Beauty Packaging Staff10.31.19

A new survey, the 38th semi-anual Taking Stock with Teens by investment bank and institutional securities firm Piper Jaffray Companies highlights the discretionary spending trends and brand preferences from 9,500 teens across 42 U.S. states. The average age of participants was 15.8 years -- aka Gen Z.

Generation Z is an influential consumer group that contributes approximately $830 billion to U.S. retail sales annually. (Source: Fung Global Retail & Technology.)

However - one of the survey's key takeaways is that overall, teens are spending less on cosmetics. See more on this below.

Teens Like Going to Ulta and Being Influenced By Kylie Jenner

Key highlights from the survey includes the fact that 91% of female teens prefer shopping for beauty in-store vs. online.

Where do they like to shop? Ulta maintains the No. 1 preferred beauty destination against Sephora for second survey in a row.

The survey also confirms that online influencers are the "source of discovery" for beauty brands and trends, and they are used by 89% of female teens.

Who has the most influence when it comes to beauty purchases? Kylie Jenner. Jenner ranks No. 2 “top influencer” and is the only beauty influencer in the top 10 this Fall.

Erinn Murphy, senior research analyst, Piper Jaffray, says, “Our Fall Teen Survey continues to validate several characteristics of this digitally-native demographic: 83% of teens have an iPhone, 52% of teens claim Amazon as their favorite online shopping website, and we saw an acceleration of VSCO and TikTok mentions. Importantly, however, we saw the lowest teen spending levels in eight years. The two most challenged categories were handbags and cosmetics as females reprioritize their spending with eating out and footwear/apparel."

Top Beauty Brands

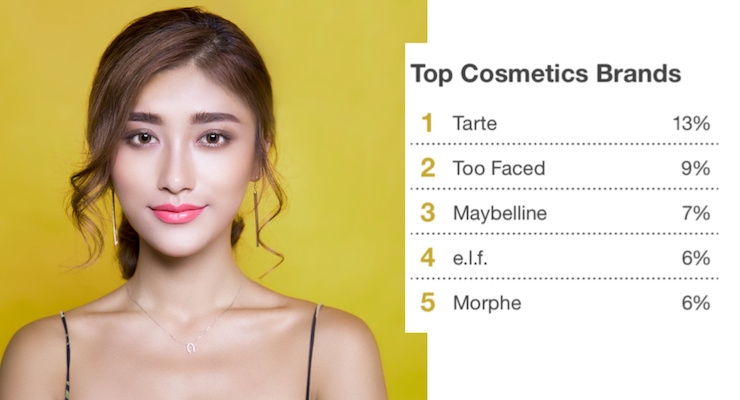

The survey ranks top brands in several categories, including cosmetics and skincare.

In cosmetics, the top brands ranked by the teen respondents are: Tarte (13%), Too Faced (9%), Maybelline (7%), e.l.f. (6%), and Morphe (6%).

In skincare, the top brands are: Neutrogena (18%), Mario Badescu (8%), Clean & Clear (8%), Cetaphil (6%), and Clinique (5%).

More Highlights

The survey reveals that overall, teen “self-reported” spending decreased by 4% Y/Y and 10% sequentially to $2,400—the lowest level since Fall 2011.

Thirty-two percent of teens believe the economy is getting worse—higher than the 25% level in Fall 2018.

Cosmetics spending for females hits 2019-survey low with spending down 21% Y/Y.

See more key takeaways from the survey here.

Read More

Expert's Opinion: Evolving Perspectives of Beauty: GenZ, Millennials and Boomers