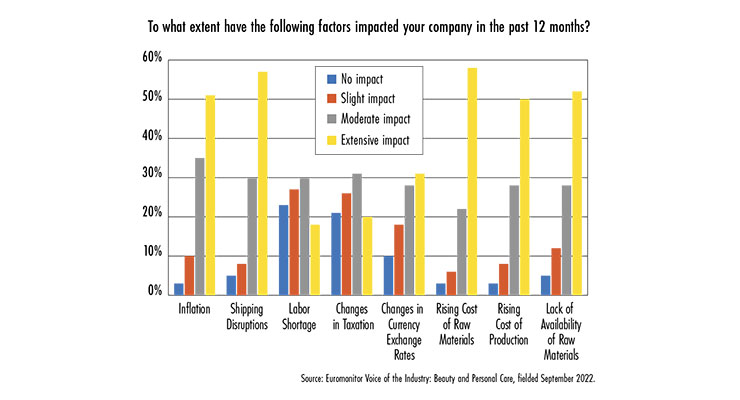

According to the survey “Euromonitor Voice of the Industry: Beauty and Personal Care,” almost three-fifths of beauty and personal care industry respondents stated that transportation/shipping disruptions extensively impacted their business in 2022.

Olivia Stelmaszczyk, Research Analyst-Beauty & Fashion at Euromonitor International, tells Beauty Packaging: “The pandemic definitely jump-started the focus on local production in light of the supply and shortage issues associated with importing products from overseas.” She explains, “It seems beauty was particularly impacted by the longer-term lockdowns in China, which is an important part of the supply chain for many brands.”

Stelmaszczy says local production in NA allows more leeway in meeting consumer demands, including product quality control, flexibility in the production process, and supporting local jobs, which is becoming more important to some consumers. “This trend isn’t exclusive to beauty,” says Stelmaszczyk, “as similar efforts have been seen in fashion, including apparel and personal accessories.” (Read Stelmaszczy’s predictions for the future of local production and supply chains at the end of this article.)

Localizing can avoid a lot of uncertainties, says Kayla Villena, Industry Manager-Beauty and Personal Care, at Euromonitor International. She tells Beauty Packaging: “The movement we’ve seen so far has been to source the ingredients from local areas/countries, rather than risk the delays that come from international shipping. What has been happening to different degrees in the past two years is that items are being held in containers at ports, but cannot be offloaded at the rate they are received due to labor shortages and other factors.”

Villena explains, “Fees pile up when this happens, and it gets passed to the company that may eventually decide to pass that cost to the consumer in the form of a price increase. This is something that has affected other FMCG industries, not just beauty and personal care.” To avoid this, she says, “We’ve seen beauty and personal care brands source as much as possible from local companies.”

Serving a Thriving Market

Just as manufacturing and delivery—and diversifying supply chains—can be critical to success in the fast-moving beauty industry, sustainability, too, is entering into the case for local production. But despite the many hurdles and blips taking place, the market continues to thrive. According to data firm Statista, the global beauty and personal care market was estimated to be worth more than $500 billion U.S. dollars in 2022. By 2026, the market is projected to reach over $600 billion U.S. dollars in value.Diversifying Supply Chains

Kristi Weaver, senior partner and global leader of the Beauty group at McKinsey, tells Beauty Packaging:“Diversifying supply chains allows companies to better respond to fast-shifting consumer demand and to lean more on data analytics and technology to manage inventory efficiently. It is one option to future-proof manufacturing.”

Weaver explains further, “It is an opportunity to maintain inventories. It also increases the speed-to-market, because it allows companies to react to consumer demands faster. This is particularly relevant, given trends in makeup, nail care and hair color can be seasonal, and the importance of the holiday season to the beauty industry as a whole.”

Transparency and sustainability in manufacturing and shipping has also become a factor as far as where goods are produced.

“With regard to sustainability,” says Weaver, “consumers also frequently ask for ingredient transparency, which also leads to beauty companies becoming more transparent with their supply chain.”

Straight Talk from Key Industry NA Suppliers

Whether Made in the USA or North America from the start, re-locating from abroad, adding an NA facility, or setting up shop for the first time, here’s why these leading packaging suppliers choose to operate in NA—and a look at some of their facilities, capabilities and packaging offerings.Production and Decoration Within One Facility

The Plastube manufacturing facility is located in Granby, Quebec, and has been operational from the same facility since the 1960s. Philip Rubin, sales representative, strategic accounts, says the plant has undergone significant capital investment over the years “in order to maintain a competitive market niche and technical advantage with respect to production efficiencies and product offerings.” All production and decoration is conducted in this facility.Rubin says, “Our location is 60 miles from the United States border and as a result, Plastube offers speed-to-market logistical advantages to our customer base in Canada and the United States.” He adds that due to their location, Plastube benefits from “a pool of well-trained workers, a sophisticated North American supplier base and on-site support for equipment and technical innovation.”

Since 2020, Rubin says Plastube has found that there has been a trend in the packaging supply chain back toward the use of North American suppliers whenever possible, noting that “brands have been significantly impacted by the logistical uncertainty of importation of packaging from offshore suppliers.” He explains that “The risk of delays of ocean shipments, customs clearance, port logistics and tariffs creates anxiety and increases the risk of missing critical dates.”

In addition, Rubin tells Beauty Packaging, “Many brands have questioned the legitimacy of realizing up-front marginalcost savings through the use of off-shore suppliers if they cannot meet commercial sales commitments and distribute their products into the U.S. marketplace.”

Minutes from Midtown Manhattan

The COII Packaging facilities, headquartered in Red Bank, NJ, are minutes from midtown Manhattan, and “facilitate quick-turnaround projects and easy on-press attendance without travel and lodging expenses,” says Joe Cicci, president emeritius. In addition, he says shipping to local customers aids speed to market and lower costs.Cicci tells Beauty Packaging, “There is definitely a trend to move manufacturing back to the U.S. especially with the tensions and uncertainties with countries today, outside of the U.S. American-made goods are a responsible and environmentally-conscious option for consumers. Many people feel that buying American is more patriotic and that USA-made goods are of higher quality.”

A Focus on Sustainability

At JSN, located in Irvine, CA, Jim Nagel, president, says as far as supply chain issues, “There still remain supply delays and high costs in some basic manufacturing materials, though currently, we’re told backlogs are due to issues with production personnel shortages.”According to Nagel, 2023 has brought increased concentration on sustainability in the form of PCR usage, recyclability, and down-weighting of parts.

He says that most PCR tubes are still earth tones, with graphics necessitating silk screen vs. offset print. “However, as the quality of the PCR resin has recently improved, we are now able to produce visually acceptable white tubes with a high percentage of PCR—unheard of previously.”

When it comes to recyclability, Nagel says JSN’s in-house flip-top closure molds are in the process of being qualified for production with HDPE resin vs. PP for a single plastic designation.

The company also has a current focus on down-weighting. “Development of low-profile, lighter-weight closures is currently in demand,” says Nagel. “In tubes, following Europe’s example, we’re beginning to see thinner wall sleeves in the U.S.”

4 Facilities in the USA; 1 in China

Anomatic originated in the USA almost 60 years ago. Today, they have four facilities in the USA and one in Suzhou, China. Located centrally in Ohio, Damien Dossin, president & CEO, says they are well-positioned to offer transit in less than a week to customers on both coasts and the Midwest. He says, “Our raw materials are sourced domestically, which helps our supply chain needs and our customers’ lead times. We have an excellent planning team, and with agility agreements in place, we can turn around orders in record time to meet their market demands.”Dossin says, “There has been a push toward regionalization over the past several years which has increased dramatically during COVID.” He notes several reasons for the move: Nearshoring for quicker lead-time for replenishment and to avoid out-of-stock situations, especially after the experiences over the past few years; further helping their customers’ sustainability objectives by reducing transportation, and thus carbon footprint; and mitigating the cost impact of tariffs where applicable.

Made in USA for More than 100 Years

“Arkay manufactures in the USA because we are an American company, born and raised!” says the company’s Ruth Rugoff, chief communications officer. “Our 120,000 square-foot state-of- the-art facility in Roanoke, VA, functions seamlessly to manufacture packaging that can be quickly transported without international delays or restrictions.” In addition, Rugoff says Arkay’s design studio in Hauppauge, NY. “thrives as a hub of innovation and graphic arts, utilizing Arkay’s Paint on Press technique and being a source of hands-on creativity.” Arkay is certified Platinum EcoVadis, an honor only 1% of companies worldwide achieve, as well as certified CarbonNeutral.Rugoff adds, “Arkay’s dedication to sustainability is vital to who we are, and our standards rank amongst the highest in the world.”

As far as supply chain, Rugoff tells Beauty Packaging, “After numerous disruptions internationally on the economic and political landscape, it is increasingly clear that relying on domestic supply chains is a safer model for manufacturing, and Arkay is noticing this shift with our customers, as well as hearing about it through several news outlets. Arkay was born in America in 1922 on the Lower East Side of Manhattan and we have been manufacturing in America for the 101 years since. We are proud of our ‘Made in the USA’ label, and believe that it is even more valuable now than ever with our speed to market accelerated by our local production.”

Saving Time and Money

At JP Packaging, Chester, NY, Doug Rofheart, senior sales executive, tells Beauty Packaging, they have seen an uptick in customers looking for domestically sourced packaging. He says JP Packaging is receiving more calls from brands to help in sourcing components domestically such as bottles, jars and tubes and providing the filling services necessary for a turnkey solution. “This streamlines the process from beginning to end,” says Rofheart, “saving time which translates into money.” He says one of their customers “even went so far as to say ‘It’s so refreshing not to hear those dreaded words ‘it’s on the water’ or ‘just waiting for it to clear customs.”Little Interruption in Material Sourcing

Randi Barron, president, Madeline Blondman & Co., Inc., headquartered in Great Neck, NY, tells Beauty Packaging, “We have always done sourcing and production in the U.S. The global concerns over the past few years, including supply chain issues, made it easier for us to react to the markets since we procured materials locally. We had little interruption in material sourcing and we were fortunate to be able to continue production.”Barron adds: “We are aware that since our products come into direct contact with cosmetic formulations, we need to know that the components we supply are made with materials that are certified and consistent from one run to the next. Having a reliable supply chain and our manufacturing close, we can monitor any issues that come up quickly.” As for manufacturing, Barron says, “producing in the U.S. gives us the flexibility to react quickly. That includes producing tooling, quick turnaround and shorter lead-times. We feel we can maintain better control of our product keeping it domestic.”

Domestic manufacturing can also help with sustainability concerns.

“Obviously, the overall trend we continue to see is the push for sustainability,” says Barron. Their business has always been focused on plastic components, and they are researching the development of components from other non-plastic material as well, and hoping those will be ready for market soon. “We have always done sourcing and production in the U.S., says Barron. “The global concerns over the past few years including supply chain issues made it easier for us to react to the markets since we procured materials locally. We had little interruption in material sourcing and we were fortunate to be able to continue production. Brands have seemed more skeptical about buying overseas, and that has benefited us.”

Madeline Blondman has expanded its product line and is now able to offer vacuum-formed clamshells and compact dustcovers in recyclable PET and RPET. “We are partnering now with multiple customers to bring these into production,” says Barron. “We believe that we are replacing offshore suppliers with better pricing and availability.”

Shorter Lead Times, Quicker Shipping and Flexibility

At Viva Healthcare Packaging (Canada) Ltd., headquartered in Ontario, Canada, Melanie Gaudun, business development manager, tells Beauty Packaging, “We have definitely seen new clients looking for Made in North America packaging solutions. Getting packaging from Viva means shorter lead times, quicker shipping, and flexibility when quick decisions need to be made.” She adds that getting packaging from North American suppliers improves the brand’s carbon footprint.Sustainability is also a key pillar at Viva. Gaudin says beauty brands are requiring their packaging to have some aspect of sustainability, starting with a discussion on how much recycled content they want to use. “Half of our packaging now contains recycled content, and that number is growing.” Beyond recycled content, Viva offers a mono-material tube design that is compatible with recycling. “We have been making tubes this way for over a decade,” says Gaudin. “In sticks and jars, we have some refillable systems. We have some light-weighted options for tubes, and more in development to meet the needs of our clients.”

Gaudin says Viva has noticed a lot of new products emerge in sun care, scalp care, and intimate care, such as anti-chafing and ‘pubic-forward’ products. “We are growing families of packaging for our clients into different categories, from tubes into sticks and jars.”

Shorter Lead Times, Greater Flexibility

At Screentech/Sprayetech, a short drive from Manhattan, in Linden, NJ, John Schofield, president, tells Beauty Packaging, shorter lead times are attracting some companies to domestic manufacturing. “As lead times for glass plus decoration continue to be long outside of USA/North America,” he says, “we see many customers deciding to bring the decoration stateside for greater flexibility.” He also notes that many customers choose ScreenTech/SprayeTech because of their in-house color-matching capabilities, which allows for greater speed to market. “Our capabilities to spray, screen print, hot stamp, and label glass provide our customers with a wide range of decorating options. This along with flexible lead times allows for timely production to meet customer deadlines.”Looking Ahead

Is the pandemic behind us now? Will shipping and supply chain kinks straighten out? Will the world economy stabilize? Or will domestic production continue to expand, with more companies setting up NA facilities to service the booming cosmetic market and meet sustainability guidelines? Only time will tell for sure.Euromonitor’s Olivia Stelmaszczyk, offers the research company’s best supposition, saying, “We expect this trend [toward local production] will continue, as the pandemic highlighted the risks associated with ‘having all your eggs in one geographical basket.” But eventually the pandemic-related issues associated with lead times or supply chain issues should normalize. Despite this, consumer behavior of wanting to support the local economy or companies will sustain this trend moving forward. Growing demands for more environmentally friendly or sustainable solutions could also play a greater role in the trend of local production moving forward. Consumers are becoming more interested with where and how the ingredients and their beauty products are made, so the local production conversation may develop more into a sustainability/ethics/safety conversation once supply chain issues subside.

“In fashion, we’ve already seen a growing conversation on the working conditions at factories, which is shining a light on the production process. Beauty has yet to see a large impact here yet, but it may become more important as beauty players work toward having an ethical supply chain and educating their consumers about it.

“For instance, ELF Cosmetics has a Fair Trade certification for most of its brands’ factories in China. If consumer awareness of the supply chain continues growing, it may shine a brighter light on the ethical, sustainable or safety advantages of local production for instance.

“Moving forward, we know the U.S. beauty consumer is expected to become more value-driven and oriented, especially considering the inflationary environment. So, it will be imperative for players to consider how a local production strategy could also help support pricing strategies as well.”