09.27.21

According to the latest report from GlobalData, the makeup market in India is forecasted to grow at a compound annual growth rate (CAGR) of 9.6% from $1.2 billion in 2020 to $1.6 billion in 2025, primarily driven by quality-conscious and digitally savvy consumers.

GlobalData’s report, ‘India Makeup - Market Assessment and Forecasts to 2025’, reveals that the market is majorly driven by the face makeup category, which is forecasted to register the fastest value CAGR of 11.9% during 2020–2025. The category is followed by eye makeup, which is projected to record a CAGR of 11.6% during the same period.

Sukanyashri Kabali, consumer analyst at GlobalData, says, “India is a fast-growing beauty market, driven by growing middle-class, increasing disposable incomes, and higher levels of aspirations. Indian consumers are extremely value-conscious and demand high quality and experience from beauty brands. Aspirational brands providing premium and indulgent products are gaining steam, as the trend of self-preservation and self-care grows among the consumers.”

Insights from the Report

‘Department stores’ was the leading distribution channel in the Indian makeup market in 2020, followed by convenience stores and health & beauty stores.

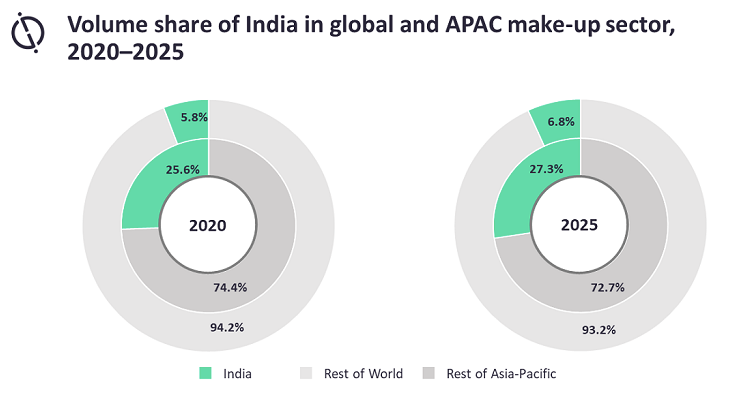

The volume share of the Indian makeup sector at a global level is expected to grow from 5.8% in 2020 to 6.8% in 2025. Similarly, the country’s share at the regional level is expected to increase from 25.6% in 2020 to 27.3% in 2025.

Unilever, L'Oréal S.A. and Revlon, Inc. were the top three companies in the Indian makeup market by value in 2020 while Lakme and Maybelline were the leading brands in the market.

Kabali concludes, “Indian consumers are becoming increasingly digitally savvy. According to L'Oréal S.A., in India during the Covid-19 pandemic, 18% of people purchased personal care products online. Beauty companies are looking to use new technologies such as augmented reality (AR) to drive brand sales.”

“For example, Sugar Cosmetics uses AR to bridge the gap between online and offline shopping experience. Even L'Oréal, which is transforming itself from a beauty company to beauty-tech company has developed a ‘try & test’ feature to improve user experience through an advanced face tracker algorithm.”

GlobalData’s report, ‘India Makeup - Market Assessment and Forecasts to 2025’, reveals that the market is majorly driven by the face makeup category, which is forecasted to register the fastest value CAGR of 11.9% during 2020–2025. The category is followed by eye makeup, which is projected to record a CAGR of 11.6% during the same period.

Sukanyashri Kabali, consumer analyst at GlobalData, says, “India is a fast-growing beauty market, driven by growing middle-class, increasing disposable incomes, and higher levels of aspirations. Indian consumers are extremely value-conscious and demand high quality and experience from beauty brands. Aspirational brands providing premium and indulgent products are gaining steam, as the trend of self-preservation and self-care grows among the consumers.”

Insights from the Report

‘Department stores’ was the leading distribution channel in the Indian makeup market in 2020, followed by convenience stores and health & beauty stores.The volume share of the Indian makeup sector at a global level is expected to grow from 5.8% in 2020 to 6.8% in 2025. Similarly, the country’s share at the regional level is expected to increase from 25.6% in 2020 to 27.3% in 2025.

Unilever, L'Oréal S.A. and Revlon, Inc. were the top three companies in the Indian makeup market by value in 2020 while Lakme and Maybelline were the leading brands in the market.

Kabali concludes, “Indian consumers are becoming increasingly digitally savvy. According to L'Oréal S.A., in India during the Covid-19 pandemic, 18% of people purchased personal care products online. Beauty companies are looking to use new technologies such as augmented reality (AR) to drive brand sales.”

“For example, Sugar Cosmetics uses AR to bridge the gap between online and offline shopping experience. Even L'Oréal, which is transforming itself from a beauty company to beauty-tech company has developed a ‘try & test’ feature to improve user experience through an advanced face tracker algorithm.”